Pension Real Estate Market Report Scope & Overview:

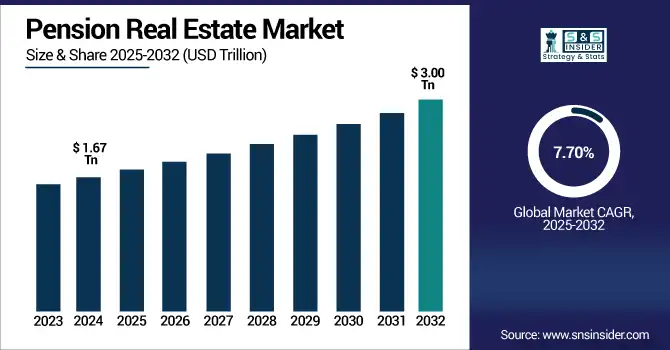

The Pension Real Estate Market was valued at USD 1.67 trillion in 2024 and is expected to reach USD 3.00 trillion by 2032, growing at a CAGR of 7.70% over 2025–2032.

To Get more information on Pension Real Estate Market - Request Free Sample Report

The Pension Real Estate Market growth is d rising global life expectancy and an expanding aging population, which are increasing the need for stable, long-term income sources. Pension funds are now diversifying their portfolios to invest in real estate, hoping to benefit from more stable return costs and hedge against inflation. This change is part of a wider move to real assets, which provide stability, capital preservation and defensible income under a cloudier market outlook.

-

Notably, 76% of institutional investors use real estate for portfolio diversification, with it being the most common hedge against inflation, according to S&P and Preqin.

-

Defined Benefit plans in the U.K. are gradually increasing their exposure to REITs, with asset weight share rising from 60% in January 2020 to 70% by January 2025, and count share growing from 39% to 51%.

-

Recent New York Fed data highlights that U.S. pension real estate portfolios hold approximately 4.4% in multifamily affordable housing, with expectations to increase to 5.0% by June 2025.

-

Additionally, the Government Pension Investment Fund (Japan), the world’s largest pension fund reported USD 1.73 trillion in assets under management as of 2024, reflecting the scale and investment potential of global pension entities.

Positive reforms, increasing defined contribution inflows, urbanization, infrastructure expansion, and demand for sustainable, mixed-use assets fuel market growth, while real assets act as a stabilizing asset class, providing significant risk-adjusted returns.

The U.S. Pension Real Estate Market size was valued at USD 0.46 trillion in 2024 and is expected to reach USD 0.81 trillion by 2032, growing at a CAGR of 7.46% over 2025-2032.

The U.S. Pension Real Estate Market growth is driven by growing retirement savings, growing allocations to real assets for un-correlated and stable returns, and demand for income-generating properties. Positive demographics and investments in urban infrastructure increase the attractiveness of real estate as an asset class for pension funds.

Market Dynamics:

Drivers:

-

Aging Global Population Drives Consistent Demand for Retirement Housing and Long-Term Care Real Estate Investments Across Developed Markets

Rising demand for senior living and long-term care properties is being fueled by an aging global population, especially in developed nations. That is part of the reason that pension funds have been gravitating towards these stable, yield generating assets. The advantage of purpose-built housing is that it is a sure source of tenants over time, as life expectancy rises and therefore a steady source of rental income. This demographic trend is strong for pension portfolio diversification and inflation protection. As the sector continues to be resilient and matches their goal, pension funds are expected to maintain confidence and be active buyers within the pension real estate market.

-

As of 2024, there are over 1 million residents in the U.S. assisted living facilities, with median annual costs of USD 64,200.

-

Governments in Asia, such as China, are expanding senior care services including home care, dementia facilities, and subsidies to meet growing demand from a rapidly aging population of 400 million aged 60+ by 2035.

-

According to the World Health Organization, between 2015 and 2050, the share of the global population aged over 60 will nearly double from 12% to 22%.

Restraints:

-

Regulatory Constraints and Zoning Limitations Restrict New Real Estate Developments for Pension-Backed Investment Expansion

Changing regulations and strict zoning laws limit the growth potential of pension real estate investments. This obviously impacts returns as long approval processes and land-use restrictions hinder the development process. Similarly, pension funds have fiduciary duties and investment limits by jurisdiction that restrict real estate allocations. These restrictions lessen operational agility and repel from entering high-potential markets. This regulatory friction not only limits the size and velocity of fresh investments, but continues to impede a key ingredient of pension real estate portfolio expansion in particularly permitting-challenged markets.

-

A UCLA–Anderson study found the average approval time across all multifamily housing projects in Los Angeles was 652 days (1.8 years), with total development averaging 3.9 years.

-

Moreover, 97% of developers report construction delays due to permitting issues, with nearly 18 months on average required to build an apartment building.

Opportunities:

-

Growth of Urban Retirement Communities Presents Scalable Investment Potential for Pension Real Estate in Emerging and Developed Markets

Demand for urban integrated retirement communities is fueled by rising urbanization, alongside changing retirement demands, making this a scalable opportunity for private equity real estate steered by pensions. Seniors who want to remain engaged with the urban environment they inhabited prior to retirement boost demand for mixed-use senior housing by seeking urban healthcare and amenities. Rental income and capital gains provide pension funds with stable long-term returns. In aging societies, vertical retirement villages and community-focused developments have emerged as a natural synergy between pension funds investing in urban infrastructure that is socially impactful, whilst also ensuring a demographic dividend of the graph are aligned with investment goals.

-

As of 2024, the U.S. population aged 65+ rose 3.1% to 61.2 million, while the under‑18 group declined slightly indicative of a shifting demographic structure.

-

In 2024, the national median cost for assisted living was about USD 70,800/year, with occupancy rates climbing from 77% to 84% year-over-year. Maplewood Senior Living’s portfolio achieved 95% occupancy in late 2023, far above national averages.

Challenges:

-

Volatility in Interest Rates Impacts Pension Real Estate Valuations and Deters Consistent Capital Allocation Strategies

Pension investments in real estate are affected by fluctuating interest rates by affecting asset valuations and financing costs. Increased borrowing costs with rising rates therefore push down property values and squeeze out return and add to timing challenges. Such valuation shifts are difficult for pension funds with fixed liabilities to absorb. On the flipside, lower rates may create or aggravate asset bubbles or postpone corrections. Such volatility leaves little room for long-term capital planning and compels pension managers to implement strategy changes with alarming frequency, often at the expense of stability. Consequently, the uncertainty restricts the possibility of fast-paced growth and unfortunately destabilizes pension property investment frameworks.

-

Between March 2022 and July 2023, the Fed raised rates by over 525 bps, causing significant valuation compression in commercial real estate. Property values declined approximately 25–30% since 2019 peaks, with office buildings being the hardest hit.

Segmentation Analysis

By Type of Pension Plans

Defined Benefit Plans dominated the Pension Real Estate Market share in 2024 of a 31%, owing to their long-term liability profiles and specific cash flow requirements, which makes the stable cash flow characteristics produced by real estate well suited as an investment. Real estate assets seem to benefit from these plans in terms of diversification, income stability and inflation hedging, helping them achieve risk-adjusted return objectives.

Defined Contribution Plans are expected to grow at the fastest CAGR of 9.41% over 2025–2032, driven by rising personal control over retirement assets and the rising interest in alternative investment products, including real estate. The growing desire for inflation-hedged returns, digital investment platforms, and increasing interest in flexibility are attracting greater participation in real estate exposure in defined contribution structures.

By Investment Strategy

Conservative Strategies held the highest revenue share of 24% in 2024, as pension funds prioritize stability, capital preservation, and predictable income. This approach fits the fiduciary responsibility of pension managers to minimize risk while meeting long-term obligations, leading to strong preferences for core real estate investments with stable tenants and long leases in low-volatility markets.

Growth-oriented Investments are projected to grow at the fastest CAGR of 10.71% over 2025–2032, owing to a growing desire for long-term capital gain and higher returns. But with inflation still concerns, low yields from traditional fixed income assets and a need for diversification pension funds are looking at more opportunistic and development-based assets in high growth urban areas, combined with significant hedging of any exchange risk as this should be treated as a true domestic exposure.

By Types of Real Estate Assets

Residential Properties dominated the market in 2024 with a 25% revenue share, owing to its stable demand, near-zero vacancy rates and stable rental income. Multi-family housing and senior living developments have become appealing investment opportunities amid urban housing shortages and the aging tenant population, ensuring stable and long, pandemic-resistant returns for pension portfolios in search of reliable, income-generating assets.

Industrial Properties are expected to grow at the fastest CAGR of 10.41% over 2025–2032, as rising e-commerce, logistics networks, and last-mile delivery infrastructure are driving demand for parking lots, fulfillment centers, and warehouses. Pension funds are missing out on warehouses, distribution centers and datacenters as high-yielding assets with rising rents and a demand that is well-known to be pandemic-proof in the new digital economy.

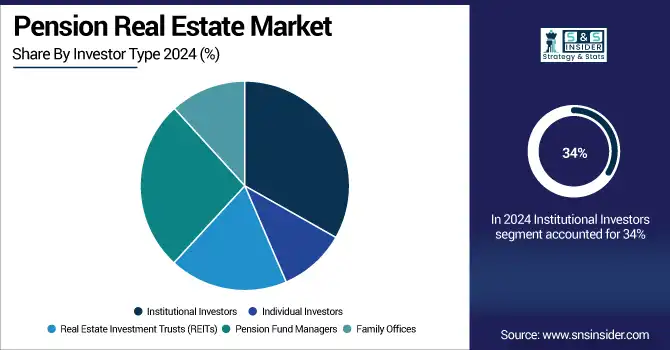

By Investor Type

Institutional Investors led the market in 2024 with a 34% revenue share, due to their substantial asset bases and long-term investment timelines, in addition to their professional management skills. Such investors are heavy allocators to real estate for asset class diversification and reliable income, and enjoy scale benefits, direct access to large transactions, and development of proven risk management systems.

Family Offices are expected to grow at the fastest CAGR of 10.27% over 2025–2032, due to the increasing need for diversification and investments related to legacy. This is in line with their inherent flexibility in investment decisions, longevity of wealth play, and shift toward investing in alternative assets, such as real estate, particularly in value-rich or emerging segments that are tied to pensions.

By Risk Tolerance

Low-risk Tolerance Investments led the market in 2024 with a 29% revenue share, as pension funds are focused on capital preservation, income stability, and downside protection. It is this that has been attractive to retirees and older funds and so the focus is in core real estate such as stabilized office buildings and residential properties with long-term leases and credit tenants.

Value-add Investments are expected to grow at the fastest CAGR of 10.22% over 2025–2032, as pension funds are strategically channeling Oak and transitioning into higher return profiles supported with a solid narrative from the perspective of the liabilities and inflation drivers. This allows funds to add the upside through renovations, operational enhancements, and market repositioning while providing the benefits of necessary diversification and improved risk-adjusted returns.

Regional Analysis:

North America

North America dominated the Pension Real Estate Market in 2024 with a 39% revenue share due to its mature pension system, locally deep institutional investor base and stable property environment in this region. Through legislative support and relatively higher transparency, the region became highly attractive to pension funds by providing consistent, long-term income and risk-adjusted returns from diversified real estate sectors, such as office, residential, and industrial.

-

According to the 2022 Private Pension Plan Bulletin, reported Form 5500 schedules show that defined benefit (DB) plans held USD 52.5 billion in real estate, while defined contribution (DC) plans accounted for another USD 17.1 billion totaling USD 69.6 billion in pension real estate assets, underlining the significant exposure of U.S. pensions to this asset class.

The U.S. is dominating the Pension Real Estate Market due to its large institutional base, mature real estate sector, and stable long-term investment environment.

Asia Pacific

Asia Pacific is expected to grow at the fastest CAGR of 9.89% over 2025–2032, due to rapid urbanization, the expanding middle class demographic, and growing allocations of pension funds into real assets.

-

A study surveying 75 government and public-sector pension schemes (including 23 in APAC) revealed that only 17% of APAC plans currently allocate over 20% of assets to real assets but 67% globally plan to increase allocations in the next two years, with APAC leading this trend.

Japan leads the Asia Pacific Pension Real Estate Market, driven by its vast pension assets, mature property sector, and a stable investment climate amid regional growth in infrastructure, housing, and logistics.

Europe

Europe holds a significant share in the Pension Real Estate Market owing to the longstanding pension systems in place in various countries, stable regulations, and the wider scope of availabilities of real estate options to investors looking for stability and income.

-

According to EIOPA, European insurers dedicate 5.7% of their assets to real estate through funds, mortgages, and property within a broader 16% allocation to alternative assets.

-

European pension schemes predominantly invest in core real estate, with allocations ranging from 3% in Germany to over 12% in Finland, delivering an average annualized return of 7.8% for pan-European core real estate.

The U.K. is dominating the Pension Real Estate Market in Europe due to its strong pension infrastructure, deep capital markets, and a diversified real estate portfolio.

Middle East & Africa and Latin America

Pension Real Estate Market trends in the Middle East & Africa and Latin America show steady growth, supported by emerging pension reforms, increasing institutional interest and growing demand for infrastructure, residential and commercial assets in rapidly urbanizing economies within the regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Pension Real Estate Market companies are China Poly Group Corporation, China Vanke Co. Ltd, China Resources Land Holdings Limited, Capital Land Limited, Greenland Holdings Corporation Limited, Zhejiang Yuntian Group Co. Ltd, Del E. Webb Construction Company, Groupe Primonial, Cofinimmo, Korian, Orpea, Domusvi, Silver Care, Dussmann, and Tertianum Group.

Recent Developments:

-

In 2023, Vanke launched a pioneering “life‑cycle housing maintenance” pilot program, integrating eldercare solutions into its rental and property‑management services, aiming to enhance tenant well‑being across diverse residential properties.

-

In 2024, Vanke sold approximately 19,000 sqm of land at a 29% discount; this strategic move supports pension‑style asset recycling and reinforces the company’s financial health and long‑term stability.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.67 Trillion |

| Market Size by 2032 | USD 3.00 Trillion |

| CAGR | CAGR of 7.70% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type of Pension Plans (Defined Benefit Plans, Defined Contribution Plans, Hybrid Plans, Government Pension Plans, Corporate Pension Plans) • By Investment Strategy (Conservative Strategies, Aggressive Strategies, Balanced Strategies, Income-focused Investments, Growth-oriented Investments) • By Types of Real Estate Assets (Residential Properties, Commercial Properties, Industrial Properties, Mixed-use Developments, Retail Properties) • By Investor Type (Institutional Investors, Individual Investors, Real Estate Investment Trusts (REITs), Pension Fund Managers, Family Offices) • By Risk Tolerance (Low-risk Tolerance Investments, Moderate-risk Tolerance Investments, High-risk Tolerance Investments, Value-add Investments, Core Investments) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | China Poly Group Corporation, China Vanke Co. Ltd, China Resources Land Holdings Limited, Capital Land Limited, Greenland Holdings Corporation Limited, Zhejiang Yuntian Group Co. Ltd, Del E. Webb Construction Company, Groupe Primonial, Cofinimmo, Korian, Orpea, Domusvi, Silver Care, Dussmann, Tertianum Group |