Car Rental Market Report Scope & Overview

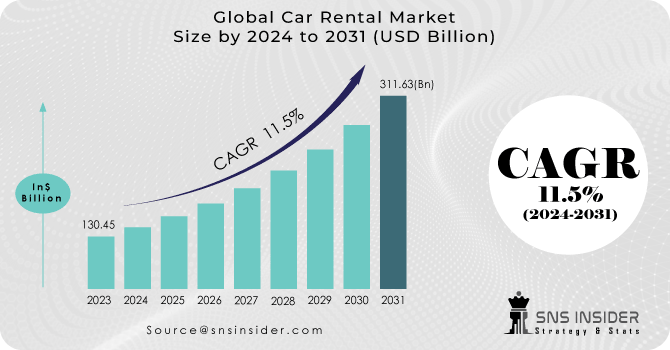

The Car Rental Market Size was valued at USD 130.45 billion in 2023 and is expected to reach USD 311.63 billion by 2031 and grow at a CAGR of 11.5% over the forecast period 2024-2031.

The car rental industry is experiencing a rise due to the several factors. More people are traveling for business and leisure, creating a surge in demand. Child safety seats, navigation systems, mobile phones, entertainment systems, and portable Wi-Fi are some of the additional services and items that can be rented from the car rental facility in addition to the vehicle itself.

Get more information on Car Rental Market - Request Sample Report

The rise of the internet, particularly in developing countries, allows companies to reach a wider audience through convenient mobile apps. Technology is a key driver, with improved customer management systems and online booking streamlining the rental process. The global travel surge has also spurred car rental companies to expand their reach internationally, creating integrated systems to manage their geographically dispersed operations. Another trend impacting the industry is "bleisure travel," the merging of business trips with leisure activities. Companies are increasingly allowing employees to bring their families on business trips, particularly for international destinations, to boost employee retention and reduce stress. This "bleisure" concept caters to younger business travellers who value the opportunity to explore new locations while on work trips.

MARKET DYNAMICS:

KEY DRIVERS:

- Rising Business & Leisure Travel Fueling Car Rental Market Growth

The car rental market is flourishing due to a surge in global travel for both business and leisure. A growing number of business trips, fueled by expanding industries, translates to more car rentals for work commutes. Increased disposable income also plays a role, as people have more resources to dedicate to personal travel and exploring new destinations. This rise in travel needs, coupled with growing spending power is propelling the car rental market forward.

- Rising Internet Penetration and Mobile Apps Fuel Customer Growth in Car Rental Market

RESTRAINTS:

- Economic downturns can lead to decreased travel and car rental demand.

The car rental industry can be susceptible to economic fluctuations. When economic downturns or recessions occur, consumer spending tends to become more cautious. Travel, which is often considered discretionary spending, can be one of the first areas where people cut back. This decrease in travel translates to a lower demand for car rentals. Companies on limited budgets may reduce business trips, and individuals might opt for staycations or more economical travel options that don't require car rentals. Thus, the car rental industry can experience a slowdown during economic hardships.

- The rise of ride-sharing services like Uber and Lyft presents a significant alternative to car rentals.

OPPORTUNITIES:

- Offering subscription models for long-term car rental needs can attract budget-conscious customers.

- Partnering with travel agencies and tourism boards creates bundled vacation packages with car rentals.

- Investing in technological advancements like self-service kiosks and keyless rentals streamlines the customer experience.

CHALLENGES:

- Fluctuations in fuel prices create uncertainty and impact car rental profitability.

- Maintaining a modern fleet with the latest features requires significant capital investment.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has significantly disrupted the car rental market globally. Reduced tourism is a major cause with 70% of drop in Eastern European tourism, leading to rapid decline in car rental demand and impacting regional companies' revenue. The war has exacerbated existing supply chain issues in the auto industry. Sanctions and logistical hurdles have limited car production and deliveries, making it harder for rental companies to acquire new vehicles. This shortage could inflate rental prices by up to 15% in some areas due to limited car availability. The conflict has also driven up insurance costs for car rentals in nearby countries due to heightened regional instability. This could deter travellers from renting cars, further decreasing demand. The war's impact on global oil prices has caused fuel cost volatility for car rentals. Companies may raise rental rates or implement fuel surcharges to offset these increased expenses.

IMPACT OF ECONOMIC SLOWDOWN

The Economic downturns can significantly disrupt the car rental market. Tightened consumer spending puts a damper on car rentals, often seen as less economical than using personal vehicles. This is especially true in regions with limited government incentives for rentals. There is a potential 5-10% of revenue decline during downturns. Businesses, a major source of demand, often cut back on discretionary spending like travel, leading to a potential reduction in business travel spending. Consumers, with limited budgets, may opt for staycations or cheaper travel options, further reducing car rental needs. Thus, economic sensitivity can make it difficult for rental companies to raise prices despite rising operational costs, potentially squeezing profit margins.

KEY MARKET SEGMENTS:

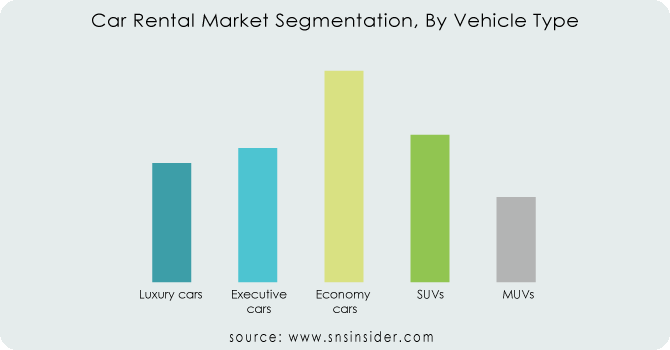

By Vehicle Type

- Luxury cars

- Executive cars

- Economy cars

- SUVs

- MUVs

Economy Cars is the dominating sub-segment in the Car Rental Market by vehicle type holding around 30-35% of market share due to their affordability. They are the favourite choice for budget-conscious travellers and for short-term rentals. This segment caters to a wider audience, making it the most in-demand category.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

- Local usage

- Airport transport

- Outstation

- Others

Airport Transport is the dominating sub-segment in the Car Rental Market by application. Airport transport caters to arriving passengers seeking convenient onward journeys. Outstation rentals are popular for exploring destinations beyond the arrival city, often for leisure purposes. The dominance can vary depending on location and tourist activity.

REGIONAL ANALYSES

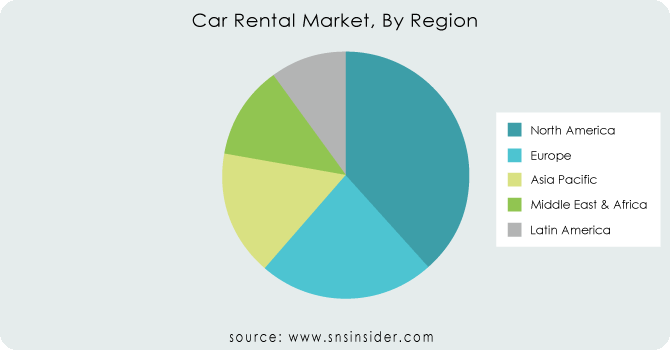

The North America is the dominating region in the car rental market, holding roughly 35% share. This dominance stems from a thriving tourism industry attracting millions of visitors annually. Strong economies in the US and Canada translate to higher disposable income, fueling leisure travel and car rental needs.

Europe is the second highest region in this market driven by its rich cultural heritage and diverse landscapes. These factors create a high demand for car rentals as tourists explore the continent. Major European cities like London and Paris act as global business hubs, attracting business travellers who frequently rely on car rentals.

The Asia Pacific is the fastest growing region in this market. This rapid growth is fueled by growing economies in countries like China and India, leading to a rise in disposable income and increased travel spending, with car rentals included.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Enterprise Holdings Inc, Uber Technologies, Inc., Avis Budget Group Inc, Hertz Global Holdings Inc, ANI Technologies Pvt. Ltd., Europcar, Carzonrent India Pvt Ltd, SIXT, Eco Rent a Car, Localiza and other key players.

Enterprise Holdings Inc-Company Financial Analysis

RECENT DEVELOPMENT

-

In May 2023: Car Karlo, a new self-drive car rental service, launched in Pune, India. They aim to capture a share of the booming Indian market by offering an easy-to-use website and mobile app for booking rentals.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 130.45 Billion |

| Market Size by 2031 | US$ 311.63 Billion |

| CAGR | CAGR of 11.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Application (Local Usage, Airport Transport, Outstation, Others) • by Rental Duration (Short-term, Long-term) • by Vehicle Type (Luxury car, Executive car, Economical car, Sports utility vehicle (SUV), Multi-utility vehicle (MUV)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Enterprise Holdings Inc, Uber Technologies, Inc., Avis Budget Group Inc, Hertz Global Holdings Inc, ANI Technologies Pvt. Ltd., Europcar, Carzonrent India Pvt Ltd, SIXT, Eco Rent a Car, and Localiza |

| Key Drivers | • Consumers' increasing ability to spend their money and economies that are expanding steadily. • Renting a car is becoming more popular as millennials are less likely to possess a car than previous generations. |

| RESTRAINTS | • Rising gasoline and diesel prices in developing countries are expected to slow market growth. • The lack of awareness regarding car rental in these locations is the main setback in the business. |