Human Resource Management Software Market Report Scope & Overview:

Get more information on Human Resource Management Software Market - Request Sample Report

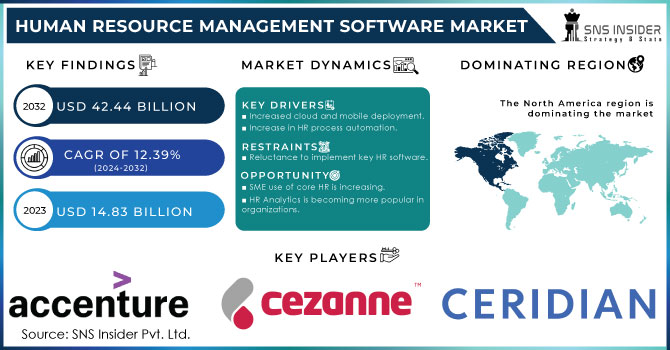

The Human Resource Management Software Market Size was valued at USD 29.77 Billion in 2023 and is expected to reach USD 78.84 Billion by 2032 and grow at a CAGR of 11.43% over the forecast period 2024-2032.

The rapid adoption of cloud-based solutions is a significant driver behind the growth of the Human Resource Management Software (HRMS) market. Cloud-based HRMS offers businesses of all sizes enhanced scalability, flexibility, and reduced upfront costs, advantages that traditional on premise systems cannot provide. These cloud solutions enable companies to access real-time data, improve collaboration, and lower IT overheads. As organizations increasingly recognize the advantages of automating HR processes, the shift from manual tasks to cloud-driven operations has become more prominent. Cloud HRMS eliminates the need for manual data entries, reducing errors and inefficiencies in employee management and overall business operations.

The rapid adoption of cloud-based Human Resource Management Software (HRMS) is driving significant growth in the market. Businesses of all sizes are migrating to cloud solutions due to their scalability, flexibility, and cost-efficiency. Unlike traditional on-premise systems, cloud HRMS offers real-time data access, improved collaboration, and reduced IT overhead, streamlining HR processes and enhancing operational efficiency. This shift to automated, cloud-driven solutions eliminates manual data entry, minimizing errors and inefficiencies in employee management. The growing demand for data-driven, automated solutions is transforming the HRMS market, with features like real-time analytics optimizing workflows and improving transparency. Strategic partnerships, such as PeopleStrong's collaboration with Muthoot FinCorp, are driving digital transformation by reducing HR team dependency and enhancing workforce management.

The shift to cloud-based HRMS raises data security concerns, as highlighted by the UKG data breach in December 2021, which compromised payroll and personal data for thousands. As remote work models become more common, secure cloud HRMS solutions are essential for managing employees across diverse environments. CIOs are focusing on balancing cost-cutting with efforts to improve efficiency (49%) and effectiveness (51%), with cybersecurity (33%) and regulatory challenges (30%) being top concerns. Additionally, 92% of CIOs now influence corporate strategy, underscoring the importance of technology in business growth.

Human Resource Management Software Market Dynamics:

Drivers

-

Revolutionizing HR Operations with Automation and AI Integration in Human Resource Management Software market

The increasing demand for automation and AI integration is a driving force behind the growth of the Human Resource Management Software (HRMS) market. Automation of HR functions such as recruitment, payroll management, performance evaluation, and employee engagement is reshaping HR departments by streamlining processes and improving efficiency. With businesses seeking more effective ways to handle complex HR tasks, AI and automation have become essential elements in modern HRMS solutions. These AI-powered tools help reduce manual effort and enhance decision-making by using machine learning and data analytics to optimize HR operations. For example, AI algorithms can automate recruitment by scanning resumes and matching candidates to job descriptions, speeding up the hiring process. AI chatbots are also increasingly used in HRMS to answer employee queries, assist with onboarding, and handle routine tasks like payroll inquiries, benefits enrollment, and time-off requests, which lightens the HR workload and enhances the employee experience with quick and accurate responses. AI also transforms performance management by enabling continuous tracking of employee performance through data-driven insights, identifying skill gaps, and offering real-time feedback. This creates a more dynamic and personalized approach to employee development. In payroll management, AI can identify errors, ensure compliance with labor laws, and predict payroll costs with greater accuracy. Additionally, AI tools assess employee sentiment and engagement, helping HR teams address potential issues and improve retention. By integrating automation and AI into HRMS, organizations can not only reduce costs but also create a more agile, data-driven HR function, enhancing both decision-making and employee satisfaction in today’s competitive and fast-paced environment.

Restraints

-

Ensuring Data Security and Privacy in HRMS while Mitigating Risks of Cyber Threats and Compliance Challenges

Data security and privacy are critical concerns in the Human Resource Management Software market due to the sensitive employee information these systems manage, such as payroll, performance reviews, medical records, and other personal details. The centralization of this data makes HRMS platforms an attractive target for cybercriminals. Cyberattacks, including hacking, malware, ransomware, and phishing, pose significant risks, as breaches can lead to the theft or manipulation of employee data, resulting in identity theft, financial fraud, and reputational damage. Data breaches occur when unauthorized individuals gain access to HRMS systems due to weak security protocols or human error, such as employees inadvertently exposing data or exploiting software vulnerabilities. These breaches not only threaten privacy but can also lead to substantial fines, especially in regions with stringent data protection laws like GDPR in the EU or CCPA in California. Unauthorized access, whether malicious or accidental, further heightens these risks, with insider threats from employees, contractors, or collaborates adding complexity. Without robust authentication systems or access controls, HRMS systems are vulnerable to manipulation. Compliance with regulations such as GDPR, HIPAA, and CCPA adds another layer of complexity for organizations, which must ensure their platforms meet legal standards for data storage, processing, and access. Non-compliance can result in legal consequences and damage to trust with employees and customers.

Human Resource Management Software Market Segments Analysis:

By Component

In 2023, the software segment held the largest share of the Human Resource Management Software market, accounting for approximately 65% of the revenue. This dominance stems from the growing adoption of integrated, all-in-one HR solutions that streamline key functions such as recruitment, payroll, performance management, employee engagement, and compliance. HRMS software, particularly cloud-based solutions, has gained significant traction due to its flexibility, scalability, and cost-efficiency. Cloud-based HRMS offers businesses real-time data access, enhanced collaboration, and lower infrastructure and maintenance costs compared to traditional on premise systems. As companies increasingly prioritize digital transformation, the demand for automated, data-driven HR systems continues to rise, further propelling the software segment’s growth. By automating manual, repetitive tasks, HRMS software improves operational efficiency, minimizes errors, and enables HR teams to focus on more strategic activities like talent management and employee development, strengthening the segment's market leadership.

By Type

In 2023, the cloud-based segment led the Human Resource Management Software (HRMS) market, accounting for approximately 73% of the revenue share. This growth is driven by the rising preference for cloud solutions, which provide scalability, flexibility, and cost-efficiency. Cloud HRMS enables businesses to access real-time data remotely, fostering better collaboration and faster decision-making. These solutions ease the IT burden by streamlining software updates and system maintenance, ensuring access to the latest features and security measures. Furthermore, cloud-based HRMS integrates smoothly with other enterprise systems, enhancing operational efficiency.

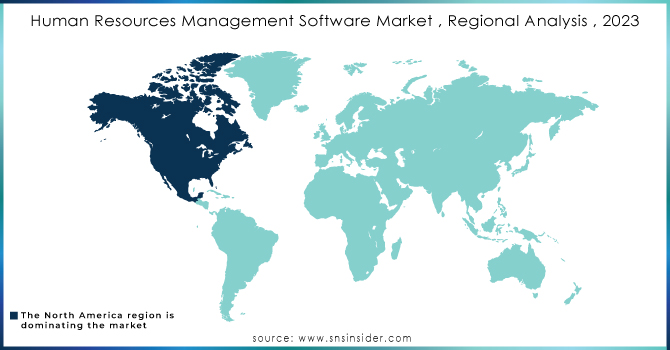

Regional Analysis

In 2023, North America held the largest revenue share of approximately 39% in the Human Resource Management Software (HRMS) market. This dominance is driven by advanced technological infrastructure, high adoption of cloud-based HRMS solutions, and a strong focus on digital transformation. The U.S. and Canada have embraced HRMS tools to streamline HR operations and enhance data-driven decision-making. Key growth factors include the need for automation in payroll, recruitment, and performance management, along with an emphasis on improving employee experience and meeting labor law compliance. Additionally, North America’s strict data protection laws, such as CCPA and GDPR, have encouraged investments in secure HRMS platforms. The region's evolving workforce, including the rise of remote and hybrid work, has further accelerated cloud-based HRMS adoption, with major vendors like ADP, Workday, and Oracle leading the market.

In 2023, the Asia-Pacific region became the fastest-growing market for Human Resource Management Software (HRMS), driven by rapid technological advancements and increasing digital HR adoption. The region’s expanding economies, growing middle class, and need for streamlined HR processes have fueled this growth. Key countries like China, India, Japan, and Australia are leading the charge. China’s industrialization and tech developments have boosted the demand for AI-driven HRMS solutions, while India’s growing IT sector and young workforce drive cloud HRMS adoption. Japan’s focus on automation has accelerated digital HR system adoption, and Australia’s diverse workforce and remote work trends have increased the need for cloud-based solutions. As these countries embrace digital transformation, the demand for HRMS is expected to soar, positioning Asia-Pacific as a key growth driver.

Key Players in Human Resource Management Software Market

Some of the major players in Human Resource Management Software Market with their product:

-

Accenture (myConcerto)

-

ADP, Inc. (ADP Workforce Now)

-

Cegid (Cegid HR Software)

-

Ceridian HCM Holding, Inc. (Dayforce HCM)

-

Cezanne HR (Cezanne HR Software)

-

IBM (IBM Talent Management Solutions)

-

Mercer LLC (Mercer Workforce Solutions)

-

Oracle (Oracle HCM Cloud)

-

PwC (PwC HR Technology Solutions)

-

SAP SE (SAP SuccessFactors)

-

UKG, Inc. (UKG Pro)

-

Workday, Inc. (Workday HCM)

-

Zoho (Zoho People)

-

SuccessFactors (SAP SuccessFactors)

-

BambooHR (BambooHR Software)

-

Gusto (Gusto HR Software)

-

Paycor (Paycor HCM)

-

ClearCompany (ClearCompany HR Software)

-

Paycom (Paycom HR Software)

-

Cornerstone OnDemand (Cornerstone HR Solutions)

List of potential customers in the Human Resource Management Software (HRMS) market, including company names across different industries:

1. Large Enterprises

-

Amazon

-

Microsoft

-

Google

-

Apple

-

Samsung

2. Small and Medium Enterprises (SMEs)

-

Startups (Various tech and service startups)

-

Patagonia

-

Warby Parker

-

Casper

-

Blue Apron

3. Government Organizations

-

U.S. Federal Government

-

UK Civil Service

-

Singapore Government

-

Dubai Government

-

Indian Government

4. Healthcare Providers

-

Mayo Clinic

-

Cleveland Clinic

-

HCA Healthcare

-

Kaiser Permanente

-

Baylor Scott & White Health

6. Retail and E-commerce

-

Walmart

-

Target

-

Amazon

-

Zalando

-

Alibaba

7. Financial Services & Banking

-

JPMorgan Chase

-

Goldman Sachs

-

American Express

-

Bank of America

-

Citigroup

8. Manufacturing & Industrial Companies

-

General Electric

-

Ford Motor Company

-

Siemens

-

Boeing

-

Caterpillar

9. Technology & IT Services

-

IBM

-

Accenture

-

Infosys

-

Tata Consultancy Services (TCS)

-

Wipro

10. Consulting & Professional Services

-

PwC (PricewaterhouseCoopers)

-

Deloitte

-

McKinsey & Company

-

Boston Consulting Group (BCG)

-

Ernst & Young (EY)

11. Hospitality & Travel Industry

-

Marriott International

-

Hilton Worldwide

-

Expedia

-

Airbnb

-

Booking.com

12. Telecommunications Companies

-

AT&T

-

Verizon

-

Vodafone

-

T-Mobile

-

Telefónica

13. Logistics & Transportation

-

DHL

-

FedEx

-

UPS

-

Maersk

-

China COSCO Shipping Corporation

14. Nonprofit Organizations

-

Red Cross

-

World Wildlife Fund (WWF)

-

Oxfam

-

UNICEF

-

Doctors Without Borders

15. Energy & Utilities

-

ExxonMobil

-

Shell

-

Schneider Electric

-

Chevron

-

BP

16. Legal & Law Firms

-

Baker McKenzie

-

Skadden

-

Latham & Watkins

-

Kirkland & Ellis

-

DLA Piper

17. Real Estate Firms

-

Keller Williams

-

CBRE

-

RE/MAX

-

Coldwell Banker

-

JLL (Jones Lang Lasalle)

18. Entertainment & Media Companies

-

Disney

-

Warner Bros.

-

Netflix

-

Sony Pictures

-

Universal Studios

Need any customization research/data on Human Resource Management Software Market - Enquiry Now

Recent Development:

-

September 12, 2024 – Accenture Federal Services has won an USD1.59 billion task order from the U.S. Air Force for cloud service provider reseller and software management support services. The contract, awarded through a competitive process, is expected to run through December 2029.

-

October 29, 2024 – Oracle has introduced new features in its Fusion Cloud HCM and SCM suites, targeting healthcare firms. The Oracle Healthcare Talent Network, part of Fusion Cloud Recruiting, aims to help healthcare companies streamline recruitment and find skilled talent for critical roles.

-

November 2024 – A regional tech company successfully transitioned its HR operations to SAP with the help of PwC after an acquisition. The move eliminated the need for costly transition services agreements (TSAs) and provided enhanced data visibility, achieving over 99% time and pay accuracy and implementing SAP SuccessFactors and Fieldglass 40% faster than the industry standard.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 29.77 Billion |

|

Market Size by 2032 |

USD 78.84 Billion |

|

CAGR |

CAGR of 11.43% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Software and Service) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Key players in the Human Resource Management Software (HRMS) market include Accenture, ADP, Inc., Cegid, Ceridian HCM Holding, Inc., Cezanne HR, IBM, Mercer LLC, Oracle, PwC, SAP SE, UKG, Inc., Workday, Inc., Zoho, SuccessFactors, BambooHR, Gusto, Paycor, ClearCompany, Paycom, and Cornerstone OnDemand. |

|

Key Drivers |

• Revolutionizing HR Operations with Automation and AI Integration in Human Resource Management Software market |

|

Restraints |

• Ensuring Data Security and Privacy in HRMS while Mitigating Risks of Cyber Threats and Compliance Challenges |