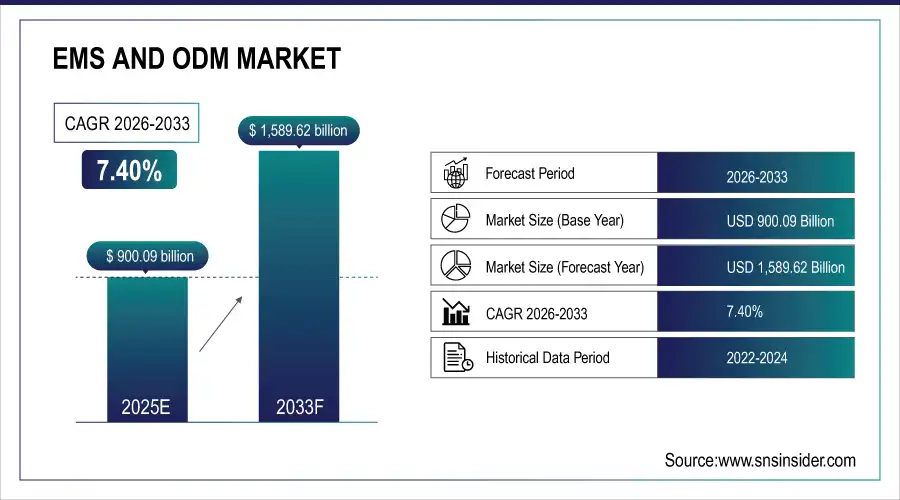

EMS and ODM Market Size & Growth:

The EMS (Electronics Manufacturing Services) and ODM (Original Design Manufacturing) market size was valued at USD 900.09 Billion in 2025E and is projected to reach USD 1,589.62 Billion by 2033, growing at a CAGR of 7.40% during the forecast period 2026–2033.

The EMS and ODM Market analysis is based on demand from electronics, automotive, and industrial sectors, driven by rising outsourcing, technological advancements, and the need for efficient manufacturing solutions. Market growth is driven by rising production of consumer electronics-Industrial automation-and healthcare equipment.

EMS and ODM production reached 200 million units in 2025, driven by demand for consumer electronics, automotive components, industrial automation, and healthcare devices.

Market Size and Forecast:

-

Market Size in 2025: USD 900.09 Billion

-

Market Size by 2033: USD 1,589.62 Billion

-

CAGR: 7.40% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On EMS and ODM Market - Request Free Sample Report

EMS and ODM Market Trends:

-

Growing need for contract manufacturing is a key factor driving the EMS and ODM market in consumer, automotive, and industrial applications.

-

Progress in microelectronics, PCB design and in modular assembly procedures enhance production performance, accuracy and scalability.

-

The growing smart device, IoT and electric vehicle businesses are further driving demand for component-labor based manufacturing, design outsourcing services.

-

Growing focus on sustainability and energy-efficient production is also expected to drive the adoption of eco-friendly manufacturing methods among businesses.

-

Market competition is forcing suppliers to provide integrated solutions, accelerated turn-around time and high-quality design-for-manufacturability services that address industry changes.

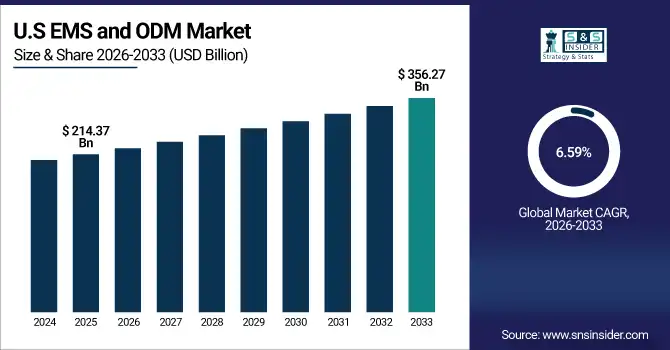

U.S. EMS and ODM Market Insights:

The U.S. EMS and ODM Market is projected to grow from USD 214.37 Billion in 2025E to USD 356.27 Billion by 2033, at a CAGR of 6.59%. Increasing demand for consumer electronics, automotive, and industrial automation along with the uptake of advanced manufacturing and design-for-manufacturing software is expected to propel market growth.

EMS and ODM Market Growth Drivers:

-

Surging demand for consumer electronics and electric vehicles is accelerating growth in the EMS and ODM market.

Surging demand for consumer electronics and electric vehicles is the primary driver of EMS and ODM market growth. Growing penetration of outsourced manufacturing and complex design specifications are generating demand in automotive, industrial and healthcare applications. It’s helping to bolster production volumes, and adoption of scalable, high precision services. Advancements in PCB assembly, modular manufacturing, and testing techniques continue to drive improvements in efficiency, quality and flexibility.

EMS and ODM service demand grew by 6.2% in 2025, driven by rising consumer electronics production, electric vehicle adoption, and industrial automation requirements.

EMS and ODM Market Restraints:

-

Supply chain disruptions and skilled labor shortages are limiting large-scale production and adoption of EMS and ODM services.

Supply chain disruptions and skilled labor shortages are significant factors restraining the growth of the EMS and ODM market. Specialized components, high technology machinery and skilled manpower dependency makes manufacturers susceptible to production delays and quality variances. Furthermore, the growing complexity in electronics design and enhanced compliance to safety and environmental standards increases operational costs. Smaller players may have difficulties expanding their operations or introducing more advanced production technologies, thereby preventing them from fully benefitting from the increasing industry demand.

EMS and ODM Market Opportunities:

-

Rising demand for smart devices and electric vehicles presents opportunities for advanced EMS and ODM solutions globally.

Rising demand for smart devices and electric vehicles presents a significant opportunity for the EMS and ODM market. Advanced manufacturing technologies along with modular assembly and precision PCB services can drive efficiency, quality and scale for automotive, consumer electronics and industrial in a single location. The long-term story: Rising proliferation of connected devices, IoT installs and electric mobility offerings with manufacturers’ capability to match product with design and regulatory changes will drive longer-term growth and innovation.

Advanced EMS and ODM solutions - 15% of electronics manufacturing innovations in 2025, driven by demand in consumer electronics, automotive, and industrial automation sectors.

EMS and ODM Market Segmentation Analysis:

-

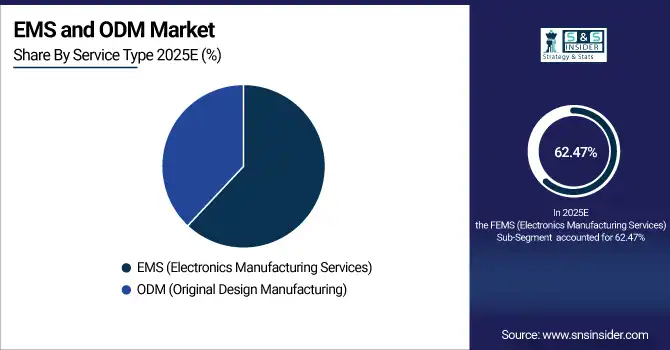

By Service Type, EMS held the largest market share of 62.47% in 2025, while ODM is expected to grow at the fastest CAGR of 8.12%.

-

By Component Type, PCBs dominated with a 45.36% share in 2025, while Modules are projected to expand at the fastest CAGR of 9.05%.

-

By Production Type, Volume Manufacturing accounted for the highest market share of 53.88% in 2025, and Prototype Development is projected to record the fastest CAGR of 8.73%.

-

By End-Use Industry, Consumer Electronics held the largest share of 49.29% in 2025, while Automotive is expected to grow at the fastest CAGR of 7.89%.

By Service Type, EMS Dominates While ODM Expands Rapidly:

EMS segment dominated the market, driven by high penetration in consumer electronics, automotive and industrial applications; established supply chains and flexible production processes. It is ideal for mass production and other general applications. ODM is the fastest growing segment due to the clients require custom designs and higher-end electronics and tailor-made manufacturing solutions. Innovation in design-for-manufacturing is growing and causing interest to spread in various industries.

By Component Type, PCBs Dominate While Modules Expand Rapidly:

PCB segment dominated the market, as they are a necessity for virtually all electronics and are economical for mass production. Their multiple uses and centrality to electronic design ensure their continued market leadership. Modules is the fastest growing segment, propelled by increasing demand in IoT products, automotive electronics and high-end consumer gadgets. Advancements in modular construction and miniaturization are driving greater usage of modules and market growth across industries.

By Production Type, Volume Manufacturing Dominates While Prototype Development Expands Rapidly:

Volume Manufacturing segment dominated the market as electronical devices, industrial components, and standard manufacturing processes all have been available to guarantee efficiency and low piece prices. Lead by its capability of providing mass production to various industries. Prototype Development is the fastest-growing segment due to an increasing number of product launches, high R&D activity, and small-lot custom work. Advanced prototyping technologies and flexible production lines are enabling rapid adoption

By End-Use Industry, Consumer Electronics Dominates While Automotive Expands Rapidly:

Consumer Electronics segment dominated the market, driven by demand for smartphones, laptops and smart products which needed a high level of manufacturing know-how. Their steady and high growth rates support this dominance. Automotive is the fastest growing segment, due to the rise of electric vehicles, connected car and the trend toward more electronics in cars. Increasing the acceptance of this emerging end-use sector is investment in high-precision assembly and scalable solutions.

North America EMS and ODM Market Insights:

North America dominated the market, with a market share of 35.76% in 2025 due to strong demand from consumer electronics, automotive and industrial applications. Large-scale existence relies on established supply lines, manufacturing and tech know-how. Increasing use of electric vehicles, smart devices and industrial automation is bolstering the market penetration. Growing attention to high-precision assembly, scalable production, and revolutionary design-for-manufacturing services solidify North America’s position as a leading region in the EMS and ODM industry.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. EMS and ODM Market Insights:

The U.S. EMS and ODM Market is growing due to rising demand for high-precision electronics, automotive components, and industrial automation solutions. With excellent manufacturing facilities, a high level of PCB and module assembly processes converge with the application of advanced production technologies and smart devices and electric vehicle applications prosperous the market.

Asia-Pacific EMS and ODM Market Insights:

The Asia-Pacific EMS and ODM Market is the fastest-growing region with a CAGR of 8.68%, owing to accelerating industrialisation, growth in electronics manufacturing and surging demand for automobiles transportation along with consumer electronic goods. Rising utilization of high-end PCB assembly, modular manufacturing and smart device a production in China, India, Japan and South Korea is anticipated to drive the market. Growing industrial automation, urbanization and increasing demand for high precision and scalable manufacturing solutions are continuously driving the market growth.

China EMS and ODM Market Insights:

The China EMS and ODM dominated the market by owing to the rapid industrialization, increasing manufacturing of consumer electronics and automotive products and significant demand for advanced PCB and module assembly. Rising manufacturing capabilities, aggressive uptake of smart devices, and higher rate of industrial automation are pushing the market for EMS and ODM providers in the country.

Europe EMS and ODM Market Insights:

The Europe EMS and ODM market is witnessing an increase in demand for the advanced electronics, automotive components and industrial automation. Key markets are Germany, France and UK. Growth is attributed to robust manufacturing base, rise in high-precision PCB and module assembly, design-for-manufacturing (DFM), and sustainability in manufacturing activities to cut down on usage of energy. Increasing smart devices and industrial digitization are also propagating the growth of market in the region.

Germany EMS and ODM Market Insights:

Germany is a key market for EMS and ODM, driven by strong demand in automotive, consumer electronics, and industrial sectors. Mature manufacturing bases, leading PCB and module assembly capacities and emphasis on high quality, sustainable manufacturing drive growth. Rapid proliferation of smart devices coupled with increasing industrial automation projects drives market growth.

Latin America EMS and ODM Market Insights:

Latin America EMS and ODM market is witnessing increasing demand from consumer electronics, automotive, and industrial segments. Growth is fuelled by additional manufacturing capacity, further infrastructure and the ongoing rise of high precision PCB and module assembly. Emerging markets, including Brazil, Mexico and Argentina, are providing new opportunities as product innovations emerge driven by technological developments, industrial automation and environmentally friendly production.

Middle East and Africa EMS and ODM Market Insights:

The Middle East and Africa EMS and ODM Market is anticipated to witness a modest growth owing to the demand from various sectors such as automotive, consumer electronics and industrial. The growth is driven by growing manufacturing capacity, urbanization and increasing use of high-precision PCB and module assembly. Government efforts, sustainable farming methods and growing industrial automation enhance the regional market.

EMS and ODM Market Competitive Landscape:

Foxconn, headquartered in Taiwan, is the world’s largest electronics manufacturing services provider, offering integrated design, assembly, and supply chain solutions. It leads the market with its huge production scale, long-term partnerships with tech giants such as Apple and advanced manufacturing processes. Its optimal operation and high-density, one stop manufacturing services contributed to its leading in the EMS and ODM experience of fast response for both volume production and prototype builds.

-

In August 2025, Foxconn unveiled its world-class, vertically-integrated AI server system solutions at the Dallas expo, following their initial presentation at GTC 2025. These systems are designed to enhance AI infrastructure and robotics capabilities, showcasing Foxconn's commitment to advancing AI technologies in manufacturing and supply chain management.

Pegatron, based in Taiwan, is a major EMS and ODM provider specializing in consumer electronics, computing, and communication devices. The company has won the market with strong design-for-manufacturing capabilities, excellent assembly quality, and years of cooperation with brands. Streamlined production capabilities, flawless supply chain management, and scalable models for mass production has strengthened Pegatron’s source of competitiveness that enables it to sustain a leading position in the EMS and ODM industry.

-

In August 2025, Pegatron launched two high-performance server platforms, the AS205-2T1 and AS400-2A1, featuring NVIDIA RTX PRO 6000 Blackwell Server Edition GPUs. These systems are tailored for AI, scientific computing, and professional visualization applications, marking a significant step in Pegatron's expansion into AI-optimized server solutions.

LuxShare, headquartered in China, is a leading EMS and ODM company focused on high-precision electronics, including connectors, modules, and consumer devices. It holds a large share of the market, thanks to rapid innovation and strong RandD capacity and partnerships with big names in tech. With production cost effectively, RandD support and vertical integration, LuxShare ICT focus on quality, scale economy and technical solution so that to put LuxShare into a good position in competing EMS and ODM market.

-

In September 2025, OpenAI partnered with Luxshare Precision to develop its first consumer AI device, a screenless smart speaker. Luxshare will handle the assembly of this device, expected to launch in late 2026 or early 2027, highlighting its growing role in AI hardware manufacturing.

Top 20 EMS and ODM Companies are:

-

Foxconn (Hon Hai Precision Industry Co., Ltd.)

-

LuxShare Precision Industry Co., Ltd.

-

Jabil Inc.

-

Flex Ltd.

-

BYD Electronics

-

Celestica Inc.

-

Sanmina Corporation

-

Benchmark Electronics

-

USI (Universal Scientific Industrial)

-

Cal-Comp Electronics

-

Plexus Corporation

-

Kaga Electronics Co., Ltd.

-

DBG (Shenzhen Daewon Electronics)

-

Etron Technology, Inc.

-

Fabrinet

-

Zollner Elektronik AG

-

Venture Corporation Limited

-

SIIX Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 900.09 Billion |

| Market Size by 2033 | USD 1589.62 Billion |

| CAGR | CAGR of 7.40% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Electronic Manufacturing Services (EMS), Original Design Manufacturing (ODM), Joint Design Manufacturing (JDM), Electronics Assembly, Others) • By Application (Consumer Electronics, Automotive, Industrial, Healthcare, IT & Telecom, Aerospace & Defense, Others) • By Product Type (PCBs & Assemblies, Enclosures, Cables & Connectors, Displays & Modules, Others) • By End User (OEMs, SMEs, Startups, Contract Manufacturers, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Foxconn (Hon Hai Precision Industry Co., Ltd.), Pegatron Corporation, Flex Ltd., Jabil Inc., Wistron Corporation, Compal Electronics Inc., Inventec Corporation, Quanta Computer Inc., Celestica Inc., Sanmina Corporation, BYD Electronics, SIIX Corporation, Venture Corporation Limited, Universal Scientific Industrial Co., Ltd. (USI), Fabrinet, New Kinpo Group, Benchmark Electronics Inc., Kimball Electronics Inc., Asteelflash Group, Plexus Corp. |