Electronic Warfare Market Report Scope & Overview:

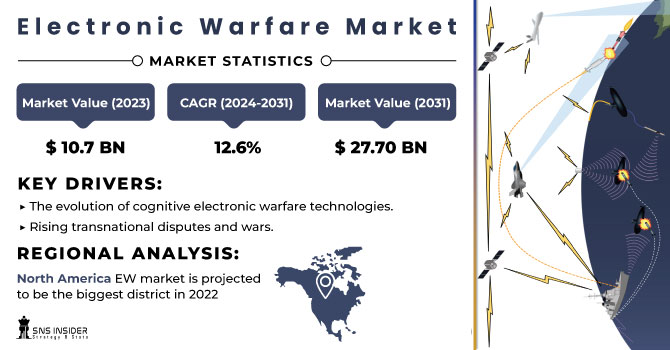

The Electronic Warfare Market Size was valued at USD 12.04 billion in 2024, is expected to reach USD 31.13 billion by 2032 and grow at a CAGR of 12.6% over the forecast period 2025-2032.

The advancement of modern electromagnetic spectrum technologies challenges military operations in an information-reliant environment. With the development in electronic threats, there is a greater requirement for electronic warfare to support unhindered access to electromagnetic environment defense activities. Electronic warfare is a major component of information warfare and is used in both offensive and defensive counter-information operations. Electronic warfare policy and doctrine have been developed and embraced by nations all over the world. Infrared and radio frequency countermeasures, electronic masking, electronic security, electronic counter-countermeasures, and anti-jamming capabilities are all part of electronic warfare efforts.

To get more information on Electronic Warfare Market - Request Free Sample Report

During the projected period, the worldwide electronic warfare market is expected to grow due to an increase in innovations and the creation of new warfare. The Iranian Army Ground Force's Research and Self-Sufficiency Jihad Organization, for example, debuted a plethora of electronic warfare and other electronic equipment. The combat technologies would be deployed to safeguard Iranian drones in enemy territory as well as to disrupt opposing drones. With the rising threat of hostile drones and remotely activated IEDs, investments in electronic warfare equipment for defence against such threats have surged. Edge Group, for example, launched Nav-Control-G, a specialist counter-drone capability, and V-Protect, a radio frequency communication jamming technology. Electronic warfare systems protect Iranian VIPs and key commanders on the move.

Market Size and Forecast:

-

Market Size in 2024 USD 12.04 Billion

-

Market Size by 2032 USD 31.13 Billion

-

CAGR of 12.6% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Electronic Warfare Market Trends:

-

Increasing adoption of AI-driven cognitive electronic warfare systems to counter evolving electronic threats.

-

Growing reliance on immersive simulations and training solutions amid rising global disputes.

-

Development of modular, interoperable systems to reduce high costs and integration challenges.

-

Intensified R&D in next-generation air and missile defense to address advanced threats.

-

Integration of automation and digital warfare tools for improved situational awareness and battlefield dominance.

Electronic Warfare Market Growth Drivers:

The immersive content creation market is propelled by two major drivers: the evolution of cognitive electronic warfare technologies, which demand advanced simulation and training tools, and the rising transnational disputes and wars, increasing the need for immersive defense applications. Together, these factors accelerate adoption across defense, security, and training sectors, enhancing situational awareness, preparedness, and mission effectiveness in complex environments.

Electronic Warfare Market Restraints:

The electronic warfare market faces restraints such as high development and deployment costs, which limit accessibility for smaller defense budgets. Integration challenges with existing legacy systems and the complexity of maintaining advanced electronic systems also hinder adoption. Additionally, strict regulatory frameworks and export restrictions on sensitive technologies slow global expansion, affecting the pace of innovation and deployment.

Electronic Warfare Market Opportunities:

The electronic warfare market presents significant opportunities through increasing research and development of next-generation air and missile defense systems, aimed at countering evolving threats. Advancements in enhanced warfare technology, including AI-driven solutions, cognitive systems, and advanced signal processing, further create avenues for growth. These innovations enable stronger defense capabilities, improved threat detection, and strategic advantages in modern military operations.

Electronic Warfare Market Segment Analysis:

By Capability

In 2024, the attack segment dominated the electronic warfare market with around 46% share, driven by rising transnational conflicts and demand for offensive capabilities. Looking ahead, the protection segment is expected to grow at the fastest CAGR from 2025–2032, fueled by increasing investments in advanced defense systems and the need for safeguarding communication and critical assets.

By Product

In 2024, jammers dominated the electronic warfare product market with approximately 28% share, driven by widespread requirements for signal disruption and legacy platform integration. From 2025–2032, counter-UAV systems are forecast to record the highest CAGR, propelled by rapid drone proliferation, heightened asymmetric threats, and accelerated investment in detection and mitigation technologies.

Electronic Warfare Market Regional Analysis:

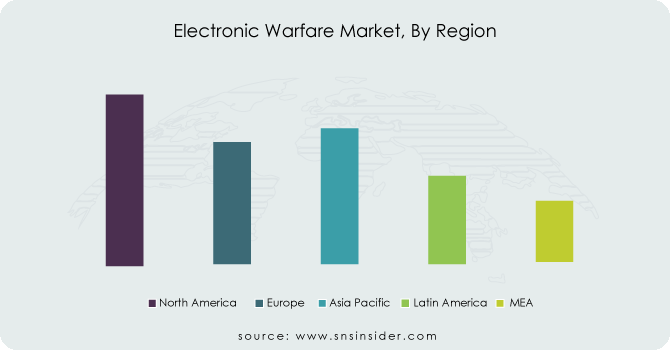

North America Electronic Warfare Market Insights

North America EW market is projected to be the biggest district in 2022 attributable to the high speculations by the U.S. Branch of Defense in the extension of EW frameworks. The U.S. DoD is supposed to put USD 25.8 billion in research, improvement, test, and assessment and USD 27.8 billion in acquirement all through the guard program. In addition, the market in the locale is expected to develop because of elements like regional questions, political debates, and expanded psychological oppression. Followed by North America, Europe is supposed to be the second-biggest district because of an ascent in interest in EW framework obtainment and improvement. Furthermore, a portion of the key market players, for example, Thales Group, BAE Systems, and Saab AB in the district are expected to fuel the development of the market.

Asia Pacific Electronic Warfare Market Insights

Asia-Pacific is anticipated to be the quickest developing district during the gauge time frame because of the fast development in interests in nations, for example, China and India to foster mechanically progressed frameworks and improve their warfighting abilities. China is zeroing in on the modernization of its powers and building strong air bases and maritime armadas. As of late, the arising clashes between China and the U.S. have driven the nations to fortify their safeguard.

Europe Electronic Warfare Market Insights

Europe’s electronic warfare market is driven by rising regional security threats, NATO modernization programs, and investments in advanced defense technologies. Countries such as the U.K., Germany, and France are prioritizing electronic protection and attack systems to strengthen air and missile defense. Strong collaboration among European defense firms further accelerates innovation and market growth.

Latin America (LATAM) and Middle East & Africa (MEA) Electronic Warfare Market Insights

The LATAM and MEA electronic warfare markets are expanding steadily, supported by growing defense modernization programs and rising geopolitical tensions. In Latin America, countries like Brazil focus on strengthening surveillance and communication security. Meanwhile, Middle Eastern and African nations prioritize counter-UAV systems and advanced radar warning receivers to address escalating border threats and asymmetric warfare challenges.

Need any customization research on Electronic Warfare Market - Enquiry Now

KEY PLAYERS

- BAE Systems

- Raytheon Technologies Corporation

- Thales Group

- Northrop Grumman Corporation

- HENSOLDT

- Boeing

- General Dynamics Corporation

- Lockheed Martin Corporation

- Leonardo SpA

- Saab AB

Raytheon Technologies Corporation-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 12.04 Billion |

| Market Size by 2032 | USD 31.13 Billion |

| CAGR | CAGR of 12.6% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Category (Electronic Attack, Electronic Support and Electronic Protection) • By Capability (Support, Attack, Protection) • By Product (Jammers, Countermeasure System, Decoy, Directed Energy Weapon, Antennas, Direction Finders, Laser Warning Systems, Radar Warning Receivers, Counter UAV Systems, Electromagnetic Pulse (EMP) Weapons, Others) • By Platform (Land, Naval, Airborne, and Space) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | BAE Systems, Raytheon Technologies Corporation, Thales Group, Northrop Grumman Corporation, HENSOLDT, Boeing, General Dynamics Corporation, Lockheed Martin Corporation, Leonardo SpA, Saab AB, and other players. |