Gigabit Ethernet Test Equipment Market Report Scope & Overview:

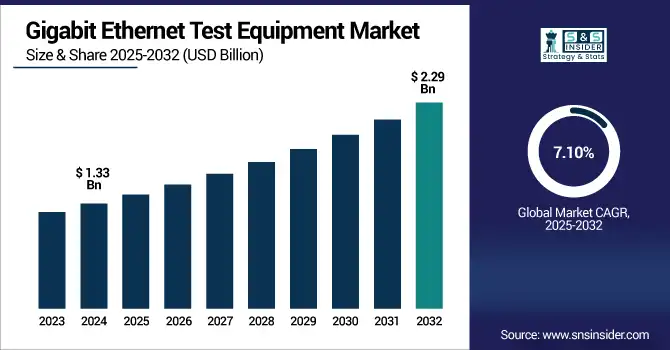

The Gigabit Ethernet Test Equipment Market size was valued at USD 1.33 billion in 2024 and is expected to reach USD 2.29 billion by 2032, expanding at a CAGR of 7.10% over the forecast period of 2025-2032.

To Get more information on Gigabit-Ethernet-Test-Equipment-Market - Request Free Sample Report

High-speed connectivity is necessary for several verticals, which include Data Center, Telecommunications, and Enterprises. Increased adoption of 5G, IoT, and edge computing is also heightening the demand for sophisticated test tools to support network performance and compliance. Major players, such as Keysight Technologies and Viavi Solutions, are investing heavily in new products that will enable higher levels of testing precision as well as automation. Although high equipment prices and technical expertise are the main hindrances of the industry, virtualized testing and green IT trends have generated prospects for the development of the market, which also underscores the value Ethernet test solutions play in modern network designs.

According to research, in 2024, Gigabit Ethernet test platforms enabled a 40% reduction in energy consumption compared to legacy systems, with 18% of deployed equipment incorporating eco-friendly materials or recyclable designs, reflecting a strong shift toward sustainable testing solutions.

The U.S Gigabit Ethernet Test Equipment Market size reached USD 0.34 billion in 2024 and is expected to reach USD 0.55 billion in 2032 at a CAGR of 5.96% from 2025 to 2032.

The U.S. has led the market because it has more advanced communication infrastructure, quicker 5G deployment, and a higher concentration of major tech companies and data centers. The country’s focus on digitalisation, cloud computing, and IOT applications fuelled strong demand for network testing solutions. Furthermore, investments in smart cities and edge computing mean accurate Ethernet validation tools are a necessity. The innovation and leadership of key market players, including Keysight Technologies, Viavi Solutions based in the United States, stemming from innovation keep the U.S. ahead in the global market.

Market Dynamics

Drivers:

-

Surging Adoption of High-Speed Data Transmission and 5G Networks Drives the Demand for Advanced Testing Equipment Solutions.

Increasing demand for high–speed data transfer and new networks such as 5G, cloud, and Internet of Things (IoT) networks is a major factor boosting the demand for advanced Ethernet test equipment. These utilities are essential to compare network results for guaranteed low latency and maximum throughput across complex and diverse networks. New Changes include AI-based analytics and automation have also been added in the testing tools for accuracy and increased speed. With this rapidly evolving landscape, major vendors such as Keysight Technologies and Viavi Solutions are keeping pace, rolling out leading-edge solutions such as 800G and 1.6T test platforms to assist service providers and enterprises in adapting to emerging network needs and in achieving compliance with demanding new Ethernet protocols.

Restraints:

-

High Initial Investment and Technical Complexity Limit Broader Adoption Among Smaller Enterprises Globally.

A significant challenge in the market is the high initial investment required to procure and maintain state-of-the-art testing equipment. The difficulty of setting up and interpreting the solution technically also presents an obstacle, particularly for the small and medium-sized enterprises that lack an IT budget and professional expertise. Training needs, as well as quickly changing Ethernet standards, compound the work at hand. This can result in a bias towards outsourced testing services or legacy solutions, slowing the uptake of more effective and efficient test platforms in developing markets and cost-limited applications.

Opportunities:

-

Rapid Expansion of Data Centers and Edge Computing Infrastructure Offers New Growth Opportunities for Test Equipment Providers.

There is a growing need for Gigabit Ethernet test equipment manufacturers, with the constant worldwide expansion of edge computing infrastructure, hyperscale data centers, and colocation markets. Such facilities require powerful network validation systems so as to operate with high performance, low latency, and low power. New industry trends, like AI-powered demand response and green IT programs, are accelerating demand for efficient, scalable, automated, and sustainable test solutions. Modular and remotely accessible test platforms are being deployed by companies to test the geographically separated edge networks.

Challenge:

-

Shortage of Skilled Network Testing Professionals Poses a Major Operational and Scalability Challenge.

A persistent problem is that whenever network testing tools become powerful enough to produce very complex data outputs, there are not enough people in the industry who are sufficiently trained to use them. As Ethernet devices become more complex and the Ethernet protocol itself becomes multi-layered, the requirement for trained expertise is more and more important. Most companies, especially in the developing world, find it difficult to hire and retain specialists well-versed in new test models as well as automation tools and real-time diagnostics. This skills gap translates into longer deployment timelines, heightened reliance on third-party testing providers, and reduced scalability.

Segment Analysis

By Application

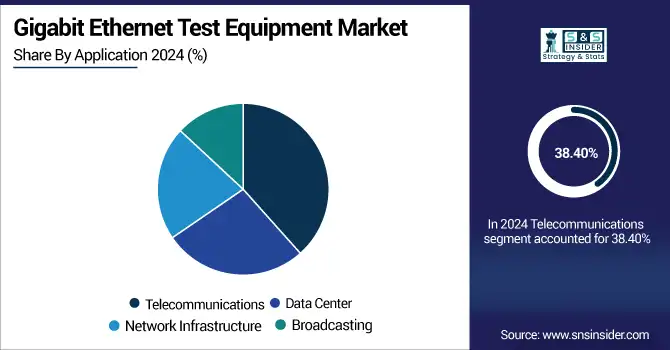

The Telecommunications segment is dominated by the applications with a gigabit ethernet test equipment market share of 38.40% in 2024. The market growth is driven by the widespread adoption of 5G across the globe and surging demand for high-speed Internet in the region. Gigabit Ethernet testing equipment is critical for checking network speed, latency, and function. Prominent vendors such as Viavi Solutions and Keysight Technologies have launched 800G and 1.6T Ethernet Test platforms to cater to the rise in telecom requirements. Services such as voice-over-IP services, increasing data consumption, and the increasing demand for always connectivity are increasing the requirement for further investment in higher-end testing solutions.

Data Centre is the fastest growing segment with a CAGR of 8.16% during the forecast period, with growing demand for cloud services, AI applications, and content delivery networks. In the crowded conditions of such an access network, joint EM dynamics lead to inter-user data interference. Gigabit Ethernet test gear is a must in order to achieve the best performance in terms of data throughput and low latency. Players, including Spirent Communications, already offer high-speed traffic testing platforms designed for hyperscale and edge data centers.

By Product Type:

The Network Analyzers segment is dominated by the largest share of revenue, with 34.17% in 2024, as they offer an extensive analysis of traffic patterns, packet loss, and network congestion. NetScout and EXFO, among others, have added AI-based diagnostics and remote capabilities to their analyzers. This is being fueled by the increasing proliferation of encrypted traffic, video streaming, and real-time applications. The use of network analyzers makes it possible to detect weaknesses in advance and utilize performance more effectively in high-speed Ethernet infrastructure.

The Traffic Generators segment is projected to have the fastest CAGR of 8.08%. Traffic generators are becoming more popular since they allow testing network devices under simulated real-world loads. With the explosion of bandwidth-hungry applications such as UHD video, gaming, and cloud services, their role is now more crucial than ever. Players like Spirent and Keysight have launched scalable, programmable traffic generation platforms that support next-gen Ethernet Speeds. The growing adoption of SDN and NFV across industries is driving demand for high-performance traffic generators capable of simulating diverse network scenarios, significantly contributing to this segment's high CAGR during the forecast period.

By End User

Based on End User, the Service Providers segment is dominated by the largest share of revenue with 40.32% in 2024, due to their wide-ranging requirement for testing solutions in complex network infrastructures. Consistent performance testing is needed for 5G, FTTH, and IP-based services rollout. And Anritsu and Viavi Solutions are working on integrated test platforms that enable automated testing, remote diagnostics, and high-speed protocol analysis. Increasing demand for robust, always-on Ethernet connections. The trend of Subscribers expecting more for faster bandwidth drives service providers to deploy complete Ethernet test solutions.

The Enterprises segment is growing at the fastest CAGR of 7.94% within the forecasted period because of the accelerating digital transformation efforts and the move to hybrid and remote working patterns. Businesses are investing in their network to ensure that it is both performance and secure, and that means a lot of testing. Vendors such as Fluke Networks are offering user-friendly Ethernet test tools specifically designed to support in-house IT teams in managing and troubleshooting network infrastructure. This trend is further driven by rising cybersecurity demands and the need for uninterrupted connectivity, pushing businesses to adopt high-speed, scalable test equipment to ensure network resilience across multiple locations.

Regional Analysis

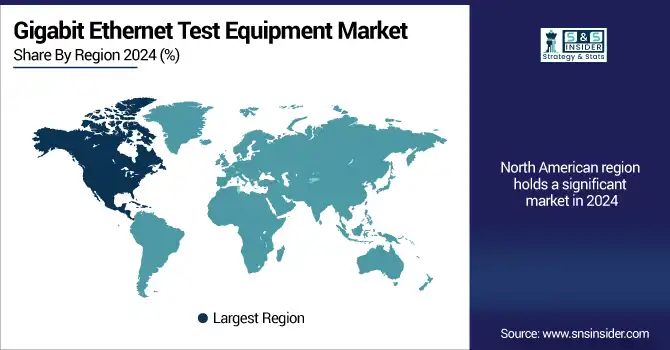

North America holds a significant share in the Gigabit Ethernet Test Equipment Market due to established telecom networks, early 5G rollout, and huge investments in high-speed data networks. An increasing use of SDN, NFV, and cloud services by enterprises is also contributing to the increasing demand for strong test offerings within the region.

The United States is leading the North American market in the adoption of next-generation technologies, with a high density of data centers, and the presence of major ground and aerospace & defense TAROS manufacturers such as Keysight Technologies and Viavi Solutions in the region.

Europe witnesses a constant growth in this market due to the growth in digital transformation, growing penetration of broadband, and the rise in expansion of high-capacity telecom networks. Demand for Ethernet Test Solution is also supported by the government's focus on improving connectivity and data infrastructure in urban and rural areas.

Germany tops the European market when it comes to the need for advanced network testing, due to a strong industrial base and investments in digital infrastructure and a wide deployment of 5G and fiber networks.

The Middle East & Africa and Latin America regions are witnessing gradual growth of the Gigabit Ethernet testing equipment market owing to the enhanced telecom facilities, digital initiatives & connectivity. In the former, the UAE takes the top spot with early 5G rollouts and smart city initiatives, while Brazil tops the region because of telecom investments and increasing demand for high-speed network testing as infrastructure is upgraded there.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players of the Gigabit Ethernet Test Equipment Market are Keysight Technologies, Viavi Solutions Inc., Spirent Communications, EXFO Inc., Rohde & Schwarz, Anritsu Corporation, NetScout Systems, Inc., Yokogawa Electric Corporation, Teledyne LeCroy, GL Communications Inc., and others.

Key Developments

-

In March 2025, Viavi said it would buy Spirent Communications plc's high-speed Ethernet and network security business for $410 million as it seeks to enhance its Ethernet and network security testing ability.

-

In October 2024, Keysight introduced a compact 800GE benchtop system to simulate, automate, and verify AI and machine learning workloads, speeding up artificial intelligence and data center interconnect testing.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.33 Billion |

| Market Size by 2032 | USD 2.29 Billion |

| CAGR | CAGR of 7.10% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Telecommunications, Data Center, Network Infrastructure, Broadcasting) •By Product Type (Network Analyzers, Cable Testers, Traffic Generators, Protocol Analyzers) •By End User (Service Providers, Enterprises, Government, Academic Institutions) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Keysight Technologies, Viavi Solutions Inc., Spirent Communications, EXFO Inc., Rohde & Schwarz, Anritsu Corporation, NetScout Systems, Inc., Yokogawa Electric Corporation, Teledyne LeCroy, GL Communications Inc. |