Electronic Adhesives Market Report Scope & Overview:

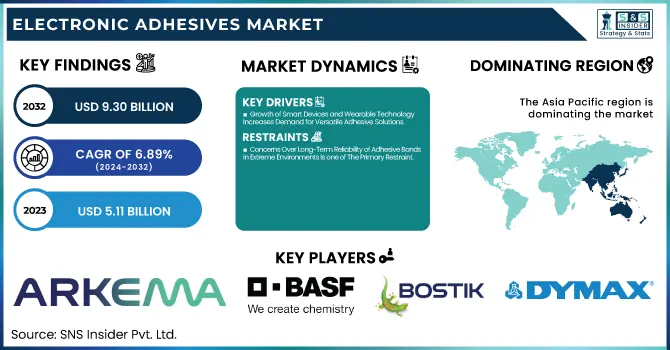

The Electronic Adhesives Market Size was valued at USD 5.11 Billion in 2023 and is expected to reach USD 9.30 Billion by 2032, growing at a CAGR of 6.89% over the forecast period of 2024-2032.

To Get more information on Electronic Adhesives Market - Request Free Sample Report

The Electronic Adhesives Market has experienced substantial growth, fueled by technological advancements and rising demand across various industries. Our report dives into the analysis of raw material trends, examining key components, supply chain dynamics, and pricing fluctuations. It also provides a detailed pricing strategy breakdown, highlighting different pricing models across regions and product types. The report covers investments in research and development, showcasing recent innovations in adhesive formulations, curing technologies, and sustainability practices. Additionally, it explores regional variations in demand, influenced by local industry needs, manufacturing hubs, and regulatory landscapes. By addressing these critical aspects, our report offers an in-depth understanding of the market’s structure, trends, and factors driving its expansion, giving valuable insights to industry stakeholders.

The US Electronic Adhesives Market Size was valued at USD 0.27 Billion in 2023 and is expected to reach USD 0.39 Billion by 2032, growing at a CAGR of 3.99% over the forecast period of 2024-2032.

The U.S. Electronic Adhesives Market is experiencing robust growth, driven by advancements in consumer electronics, automotive electronics, and renewable energy sectors. Innovations in electric vehicles (EVs) and 5G technology are boosting demand for specialized adhesives that ensure reliable bonding for high-performance components. Companies like 3M and Dow Inc. are at the forefront, developing adhesives that offer high thermal and electrical conductivity for next-gen electronics. The growth is also fueled by the U.S. government's push for sustainable solutions, with initiatives promoting energy efficiency and eco-friendly materials, further driving adoption in industries such as aerospace and defense.

Electronic Adhesives Market Dynamics

Drivers

-

Growth of Smart Devices and Wearable Technology Increases Demand for Versatile Adhesive Solutions

The increasing proliferation of smart devices, such as smartphones, tablets, and wearables, is significantly boosting the demand for versatile electronic adhesives. As these devices become more compact, efficient, and multifunctional, the need for adhesives capable of performing in challenging conditions becomes essential. Electronic adhesives are crucial for holding delicate electronic components in place and ensuring the integrity of thin, flexible, and lightweight devices. Companies like Apple and Samsung are increasingly incorporating flexible, stretchable adhesives to ensure durability in wearable technology like smartwatches and fitness trackers. The shift toward flexible and bendable screens in mobile devices also contributes to this demand, as adhesives must now maintain structural integrity without compromising performance. Additionally, the integration of sensors, actuators, and other complex components into these devices demands adhesives that can conduct or insulate electricity, resist extreme temperatures, and remain stable over time. The expanding market for wearables and other smart electronics presents a significant growth opportunity for electronic adhesives.

Restraints

-

Concerns Over Long-Term Reliability of Adhesive Bonds in Extreme Environments Is one of The Primary Restraint

The long-term reliability of adhesive bonds in harsh and extreme environments continues to be a significant concern for many industries, particularly in aerospace, automotive, and military applications. Adhesives used in these sectors must be able to withstand exposure to extreme temperatures, moisture, and physical stress without degrading over time. While advances in adhesive technologies have improved their resistance to such conditions, some types of adhesives still face challenges in terms of durability, particularly in high-stress environments. For example, the automotive industry relies on adhesives to bond various components in engines and electronic systems, where adhesives must perform reliably in both hot and cold temperatures and under vibration. Similarly, in the aerospace sector, adhesives must endure the pressures of high altitudes and fluctuating temperatures. Manufacturers are cautious about using electronic adhesives in such applications, as any failure in adhesive bonding could lead to costly repairs, product recalls, or safety issues. As a result, concerns about long-term reliability limit the adoption of electronic adhesives in these critical industries.

Opportunities

-

Growing Trend of Customization in Electronic Products Creates Demand for Tailored Adhesive Solutions

The growing demand for customized electronic products presents a unique opportunity for manufacturers of electronic adhesives. With consumers seeking more personalized and specialized products, such as custom smartphones, wearables, and home appliances, the need for tailored adhesive solutions has risen. These products often require adhesives that can meet specific performance, aesthetic, and functional requirements. For example, certain adhesive formulations may need to provide flexibility for wearable devices or high-temperature resistance for specialized industrial equipment. Customization also extends to adhesive applications, as different devices may require adhesives that offer properties such as electrical conductivity, thermal stability, or UV resistance. Companies that can provide customized adhesive solutions, designed specifically for niche applications, will be well-positioned to capitalize on this growing trend. This shift toward personalized electronic products is driving the demand for innovative adhesives that meet the unique needs of diverse consumers and industries, opening up new avenues for growth in the electronic adhesives market.

Challenge

-

Navigating Intellectual Property Issues in Adhesive Formulation Development Hinders The Growth of the Market

Developing innovative adhesive formulations for the electronic adhesives market is fraught with intellectual property challenges. Many companies invest heavily in research and development to create new, high-performance adhesives that meet the growing demands of modern electronics. However, the complex nature of adhesive formulation often leads to overlapping patents, intellectual property disputes, and challenges in securing patent rights. Companies must navigate these issues carefully to avoid infringement on existing patents while ensuring that their own innovations are protected. Legal disputes over intellectual property can delay product development, increase costs, and reduce market competitiveness. This challenge is particularly pertinent as companies seek to differentiate their products in a market that is becoming increasingly crowded with new adhesive technologies. To remain competitive and mitigate legal risks, companies must develop robust intellectual property strategies, including careful patent monitoring, licensing agreements, and strategic collaborations.

Electronic Adhesives Market Segmental Analysis

By Resin Type

In 2023, the Epoxy resin segment dominated the Electronic Adhesives Market with a market share of about 50.3% of the total share. Epoxy resins are widely used in the electronics industry due to their strong bonding properties, excellent electrical insulation, and resistance to environmental factors such as heat and moisture. The demand for epoxy-based adhesives is particularly high in semiconductor packaging, circuit board assembly, and other critical electronic applications, where reliability and durability are paramount. For example, companies like Henkel and Dow Inc. offer high-performance epoxy-based products used in various electronic manufacturing processes. According to the Adhesive and Sealant Council (ASC), epoxy adhesives are highly favored for their versatility and exceptional performance in demanding electronic applications. The extensive use of epoxy resins in both consumer electronics and automotive applications contributes to its dominance in the market.

By Product Type

In 2023, the Electrically Conductive adhesive segment dominated the Electronic Adhesives market, accounting for 45.5% of the total share. These adhesives are primarily used in the manufacturing of electronic components where the adhesive itself needs to conduct electricity, such as in circuit boards, semiconductors, and displays. Electrically conductive adhesives are particularly beneficial in applications where traditional soldering techniques are either impractical or undesirable, such as in flexible electronics or for components sensitive to heat. For instance, companies like 3M and Henkel have developed innovative electrically conductive adhesives that cater to the growing demand for lightweight and flexible electronics. Additionally, the rising adoption of electric vehicles (EVs) and the expanding consumer electronics market have significantly contributed to the demand for electrically conductive adhesives, which are used to connect battery cells, heat sinks, and other electronic components in these industries.

By Application

The Surface Mounting segment dominated the Electronic Adhesives Market in 2023, holding a market share of 35.6%. Surface mounting technology (SMT) involves placing electronic components directly onto the surface of printed circuit boards (PCBs), which is widely used in the electronics industry due to its compact design and high efficiency. Surface Mounting adhesives are used to bond components onto these boards, enabling the miniaturization of electronic devices. Major players in the industry, such as Henkel and Dow, offer specialized SMT adhesives that ensure superior adhesion, thermal resistance, and electrical conductivity. SMT is critical in sectors like consumer electronics, automotive, and industrial automation, where high-density packaging and performance reliability are essential. The growing demand for smaller, lighter, and more efficient electronic devices is propelling the growth of this application segment.

By End-use Industry

In 2023, the Consumer Electronics segment dominated and held the dominant market share of 47.3% in the Electronic Adhesives Market. This dominance can be attributed to the rapidly growing demand for consumer electronics such as smartphones, laptops, tablets, and wearables. Electronic adhesives are essential for the assembly of these devices, providing reliable bonding solutions for various components like displays, circuit boards, and connectors. Companies like Apple and Samsung rely on high-performance adhesives to enhance the durability and functionality of their products. Furthermore, with advancements in 5G technology and the Internet of Things (IoT), the need for more efficient and durable adhesives in consumer electronics continues to rise. As consumer electronics evolve toward more compact, flexible, and multifunctional devices, the demand for specialized electronic adhesives remains strong.

Electronic Adhesives Market Regional Outlook

Asia Pacific dominated the Electronic Adhesives Market in 2023, accounting for 42.8% of the total market share. The region's dominance is primarily driven by the high concentration of electronics manufacturing in countries like China, Japan, South Korea, and Taiwan. These countries house major electronics manufacturers such as Samsung, LG, and Foxconn, who heavily rely on advanced electronic adhesives for the production of consumer electronics, semiconductors, and electronic components. For instance, China is a global leader in the production of smartphones, which significantly boosts the demand for electronic adhesives used in the assembly of these devices. According to the China National Electronics Association (CNEA), the country's electronics industry continues to expand, with demand for high-performance adhesives growing in parallel. Additionally, Japan’s and South Korea’s advanced semiconductor industries contribute to the strong market demand for specialized adhesives, such as electrically conductive and thermally conductive adhesives. The region's manufacturing hubs, rapid technological advancements, and increasing consumer electronics demand ensure Asia Pacific's continued dominance in the market.

On the other hand, North America emerged as the fastest-growing region in the Electronic Adhesives Market in 2023, with a significant growth rate during the forecast period. The U.S. is a key driver of this growth due to the increasing demand for electronic devices, such as smartphones, wearables, and automotive electronics, which rely heavily on high-performance adhesives. Major players in the region, such as Dow Inc. and 3M, are continually innovating in the field of electronic adhesives, offering products that meet the rising demands for flexibility, conductivity, and environmental sustainability in electronics manufacturing. Additionally, the expansion of electric vehicle (EV) adoption and the subsequent need for electronic adhesives in battery systems and power electronics are driving the market growth in North America. According to the U.S. Department of Energy, the increasing focus on EV production and green technologies is further fueling the demand for adhesives in automotive applications. As a result, North America’s market for electronic adhesives is expected to experience rapid growth throughout the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Arkema SA (Kraton D Series, Epikure Epoxy Hardener)

-

BASF SE (Epoxy Adhesives, 2-component polyurethane adhesive)

-

Bostik (An Arkema Company) (Bostik 600 adhesive, Bostik 2550 adhesive)

-

Dow Inc. (DOWSIL SE 4486 adhesive, DOWSIL 3-1941 adhesive)

-

Dymax Corporation (Dymax 1-4041 adhesive, Dymax 9-20558 adhesive)

-

Ellsworth Adhesives (EP 1000 adhesive, EPOXY 145 adhesive)

-

Evonik Industries AG (Dynasylan Adhesives, Vestanat epoxy adhesive)

-

H.B. Fuller Company (H.B. Fuller 950 adhesive, Flextra adhesive)

-

Henkel AG (Loctite 9462 adhesive, Loctite 502 adhesive)

-

Hitachi Chemical (EP-2100 adhesive, ECA-1100 adhesive)

-

Illinois Tool Works Inc. (ITW) (Devcon 5 Minute Epoxy, Devcon Plastic Steel Epoxy)

-

Indium Corporation (Indium 1.0 adhesive, Indium 2.0 adhesive)

-

Kyocera Chemical Corporation (KCU-621 adhesive, KCA-301 adhesive)

-

Lord Corporation (Parker Hannifin Corporation) (Lord 406 adhesive, Lord 200 adhesive)

-

Master Bond Inc. (EP21LV adhesive, EP17 adhesive)

-

Mitsui Chemicals (Mitsui Chemco adhesive, Durabond adhesive)

-

Nagase Chemtex Corporation (NCT 320 adhesive, NCT 210 adhesive)

-

Permabond LLC (Permabond 105 adhesive, Permabond ET516 adhesive)

-

Sika AG (Sikaflex adhesive, SikaForce adhesive)

-

The 3M Company (3M Scotch-Weld epoxy adhesive, 3M 8810 adhesive)

Recent Developments

-

February 2025: Henkel expanded its presence in India with a new Application Engineering Centre and plant, aiming to boost the production of high-performance adhesives for the electronics sector. This move supports India's "Make in India" initiative, contributing to local manufacturing growth.

-

February 2025: LG Chem teamed up with HL Mando to develop adhesives for automotive electronic components, including thermal gap fillers for ADAS systems. This collaboration focuses on eco-friendly, high-performance solutions for the automotive industry.

-

May 2023: Arkema acquired Polytec PT to strengthen its adhesive offerings for electronics and batteries, particularly for thermal interface materials and engineering adhesives. This acquisition is part of Arkema’s strategy to enhance its global footprint in these growing sectors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.11 Billion |

| Market Size by 2032 | USD 9.30 Billion |

| CAGR | CAGR of 6.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Resin Type (Epoxy, Silicone, Polyurethane (PU), Acrylic, Others) •By Product Type (Electrically Conductive, Thermally Conductive, UV Curing, Others) •By Application (Conformal Coatings, Encapsulation, Surface Mounting, Wire Tacking, Others) •By End-use Industry (Consumer electronics, Automotive, Communications, Medical, Aerospace and defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Henkel AG, H.B. Fuller Company, The 3M Company, Dow Inc., Arkema SA, Sika Ag, Evonik Industries Ag, Dymax Corporation, BASF SE, Master Bond Inc. and other key players |