Shape Memory Alloys Market Report Scope & Overview:

The Shape Memory Alloys Market Size was estimated at USD 13.90 billion in 2023 and is supposed to reach USD 40.61 billion by 2032 with a growing CAGR of 12.65% over the forecast period 2024-2032. The Shape Memory Alloys (SMA) Market report offers a unique perspective by analyzing production capacity & utilization trends across key regions, highlighting supply-demand dynamics. It explores regulatory standards & compliance variations shaping regional market entry. The study tracks technological advancements and adoption rates, showcasing innovations in biomedical, aerospace, and robotics applications. Additionally, export/import trends reveal shifts in global trade flows. A key trend includes the rising integration of AI-driven material design, enhancing SMA performance and lifecycle predictions.

To Get more information on Shape Memory Alloys Market - Request Free Sample Report

Shape Memory Alloys Market Dynamics

Drivers

-

The increasing adoption of shape memory alloys in biomedical applications, driven by their biocompatibility, super elasticity, and advancements in medical technology, is a key factor fueling market growth.

The growing demand for shape memory alloys (SMAs) in biomedical applications is a key driver of market growth. Due to its biocompatibility, super elasticity, and shape recovery properties, it has become one of the most used alloys for devices like stents, orthopedic implants, guidewires, and dental braces. SMA-based medical devices are gaining traction due to the rising prevalence of cardiovascular diseases, growing orthopedic surgeries, and advancements in minimally invasive procedures. Moreover, recent technological innovations in the healthcare sector, which comprise smart implants and self-expanding stents, are extending the range of SMAs. Market opportunities are further boosted by the trend towards patient-specific and adaptive medical solutions. Ongoing R&D work results in increasing fatigue resistance and mechanical performance, increasing long-term reliability of SMAs. Ease of the biomedical segment is anticipated to aid the overall development of the shape memory alloys industry on the back of rising aging population and rising healthcare investments.

Restraint

-

The high production costs of SMAs, driven by complex manufacturing and expensive raw materials like nickel and titanium, limit their adoption in cost-sensitive industries.

Shape memory alloys (SMAs) are costly due to their complex manufacturing processes and the high prices of essential raw materials like nickel and titanium. SMAs are costly to produce because they require exact alloy compositions coupled with specialized heat treatments and advanced processing methods, such as vacuum melting and thermomechanical training. And the main constituents of the majority of the SMAs, titanium and nickel, are generally expensive and have a sensitive market too, aggravating the expenses. These combined characteristics deter use of SMAs in cost-sensitive industries, which often opt to use inexpensive replacements such as regular metals or polymers. Additionally, the requirement for strict quality control, as well as specialized equipment, raise operational costs, hindering large-scale implementation. Note: while SMAs provide unique characteristics like super elasticity and shape memory effects, their relatively high price limits their applications to the high-value domains of aerospace, healthcare, and robotics, hindering their penetration into mass-market consumer products and general manufacturing sectors.

Opportunities

-

Shape memory alloys (SMAs) enhance energy efficiency in smart grids, renewable energy, and sustainable infrastructure through adaptive, self-healing, and lightweight designs.

The development of shape memory alloys (SMAs) for sustainable and eco-friendly applications is gaining momentum, particularly in energy-efficient systems. With the implementation of SMAs in smart grids, energy storage can be improved, power distribution can be optimized, and the resilience of the grid can be enhanced. For renewable energy, alloys are employed with solar panel actuators, wind turbine components, and thermal systems that self-adjust to secure the greatest efficiency. Their ability to phase transform with low energy input means they are excellent candidates for adaptive and self-healing structures, thereby decreasing maintenance and material waste. Moreover, SMAs promote sustainability because they are used in lightweight, durable green buildings and transportation, which ultimately reduce carbon footprints. The focus of industries on sustainable development will lead to an increase in demand for SMAs in green applications. With the increasing potential of material science and manufacturing techniques to drive the costs of these materials down, SMAs are set to unlock the next chapter of cleaner and energy-efficient technologies.

Challenges

-

Designing SMA-based systems is complex due to the need for precise control over phase transformation temperatures, material behavior, and integration challenges.

Designing shape memory alloy (SMA)-based systems is technically complex due to the precise control required over phase transformation temperatures and material behavior. SMAs have unique properties like the ability to return to a predefined shape by applying heating or removing stress, but these properties depend on parameters such as alloy composition, processing methods, and thermal cycling. In high-stakes industries such as aerospace, automotive, and robotics, engineers face rigorous challenges to design these SMA components to maintain reliable performance in response to changing environmental conditions. Further, SMAs possess nonlinear stress-strain behavior, which can make analysis and predictions challenging, often necessitating the use of envelopes and specialized computational tools. Integration with current systems means that the material must also be compatible with other materials and control methods, further complicating matters. In applications including medical devices and actuators, even marginal transformations are critical in functionality, demanding precision in manufacturing and testing. However, these technical challenges have constrained the widespread adoption of SMAs despite their potential benefits.

Shape Memory Alloys Market Segmentation Analysis

By Product

The Nickel-Titanium (Nitinol) Alloys segment dominated with a market share of over 74% in 2023, due to its exceptional super elasticity, corrosion resistance, and biocompatibility. All these properties have made it the material of choice for certain medical applications, such as stents, orthopedic implants and guidewires. Nitinol's properties enable its use in actuators and adaptive structures in the aerospace industry, where extreme conditions must be able to be withstood. Moreover, its excellent durability and flexibility propel its usage in robotics and industrial automation for advanced actuating mechanisms. Nitinol's market quadrants are also reinforced by the increasing need for minimally invasive surgical procedures with rising demand for high-performance materials in critical industries. As there are new inventions in the field of Biomedical Engineering and Smart Materials continuously, this segment will also witness the fastest growth in the market.

By End Use

The Biomedical segment dominated with a market share of over 68% in 2023, due to its widespread use in critical medical applications. These alloys are widely used, e.g., in stents, guidewires, orthopedic implants, and dental braces, where their properties confer major advantages. Its high biocompatibility makes it safe to contact with human tissues, while corrosion resistance is one of the main reasons for its long-lasting applications and durability of medical devices. Their super elastic property also enables flexibility and shape recovery, making them suitable for minimally invasive procedures. The increasing incidence of cardiovascular disorders, orthopedic disorders, and dental correction is another major factor driving the market. Owing to the increased efficacy of shape memory alloys, as medical technology keeps advancing, the biomedical sector remains the driving force behind the market leader.

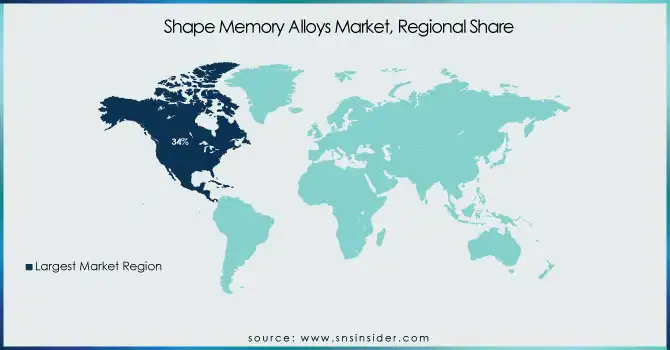

Shape Memory Alloys Market Regional Outlook

North America region dominated with a market share of over 34% in 2023, owing to its well-established aerospace, automotive, and biomedical industries that continuously utilize these advanced materials. Factors such as significant R&D investments, tech innovations, and presence of key market players are driving the growth across the region. In aerospace, shape memory metals are used in the design of actuators, smart morphing structures, etc., and in biomedical applications, they are used in the design of medical implants, surgical instruments, and more. The automotive industry also incorporates these alloys for improved performance and safety features. North America continues to be the most dominant region for shape memory alloys due to the growing utilization of smart materials, along with governmental assistance to drive research and innovation.

The Asia-Pacific region is the fastest-growing market for shape memory alloys (SMAs) due to rising demand from key industries such as healthcare, consumer electronics, and automotive. Countries such as China, Japan, and India are investing significantly in advanced manufacturing technologies as the region goes on to witness rapid industrialization. The increasing healthcare costs are driving the demand for SMAs in medical applications such as stents, orthopedic implants, and surgical instruments. In addition, the burgeoning consumer electronics industry is energizing the demand for shape memory alloys (SMAs) in smartphones, wearables, and flexible devices. SMAs for lightweight and high-performance parts are also being used in the automotive sector. Strong government support, advances in technology and a budding industrial base also propels Asia-Pacific in leading the charge for market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players in the Shape Memory Alloys Market

-

ATI – (Nickel-Titanium Alloys, Cobalt-Based SMAs)

-

Baoji Seabird Metal Material Co., Ltd. – (Nickel-Titanium Wires, SMA Sheets)

-

Dynalloy, Inc. – (Flexinol Shape Memory Alloy Wires)

-

Fort Wayne Metals Research Products Corp – (Nickel-Titanium Wires, Nitinol Tubing)

-

Furukawa Electric Co., Ltd. – (Shape Memory Alloy Actuators, Medical-Grade SMAs)

-

Johnson Matthey – (Nickel-Titanium Alloys, Biomedical SMAs)

-

Mishra Dhatu Nigam Limited (MIDHANI) – (Nitinol Alloys, Aerospace-Grade SMAs)

-

Nippon Seisen Co., Ltd. – (Nickel-Titanium Wires, Shape Memory Tubes)

-

Nippon Steel Corporation – (Shape Memory Alloy Sheets, Structural SMAs)

-

SAES Group – (SMA Actuators, Smart Materials for Robotics)

-

Memory Corporation – (Medical-Grade Nitinol, SMA Tubing)

-

Confluent Medical Technologies – (Biomedical Nitinol Components)

-

TiNi Alloy Co. – (SMA Actuators, Smart Springs)

-

G.RAU GmbH & Co. KG – (Shape Memory Alloy Wires, Nitinol Components)

-

Metalwerks PMD Inc. – (Nickel-Titanium Shape Memory Materials)

-

SAES Getters S.p.A. – (SMA Actuators, Smart Materials)

-

Xian Saite Metal Materials Development Co., Ltd. – (Nitinol Tubing, SMA Wires)

-

Ultimate NiTi Technologies – (Nickel-Titanium Medical Devices, SMA Components)

-

Baoji Titanium Industry Co., Ltd. – (SMA Sheets, Medical Wires)

-

Mitsubishi Materials Corporation – (Shape Memory Alloy Actuators, Industrial SMAs)

Suppliers for (Special metals and alloys, including shape memory alloys for aerospace and defense) on the Shape Memory Alloys Market

-

SAES Getters S.p.A.

-

Mishra Dhatu Nigam Limited (MIDHANI)

-

Memory Corporation

-

SAES Smart Materials

-

Special Metals Corporation

-

Memory GmbH

-

Actuator Solutions GmbH

-

Power & Energy

-

Alfmeier

-

National Aerospace Laboratories (CSIR-NAL)

RECENT DEVELOPMENT

In April 2024: ATI Inc. (NYSE: ATI) announced the completion of its Vandergrift Operations expansion, now the most advanced materials finishing facility of its kind. The event, attended by government and community leaders, highlights ATI’s strategic focus on high-quality titanium and nickel-based alloys. By consolidating production from five other sites, the expansion enhances efficiency and boosts the output of high-value, specialized materials.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 13.90 Billion |

| Market Size by 2032 | USD 40.61 Billion |

| CAGR | CAGR of 12.65% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Nickel-Titanium (Nitinol) Alloys, Copper-Based Alloys, Others) • By End Use (Biomedical, Automotive, Aerospace & Defense, Consumer Electronics & Household, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ATI, Baoji Seabird Metal Material Co., Ltd., Dynalloy, Inc., Fort Wayne Metals Research Products Corp, Furukawa Electric Co., Ltd., Johnson Matthey, Mishra Dhatu Nigam Limited (MIDHANI), Nippon Seisen Co., Ltd., Nippon Steel Corporation, SAES Group, Memry Corporation, Confluent Medical Technologies, TiNi Alloy Co., G.RAU GmbH & Co. KG, Metalwerks PMD Inc., SAES Getters S.p.A., Xian Saite Metal Materials Development Co., Ltd., Ultimate NiTi Technologies, Baoji Titanium Industry Co., Ltd., Mitsubishi Materials Corporation. |