Enterprise Agile Planning Market Report Scope & Overview:

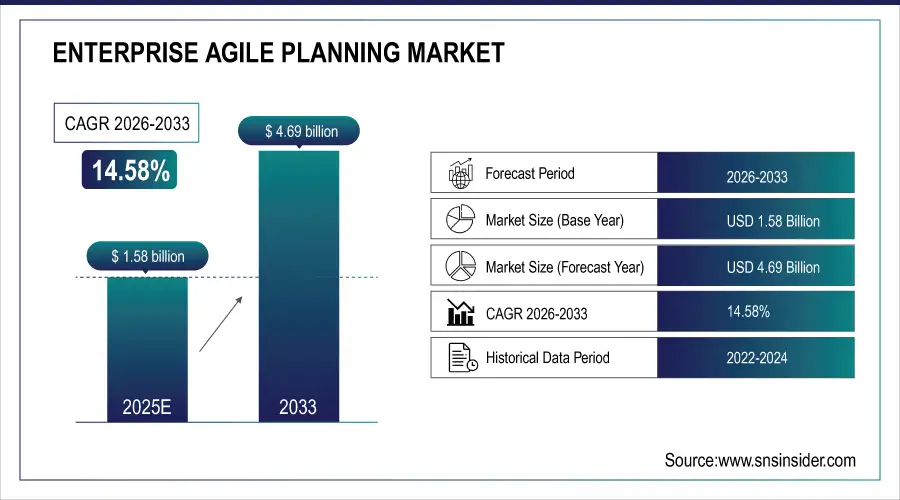

The Enterprise Agile Planning Market size was valued at USD 1.58 billion in 2025E and is expected to reach USD 4.69 billion by 2033, expanding at a CAGR of 14.58% over the forecast period of 2026-2033.

The demand for the Enterprise Agile Planning (EAP) market is rapidly growing as enterprises demand productivity and competence tools to obtain greater flexibility, faster delivery, and enhanced collaboration. Agile planning tools facilitate the management of projects, resource optimization, and adaptation to changing demands using methodologies such as Scrum and Kanban. The trend towards remote work and the need for scalability is making cloud-based solutions more popular. AI-enhanced tools like predictive analytics can give project outcomes a boost. These tools are being embraced by critical sectors such as IT, healthcare, and manufacturing to enhance productivity and drive innovation. While there are challenges due to integration issues and poor acceptance of Agile itself, the market is large for vendors with sophisticated and easy-to-use Agile planning solutions.

Enterprise Agile Planning Market Size and Forecast:

-

Market Size in 2025: USD 1.58 Billion

-

Market Size by 2033: USD 4.69 Billion

-

CAGR: 14.58% from 2025 to 2032

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Enterprise Agile Planning Market - Request Free Sample Report

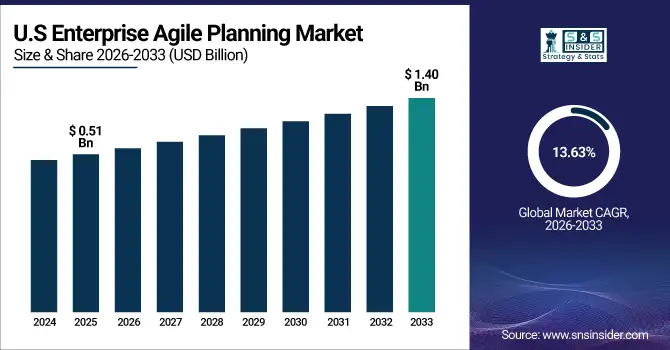

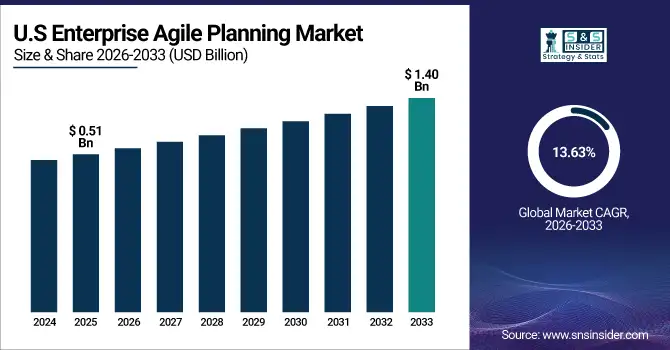

The U.S Enterprise Agile Planning Market size reached USD 0.51 billion in 2024 and is expected to reach USD 1.40 billion in 2032 at a CAGR of 13.63% from 2025 to 2032.

The U.S is a major contributor to creating the demand for Agile and DevOps software in the market, due to its stable development of IT infrastructure, early adoption of Agile methodologies, and solid presence of technology-driven enterprises. The increased focus on digital transformation initiatives and the need to accelerate product development cycles only adds to the demand. The acceleration of remote and hybrid work models has also fueled the acceptance of Cloud-based Agile planning solutions. Top movers for improvement are collaboration, real-time project tracking, and the integration of DevOps and other enterprise systems.

Enterprise Agile Planning Market Drivers:

-

Growing Demand for Enhanced Collaboration and Real-Time Project Visibility Drives Agile Planning Adoption Across Enterprises.

The need for better collaboration and real-time visibility of projects is a major trend that is driving enterprises to adopt Agile planning solutions. Organizations are trying to achieve effective communication across cross-functional teams, breaking down departmental silos, and increased transparency of project progress. This allows for faster decision-making and greater responsiveness to changing business needs. Moreover, as remote and hybrid work models have become prevalent, so too has the demand for centralized, real-time insights available wherever your data lives. However, recent trends suggest growing integration of AI and machine learning into the Agile planning platform to offer solutions to predictive analysis, automated reporting, and resource allocation, which injects power into collaboration and operations.

Enterprise Agile Planning Market Restraints:

-

Organizational Resistance to Change and Traditional Mindsets Hinder Agile Planning Implementation in Enterprises.

Organizational change resistance is the first restraint to the wide adoption of Agile planning methodologies. For many enterprises, this shift is made difficult by deeply entrenched cultural mindsets, hierarchical structures, and the mobile nature of the core projects of these global behemoths, all of which combine to create an unwillingness to alter legacy project management processes. This resistance typically leads to extended adoption cycles and misuse of Agile tools. Likewise, poor training and change management make matters worse, preventing Agile from reaching its full potential. Existing literature shows that to overcome these cultural challenges, visible leadership commitment, organization-wide training, and stepwise change management strategies are needed to implement Agile practices successfully at scale in an enterprise.

Enterprise Agile Planning Market Opportunities:

-

Increasing Integration of Artificial Intelligence and Machine Learning Technologies Offers Significant Growth Opportunities.

Integration of AI & ML with Agile planning solution is a significant opportunity for the overall market. With these technologies, the organizations are capable of using predictive analytics for sprint predictions, sprint risk, and resource prediction, thus resulting in enhanced project quality. Powerful automated task prioritization and intelligent reporting features minimize the manual effort required and increase productivity. To align with this trend, vendors are innovating to integrate AI/ML capabilities, setting themselves up with differentiated solutions for complex project management requirements and establishing their unique positioning in this changing market landscape.

Enterprise Agile Planning Market Challenges:

-

Complexities in Scaling Agile Practices Across Large Enterprises Pose Significant Challenges.

Scaling Agile practices across large, complex enterprise environments continues to be a key challenge. In contrast to small teams, where the decision-making is limited to the context of the team, the structures, business units, and outcomes are complex for larger organizations, making it difficult to adopt Agile uniformly with the needs of multiple stakeholders. The key hurdles lie in bringing alignment among different departments, integrating Agile with existing legacy systems, and maintaining consistency of practices. Current research claims that without an articulated scaling strategy paired with genuine executive sponsorship, organizations run a high risk of siloed Agile implementations that do not confer the desired organization-wide benefits.

Enterprise Agile Planning Market Segmentation Analysis

By Types: On-Premise Dominates Revenue; Cloud-Based Solutions Exhibit Rapid Growth

In 2025, the On-premise segment held the largest revenue share at 56.19% and is expected to show a similar trend in the future, owing to enterprises emphasizing data security, control, and compliance. Mature vendors such as CA Technologies and Microsoft have launched enhanced on-premise Agile planning suites with new security measures and better integration. The industries with strict regulations, namely finance and healthcare, are driving the segment because they tend to opt for on-premise deployments to protect sensitive data.

The Cloud-based segment is anticipated to be the fastest growing at a healthy CAGR of 41.73%, owing to the increasing requirement for scalable, flexible, and accessible Agile planning solutions, positively affecting the segment growth. enterprise agile planning market companies, such as Smartsheet and Asana, have introduced cloud-native Agile planning platforms that focus on enabling seamless collaboration, automation, and real-time updates with built-in AI. Few enterprises struggle to find a reason to adopt the cloud since the cloud is easy to deploy and comes with a lower upfront cost, which appeals to all forms of enterprises that desire the benefits of agility, but are not willing to incur extensive IT overhead.

By Application: Large Enterprises Lead Revenue Share While SMEs Drive Fastest Growth

The Large Enterprises segment holds the largest revenue share of 22.40% in 2025, supported on the basis of the high requirements for comprehensive, scalable Agile planning solutions for complex end-to-end project portfolios. Enterprise-ready Agile planning tools have been recently introduced by major companies, including Atlassian and IBM, which include capabilities like advanced analytics and coordination across multiple teams. These initiatives are in line with demand from large enterprises for single platforms that can integrate writing workflow and compliance. Its steady growth highlights enterprises' focus on accelerating digital transformation and operational efficiency, driving the Enterprise Agile Planning Market forward.

The Small and Medium Enterprises (SMEs) are expected to grow at a CAGR of 41.83% as a result of the growing penetration of low-cost and easily deployable Agile planning solutions. Startups like Monday. Light, elastic on on-demand products aimed towards startups were launched by competitors like Command and JIRA. These offerings allow SMEs to boost collaboration, improve the speed of delivery cycles, and increase competitiveness. This surge in adoption also highlights the increasing recognition of Agile advantages amongst the SMEs and makes this segment a key growth contributor to the Agile Planning Market throughout the forecast period.

Enterprise Agile Planning Market Regional Insights:

North America Dominates Enterprise Agile Planning Market in 2025

In 2025, North America commands an estimated 40.19% share of the Enterprise Agile Planning Market, driven by advanced IT infrastructure, high adoption of Agile methodologies, and the presence of major technology companies. Significant investments in digital transformation and innovation are creating strong demand for scalable enterprise Agile planning tools across industries.

The United States dominates North America’s EAP Market due to its large technology sector, early Agile adoption, and substantial investments in cloud-based and AI-powered Agile planning solutions. U.S. enterprises continue to focus on enhancing project efficiency and operational agility, further reinforcing the region’s market leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe Enterprise Agile Planning Market Insights, 2025

Europe holds a significant portion of the EAP market, fueled by rising digitalization and regulatory compliance requirements, alongside strong adoption of agile project management processes across key industries such as automotive, finance, and manufacturing.

Germany leads Europe’s EAP market due to its large industrial base and early adoption of Agile frameworks, delivering high efficiency and innovation at the project level. European enterprises increasingly integrate Agile planning tools to optimize project portfolios and drive operational excellence.

Asia Pacific is the Fastest-Growing Region in Enterprise Agile Planning Market

Asia Pacific is projected to grow at a CAGR of 15.97% in 2025, driven by digitization initiatives, broadening IT offerings, and increasing SME adoption. Government support for technology modernization and growing cloud adoption across sectors further accelerate market growth.

China tops the Asia Pacific EAP market, supported by a large enterprise base, rapid growth of tech startups, and active investments in digital transformation and Agile planning solutions.

Middle East & Africa and Latin America Enterprise Agile Planning Market Insights, 2025

The Middle East & Africa and Latin America markets are rapidly growing, supported by rising Agile adoption in sectors such as finance, telecommunications, and retail, along with IT infrastructure investments, cloud service deployments, and government initiatives. The UAE and Brazil are emerging as key contributors, driving adoption of enterprise Agile planning tools to enhance operational efficiency and project governance.

Key Players in the Enterprise Agile Planning Market:

-

Atlassian Corporation Plc

-

Microsoft Corporation

-

Planview, Inc.

-

Broadcom Inc. (Rally Software)

-

VersionOne (CollabNet/Digital.ai)

-

Targetprocess

-

Smartsheet Inc.

-

ServiceNow, Inc.

-

Asana, Inc.

-

Wrike, Inc.

-

Monday.com Ltd.

-

Zoho Corporation (Zoho Sprints)

-

ClickUp

-

Micro Focus International plc

-

IBM

-

AgileCraft (Jira Align)

-

QuickBase

-

Miro

-

Kanbanize

-

Aha!

Competitive Landscape for the Enterprise Agile Planning Market:

Atlassian Corporation Plc

Atlassian Corporation Plc is a global leader in enterprise software and agile planning solutions, known for Jira, Jira Align, and Trello. The company specializes in workflow management, project portfolio planning, and scaled Agile frameworks. With years of experience, Atlassian provides tools that enhance team collaboration, streamline project execution, and improve visibility across complex portfolios. Its role in the Enterprise Agile Planning Market is critical, as it enables organizations to accelerate digital transformation, improve delivery speed, and maintain operational agility.

-

In 2025, Atlassian expanded Jira Align capabilities with AI-driven analytics and enhanced integration across cloud and on-premise platforms, supporting enterprises in scaling Agile initiatives across multiple teams and departments.

Microsoft Corporation

Microsoft Corporation is a U.S.-based technology giant offering Agile planning solutions through Azure DevOps, Project for the web, and other integrated tools. Microsoft enables enterprises to manage complex project portfolios, track progress in real-time, and optimize resource allocation. Its role in the Enterprise Agile Planning Market is significant, providing robust, enterprise-ready tools that support both small teams and large-scale digital transformations.

-

In 2025, Microsoft introduced new AI-powered features in Azure DevOps, including predictive project analytics, cross-team dependency tracking, and cloud-based collaboration enhancements to improve Agile planning efficiency.

Planview, Inc.

Planview, Inc. is a U.S.-based provider of enterprise portfolio management and Agile planning solutions. The company focuses on project portfolio optimization, resource management, and Agile adoption at scale. Planview helps organizations align strategy with execution, manage multi-team workflows, and achieve operational efficiency. Its role in the Enterprise Agile Planning Market is pivotal, enabling enterprises to streamline complex project management and maximize ROI on digital initiatives.

-

In 2025, Planview launched enhanced Agile planning modules with real-time dashboards, AI-assisted resource forecasting, and integration with popular collaboration tools to support enterprise-wide agility.

Broadcom Inc. (Rally Software)

Broadcom Inc., through its Rally Software division, is a leader in enterprise Agile planning and scaled Agile solutions. The company provides tools for portfolio management, program tracking, and team-level Agile execution. Broadcom’s role in the Enterprise Agile Planning Market is central, as it supports large enterprises in orchestrating multiple Agile teams, improving transparency, and accelerating project delivery.

-

In 2025, Rally Software introduced AI-enabled roadmapping and predictive analytics features, helping organizations optimize program execution and enhance cross-team collaboration for complex enterprise initiatives.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.58 Billion |

| Market Size by 2033 | USD 4.69 Billion |

| CAGR | CAGR of 14.58% From 2025 to 2032 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

Atlassian Corporation Plc, Microsoft Corporation, Planview, Inc., Broadcom Inc. (Rally Software), VersionOne (CollabNet/Digital.ai), Targetprocess, Smartsheet Inc., ServiceNow, Inc., Asana, Inc., Wrike, Inc., Monday.com Ltd., Zoho Corporation (Zoho Sprints), ClickUp, Micro Focus International plc, IBM, AgileCraft (Jira Align), QuickBase, Miro, Kanbanize, Aha!. |