Digital Signage Market Report Scope & Overview:

Get More Information on Digital signage market - Request Sample Report

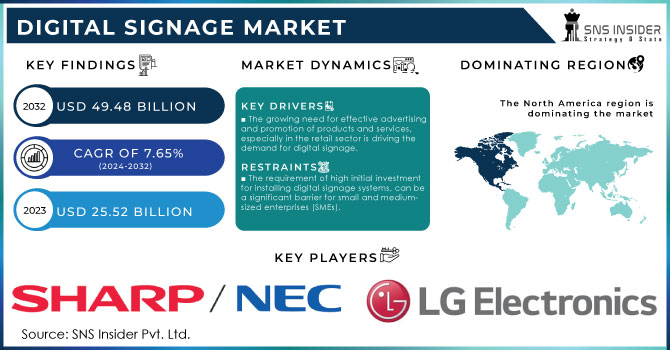

Digital signage market size was valued at USD 25.52 Billion in 2023. It is expected to Reach USD 49.48 Billion by 2032 and grow at a CAGR of 7.65% over the forecast period of 2024-2032.

The growing need for digitalized promotion to reach the target customers is driving Digital signage market growth. This increasing adoption of 4K digital signage displays with embedded software and media players is providing an affordable Ultra HD solution, which in turn augments the demand for these devices. This combined with the increase in online spending on products like innovative home monitoring systems and forex cards that need clear, informative ads is driving this growth. This factor is expected to drive the global market over the forecast period as advanced products require digitization data management that can be accessed remotely as well Digital signage are boards that display information to large audiences on a larger scale digital displays, making way for more effectiveness over the conventional methods. Digital signage integrated with biometric technology, like gaze tracking, can keep a complete record of what the typical behaviour patterns in consumers are doing which helps companies to make improvements and increase their marketing way effectiveness. The realization from traditional advertising's shortcomings; the short span of print marketing etc. have pushed toward digitalized advertisements. Moreover, substantial investments are being made into improving display technology. Recently, in May 2022 Brass Roots Technologies LLC (especially its advanced optics and electronics) was acquired by Christie Digital Systems USA, Inc. This acquisition is the next step in a multi-phase strategy to strengthen and expand Christie's engineering competencies as global demand for these solutions rises.

Market Dynamics

Drivers

-

The growing need for effective advertising and promotion of products and services, especially in the retail sector is driving the demand for digital signage.

-

Continuous advancements in display technologies, such as the development of OLED and 4K displays, are enhancing the quality and efficiency of digital signage, making them more appealing to businesses.

-

Increased usage of digital signage in sectors such as transportation (airports, railway stations), healthcare (hospitals), and education (schools, universities) is contributing to market growth.

-

Government initiatives to install digital signage in public spaces for information dissemination and public safety messages are boosting market growth.

The demand for digitized advertising of goods and services is increasing, especially in the retail sector which is one of the main factors that propel the digital signage market. This gives a huge edge to digitized advertising being a more dynamic, interactive way of retaining consumer attention over traditional static ads. Marketers looking for ways to improve customer engagement and boost sales will find digital signage appealing as it allows them to present real-time information, animations, or other interactive elements. This is not surprising, given the importance of retail as a vertical for digital signage with a 19% market share in spending on technology such as this.

The competition among retailers is driving the increased use of digital signs because the technology alone stands out as an effective marketing strategy. Consumer demand for interactive and visually appealing content is on the rise, and companies are using digital signage to help deliver more immersive shopping experiences. Technological advances in display manufacture are setting the trend as digital signage is becoming progressively affordable and accessible to a broader range of businesses.

Restraints

-

The requirement of high initial investment for installing digital signage systems, can be a significant barrier for small and medium-sized enterprises (SMEs).

-

The complexity involved in setting up and maintaining digital signage systems, including technical issues and software updates, can deter some businesses from adopting these solutions.

-

Rapid technological advancements can lead to quick obsolescence of existing digital signage solutions, requiring businesses to invest in newer technologies more frequently.

-

The use of interactive and data-collecting digital signage can raise privacy and security concerns among consumers and businesses, potentially limiting the adoption of more advanced features.

High upfront costs involved with digital signage systems have made it rather difficult to buy in for the Small and Medium Enterprises (SME) segment. These costs span hardware (displays, media players, mounts), software (content management systems, licenses), and content creation (design/animation/ video production). A standalone digital signage display setup costs from $1,500 to $10,000 depending on factors such as the size/quality of the screen and the complexity of the installation.

On top of this, the expense of installing numerous screens within a large facility or multiple locations can add up quickly escalate. For example, a 10-display network within one retail chain could easily top over $50k when factoring in installation and setup fees. These ongoing operational costs are also no small amount - maintenance, updates, and potential repairs can add another 10-20% of the initial investment per year.

Segment Analysis

By Type

In 2023, the video walls segment held largest share of market 25%, while expected to grow with significant growth rate during forecast period. The video wall or screen has become popular in shopping arcade and other public places. Nevertheless, kiosks segment is likely to witness significant revenue growth by 2032, accounting as the largest type of segment in the global market between this period. In educational institutions also kiosks are dominantly used for information dissemination and in advertising.

On the other hand, transparent LED screens type is expected to exhibit high growth rate with a CAGR of 9.8% during forecast period. Transparent LED screens provide more than 80% transparency and high-resolution image & video quality with energy saving, so it can avoid increasing power consumption to save running costs. These benefits are expected to drive the demand for transparent LED screens, leading the substantial growth of this segment.

By Application

In 2023, retail sector market will be largest with the share of more than 20%. One of the major consumers of digitized ads, which are used for marketing and selling products is this sector. Heightened competition among retailers, with different products and service offerings is driving the greater need for effective marketing. As a result, in the retail industry, use of various forms of digital posters are very popular because ads can be converted into digitized ones which attract more attention from their target consumers.

The transportation sector is expected to be the highest growing at a CAGR of 9.5% This area uses digitized promotions and posters in locations such as airports, railway stations, metro stations. Moreover, digital display used on the roads through cab and public transport buses for advertising purpose of any goods or services. The development of the transportation industry in emerging countries is anticipated to significantly boost advertisement and digital signage market, subsequently fuelling growth of global digital signage.

By Technology

The LED segment led the market by accounting for more than 46.5% in 2023 LCD technology, predominantly employed within the advertisement as well as promotion industry is favoured because of its simpler manufacturing and cheaper expenses. However, with time they become the standard as far their high-quality display is concerned and specifically for LED TV. Companies are always working on creating flat-panel, wider and brighter if not slimmer LEDs becoming the trend in display technology.

OLED displays use LED technology and are likely to drive even more adoption of LEDs in display applications. OLEDs offer better image quality, which is one of the key factors boosting their sales. Manufacturing of the same was also a complicated process, thereby putting such displays at a high production cost and short life compared to their LED segment counterparts. However, the ongoing advancements and improvements of LED technology remain instrumental in growth across industries.

Regional analysis

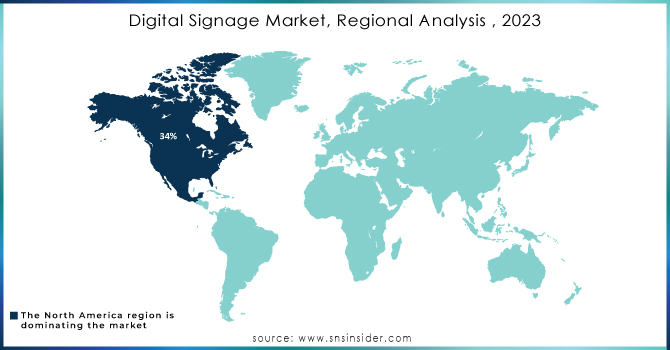

In terms of revenue, North America dominated the Market in 2023 with a global market share of 34% While Europe held second position. The U.S. is experiencing remarkable growth on account of increasing R&D efforts for improving product quality and initiatives adopted by governmental organizations to deploy digital signage in numerous offices for uninterrupted information flow. The U.S. digital signage market is projected to grow with a significant CAGR. whilst broadcasting emergency Alerts about the trends that originate from the U.S and the presence of dedicated suppliers.

The Asia Pacific region is projected to grow with the fastest CAGR of 9.8 %. This growth is mainly due to the growing awareness of digital signage advantages. Significant expansion is therefore projected for Asia-Pacific, which includes the emerging markets of India and China as their adoption surges in retail stores, corporate offices, hospitals, and hotels. This year saw more footfall into malls and ingesting joints spread across multiplex stores in emerging Asia Pacific countries due to increased disposable income. Businesses are cashing in on this through large displays, reaching their customers with larger, more effective placements. On the other hand, China accounted for a more than 36% revenue share in the Asia Pacific market for digital signage due to an ever-increasing retail industry and consumer electronics sales as well as mobile gaming trends which are increasingly popular across many APAC countries. During the forecast period, Japan is predicted to grow significant growth rate with advancements in display technologies that provide improved quality and cost-effective digital signage across all sectors.

Need any customization research on Digital Signage Market - Enquiry Now

Key Players:

The major players in the market are Panasonic Holdings Corporation, Sharp NEC Display Solutions, Ltd., AUO Corporation, LG Electronics, Leyard Optoelectronic Co., Ltd., Cisco Systems, Inc., Sony Group Corporation, Samsung Electronics Co., Ltd., Intel Corp., Barco, BrightSign LLC, Shanghai Goodview Electronics Technology Co., Ltd., Winmate Inc., and others in the final report.

Recent Developments:

-

Barcelona, 19 FEBRUARY 2024 - Barco has signed a distribution partnership agreement with Ingram Micro Korea to make its G-series projection and image processing solutions available through the leading IT distributor in Asia Pacific Singapore from February onwards. This partnership will serve to scale Barco's high-end offerings with a wide range of products, such as G-series projectors, ImagePro-4K and PDS-4K.

-

Samsung Electronics Co., Ltd. announced the VXT platform in January 2024, a new cloud-based offering meant to make it easier for businesses of all sizes and sectors to do digital signage right The VXT platform is a unified cloud-based solution for content creation and remote display management, delivering an intuitive approach to all stages of the digital signage process.

-

In February 2023, Winamte Inc. announced its new series of outdoor displays that can provide more viewability for bus shelter advertising, digital drive-thru menu boards and smart cities or window display applications. A new set of instrumentation displays guesses enabled for even clearer images, light transmission and sturdily stable/drifting actually used together.

| Report Attributes | Details |

| Market Size in 2023 | USD 25.52 Bn |

| Market Size by 2032 | USD 49.48 Bn |

| CAGR | CAGR of 7.65%From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Video Walls, Video Screen, Transparent LED Screen, Digital Poster, Billboards, Kiosks, Others) • By Technology (LCD, LED, OLED, Projection) • By Component (Hardware, Software, Service) • By Resolution (8K, 4K, Full High Definition (FHD), High Definition (HD), Lower than HD) • By Location (In-store, Out-store) • By Application (Retail, Hospitality, Entertainment, Stadiums & Playgrounds, Corporate, Banking, Healthcare, Education, Transport) • By Content Category (Broadcast, News, Weather, Sports, Others, Non-Broadcast) • By Signage size (Below 32 Inches, 32 to 52 Inches, more than 52 Inches) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Panasonic Holdings Corporation, Sharp NEC Display Solutions, Ltd., AUO Corporation, LG Electronics, Leyard Optoelectronic Co., ltd., Cisco Systems, Inc., Sony Group Corporation, Samsung Electronics Co., Ltd., Intel Corp., Barco, BrightSign LLC, Shanghai Goodview Electronics Technology Co., Ltd., Winmate Inc. |

| Key Drivers | • The growing need for effective advertising and promotion of products and services, especially in the retail sector is driving the demand for digital signage. |

| Market Restraints | • The complexity involved in setting up and maintaining digital signage systems, including technical issues and software updates, can deter some businesses from adopting these solutions. |