Endoprosthesis Market Size Analysis:

Get more information on Endoprosthesis Market - Request Sample Report

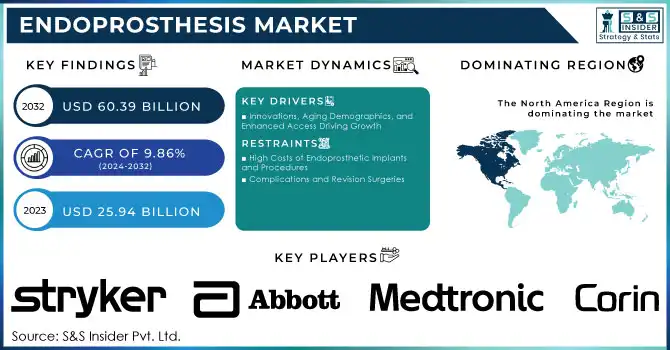

The Endoprosthesis Market Size was valued at USD 25.94 billion in 2023 and is expected to reach USD 60.39 billion by 2032 and grow at a CAGR of 9.86% over the forecast period 2024-2032.

The global endoprosthesis market is experiencing significant growth, driven by an aging population, rising prevalence of chronic conditions, and technological advancements in prosthetic design and materials. According to the World Health Organization (WHO), 1.71 billion individuals worldwide are affected by musculoskeletal disorders, with osteoarthritis and osteoporosis among the leading contributors. These conditions have heightened demand for joint and bone replacement procedures, where endoprostheses are integral. Trauma and sports injuries are also significant factors contributing to the market's expansion. The CDC reports that 3 million nonfatal injuries annually require hospital care in the U.S., many of which necessitate orthopedic interventions. Among younger populations, sports-related injuries are particularly notable, driving demand for advanced solutions like knee, shoulder, and hip prostheses.

The integration of innovative technologies is revolutionizing the market. For example, 3D-printed endoprostheses enable the creation of patient-specific implants that enhance surgical precision and improve postoperative outcomes. A study published in The Journal of Orthopaedic Surgery and Research revealed that 3D-printed titanium prosthetics offer a 25% improvement in fit and durability compared to traditional designs. These advancements reduce revision surgery rates and improve patient satisfaction. Material innovation is another key driver. The use of biocompatible materials such as titanium alloys and high-density polyethylene ensures longer-lasting implants and fewer complications. A study in PMC highlights that titanium-based implants have a 15-year survival rate exceeding 90%, making them a preferred choice for surgeons and patients alike.

The market's growth is further bolstered by increasing awareness of advanced prosthetic options and ongoing investment in research and development. For example, regenerative medicine approaches, like bio-integrative prosthetics, are being explored to merge artificial components with natural tissue, promising enhanced functionality and integration. As these advancements address critical patient needs, the endoprosthesis market is positioned for continued expansion, offering transformative solutions in the management of degenerative diseases, trauma, and functional impairments.

Market Dynamics

Drivers

-

Innovations, Aging Demographics, and Enhanced Access Driving Growth

Rising awareness of advanced treatment options is a significant driver, as patients increasingly seek modern solutions for conditions such as osteoarthritis, trauma, and congenital deformities. Coupled with improvements in healthcare access, particularly in emerging markets, this has fueled demand for endoprosthetic implants.

Developments such as 3D printing technology and patient-specific implants have revolutionized prosthetic designs, allowing for customized solutions that enhance surgical precision and reduce complications. Innovations in materials, including biocompatible metals and polymers, have improved implant durability and patient outcomes. Another critical driver is the rising incidence of road accidents and sports injuries, which has created a growing need for trauma-related prosthetic solutions. Similarly, the increase in joint replacement surgeries, particularly among aging populations, has escalated the demand for knee, hip, and extremity reconstructions.

The market also benefits from a shift toward minimally invasive surgical techniques, which reduce recovery times and improve patient satisfaction. Furthermore, supportive government initiatives and favorable reimbursement policies have made endoprosthetic procedures more accessible to a broader patient demographic. Lastly, the integration of smart technologies, such as sensor-enabled prosthetics for real-time monitoring, is expanding the scope of applications, attracting more patients and healthcare providers to adopt advanced endoprosthesis solutions. These drivers collectively ensure sustained market growth.

Restraints

-

High Costs of Endoprosthetic Implants and Procedures

The advanced technologies and materials used in endoprosthesis significantly increase costs, limiting accessibility for patients in low- and middle-income regions.

-

Complications and Revision Surgeries

Issues such as implant failure, infection, and the need for revision surgeries deter adoption, impacting patient confidence and healthcare providers' willingness to recommend these solutions.

Key Segmentation

By Product Type

Knee reconstruction endoprostheses held the largest market share in 2023, accounting for approximately 35.0% of the global market. This dominance is attributed to the high prevalence of knee-related degenerative conditions such as osteoarthritis, which affects over 500 million people globally (WHO). The increasing number of total knee replacement surgeries, driven by an aging population and rising obesity rates, further supports this segment’s dominance. Advanced materials and minimally invasive surgical techniques have also bolstered adoption.

The extremities reconstruction segment is projected to grow at the highest CAGR during the forecast period. This growth is fueled by advancements in prosthetic designs for trauma cases, particularly in complex elbow, shoulder, and ankle surgeries. Rising incidences of trauma injuries, sports-related fractures, and congenital limb deformities are major contributors to the surge in demand for extremities reconstruction endoprostheses.

By Material

Metallic materials, such as titanium and cobalt-chromium alloys, were the most widely used in endoprostheses in 2023, commanding a 40.0% market share. These materials are preferred due to their high durability, biocompatibility, and ability to withstand substantial load-bearing stress. They are extensively used in knee and hip reconstruction procedures, making them a key contributor to market dominance.

The biological materials segment is expected to grow at the fastest rate, driven by advancements in regenerative medicine. The growing demand for bio-integrative prostheses, which promote natural tissue growth and integration with implants, is a major factor propelling this segment. Biological materials are gaining traction in dental and cardiac reconstructions due to their natural adaptability and reduced risk of rejection.

By End-User

Hospitals were the largest end-users in 2023, accounting for nearly 43.0% of the market share. This dominance stems from the comprehensive care they offer, including advanced surgical facilities, expert orthopedic surgeons, and post-operative rehabilitation services. Hospitals are also preferred for complex procedures such as total joint replacement and cardiac reconstructions, which require specialized resources.

Orthopedic clinics are the fastest-growing segment, driven by their focus on specialized and patient-centric care. The increasing number of clinics equipped with advanced diagnostic and surgical tools, coupled with shorter wait times and reduced costs compared to hospitals, has made them a preferred choice for patients seeking endoprosthetic solutions.

Regional Analysis

North America held a dominant share in 2023, primarily attributed to advanced healthcare systems, high adoption rates of cutting-edge technologies, and a substantial aging population requiring joint replacements and trauma care. The United States, in particular, leads the region due to robust reimbursement policies and extensive R&D initiatives by major market players.

Europe followed closely, with countries like Germany, France, and the UK contributing significantly to market growth. The region benefits from an established medical infrastructure, supportive government initiatives, and a rising number of joint replacement procedures among its aging population. Furthermore, collaborations between healthcare providers and manufacturers to integrate advanced technologies like 3D printing into clinical settings are fostering growth.

Asia-Pacific is the fastest-growing region, fueled by increasing healthcare expenditure, improving access to advanced treatment options, and a large pool of untreated patients with joint or trauma-related conditions. Emerging economies like China and India are seeing rapid adoption of endoprosthetic solutions due to government healthcare reforms and growing medical tourism.

Need any customization research on Endoprosthesis Market - Enquiry Now

Key Players and Related Products

-

Johnson & Johnson Services, Inc.

-

ATTUNE Knee System

-

Pinnacle Hip Solutions

-

-

-

Persona Knee System

-

G7 Acetabular System

-

ROSA Knee System

-

-

-

Triathlon Total Knee System

-

Accolade Hip System

-

Mako Robotic-Arm Assisted Surgery

-

-

Smith & Nephew

-

JOURNEY II Total Knee System

-

REDAPT Hip System

-

EBI Bone Growth Stimulation System

-

-

Corin Ltd

-

Optimized Dual Mobility (ODM) System

-

Unity Modular Hip System

-

-

Medacta International SA

-

MyKnee Personalized Knee System

-

M.O.R.E. (Medacta Orthopaedic Robotic Surgery) System

-

-

Exactech, Inc.

-

Equinoxe Shoulder System

-

Optetrak Logic Knee System

-

-

MicroPort Orthopedics, Inc.

-

PROFEMUR Hip System

-

EVOLUTION Total Knee System

-

-

Baumer S.A.

-

Endoprosthetic Components for Trauma and Joint Replacement

-

-

B. Braun Melsungen AG

-

Aesculap Prosthesis System

-

Medtronic

-

TiLITE Total Knee System

-

Simplify Disc Replacement System

-

Boston Scientific

-

Spinal Cord Stimulation Systems (related to pain management in endoprosthetic patients)

-

Abbott Laboratories

-

Advanced Orthopedic Implants (used in joint reconstruction surgeries)

Recent Development

In Sept 2024, the ARISE II clinical trial commenced to evaluate the effectiveness of an ascending aorta stent graft for endovascular repair. This study aims to assess the potential of the device in providing less invasive treatment options for patients with ascending aorta conditions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 25.94 billion |

| Market Size by 2032 | US$ 60.39 billion |

| CAGR | CAGR of 9.86% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Knee Reconstruction, Hip Reconstruction, Extremities Reconstruction, Dental Reconstruction, Cardiac Reconstruction, Others) •By Material (Metallic, Polymeric, Ceramic, Biological, Others) •By End-User (Hospitals, Orthopedic Clinics, Ambulatory Surgery Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Johnson & Johnson Services, Inc., Zimmer Biomet Holdings Inc., Stryker, Smith & Nephew, Corin Ltd, Medacta International SA, Exactech, Inc., MicroPort Orthopedics, Inc., Baumer S.A., B. Braun Melsungen AG, Medtronic, Boston Scientific, Abbott Laboratories, and W. L. Gore. |

| Key Drivers | • Innovations, Aging Demographics, and Enhanced Access Driving Growth |

| Restraints | • High Costs of Endoprosthetic Implants and Procedures • Complications and Revision Surgeries |