Elevator and Escalator Market Report Scope & Overview:

To get more information on Elevator and Escalator Market - Request Free Sample Report

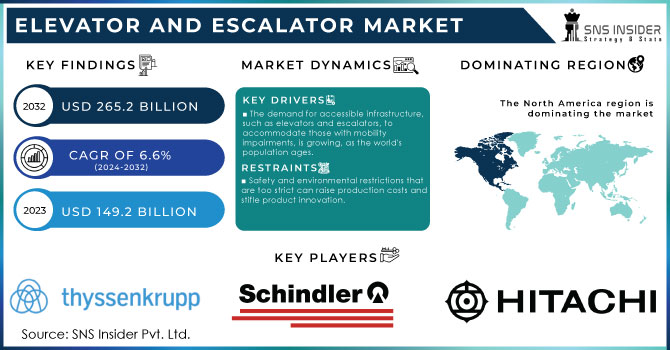

The Elevator and Escalator Market size was estimated at USD 149.2 billion in 2023 and is expected to reach USD 265.2 billion by 2032 at a CAGR of 6.6% during the forecast period of 2024-2032.

The elevator & escalators market is growing, owing to the surge in the investment in residential and commercial buildings across developed and developing countries. In addition, major governments are planning to invest in the skyscrapers and the tallest building projects, which is propelling the market growth. In January 2024, the government of Saudi Arabia plans to invest approximately USD 500 billion in establishing a twin for a skyscraper of 500 meters. The skyscraper comprises a range of retail, residential, and office buildings. The escalating need for smarter and greener technologies is driving the need for smart elevator systems, with integration of IoT and energy-efficient technologies. Not only does the smart elevator systems enhance operational efficiency, but they also ensure better passenger safety through the use of real-time data to predict and prevent the malfunctions. This trend is also evident during new installation and modernization projects.

The building owners are increasingly modernizing and upgrading their old units to meet the newer safety codes and improved energy standards. Moreover, the escalator market is enhancing, due to the US government focus on the infrastructure renewal, including the major transport hubs. Airports, shopping malls, and the public transit systems have witnessed huge perpetration on renovation, with an extensive focus on the installation and up-gradation of the escalators. Modern escalators are equipped with regenerative drives that reduce the energy consumption. Moreover, the new technologies also align with the country’s sustainability goals, which are further driving the market.

MARKET DYNAMICS

DRIVERS

The market for elevators and escalators is growing due to increased demand for safer, more energy-efficient, and regulation-compliant systems in modernized buildings.

Renovating and modernizing existing buildings with advanced elevator and escalator systems is increasingly crucial due to the growing demand for enhanced safety, energy efficiency, and regulatory compliance. Modernization projects often involve upgrading old elevator and escalator systems to meet stringent safety standards and codes, thereby reducing the risk of accidents and improving overall building safety.

Energy efficiency is another key driver, as older systems tend to consume more power, resulting in higher operational costs and a larger carbon footprint. Upgrading to modern, energy-efficient systems equipped with regenerative drives, LED lighting, and advanced control systems can significantly reduce energy consumption and operational costs. This not only supports sustainability goals but also provides long-term economic benefits by lowering energy bills and reducing maintenance expenses. Furthermore, regulatory compliance plays a vital role in the renovation and modernization process. As building codes and standards evolve, older systems may no longer meet current requirements, necessitating upgrades to ensure compliance. Modern systems are designed to adhere to the latest regulations and standards, helping property owners avoid potential fines and legal issues.

Tech innovations such as AI elevators, IoT, and energy-efficient designs are upgrading performance, safety, and sustainability, driving the modernization of outdated systems.

Technological advancements are reshaping the elevator market with innovations such as AI-driven elevators, IoT integration, and energy-efficient designs, driving substantial improvements in performance, safety, and sustainability. AI-driven elevators utilize advanced algorithms and machine learning to optimize traffic flow and predict maintenance needs, leading to reduced wait times and enhanced operational efficiency. These systems can learn from usage patterns to dynamically adjust performance, providing a smoother and more responsive user experience. IoT integration further elevates the market by connecting elevators to a network, allowing real-time monitoring and control. This connectivity enables predictive maintenance, where potential issues are identified and addressed before they lead to failures, thus minimizing downtime and repair costs. Additionally, IoT-enabled elevators can provide valuable data analytics for building managers to optimize performance and energy consumption. Energy-efficient designs are another key advancement, incorporating technologies such as regenerative drives and LED lighting to reduce power consumption and lower operational costs. Regenerative drives, for instance, capture and reuse energy during braking, contributing to significant energy savings. These advancements collectively drive the modernization of older elevator systems, encouraging upgrades that align with contemporary standards for efficiency and sustainability.

RESTRAIN

High costs of installing and maintaining advanced IoT-enabled elevators and escalators can deter smaller developers and building owners from adopting these modern systems.

The increased expenses associated with the implementation and maintenance of IoT-enabled solutions for elevators and escalators undoubtedly created a serious financial burden on developers/owners of buildings, especially those of medium and small scale. Highly efficient and connected systems based on cutting-edge technology required enormous initial costs as the price for initial investment. The need for professional maintenance and service also became more complicated due to the new level of sophistication in all operations. In such a way, costs related to the installation and operation of elevators and escalators went beyond what smaller companies could afford. This factor might put certain restrictions on the segment of the market regarding modern elevators and escalators. As a result, available technologies could be applicable only for big enterprises, leaving other firms with poor opportunities in applying advanced systems. Such financial impediments could result in slowed or stagnated growth in the market of elevators and escalators and impede advances to more technologically-enriched solutions currently in development.

KEY MARKET SEGMENTATION

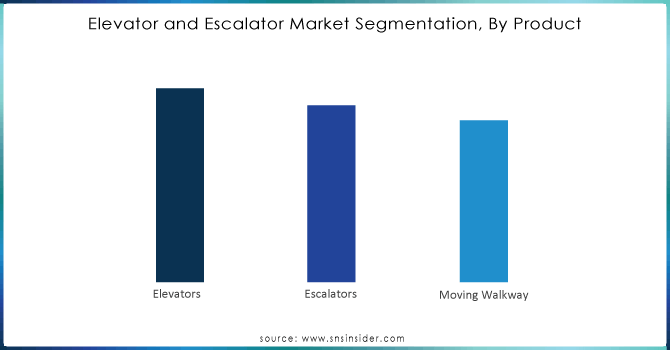

By Product

- Elevators

- Escalators

- Moving Walkway

The Elevators segment accounted for the highest revenue share of over 36.2%, and is expected to grow significantly during the forecast period. This is owing to rising demand from the residential, commercial, and industrial. Additionally, growth in the aging population across China, India, and others create the demand for elevators, which fuel the market growth.

The Escalator is expected to grow steadily during the forecast period, owing to rising demand from commercial parks, high rise buildings, amusement parks, and shopping malls. In addition, a rising number of shopping malls, and commercial spaces across the globe will drives the market growth.

Need any customization research on Elevator and Escalator Market - Enquiry Now

By Business

- New Equipment

- Maintenance

- Modernization

By Application

- Residential

- Commercial

- Industrial

In 2023, Residential segment accounted for the highest revenue share of over 34.28%, This is owing to rising in product penetration across multi-homes, and residential apartments. In addition, increasing investment in the residential sector will drive the market growth

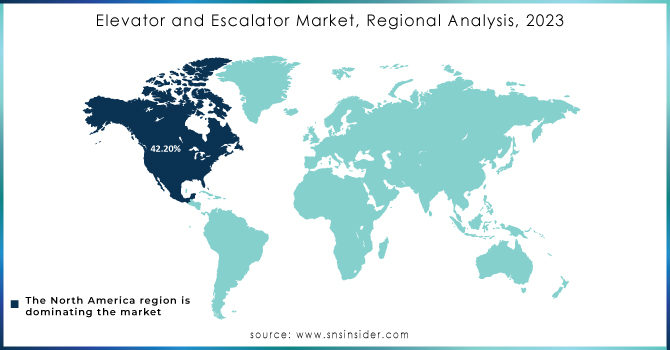

REGIONAL ANALYSES

North America was the dominant region in 2023, generating more than 42.2% of the revenue as most smart buildings are installed and modernized with traditional building structures. Market players have a prominent market advantage in the U.S. and Canada, offer their service to their final customers and modernize their buildings by providing elevator & escalator services. Moreover, a surge in the number of eco-friendly infrastructural activities and the development of smart cities in the U.S. to incite the demand for elevators and escalators expected to fuel the market growth in the forecast period.

Europe is expected to grow moderately in the prediction period as the renovation and modernization of high-rise building infrastructure across Germany, the U.K., France, and others are expected to foster the growth. Additionally, the aging population in Europe, namely Germany, Spain, the UK, and Greece, is expected to create demand for elevator Upgrading Services.

KEY PLAYERS

The major Key players are Fujitec Co. Ltd (Japan), Hitachi, Ltd., (Japan), Hyundai Elevator Co Ltd (South Korea), KONE CORPORATION, Mitsubishi Electric Corporation (Japan), Otis Worldwide Corporation (U.S.), Schindler (Switzerland), SJEC Corporation (China), TK Elevator GmbH (Germany), Toshiba Corporation (Japan), CT Elevator Pte Ltd, ThyssenKrupp AG, and others.

RECENT DEVELOPMENT

In March 2024: Otis Worldwide Corporation received an order for the modernization of 34 elevators in Burj Khalifa based in the U.A.E. The Burj Khalifa is the world’s tallest building. The company got a maintenance and modernization contract for ten years.

In October 2023: TK Elevator GmbH launched the new EXO Renew Series of elevators for low-rise and high-rise residential buildings. It is versatile, designed for using 100% green electricity and requires 28% less energy compared to other models.

| Report Attributes | Details |

| Market Size in 2023 | US$ 149.2 Bn |

| Market Size by 2032 | US$ 265.2 Bn |

| CAGR | CAGR of 6.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Elevators, Escalators, Moving Walkway) • By Business (New Equipment, Maintenance, Modernization) • By Application (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fujitec Co. Ltd (Japan), Hitachi Ltd (Japan), Hyundai Elevator Co Ltd (South Korea), Kone Corporation (Finland), Mitsubishi Electric Corporation (Japan), Otis Worldwide Corporation (U.S.), Schindler (Switzerland), SJEC Corporation (China), TK Elevator GmbH (Germany), Toshiba Corporation (Japan) |

| Key Drivers | • The market for elevators and escalators is growing due to increased demand for safer, more energy-efficient, and regulation-compliant systems in modernized buildings.

• Tech innovations such as AI elevators, IoT, and energy-efficient designs are upgrading performance, safety, and sustainability, driving the modernization of outdated systems. |

| Market Challenges | • High costs of installing and maintaining advanced IoT-enabled elevators and escalators can deter smaller developers and building owners from adopting these modern systems. |