Embedded Analytics Market Report Scope & Overview:

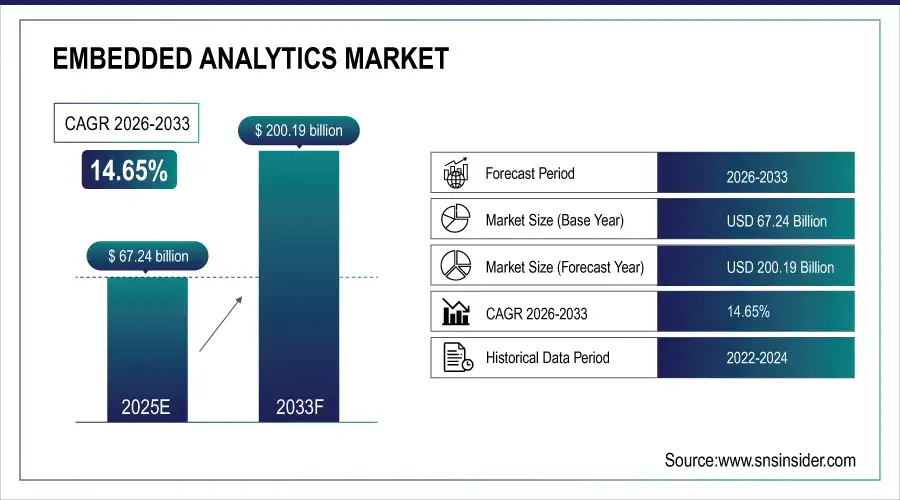

The Embedded Analytics Market Size was valued at USD 67.24 Billion in 2025E and is expected to reach USD 200.19 Billion by 2033 and grow at a CAGR of 14.65% over the forecast period 2026-2033.

The Embedded Analytics Market is experiencing strong growth due to the increasing demand for real-time, data-driven decision-making across enterprises. Organizations are seeking to integrate analytics directly into business applications such as ERP, CRM, and supply chain management systems to enhance operational efficiency, improve reporting accuracy, and gain actionable insights without switching between multiple platforms. The rapid adoption of cloud computing, coupled with advancements in AI, machine learning, and data visualization tools, is further driving the market, enabling businesses to access predictive and prescriptive analytics seamlessly. According to study, Analytics is increasingly being integrated into ERP, CRM, and supply chain management systems, indicating that over 60% of enterprise applications are expected to embed analytics by 2025.

Market Size and Forecast:

-

Market Size in 2025: USD 67.24Billion

-

Market Size by 2033: USD 200.19 Billion

-

CAGR: 14.65% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Embedded Analytics Market - Request Free Sample Report

Embedded Analytics Market Trends

-

Rising demand for integrated ERP, CRM, SCM analytics drives adoption.

-

AI and machine learning enable predictive, actionable insights across enterprises.

-

Self-service analytics empowers non-technical users to generate critical insights.

-

Real-time dashboards accelerate decision-making and improve operational efficiency significantly.

-

Cloud-based platforms offer scalability, flexibility, and reduced IT infrastructure costs.

-

Digital transformation grows as cloud analytics integrates predictive, collaborative capabilities.

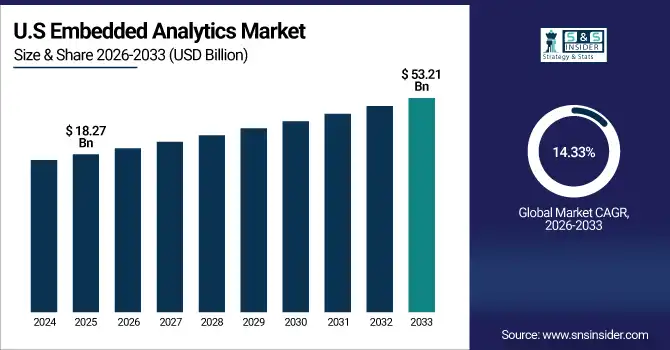

The U.S. Embedded Analytics Market size was USD 18.27 Billion in 2025E and is expected to reach USD 53.21 Billion by 2033, growing at a CAGR of 14.33% over the forecast period of 2026-2033, drives embedded analytics adoption through early cloud and AI integration, strong IT infrastructure, and high enterprise spending on data-driven solutions.

Embedded Analytics Market Growth Drivers:

-

Real-Time Analytics Demand Fuels Enterprise Growth and Smarter Decisions Rapidly

Enterprises are increasingly relying on data to drive business strategies, operational efficiency, and customer satisfaction. Embedded analytics allows organizations to integrate analytics directly into business applications like ERP, CRM, and supply chain management systems. This reduces the need to switch between multiple platforms, accelerates decision-making, and improves reporting accuracy. The demand for real-time insights, predictive analytics, and actionable intelligence is particularly high in industries like BFSI, healthcare, manufacturing, and retail. The rise of AI, machine learning, and advanced data visualization tools further enhances the capabilities of embedded analytics, driving adoption across enterprises of all sizes.

Real-Time Insights Adoption: More than 50% of business decisions in leading enterprises rely on real-time embedded analytics.

Embedded Analytics Market Restraints:

-

High Implementation Costs and Complexity Challenge Widespread Embedded Analytics Adoption

Despite the benefits, the cost and complexity of implementing embedded analytics solutions can be a significant barrier, especially for SMEs. Deploying and integrating analytics into existing enterprise systems requires skilled personnel, robust IT infrastructure, and ongoing maintenance. Additionally, configuring advanced features such as predictive analytics, real-time dashboards, or AI-driven insights can increase operational complexity. Many organizations may face challenges in training staff, ensuring data security, and aligning analytics with business workflows. These factors can slow down adoption, particularly in cost-sensitive industries or regions with limited technical expertise.

Embedded Analytics Market Opportunities:

-

Cloud-Based Solutions Unlock Scalable, Innovative Growth for Embedded Analytics Market

Cloud-based embedded analytics is emerging as a major growth opportunity. Cloud deployments reduce upfront capital expenditure, offer scalable solutions, and enable faster integration with business applications. Organizations can leverage SaaS-based analytics platforms to gain insights without significant IT overhead. Additionally, cloud solutions support remote access, real-time collaboration, and integration with AI/ML technologies, which is particularly valuable in the post-pandemic digital workplace. With the global shift toward digital transformation, cloud-based embedded analytics presents opportunities for vendors to expand market reach, target SMEs, and introduce innovative features like predictive modeling and self-service dashboards.

Approximately 45% of cloud-based embedded analytics solutions now integrate AI/ML for predictive and prescriptive insights.

Embedded Analytics Market Segmentation Analysis:

-

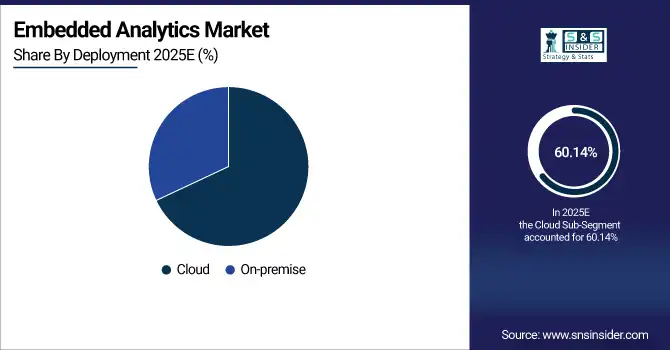

By Deployment: In 2025, Cloud the market 60.14%, while Cloud fastest-growing segment with a CAGR 15.40%.

-

By Enterprise Type: In 2025 Large Enterprise led the market with share 63.40%, while Medium and Small Enterprise the fastest-growing segment with a CAGR 15.60%.

-

By Application: In 2025, ERP/CRM led the market with share 34.62%, while Supply Chain Management are the fastest-growing segment with a CAGR 16.70%.

-

By End-user: In 2025, BFSI led the market with share 25.40%, while Healthcare is the fastest-growing segment with a CAGR 16.30%.

By Deployment, Cloud Leads Market and Fastest Growth

The Cloud deployment segment leads the market and is also the fastest-growing segment. Organizations are increasingly adopting cloud solutions to achieve scalable, cost-efficient, and easily integrable analytics platforms. Cloud deployments enable faster integration with business applications, support real-time collaboration across distributed teams, and provide access to AI and machine learning-powered predictive analytics. Additionally, self-service dashboards allow users to generate insights independently, improving operational efficiency and decision-making.

By Enterprise Type, Large Enterprises Lead Market and SMEs Fastest Growth

The Large Enterprises currently lead adoption, driven by higher investments in advanced analytics, automation, and digital transformation initiatives. These organizations leverage embedded analytics to enhance operational efficiency, improve decision-making cycles, and optimize enterprise-wide workflows.

Meanwhile, SMEs represent the fastest-growing segment due to increasing adoption of affordable cloud-based analytics platforms that reduce infrastructure costs and offer scalable deployment. As SMEs accelerate digital transformation and shift toward data-driven strategies, embedded analytics solutions with low-code integrations and self-service capabilities are rapidly gaining traction across smaller organizations.

By Application, ERP/CRM Leads Market and Supply Chain Management Fastest Growth

The ERP/CRM applications currently lead market, driven by the need for unified business intelligence across sales, finance, customer engagement, and enterprise resource workflows. Integrating analytics directly into these core platforms enables real-time reporting, improved forecasting, and enhanced decision-making without relying on standalone tools.

Meanwhile, Supply Chain Management is the fastest-growing segment, supported by rising demand for data-driven logistics, inventory optimization, demand forecasting, and end-to-end visibility across global supply networks. The growth of e-commerce, IoT-enabled tracking, and automation tools is further accelerating analytics adoption in supply chain processes.

By End-user, BFSI Leads Market and Healthcare Fastest Growth

The BFSI remains the leading segment, driven by the need for real-time fraud detection, risk assessment, compliance monitoring, automated reporting, and personalized financial services. Banks and fintech firms increasingly integrate analytics into core systems like loan processing, transaction monitoring, and customer management platforms to enhance decision-making and operational transparency.

Meanwhile, Healthcare is the fastest-growing segment, fueled by rising demand for data-driven diagnostics, patient outcome analysis, electronic health records integration, and predictive analytics for resource planning. Post-pandemic digitization and AI-enabled clinical insights further accelerate adoption across healthcare ecosystems.

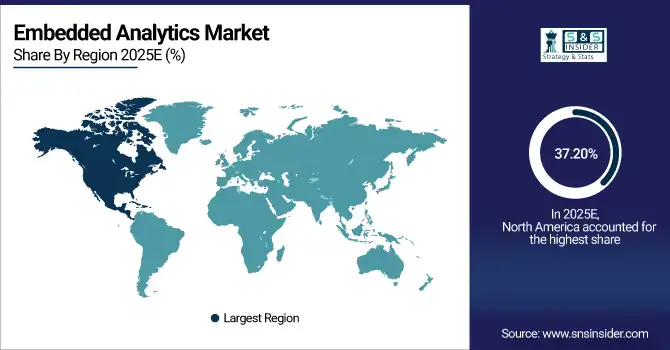

Embedded Analytics Market Regional Analysis:

North America Embedded Analytics Market Insights:

The North America dominated the Embedded Analytics Market in 2025E, with over 37.20% revenue share, due to strong technology adoption, mature IT infrastructure, and high demand for real-time data-driven decision-making across industries such as BFSI, healthcare, retail, and manufacturing. The presence of major technology providers, cloud-first enterprises, and early adoption of AI and machine learning further accelerates growth. Organizations increasingly embed analytics into CRM, ERP, and enterprise software to enhance operational efficiency and customer insights. The region benefits from widespread digital transformation initiatives, rapid cloud migration, and regulatory emphasis on data transparency.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Dominates Embedded Analytics Market with Advanced Technological Adoption

The U.S. leads the embedded analytics market due to early adoption of cloud, AI, and machine learning, driving real-time insights, predictive analytics, and enhanced operational efficiency across industries.

Asia-Pacific Embedded Analytics Market Insights

The Asia-Pacific region is expected to have the fastest-growing CAGR CAGR of 15.59%, driven by increasing digital transformation initiatives, rising enterprise IT investments, and growing demand for real-time, data-driven decision-making. Countries such as China, India, Japan, and Australia are adopting embedded analytics solutions across industries like BFSI, healthcare, retail, and manufacturing to enhance operational efficiency and customer experience. Cloud-based deployments and AI-powered analytics are gaining traction, enabling predictive insights, self-service dashboards, and seamless integration with ERP and CRM systems.

China and India Propel Rapid Growth in Embedded Analytics Market

China and India drive market expansion through increasing digital transformation, cloud adoption, AI integration, and rising enterprise demand for real-time analytics, predictive insights, and operational efficiency across industries.

Europe Embedded Analytics Market Insights

The European Embedded Analytics Market is witnessing steady growth, driven by strong digital transformation initiatives, increasing demand for real-time data insights, and rapid integration of analytics within enterprise applications such as ERP, CRM, and workflow automation systems. The region places high emphasis on data governance, compliance, and security, prompting organizations to adopt sophisticated embedded analytics platforms that support transparency and auditability. Growth is further supported by rising adoption of cloud-based analytics, AI-driven insights, and self-service data tools that empower business users to make faster, informed decisions.

Germany and U.K. Lead Embedded Analytics Market Expansion Across Europe

Germany and the U.K. drive Europe’s embedded analytics growth through early technology adoption, advanced cloud and AI integration, and strong enterprise demand for real-time insights, predictive analytics, and enhanced operational efficiency across industries.

Latin America (LATAM) and Middle East & Africa (MEA) Embedded Analytics Market Insights

The Embedded Analytics Market in Latin America and MEA is experiencing steady growth as enterprises increasingly embrace digital transformation and cloud-based solutions. Countries including Brazil, Mexico, Argentina, UAE, Saudi Arabia, South Africa, and Egypt are adopting embedded analytics across BFSI, retail, healthcare, and manufacturing sectors to enhance operational efficiency, reporting accuracy, and customer insights. Cloud deployments, AI integration, and predictive analytics are driving adoption, while SMEs and government initiatives supporting technology infrastructure create further opportunities. Real-time dashboards, scalable solutions, and cost-effective platforms enable organizations to make data-driven decisions, fostering market expansion across both regions.

Embedded Analytics Market Competitive Landscape

Microsoft drives the Embedded Analytics Market through Power BI Embedded, integrating analytics into enterprise applications. Its solutions enable real-time dashboards, AI-driven insights, and self-service reporting, enhancing operational efficiency and decision-making. Cloud deployment and scalability make Microsoft a leading provider, catering to diverse industries including BFSI, healthcare, and manufacturing.

-

In April 2025: Microsoft announced key expansions to the Embedded Analytics Solution Accelerators Partner Program at the FabCon 2025 event, showcasing the continued evolution of their accelerator offerings.

SAP strengthens the Embedded Analytics Market with SAP Analytics Cloud and Datasphere, offering integrated analytics within ERP and CRM systems. The platform provides predictive analytics, real-time insights, and data visualization capabilities. SAP’s solutions support digital transformation, operational efficiency, and informed decision-making across large enterprises and growing SMEs globally.

-

In October 2024: SAP introduced new embedded data lake capabilities for SAP Datasphere, including an integrated object store and Spark compute for efficient data transformation and processing.

Oracle accelerates embedded analytics adoption through Oracle Analytics Server, offering AI-powered dashboards, data exploration, and enhanced reporting. The platform enables seamless integration with ERP and SCM systems, real-time decision-making, and predictive insights, serving enterprises across BFSI, manufacturing, and retail, while supporting cloud and hybrid deployment models for scalability.

-

In August 2025: Oracle Analytics Server 2024 introduced enhancements such as global reset, free-form node placement, and new icons in nodes to show data settings, improving the end-user experience.

Embedded Analytics Market Key Players:

Some of the Embedded Analytics Market Companies are:

-

Microsoft

-

SAP

-

Oracle

-

Salesforce

-

IBM

-

Qlik

-

Sisense

-

MicroStrategy

-

ThoughtSpot

-

Looker (Google Cloud)

-

Domo

-

Amazon QuickSight

-

Infor

-

Logi Analytics

-

Yellowfin BI

-

TIBCO Software

-

Zoho Analytics

-

QlikTech International AB

-

Salesforce.com Inc.

-

OpenText Corporation.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 67.24 Billion |

| Market Size by 2033 | USD 200.19 Billion |

| CAGR | CAGR of 14.65% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (Cloud, On-premise) • By Enterprise Type (SMEs, Large Enterprises) • By Application (ERP/CRM, Supply Chain Management, Sales and Marketing, Logistics and Delivery, Others) • By End-user (IT & Telecommunications, Retail and Consumer Goods, BFSI, Manufacturing, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Microsoft, SAP, Oracle, Salesforce (Tableau), IBM, Qlik, Sisense, MicroStrategy, ThoughtSpot, Looker (Google Cloud), Domo, Amazon QuickSight, Infor (Koch Industries), Logi Analytics (Insightsoftware), Yellowfin BI, TIBCO Software, Zoho Analytics, QlikTech International AB, Salesforce.com Inc., OpenText Corporation, and Others. |