Bearing Isolators Market Report Scope & Overview:

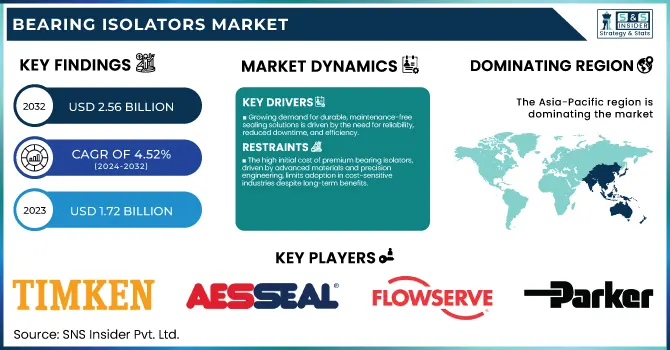

The Bearing Isolators Market was estimated at USD 1.72 billion in 2023 and is expected to reach USD 2.56 billion by 2032, with a growing CAGR of 4.52% over the forecast period 2024-2032. The report on the Bearing Isolators Market offers unique insights into production output trends across regions, highlighting manufacturing utilization rates of key producers. It explores capacity expansions, new production facilities, and supply chain disruptions, emphasizing post-pandemic recovery strategies. Additionally, it covers R&D investments by leading companies, showcasing technological advancements in sealing solutions. A trending addition includes the impact of automation and predictive maintenance adoption, driving demand for advanced bearing protection systems in industrial applications.

To Get more information on Bearing Isolates Market - Request Free Sample Report

Bearing Isolators Market Dynamics

Drivers

-

The rising demand for maintenance-free and long-lasting sealing solutions is driven by the need for enhanced equipment reliability, reduced downtime, and improved operational efficiency across industries.

The growing demand for maintenance-free and long-lasting sealing solutions in industrial applications is driven by the need for enhanced equipment reliability and reduced downtime. Conventional seals quickly wear out due to contact, contaminants, and harsh service conditions, resulting in high maintenance cost due to regular replacements. Unlike traditional seals, which are costly and time-consuming to replace, bearing isolators utilize state-of-the-art non-contact sealing technology to ensure dust, moisture and lubricants stay out of the enclosure, offering a significantly longer finishing life. These solutions are widely adopted across various industries, including manufacturing, oil & gas, and power generation & mining to improve operational efficiency and reduce machine downtime. Moreover, the increasing implementation of predictive maintenance and the integration of Industry 4.0 are also driving the demand for high-performance seals as they help reduce failures and improve the performance of the seals. With organizations targeting both cost-saving and increased equipment reliability, demand for self-lubricating and frictionless sealing technologies is anticipated to continue growth, defining the future of industrial bearing protection solutions.

Restraint

-

The high initial cost of premium bearing isolators, driven by advanced materials and precision engineering, limits adoption in cost-sensitive industries despite long-term benefits.

Premium bearing isolators offer superior performance, longevity, and maintenance-free operation compared to traditional seals. However, the high upfront investment is still a major obstacle to widespread uptake, particularly in cost-sensitive segments. Seals that rely on a lip like that are cheap, but they also wear out quickly; bearing isolators, however, use advanced materials combined with very precise engineering, making them more costly to install initially. We had to pay up not only because manufacturing is more expensive but also because these designs have to be custom made for particular applications. Although premium isolators greatly decrease long-term maintenance costs and equipment downtime, plenty of firms are still choosing cheaper options because of budgetary constraints or short-term extensions. For small and mid-sized enterprises, the long-term rewards do not always justify the investment, though. With industries prioritizing reliability, it will be essential to develop cost-effective innovations and scalable production techniques to close this pricing gap and create widespread adoption of high-performance bearing isolators.

Opportunities

-

The growing demand for retrofitting and aftermarket services in the bearing isolators market is driven by the need for cost-effective equipment upgrades, enhanced reliability, and compliance with efficiency standards.

The increasing demand for retrofitting and aftermarket services in the bearing isolators market presents significant growth opportunities. The performance of equipment reliability will drive the demand for these solutions, especially from aging industries that have old machines. Adding bearing isolators to existing systems significantly cuts downtime, maintenance, and oil leakage from lubricants, which is also more economical than replacing equipment. Furthermore, aftermarket services have come into play, involving customized isolator designs and on-site installation assistance for companies that need unique solutions for operational requirements. Particular, upgrading to these systems is a sector investment for manufacturing, oil & gas, and energy to ensure compliance with safety and efficiency regulations. Revolutionising Aftermarket Efforts for Fleet Providers With the advent of predictive maintenance technologies, aftermarket pervaders too have diversified their portfolios with remote monitoring solutions, allowing fleet providers to maintain proactive measures and better performance. Such a rising trend will continue to fuel innovation and market growth in the years to come.

Challenges

-

Limited awareness, high initial costs, and lack of technical expertise prevent small-scale industries from adopting bearing isolators despite their long-term benefits.

Small-scale industries often face challenges in adopting bearing isolators due to cost constraints and a lack of technical expertise. These businesses often have money to spare, so are reluctant to buy high-performance sealing solutions that are expensive than regular seals. In spite of their contribution to lower maintenance costs and down time, the preliminary expense on bearing isolators can be regarded as high. In addition, most small manufacturers do not have the technical expertise to qualify the performance benefits of bearing isolators, and instead stick with traditional seals. Decision-makers are unaware of the potential for savings through the extended life of equipment and through enhanced efficiency but there is a lack of awareness programs and training to support the need for the concepts. Addressing this hurdle will demand focused educational opportunity, economical initiatives and governmental motivate to create low-cost (SME) for more versatility to adopt advanced bearing protection technologies and improvement in productivity and operational reliability.

Bearing Isolators Market Segmentation Analysis

By Material

The Metallic segment dominated with a market share of over 66% in 2023, due to its exceptional durability, high load-bearing capacity, and ability to withstand extreme temperatures and harsh environments. Metallic isolators are engineered to provide enhanced durability, corrosion resistance, and load-bearing capabilities, making them a preferred choice for rigorous industrial environments. Metallic bearing isolators play an important role in preventing leakage, contamination and environmental pollution in industries that require an uninterrupted and lossless working environment including oil & gas, manufacturing and power generation sector. The capability of working efficiently at the speed of rotating equipment and prevention from contaminants helps them to be utilized highly. Even further, developments in material coatings and seal technologies are further enhancing the efficiency and longevity of metallic bearing isolators, solidifying their supremacy for industrial applications where reliability and performance are key.

By End-Use

The Oil & Gas segment dominated with a market share of over 34% in 2023, owing to the need for high reliability of equipment, little to no schedule blockage owing to break-down and shielding from severe ecological contaminants. Bearings are used in oil refineries, drilling rigs, and petrochemical plants under extreme conditions-high temperature, moisture, and corrosive substances. These factors increase wear and tear, resulting in expensive maintenance and unplanned shutdowns. Contamination prevention, lubrication retention enhancement, and extended lifespan of rotating equipment are three key operating principle benefits offered by bearing isolators. As a promising bearing protection solution, the industry undergoes frequent tests to offer the most optimal solutions for protecting bearings, providing the highest level of efficacy for preventing damage caused by the loss of bearing fluids. High output isolated bearings oil and gas operations to are producing thousands of times, therefore it is still the most faithful productivity and reduce maintenance costs.

Bearing Isolators Market Regional Outlook

Asia-Pacific region dominated with a market share of over 42% in 2023, due to rapid industrialization, a booming manufacturing sector, and increasing demand across key industries such as automotive, oil & gas, and heavy machinery. The increased economic growth, paired with higher investments in infrastructure and industrial development in the region, contributes by upsurging the adoption rate of bearing isolators for enhancing the efficiency and life of equipment. Emerging production facilities from blue-chip countries like China, India, and Japan is a major contributor to this trend, with emphasis now placed on reducing maintenance costs. Moreover, stricter mandates regarding workplace safety and equipment reliability have been instrumental in industries focusing on high performance sealing solutions. Moreover, the Asia-Pacific market for bearing isolators is further strengthened by the presence of leading manufacturers and suppliers in the region.

North America is emerging as the fastest-growing region in the Bearing Isolators Market, driven by the increasing adoption of advanced sealing technologies to enhance equipment longevity and performance. Aerospace, energy and mining sectors are among those pumping up demand, with a focus on efficiency, reliable use and maintenance cost cutting. This, in addition to stringent environmental regulations that will accelerate the industrial automation market growth. The fast growing is further accelerated by the presence of prominent players and continued technological developments being made in bearing protective methods. Increasing investment in infrastructure, along with a growing focus on predictive maintenance strategies, is also spurring market adoption. All these aspects position North America as the primary growth hotspot in the bearing isolators market over the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players in the Bearing Isolators Market

-

Timken Company (Labyrinth Bearing Isolators, Magnetic Bearing Isolators)

-

AESSEAL (Bearing Protection Seals, Non-Contact Bearing Isolators)

-

Flowserve Corporation (Bearing Protection Systems, Mechanical Seals)

-

Parker Hannifin Corporation (Composite Bearing Isolators, Rotary Seals)

-

John Crane (Non-Contact Bearing Isolators, Labyrinth Seals)

-

Garlock Sealing Technologies (Bearing Isolators, GYLON Seals)

-

Baldor Electric Company (Custom Bearing Isolators, Motor Protection Seals)

-

Advanced Sealing International (Metal Bearing Isolators, High-Speed Seals)

-

Isomag Corporation (Magnetic Bearing Isolators, Containment Seals)

-

Inpro/Seal (VBXX-D Bearing Isolators, Air Mizer Seals)

-

SKF (SKF Speedi-Sleeve, Bearing Sealing Solutions)

-

EagleBurgmann (Labtecta Bearing Isolators, Mechanical Seals)

-

Saint-Gobain (Omniseal Bearing Isolators, Polymer Sealing Solutions)

-

Freudenberg Sealing Technologies (Simrit Bearing Isolators, Non-Contact Seals)

-

SealRyt Corporation (Custom Bearing Isolators, Shaft Seals)

-

Rexnord Corporation (Bearing Isolator Rings, Contact Seals)

-

EnPro Industries (Bearing Sealing Solutions, Rotating Equipment Seals)

-

Waukesha Bearings (Bearing Protection Systems, Hydrodynamic Seals)

-

Helix Linear Technologies (Precision Bearing Isolators, Rotary Shaft Seals)

-

Technetics Group (Advanced Bearing Isolators, Metal Sealing Solutions)

Suppliers for (magnetic bearing isolators, offering superior sealing solutions for rotating equipment) on Bearing Isolators Market

-

Isomag

-

Superproof Seals Engineering Pvt. Ltd.

-

Sinoseal Holding Co., Ltd.

-

Flowserve

-

M Barnwell Services

-

Pack Seals Engineering

-

Actum Sweden AB

-

S.G. Engineering Works

-

Vinayak Components

-

Belt And Bearing House Private Limited

Recent Development

In December 2024: Dover Corporation announced that Waukesha Bearings, a subsidiary within its Fluid Management Segment and a global leader in custom-engineered hydrodynamic and magnetic bearing systems, had acquired Inpro/Seal Company. Inpro/Seal, a leading designer and manufacturer of bearing isolator technologies, is headquartered in Rock Island, Illinois.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.72 Billion |

| Market Size by 2032 | USD 2.56 Billion |

| CAGR | CAGR of 4.52% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Metallic, Non-metallic) • By End Use (Oil & Gas, Chemical, Mining, Paper & Pulp, Metal Processing, Manufacturing) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Timken Company, AESSEAL, Flowserve Corporation, Parker Hannifin Corporation, John Crane, Garlock Sealing Technologies, Baldor Electric Company, Advanced Sealing International, Isomag Corporation, Inpro/Seal, SKF, EagleBurgmann, Saint-Gobain, Freudenberg Sealing Technologies, SealRyt Corporation, Rexnord Corporation, EnPro Industries, Waukesha Bearings, Helix Linear Technologies, Technetics Group. |