Meat Processing Equipment Market Report Scope & Overview:

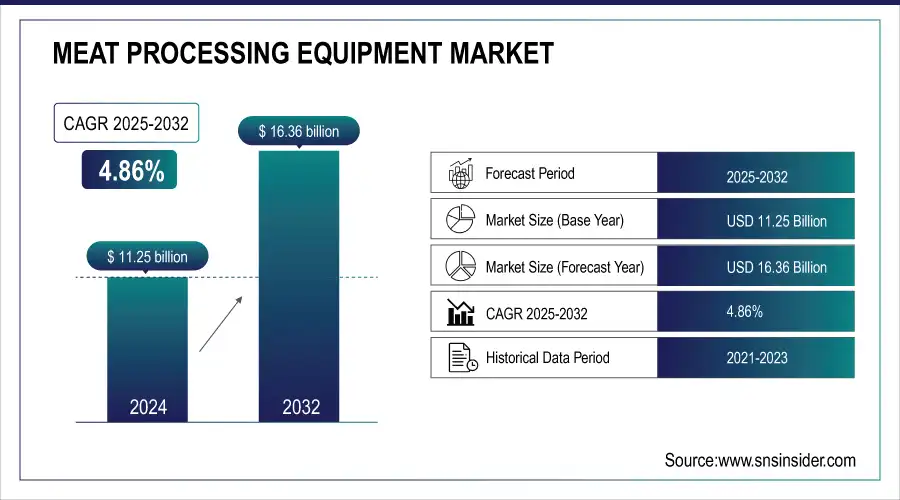

The Meat Processing Equipment Market size was valued at USD 11.25 billion in 2024 and is expected to reach USD 16.36 billion by 2032, growing at a CAGR of 4.86% over the forecast period of 2025-2032.

A detailed analysis of market dynamics, technological development, competitive landscape, and regional analysis is a part of this report. The meat processing equipment market key players are expected to attract market due to the growing demand for processed meat products and automation in food manufacturing. This overview presents a comprehensive insight into the meat processing equipment market share, identifies the scope for emerging meat processing equipment market trends, and predicts the meat processing equipment market analysis across all regions.

To Get more information on Meat Processing Equipment Market - Request Free Sample Report

“March 2024 – Marel has introduced a new automated slicing and portioning system to significantly improve productivity in the processing of meat.”

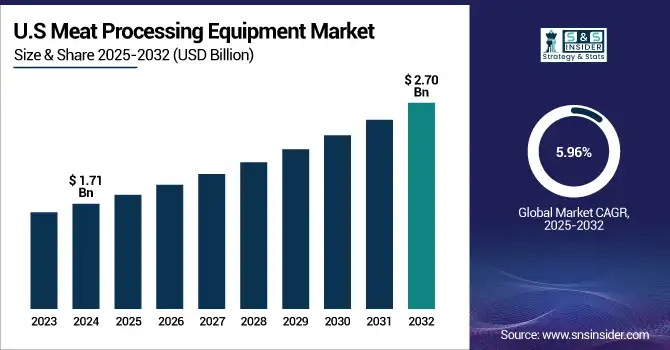

The U.S. meat processing equipment market size was valued at USD 1.71 billion in 2024 and is expected to reach USD 2.70 billion by 2032, growing at a CAGR of 5.96% over the forecast period of 2025-2032.

The growing demand for processed meat and increase use of automation in food production are all adding to the growing meat processing equipment market in the U.S. top producers in meat processing equipment market is more Innovative for efficient production. Wider food & beverage processing level systems integration is adding yet another layer of process streamlining and compliance assurance.

Meat Processing Equipment Market Dynamics:

Drivers:

-

Rising Automation in Meat Processing Facilities Accelerates Adoption of Advanced Equipment Across Industrial and Commercial Segments

Meat processing may not escape automation, similar to other markets being eaten by the food industry's automation. Meat processing facilities are now relying on a combination of robotic systems, AI, and real-time monitoring tools that have both increased throughput and decreased the need for labour at these facilities. The transition also underlines a rising need for uniform quality of product and compliance with hygiene conditions. Consequently, the demand for industrial meat processing machinery is soaring, particularly in plants with higher meat processing capacities. Current meat processing equipment market trends show that automation has been rapidly embraced by both small and large-scale operations. Nowadays, top meat processing equipment companies are modernizing their technologies to cater to changing production requirements in the red meat and poultry processing equipment segments.

“In January 2024, JBT Corporation announced the strengthening of its robotic automation solutions for the meat processing market.”

-

Growing Demand for Eco-Friendly Products in Various Industries Boosts the Meat Processing Equipment Market Growth

The meat sector is witnessing sustainability, being used increasingly as a purchasing driver. Growing regulatory burdens and rising consumer demand for sustainable food production have compelled companies to implement environmentally sustainable processing technologies. It also include machines that save water and energy, low-emission systems, and equipment design that allows equipment to be made out of recyclable materials. It goes in line with wider environmental policies in North America and Europe to embrace green technologies. In this scenario, the meat processing equipment market analysis is emphasizing lifecycle efficiency and carbon footprint reduction. Instead, sustainability is an ongoing development that is a strategic need shaping the future of Food & Beverage processing equipment that is also specific to meat-oriented solutions.

Restraints:

-

High Initial Investment and Maintenance Costs Restrain Market Growth in Developing and Small-Scale Processing Units

The high cost of procuring and operating new meat processing equipment is one of the intensifying restraints, alongside huge initial investments required, which is particularly detrimental to small and medium enterprises, even with the evolved technology. Meat processing machinery requires substantial hierarchical capital expenditure on equipment, with installation and training to be followed by regular servicing, making it a difficult move for many units. In developing regions, where financing is scarce, these costs can be prohibitive. Several analyses have probably highlighted that, despite enhancing the efficiency, costs remain a barrier. Furthermore, interfacing with larger Food & Beverage processing equipment only adds complexity and expense, which may keep adoption constrained to well-capitalized companies or mature markets.

Meat Processing Equipment Market Segmentation Analysis:

By Meat Type

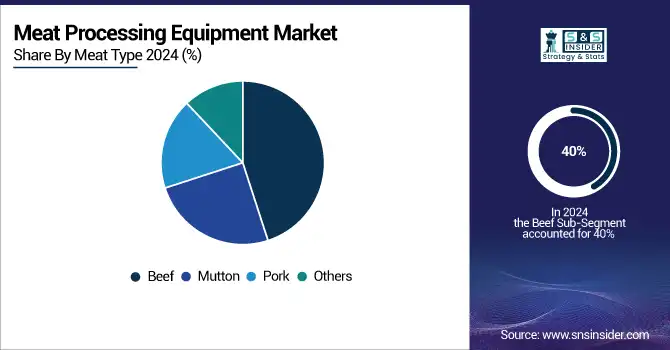

The beef segment dominated the meat processing equipment market with the highest revenue share of 40% in 2024, mainly due to the extensive global demand for beef in processed forms such as ground meat, steaks, and ready meals. Manufacturers have started to use advanced systems for getting the maximum yield and quality. The emphasis of Key companies on beef-compatible solutions with Processing Machinery operational compatibility enables this segment to be market-leading.

The pork segment is expected to have the highest CAGR growth over 2025–2032, owing to the growing consumption of pork in Asia Pacific, and an increase in the demand for pork-based processed foods such as sausages, bacon, and deli meats. Increased urbanization and dietary diversification are contributing to higher levels of penetration of more advanced processing solutions for pork. Upgrades in the equipment, such as marinating equipment, cutting equipment, and specific poultry processing equipment lines for pork transformation, will improve productivity and hygiene. As a result, the Food & Beverage processing equipment manufacturers now introducing innovative and scalable technologies for pork processors.

By Type

The slicing segment is expected to dominate the meat processing equipment market with the largest revenue share of approximately 24.00% in 2024, owing to its necessary contribution in providing various types of uniform cuts conforming to consumer demand and regulatory standards. The necessity of slicing machines cuts across all meat categories, although deli and ready-to-eat packaging lines, which typically require high throughput, are among some of the key application scopes of the meat processing machine market. Top meat processing equipment manufacturers have been focusing on automated slicing systems integrated with larger Food & Beverage processing equipment that offers precision, hygiene, and efficiency in mass production environments.

In January 2024, Bettcher Industries revealed a high-precision slicing system designed to meet the increasing demand for consistent and high-quality meat cuts. The system features the latest in automation technology, allowing the highest levels of hygiene standards and compliance to be achieved, even in necessary high-throughput meat production lines.”

The dicing segment is foreseen to witness exceptionally high CAGR of around 5.04% during the growth period of 2025–2032, driving enormous consumption of diced meat in instant food, meal packages, and catering facilities. As pre-cooked and portion-controlled meat products gain popularity, so does the demand for fast dicing equipment that can deliver consistency and minimum wastage. The incorporation of new dicing technology, which enhances throughput and facilitates rapid product changeovers, offers an increasingly valuable solution across both the red meat and poultry processing equipment categories in the modern industrial meat processing machinery.

Meat Processing Equipment Market Regional Outlook:

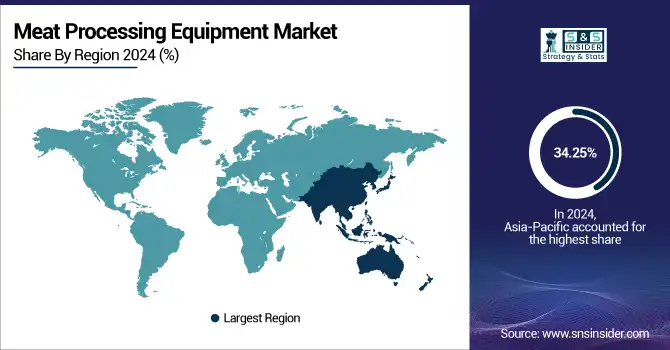

In 2024, the Asia Pacific region accounted for the highest revenue share of approximately 34.25%, which is mainly focused on large-scale meat production and reduced processing time. Factors, such as heavy meat consumption in countries including China, India, and Japan, among others, rapid urbanization, and increased investment in food processing technologies, are driving market growth. In addition, various companies are operating meat processing equipment in this region, which is also likely to fuel demand for technologically advanced equipment for red meat and poultry processing.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America is anticipated to witness a substantial CAGR of approximately 6.19%, owing to an increase in the adoption of automation in meat processing plants. Consumables, especially ready-to-eat and processed meat products, would be in high demand in North American countries, urging investment in innovative and advanced Food & Beverage processing equipment to aid working and functional productivity. Moreover, a positive outlook on the use of sustainable and energy-efficient equipment a rising need to adhere to regulations, will be propelling the growth of the market in North America, especially in the meat processing machinery.

In 2024, the U.S. accounted for the largest share of revenue in the meat processing equipment market, at approximately 68.69%, due to its large industry for large-scale meat processing, coupled with continued advancement in meat processing technology. Major meat processing equipment companies in the U.S. are targeting more automation and sustainability, which will eventually lead to an increase in demand for meat processing machinery and poultry processing equipment. The stable growth path of the processed meat products market is determined not only by the previously mentioned factors but also by the increasing consumer preference for processed meat products.

The single-country segment of the global meat convenience food processors market is expected to fastest CAGR over 2025–2032 in Canada. However, the demand for meat-based convenience foods is expected to remain high in Canada, and meat convenience food processors are predicted to grow rapidly owing to continuous development in processing equipment. However, the market growth in this region is driven by the increasing implementation of sustainable practices in meat processing.

In Mexico, which is the third largest meat processing market, the demand has also increased rapidly in line with rising exports and modernization. With the growing capacity of food production in the country, the demand for efficient food processing equipment continues to rise, especially for pork and beef industry.

However, the segment will maintain a steady growth through higher demand of processed meat products and by innovation in technology of meat processing equipment. Germany is the leading country of poultry processing equipment market. More recent innovations prioritize automation and environmental sustainability while reducing waste and increasing efficiency.

Key Players in Meat Processing Equipment Market are:

The major players operating in the market are Mepaco, Minerva Omega Group s.r.l., Tomra Systems ASA, JBT, Nemco Food Equipment, LTD., RAM Beef Equipment, LLC, The Middleby Corporation, Marel, Equipamientos cárnicos, S.L. (MAINCA), and Bettcher Industries, Inc.

Recent Developments:

-

March 2025 - Mepaco unveiled its 2025 Equipment Catalog, featuring new additions such as single and dual agitator ThermaBlend cookers and the innovative Pump Feeder. These additions aim to offer greater flexibility and precision in processing operations.

-

April 2024 - Middleby introduces advanced solutions for enhancing efficiency in salami production, focusing on automation and precision. These innovations improve processing times and product consistency while reducing labor costs.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 11.25 Billion |

| Market Size by 2032 | USD 16.36 Billion |

| CAGR | CAGR of 4.86% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Slicing, Bending, Dicing, Grinding, Massaging & Marinating, Smoking, Tenderizing, Others) • By Meat Type (Beef, Mutton, Pork, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Mepaco, Minerva Omega Group s.r.l., Tomra Systems ASA, JBT., Nemco Food Equipment, LTD., RAM Beef Equipment, LLC, The Middleby Corporation, Marel, Equipamientos cárnicos, S.L. (MAINCA), Bettcher Industries, Inc. |