Global Knee Replacement Market Size & Trends:

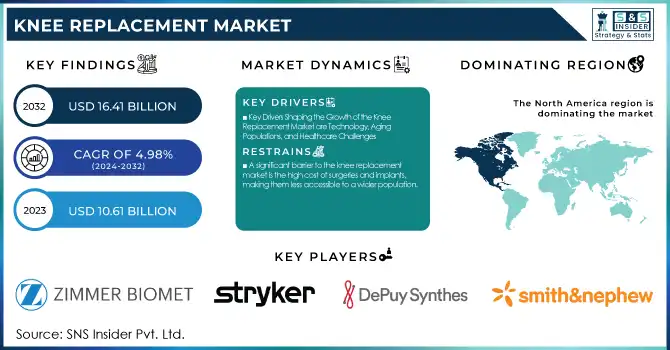

The Knee Replacement Market Size was valued at USD 10.61 billion in 2023 and is expected to reach USD 16.41 billion by 2032 and grow at a CAGR of 4.98% over the forecast period 2024-2032.

Get more information on Knee Replacement Market - Request Sample Report

This report shows the growing incidence and prevalence of knee osteoarthritis (OA) and related conditions, which have increased the demand for knee replacement procedures. The study looks into recent trends in knee replacement surgeries, including the increasing preference for minimally invasive techniques and the adoption of advanced prosthetic technologies. It also discusses prescription trends for knee replacement products, with a focus on emerging treatment options and their efficacy. The report gives a summary of device volume by region, showing how demand varies between markets. The post-surgical rehabilitation trend is also discussed, with the increase in the value of personalized recovery plans and innovative rehabilitation devices used to improve patient outcomes.

Knee Replacement Market Dynamics

Drivers

-

Key Drivers Shaping the Growth of the Knee Replacement Market are Technology, Aging Populations, and Healthcare Challenges

The most important reason is the increasing incidence of osteoarthritis, especially in the elderly population. As the world's population ages, so do knee diseases like osteoarthritis, which have led to an increase in the demand for knee replacement surgeries. In addition, rising obesity rates have increased the load on knee joints. Technological advancements also are a key factor in the growth of the market. The customized implants, produced with the aid of 3D imaging and printing technology, have revolutionized knee replacements. This allows for more precise and personalized treatments, improving surgical outcomes and reducing recovery time. For instance, Medacta and Smith & Nephew have impacted the market through their customized implant solutions. Zimmer Biomet Holdings, for instance, witnessed an increase of 4% in their joint reconstruction device revenue in the year 2024, where rising demand has been noted for knee replacements. However, in several regions like Australia, healthcare infrastructure is facing challenges because long delays are prevailing in public hospitals where patients seek private treatment. Despite these challenges, the market continues to grow due to technological innovations, an aging population, and the increasing need for joint replacements.

Restraints

-

A significant barrier to the knee replacement market is the high cost of surgeries and implants, making them less accessible to a wider population.

Although the technology has improved, with personal implants and robotic-assisted surgeries, these are often more costly. In most regions, insurance coverage and reimbursement for knee replacements are inadequate, leaving patients with a heavy financial burden. Moreover, there are risks of complications during and after surgery, including infection, blood clots, and implant failure, which can lead to prolonged recovery times and the need for further procedures. Such concerns often deter patients from choosing surgery. In addition, there is a lack of knowledge about the advantages and the recovery process following knee replacement in some sections of the population, which deters them from approaching treatment. Skilled surgeons are not readily available in rural and underdeveloped areas, thus preventing many people from receiving proper care.

Opportunities

-

Advancements in robotic-assisted surgeries, 3D printing, and minimally invasive techniques are enhancing the precision, recovery time, and customization of knee replacement procedures.

Improvements in robotic-assisted surgeries, 3D printing, and intelligent implants have advanced precision, customized procedures, and recovery time and thus increase knee replacement surgeries. For instance, robotic-assisted surgeries can make patients spend about 2 to 3 fewer days in hospitals and make a surgical procedure with more accuracy so that patients can recover more speedily. This is due to the increased frequency of sports injuries, which can be quite hazardous, and tends to increase further among younger population groups. A 2023 study suggests that 33% of knee replacements are performed on patients under 65 years; this is a pattern that has been growing amongst active, younger people. Increasing focus on MIS opportunities also offers growth opportunities because such procedures cause less pain and speed recovery times. MIS techniques have proven to have decreased recovery times by 30-40% compared to traditional surgery types. For instance, with the world aging, the number of knee replacements in elderly people suffering from osteoarthritis continues to increase. The World Health Organization estimates that by 2050, the population aged 60 years and above will double, which will have increasing demand for knee replacement. Increasingly, emerging markets like India and Brazil are witnessing significant demand due to expanding middle classes and improved healthcare infrastructure. For example, the number of knee replacement surgeries has risen by 30% in India over the last five years due to better access to healthcare and increased disposable incomes.

Challenges

-

Issues such as long recovery times, a shortage of skilled surgeons, and high revision surgery rates are hindering market growth.

One of the significant issues with the knee replacement market is that surgeries often have long recovery times. While minimally invasive techniques have reduced the recovery period, most patients still require 6 to 12 months for complete rehabilitation. The aging population contributes to a larger number of knee replacements; however, comorbidities like diabetes and heart disease, which affect more than 60% of adults aged 65 and older, can complicate surgery and lengthen recovery. Furthermore, there is a shortage of experienced surgeons, especially in emerging markets. The World Health Organization indicates that the region of sub-Saharan Africa and South Asia has insufficient orthopedic specialists to ensure access to treatment for patients. High revision surgery rates also constitute a challenge as 10-20% of knee replacements will require revision within 10-15 years following implant failure. In the end, less-invasive treatments such as PRP injections and stem cell therapy are seen as alternatives, thereby giving some patients a choice between it and traditional knee replacement surgery.

Knee Replacement Market Segmentation Analysis

By Implant Type

In 2023, Fixed Bearing Implant captured a share of around 57.3% of the knee replacement market. This is because of its proven reliability and stability in patients with a moderate to severe level of osteoarthritis. Long-term durability, few complications, and widespread adoption by surgeons describe fixed-bearing implants, which make them a favorite in the list of knee replacement surgeries.

Mobile-bearing implant is projected to be the fastest growing in the coming years. This type allows movement of the joint and wearing of the components, attracting younger and very active patients for this kind of implant. It is projected to rise as the demand for mobility and post-surgery functionality grows.

By Procedure

The Total knee arthroplasty (TKA) segment accounted for the largest share of the knee replacement market in 2023, around 64.5% of the market. TKA is still the most commonly performed procedure, especially among older adults with advanced osteoarthritis or knee degeneration. Its high success rates and long-term effectiveness make it the go-to option for those requiring a complete knee joint replacement.

The Revision Knee Arthroplasty segment is likely to be the fastest-growing throughout the forecast period. The aging population will increase the number of people undergoing primary knee replacement surgeries, leading to a greater demand for revision surgeries, caused by implant wear or complications.

By End User

The Hospital segment dominated the market in 2023 with a share of 64.8%. Hospitals possess the infrastructure, medical staff, and post-surgery care facilities that make them the primary destination for knee replacement surgeries. However, the Orthopedic Clinics segment is expected to grow at the fastest rate over the forecast years. This growth is fuelled by an increased preference for outpatient care, shorter hospital stays, and improved techniques of minimally invasive surgery, making orthopedic clinics a more convenient and cost-effective option for knee replacement procedures.

Knee Replacement Market Regional Overview

North America was the leading regional market for knee replacement, primarily due to a high prevalence of knee-related disorders, a strong healthcare system, and advanced surgical technologies. The U.S. is the main contributor to this dominance, as the number of knee replacement surgeries is increasing with each passing year, driven by an aging population and increased demand for joint replacements. This region enjoys state-of-the-art medical infrastructure, a large number of people with insurance coverage, and a high number of orthopedic specialists.

The Asia-Pacific region is anticipated to have the highest growth during the forecast period. China, India, and Japan are some of the countries that are witnessing an increase in knee replacement procedures, primarily due to the rapidly aging population, growing obesity levels, and better access to healthcare. The increase in healthcare infrastructure coupled with the rapid progress in medical technology is a major driver to accelerate the growth of knee replacement adoption. A rising middle-class population in China and India increases the disposable incomes of the population and thus demands more elective surgeries.

Need any customization research on Knee Replacement Market - Enquiry Now

Key Players

-

Zimmer Biomet (Persona Knee System, NexGen Knee System, Oxford Partial Knee, Gender Solutions Knee System)

-

Stryker (Triathlon Knee System, Scorpio NRG, K2 Knee System, Durum High Performance Insert)

-

DePuy Synthes (Johnson & Johnson Services, Inc.) (ATTUNE Knee System, Sigma Knee System, VELYS Robotics System)

-

Smith & Nephew (JOURNEY II XR Knee, LEGION Knee System, GENESIS II Knee System)

-

Aesculap, Inc. (B. Braun) (Evolution Total Knee System, Aesculap Knee System)

-

Medacta International (MyKnee, GMK Sphere, GMK Total Knee System)

-

MicroPort Scientific Corporation (EVOLIS Knee System, Journey II BCS Knee System)

-

Conformis (iTotal CR, iUni Partial Knee System)

-

SurgTech Inc. (Surgical tools and robotics, specific knee implant products not listed)

-

Corin Group (Persona Partial Knee System)

Recent Developments

In Feb 2025, TORC introduced a cutting-edge robot for knee replacement, marking a significant advancement in medical robotics. With the integration of big data and AI (Artificial Intelligence), this technology is expected to enhance patient outcomes and improve surgical precision, as highlighted by Information Technology and Digital Services Minister Palanivel Thiaga Rajan.

In Jan 2025, AdventHealth Hendersonville earned the Advanced Hip & Knee Replacement Certification from DNV, a global leader in certification and risk management. This certification underscores the hospital's commitment to delivering high-quality orthopedic care, including advanced hip and knee arthroplasty and related services, from diagnosis to surgery and rehabilitation.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 10.61 Billion |

|

Market Size by 2032 |

USD 16.41 Billion |

|

CAGR |

CAGR of 4.98% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Implant Type (Mobile bearing, Fixed bearing, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Zimmer Biomet, Stryker, DePuy Synthes (Johnson & Johnson Services, Inc.), Smith & Nephew, Aesculap, Inc. (B. Braun), Medacta International, MicroPort Scientific Corporation, Conformis, SurgTech Inc., and Corin Group. |