Electric Power Steering Market Report Scope & Overview:

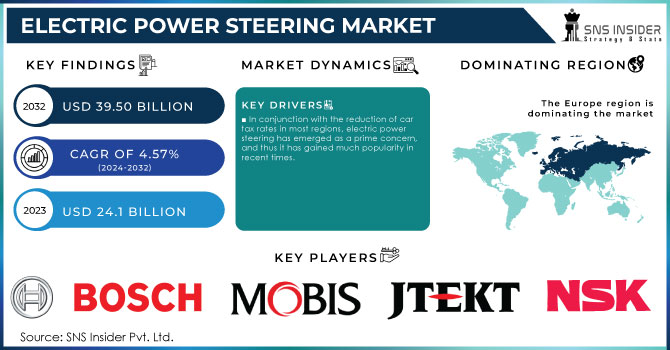

The Electric Power Steering Market size was valued at USD 24.1 billion in 2023 and is expected to reach USD 39.50 billion by 2032 and grow at a CAGR of 4.57% over the forecast period 2024-2032.

Get E-PDF Sample Report on Electric Power Steering Market - Request Sample Report

Perhaps more importantly, adoption of EPS systems in vehicle - while achieving and exceeding 85 % penetration of all new vehicles fitted with some form of electric power steering. This is primarily driven by an increasing demand for improvement of fuel efficiency, which EPS systems possesses to the extent that up to a 3-5% improvement in fuel consumption occurs as compared to traditional hydraulic power steering systems.

The growth in the EPS market has been driven by automobile manufacturers' R&D research. It has been calculated those investments made on R&D by the automobile industry amount to approximately 8-10% of annual revenues and primarily focus on steering system innovation. Furthermore, government regulations regarding increasing fuel efficiency and emission levels make car manufacturers invest more in electric steering technologies. In fact, CO2 emission standards in the European Union are considered to influence EPS market growth; 25-30% EPS use is expected for the region by 2030.

Consumer preference for cars equipped with the latest advanced driver assistance systems also benefits the EPS market. New vehicles integrate EPS systems up to 60% of the time to support features such as lane-keeping assistance and automated parking systems. This trend will fuel demand for smart steering solutions, adding to strong growth in the global EPS market.

Major trends in the automotive EPS market are more advanced driver assistance systems, which is increasing the demand for more advanced steering solutions. Today, more than 60% of the new vehicles are fitted with ADAS, based on EPS, like lane-keeping assist and automated parking. Another major trend is the shift towards electric and hybrid vehicles where EPS was critical in reducing energy usage. This will drastically increase the adoption rate for EPS as electric vehicles are expected to account for 35-40% of total global EPS demand by 2030. In addition, the vehicle electrification and lightweighting thrust has provided an impetus to the EPS technologies with the auto manufacturers aggressively working towards reduction in fuel efficiency through reduction in the lightness of vehicles. Autonomous driving is another growth factor. Fully autonomous cars are expected to have 10-15% of the market by 2035 and so the EPS system will be necessary for complete, real-time steering control. There are finally regional regulations by their specific standards for fuel efficiency and emission reduction in Europe and North America that are forcing the change to EPS. This region's growth is supposed to increase by 20-25% over the decade.

Electric Power Steering Market Drivers:

In conjunction with the reduction of car tax rates in most regions, electric power steering has emerged as a prime concern, and thus it has gained much popularity in recent times.

Electric power steering, along with its reasonably low cost of implementation, has gained much popularity in recent years as a whole, mainly due to its efficient performance and the recent cut in tax rates for cars. This is driven by a higher consumer trend towards low-cost and environmental-friendly solutions in the automobile industry, accelerated by increasing fuel costs and a rising concern for sustainability within the vehicle itself. The consumers today are very particular about the automobiles they opt for, which has increased the demand for systems that perform better, but at a lower operational cost as well.

One advantage over hydraulic steering is that EPS is lighter in weight, consumes less energy, and does not require much in the way of after-sale servicing. Those factors alone make it attractive to both manufacturers and the average consumer, particularly in this transitional phase of the automotive sector into electrification and development of hybrid and fully electrical vehicles. Even though some sources suggest that an EPS system can result in up to 3-5% better fuel efficiency, that is another important factor if one considers its overall implications on vehicle operating costs.

Market Segmentation Analysis:

By Type:

EPS systems are classified into rack assist (REPS), column assist (CEPS), and pinion assist (PEPS). REPS is the most widely used in passenger cars. Since it provides direct torque assistance for the better performance of driving, it is likely to rule the market with a share of 50-60%. CEPS finds its utility in smaller vehicles because of its compact structure. This also is going to be the appropriate one that capture will hold 25-30% of the market. This is further supplemented with that the PEPS, which provides better support to larger vehicles like SUVs and trucks, would account for around 15-20% of the EPS market.

By Vehicle Type:

The market can also be segmented based on vehicle type into passenger cars and commercial vehicles. Passenger cars are driving the EPS market, occupying around 70-75% of the share. The rising demand for comfort and safety features is driving the EPS market in the passenger cars. Meanwhile, commercial vehicles, representing trucks and vans, should account for 25-30% of the market owing to higher requirements for driver assistance and operational efficiency in more significant vehicles. As the automotive sector leans more towards electrification and advanced technology, so will the two segments continue to develop, promoting the growth of the EPS market.

Electric Power Steering Market Regional Analysis:

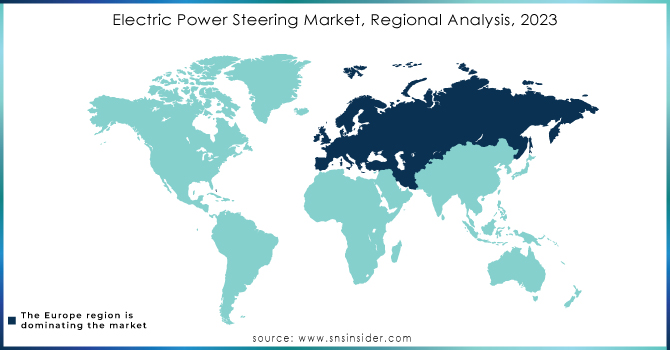

The automotive electric power steering market is expected to have a promising growth, and it is anticipated that in the projection period, Europe will take the top position. Growth in sales of electric vehicles will be the main driver of this leadership with estimates showing their performance is likely to expand by nearly 25% year after year till 2030. Major producers in the automotive industry like Volkswagen, Renault, and BMW are situated in Germany, France, Italy, and the United Kingdom. The companies are investing highly in producing electric vehicles, which by nature, is going to require EPS systems. Further strengthening its stance, the European market is expected to capture around 40-45% of the global market share in the EPS market by 2030, with the presence of multiple OEMs and tier-1 suppliers that possess highly sophisticated research and development capabilities in electric power steering technology.

The market for EPS in the Asia Pacific region is expected to grow rapidly with growth estimated to grow at a compound annual growth rate of 15-20% through the forecast period. The region leads in the supply of electric vehicles and its components, with China being the largest market in the world for EVs. Consistent growth in the sales of EVs in India and other countries of ASEAN will create attractive opportunities for market players. Consumer demand for safety features and a comfortable ride experience is likely to contribute to the Asia Pacific market growth, which will account for 30-35% of the global EPS market in 2030. North America EPS Market will grow with a CAGR of 12-15% owing to rising sales of SUVs and light commercial vehicles and efforts toward integration of automation in automotive applications.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players:

Some of the major key players are:

-

Robert Bosch GmbH: (Electric Power Steering (EPS) Systems, Steering Column Control Units)

-

Hyundai Mobis Co., Ltd.: (Integrated EPS with Torque Sensor, Column-Type EPS Systems)

-

JTEKT Corporation: (Electric Rack and Pinion Steering, Torque Sensor EPS Systems)

-

ZF TRW Automotive Holdings Corp: (Electric Power Steering Gear, Advanced Driver Assistance System (ADAS) Integration)

-

NSK Ltd.: (Electric Power Steering Units, Steering Column Assemblies)

-

Nexteer Automotive Group Limited: (Electric Power Steering System, Active Steering System)

-

Mando Corporation: (Electric Rack and Pinion Steering, Column Assist Steering Systems)

-

ThyssenKrupp AG: (Electric Steering Systems, Steering Column Drive Motors)

-

Showa Corporation: (Electric Power Steering Systems, Active Steering Systems)

-

China Automotive Systems: (Electric Power Steering Gear, Hydraulic Power Steering Products)

-

DENSO Corporation: (Electric Power Steering System, Column Assist EPS Units)

-

Hitachi Automotive Systems: (Electric Power Steering Units, Steer-by-Wire Systems)

-

Pioneer Corporation: (Electric Power Steering Control Systems, Advanced EPS Solutions)

-

Mitsubishi Electric Corporation: (Electric Power Steering Motors, Integrated Steering Control Systems)

-

Fujikura Ltd.: (Electric Power Steering Systems, Column-Type Steering Mechanisms)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 25.85 Billion |

| Market Size by 2031 | US$ 36.98 Billion |

| CAGR | CAGR of 5.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Rack assist type (REPS), Colum assist type (CEPS), Pinion assist type (PEPS)) • by Component (Steering column, Sensors, Steering gear, Mechanical rack, and pinion, electronic control unit, Electric motor, Bearing) • by Vehicle Type (Passenger cars, Commercial vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Robert Bosch Automotive Steering GmbH, Hyundai Mobis Co., Ltd., Electric Steering JTEKT Corporation, ZF TRW Automotive Holdings Corp., NSK Ltd., Nexteer Automotive Group Limited, Mando Corporation, ThyssenKrupp Ag, Showa Corporation, and China Automotive System |

| Key Drivers | • Because of the decrease in car tax rates, electric power steering is also in high demand. • Because of strict pollution rules, the industry is likely to expand rapidly around the world. |

| RESTRAINTS | • The much greater cost of EPS in contrast to conventional steering systems. • A lack of steering feel might have a negative impact on market expansion. |