Smart Parcel Locker Market Report Scope & Overview:

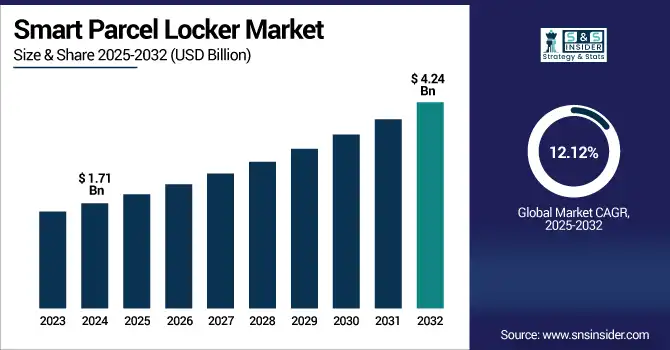

Smart Parcel Locker Market was valued at USD 1.71 billion in 2024 and is expected to reach USD 4.24 billion by 2032, growing at a CAGR of 12.12% from 2025-2032.

To Get more information on Smart Parcel Locker Market - Request Free Sample Report

The growth of the Smart Parcel Locker Market is driven by rising e-commerce volumes, last-mile delivery challenges, and the growing need for secure, contactless, and efficient parcel delivery solutions.

-

In 2023, U.S. e-commerce sales reached USD 1.12 trillion, marking a 7.6% increase over 2022, according to the U.S. Census Bureau. To address delivery inefficiencies, particularly in multifamily housing, the United States Postal Service (USPS) has installed over 300,000 parcel lockers nationwide by 2023.

Consumers increasingly prefer automated locker systems for their 24/7 accessibility, which reduces missed deliveries and wait times.

-

Amazon have deployed thousands of Amazon Hub Lockers across the U.S., U.K., and other countries, placing them in retail outlets, apartment lobbies, and public transit hubs.

These systems improve delivery efficiency, reduce operational costs, and optimize space utilization. Technological advancements such as IoT integration, RFID tracking, mobile access, and cloud-based management further enhance locker functionality and user experience. Increased adoption across residential complexes, retail BOPIS setups, offices, and universities continues to drive market expansion.

U.S. Smart Parcel Locker Market was valued at USD 0.41 billion in 2024 and is expected to reach USD 0.99 billion by 2032, growing at a CAGR of 11.72% from 2025-2032.

The U.S. Smart Parcel Locker Market is growing due to rising e-commerce demand, increased adoption of contactless delivery, enhanced last-mile logistics, and greater use in residential, retail, and corporate settings, driven by convenience, security, and operational efficiency improvements.

Smart Parcel Locker Market Dynamics

Drivers

-

Rising e-commerce demand and last-mile delivery complexities are pushing retailers to adopt smart parcel lockers at scale.

With the explosive growth of e-commerce, traditional delivery methods face rising inefficiencies, missed deliveries, and customer dissatisfaction. Smart parcel lockers offer a scalable solution that addresses last-mile challenges, reduces delivery times, and enhances consumer convenience by enabling 24/7 package access. Their ability to reduce logistics costs and carbon footprint further incentivizes adoption by retailers and logistics providers. Additionally, lockers are increasingly integrated with mobile and IoT platforms, making them seamless to use. As urbanization and online shopping converge, the demand for automated delivery infrastructure like smart lockers continues to grow rapidly.

-

InPost, operating across Europe, emphasizes that smart lockers can cut CO₂ emissions by up to 75% per delivery compared to home delivery.

-

Additionally, companies like TZ Limited and Quadient integrate mobile apps and IoT platforms into their locker systems to enable real-time notifications, remote access, and usage analytics, supporting smarter, more efficient last-mile operations.

Restraints

-

Lack of standardization and interoperability limits network scalability and cross-platform logistics integration.

As the smart locker ecosystem expands, fragmentation in hardware designs, software protocols, and authentication systems creates operational silos. Carriers and retailers must often work with proprietary platforms that are not compatible across vendors, reducing the efficiency of shared logistics infrastructure. This lack of standardization hinders broader integration into national delivery grids and makes multi-carrier cooperation difficult. Furthermore, frequent software updates and evolving security protocols can create maintenance burdens. Until industry-wide standards emerge for interoperability, scalability remains restricted, undermining the seamless user experience and efficiency gains that smart lockers aim to deliver.

-

The European Commission, in its assessment of the Cross-border Parcel Delivery Regulation, identified the lack of interoperability and standardization in parcel lockers as a major barrier to achieving efficient cross-border e-commerce logistics under the Digital Single Market initiative.

-

Similarly, Australia Post, in a 2022 update, acknowledged that non-standardized lockers across different providers create service silos, preventing multiple carriers from accessing shared infrastructure especially in densely populated urban areas.

Opportunities

-

Integration with AI, mobile apps, and cloud analytics enhances locker intelligence and creates value-added logistics services.

Smart parcel lockers are evolving beyond simple storage to become connected nodes in the digital logistics network. Integration with AI and cloud platforms enables predictive analytics for delivery patterns, real-time monitoring, and dynamic rerouting. Mobile apps facilitate user authentication, remote access, and time-slot booking, improving convenience and reducing congestion. Locker data can also inform supply chain decisions, optimize delivery fleets, and support sustainability tracking. As demand grows for data-driven, intelligent delivery ecosystems, smart lockers embedded with advanced technologies offer platforms for innovation and service differentiation in both urban and suburban markets.

- Quadient, a leading smart locker manufacturer, reports that its Parcel Pending lockers integrate with AI-enabled cloud platforms to provide predictive analytics, remote diagnostics, and live system status updates.

- The systems also deliver a mobile-first experience with app-based QR code access, real-time notifications, and automated locker assignment, enhancing convenience and operational efficiency.

Challenges

-

Vandalism, security breaches, and technical malfunctions threaten consumer trust and operational continuity.

Smart parcel lockers store valuable goods in unattended locations, making them vulnerable to theft, tampering, and vandalism. Malicious actors may exploit software vulnerabilities or physical access points, leading to breaches of customer data or loss of goods. Hardware faults, power outages, and network disruptions can also halt operations or lock users out. Such incidents erode consumer confidence and can lead to liability issues for service providers. To mitigate these risks, companies must invest in advanced surveillance, multi-layered authentication, and robust failover systems, all of which add to operational complexity and cost.

Smart Parcel Locker Market Segmentation Analysis

By Component

The hardware segment dominated the Smart Parcel Locker Market with the highest revenue share of about 69% in 2024 due to the significant demand for locker cabinets, control panels, and integrated hardware systems necessary for physical parcel storage. The need for robust, secure, and scalable infrastructure across high-traffic locations such as malls, offices, and campuses continues to drive substantial investments in physical locker deployment and manufacturing capabilities.

The software segment is expected to grow at the fastest CAGR of about 13.08% from 2025–2032 due to rising demand for real-time tracking, mobile app integration, cloud-based management, and analytics capabilities. As locker networks scale, operators require advanced software for secure access control, system monitoring, remote diagnostics, and dynamic route optimization, which fuels continued innovation and higher spending on digital locker ecosystems.

By Deployment Type

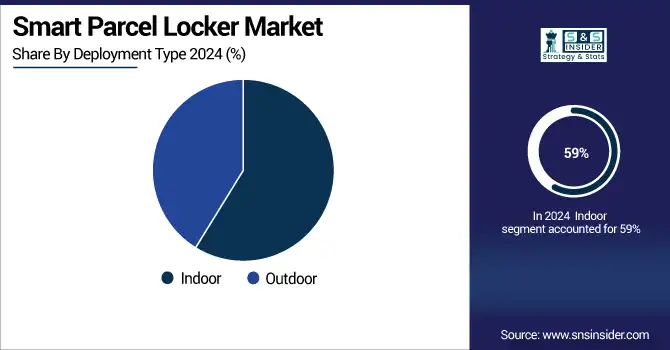

The indoor segment dominated the Smart Parcel Locker Market with the highest revenue share of about 59% in 2024 due to higher installation in shopping malls, corporate buildings, apartments, and retail stores where environmental control, safety, and space utilization are prioritized. Indoor lockers also have lower maintenance costs, experience less wear from weather conditions, and are preferred for high-frequency consumer interaction in urban delivery systems.

The outdoor segment is expected to grow at the fastest CAGR of about 13.15% from 2025–2032 driven by expanding delivery needs in public areas, transportation hubs, and suburban communities. These lockers enable 24/7 access and reduce last-mile inefficiencies in regions without dense retail or residential infrastructure, making them ideal for enhancing logistics outreach in underserved or high-volume outdoor delivery locations.

By Application

The Retail BOPIS segment dominated the Smart Parcel Locker Market with the highest revenue share of about 28% in 2024 as omnichannel retail strategies continue to gain traction. Retailers use lockers to streamline Buy Online, Pick Up In-Store (BOPIS) operations, reduce in-store congestion, and meet consumer demand for fast, contactless pickup, especially during peak seasons and promotional events across large retail chains and department stores.

The residential segment is expected to grow at the fastest CAGR of about 13.99% from 2025–2032 due to rising urbanization, apartment living, and increased e-commerce penetration. Property managers and developers are investing in smart lockers to address package theft, limited concierge staff, and secure unattended deliveries, making them a value-added amenity in multi-family housing complexes and gated residential communities.

By Technology

The electronics segment dominated the Smart Parcel Locker Market with the highest revenue share of about 35% in 2024 due to widespread use of sensors, barcode/RFID scanners, and secure access terminals that enable automated operations. Continuous hardware upgrades, integration of surveillance cameras, and user interfaces further add to electronic system costs, making it the most capital-intensive yet essential segment of smart locker systems.

The cloud-based segment is expected to grow at the fastest CAGR of about 15.87% from 2025–2032 driven by demand for remote locker management, scalable deployment, and data analytics. Cloud platforms enable real-time access control, fleet coordination, and service personalization, making them ideal for large-scale operators seeking flexibility, centralized monitoring, and lower IT overheads in managing distributed locker networks.

By Type

The modular parcel lockers segment dominated the Smart Parcel Locker Market with the highest revenue share of about 55% in 2024 due to their customizable design, ease of expansion, and adaptability to various industries and locations. Logistics providers, retailers, and universities prefer modular systems for their scalability, standardized installation processes, and ability to accommodate variable parcel volumes and sizes efficiently.

The cooling lockers for fresh food segment is expected to grow at the fastest CAGR of about 15.09% from 2025–2032 owing to rising demand for temperature-controlled last-mile delivery solutions. Online grocery shopping, meal kit services, and food retailers are integrating refrigerated lockers to maintain cold chains, reduce spoilage, and enable convenient, contactless pickup of perishable goods in both urban and suburban settings.

Smart Parcel Locker Market Regional Outlook

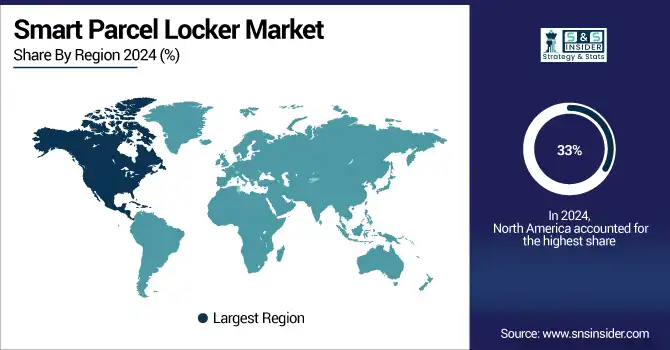

North America dominated the Smart Parcel Locker Market with the highest revenue share of about 33% in 2024 due to the region’s well-established e-commerce infrastructure, strong BOPIS adoption by major retailers, and high consumer demand for secure, contactless delivery solutions. Significant investments in smart city logistics, coupled with the presence of key market players and advanced digital ecosystems, have further accelerated widespread locker deployment across urban and suburban areas.

The United States is dominating the Smart Parcel Locker Market in North America due to its advanced e-commerce ecosystem and large-scale retail deployment.

Asia Pacific is expected to grow at the fastest CAGR of about 14.25% from 2025–2032 driven by rapid urbanization, booming online retail, and growing middle-class populations in countries like China, India, and Southeast Asia. Government-backed smart city initiatives, high smartphone penetration, and increasing demand for convenient last-mile delivery options are encouraging the expansion of smart locker networks across residential, retail, and transportation hubs in the region.

China is dominating the Smart Parcel Locker Market in Asia Pacific due to its massive e-commerce growth, dense urban population, and rapid smart logistics deployment.

Europe is a significant market in the Smart Parcel Locker industry, driven by increasing e-commerce penetration, growing demand for contactless deliveries, and strong emphasis on sustainability. Advancements in urban logistics and widespread adoption of automated solutions further support market growth.

Germany is dominating the Smart Parcel Locker Market in Europe due to its strong logistics infrastructure, high parcel volumes, and widespread adoption of automated delivery solutions.

Middle East & Africa and Latin America are emerging markets in the Smart Parcel Locker industry, supported by expanding urbanization, growing e-commerce activity, and increasing investments in logistics infrastructure, though adoption remains limited due to economic and connectivity constraints.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Smart Parcel Locker Market companies are Ricoh Group, Pitney Bowes Inc., ASSA ABLOY, Quadient (owns Parcel Pending LLC), Gibraltar Industries, Hollman Inc., Bell and Howell, LLC, Cleveron, InPost SA, Parcel Pending LLC, Smartbox USA Inc., Gantner, Meridian Kiosks, LUXER Corporation, eLocker Ltd., TZ Limited, Patterson Pope, DeBourgh, KEBA, RENOME.

Recent Developments:

-

In January 2025, Quadient partnered with ScotRail to deploy smart parcel lockers across Scotland’s rail network, offering commuters 24/7 secure, contactless drop-off and pick-up services

-

In July 2025, InPost S.A. finalized the acquisition of Spain’s courier & fulfilment provider Sending, strengthening its parcel locker logistics network in the Iberian Peninsula.

-

In September 2024, Pitney Bowes released the ParcelPoint Smart Lockers User Guide detailing accessible, audio‑assisted parcel pick‑up/drop‑off features.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.71 Billion |

| Market Size by 2032 | USD 4.24 Billion |

| CAGR | CAGR of 12.12% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software) • By Deployment Type (Indoor, Outdoor) • By Type (Modular Parcel Lockers, Postal Lockers, Cooling Lockers for Fresh Food, Laundry Lockers) • By Application (Commercial/Corporate Offices, Residential, Retail BOPIS, Government & Municipal Buildings, Universities and Colleges, Others) • By Technology (Radio Frequency Identification (RFID), Electronics, Mobile, Biometric, Cloud-Based) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Ricoh Group, Pitney Bowes Inc., ASSA ABLOY, Quadient (owns Parcel Pending LLC), Gibraltar Industries, Hollman Inc., Bell and Howell, LLC, Cleveron, InPost SA, Parcel Pending LLC, Smartbox USA Inc., Gantner, Meridian Kiosks, LUXER Corporation, eLocker Ltd., TZ Limited, Patterson Pope, DeBourgh, KEBA, RENOME |