Military Sensors Market Report Scope & Overview:

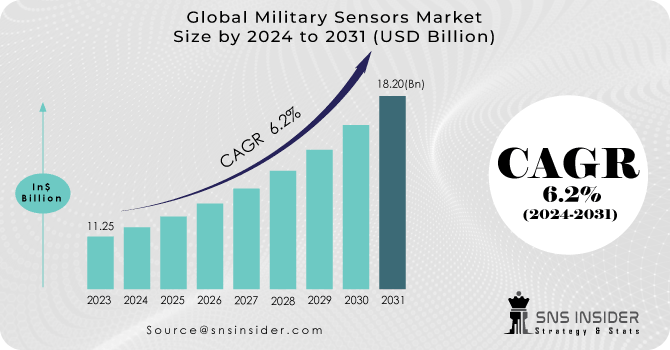

The Military Sensors Market Size was valued at USD 11.25 billion in 2023 and is expected to reach USD 18.20 billion by 2031 and grow at a CAGR of 6.2% over the forecast period 2024-2031.

The global military sensors market is expanding rapidly as militaries around the world increase their purchases of defense systems. Military sensors are components of a weapon, aircraft, or electronic device that detect changes in their surroundings or scan their surroundings to gather information. The collected data is then relayed to another electronic system, typically a computer processor, for data processing and analysis. Military sensors are used in a variety of systems such as missiles, combat aircraft, and radars for navigation, weapon control, active guidance, target tracking, and environmental awareness. Furthermore, sensors such as electro-optical sensors can detect fog, smoke, and dust. Sensors play an important role in providing solutions to the entire defense ecosystem, including complex controls, measures, monitoring, and implementation. Current military and defense environments require technology that is efficient, dependable, and scalable.

To get more information on Military Sensors Market - Request Free Sample Report

Missiles, drones, spaceships, military vehicles, sea systems, ships, rocket systems, and satellites are examples of military and defense systems. Such systems operate in harsh environments during both regular and combat operations. Furthermore, smart sensor technology is used by internal and external security systems to track and support military operations. Sensors have thus become an essential component of military systems.

MARKET DYNAMICS:

KEY DRIVERS:

-

Rising demand of battlespace

-

Enhancing technology

RESTRAINTS:

-

Lack of accuracy

-

Operational Complexities in Maintenance and Assembling

OPPORTUNITIES:

-

New generation technology demand is high

-

Continuous development of hardware and software

CHALLENGES:

-

Cybersecurity risk and enhancement

-

High technology maintenance

THE IMPACT OF COVID-19

Due to a workforce scarcity, the government's lockdown campaign to limit the spread of COVID-19 has harmed military sensor developers.

Long-term market drivers for military sensors remain strong, and the market had begun to show signs of recovery from the major market price reset prior to the pandemic. The COVID-19 pandemic has swept the world, leaving many industries struggling to survive. Governments and companies involved in sensor technology are reacting differently to the new situation. Some product launches are proceeding, while others are not; some tests are ongoing, while others are postponed; some businesses remain open, while others have closed.

Due to the supply chain disruption created by COVID-19, sensor producers are experiencing a shortage of components required for the development and manufacturing of military sensors.

Defense contractors who rely on international labour are experiencing short-term operating challenges as a result of travel restrictions imposed by the government to combat the COVID-19 outbreak.

Defense agencies are being obliged to postpone ongoing initiatives as well as research and development in order to comply with the authorities' shutdown.

MARKET ESTIMATION

The emergence of MEMS-based gyroscopes was a significant innovation in gyroscope technology. Demand for high-performance inertial navigation systems has spurred the expansion of gyroscopes in the military sensor industry. The military aviation industry, which is a significant user of inertial navigation systems, has been a major driver of market growth and is likely to continue to do so. The rising use of drones and unmanned aerial vehicles in the defense sector will also have a significant impact on market growth.

The military sensors market is divided into communication and navigation, electronic warfare, combat operations, intelligence and reconnaissance, command and control, target recognition, and surveillance and monitoring. From 2024 to 2031, the surveillance & monitoring category is expected to have the greatest market size. Drones are being used for surveillance of various military actions in economies such as India, China, Indonesia, and Japan, which will increase demand for the surveillance and monitoring segment in the near future. The increasing use of airborne sensors in the defense sector is propelling the airborne segment of the military sensors market forward. The proliferation of UAVs is one of the factors driving the rapid expansion of the military sensors market for air-based platforms. Countries all over the world are investing in unmanned aerial vehicles to improve surveillance. Various countries are also adding new fighter aircraft fleets or upgrading current fighter aircraft with cutting-edge sensor technology, which will play a significant role in the growth of the airborne military sensor market. The rapid evolution of geopolitical dynamics around the world, combined with rising terrorism threats, emerging economies' procurement plans, modernizations, and political instability in a few locations, will fuel demand for airborne military sensors

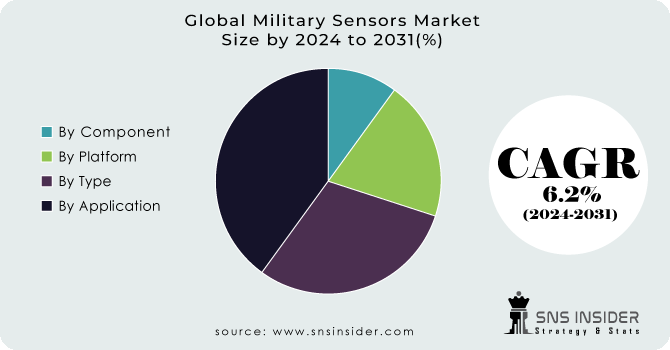

KEY MARKET SEGMENTATION

By Application

-

Intelligence

-

Surveillance

-

Reconnaissance

-

Communication and Navigation

-

Target Recognition

-

Electronic Warfare

By Type

-

Imaging sensors

-

Seismic sensors

-

Acoustic sensors

-

Magnetic sensors

-

Pressure sensors

-

Temperature sensors

By Component

-

Software

-

Hardware

-

Cybersecurity Solutions

By Platform

-

Airborne

-

Land

-

Naval

-

Munitions

-

Satellites

Need any customization research on Military Sensors Market - Enquiry Now

REGIONAL ANALYSIS

North America is expected to lead the military sensory market from 2024 to 2031. Significant investment in R&D activities to develop military power solutions developed by key players and the growing need for lightweight and energy-saving nerves are some of the factors that are expected to advance military power. the growth of the military sensory market in the region. The US is expected to continue the growth of the North American military nerve market during the forecast period, thanks to easy access to various new technologies and important investments made by manufacturers in the country to promote improved health and military sensitivity. Several advances have been made in the field of military nerves in the region. a cost conversion and fixed cost contract was awarded to Honeywell International for merging Advanced Battle Management Systems (ABMS) with a variety of sensors and sensor modes.

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Rockwest Solutions., Esterline Technologies Corporation, Honeywell International Inc., Thales Group, BAE Systems PLC., Curtiss-Wright Corporation, Kongsberg Gruppen ASA, TE Connectivity Ltd., Lockheed Martin Corporation, Raytheon Company, and other players.

Esterline Technologies Corporation-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 11.25 Billion |

| Market Size by 2031 | US$ 18.20 Billion |

| CAGR | CAGR of 6.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Intelligence, Surveillance, Reconnaissance, Communication and Navigation, Target Recognition, Electronic Warfare, Command and Control) • By Type (Imaging sensors, Seismic sensors, Acoustic sensors, Magnetic sensors, Pressure sensors, Temperature sensors) • By Component (Software, Hardware, Cybersecurity Solutions) • By Platform (Airborne, Land, Naval, Munitions, Satellites) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Rockwest Solutions., Esterline Technologies Corporation, Honeywell International Inc., Thales Group, BAE Systems plc., Curtiss-Wright Corporation, Kongsberg Gruppen ASA, TE Connectivity Ltd., Lockheed Martin Corporation, Raytheon Company, and other players. |

| DRIVERS | • Rising demand of battlespace • Enhancing technology |

| RESTRAINTS | • Lack of accuracy • Operational Complexities in Maintenance and Assembling |