Erosion and Sediment Control Market Report Scope & Overview:

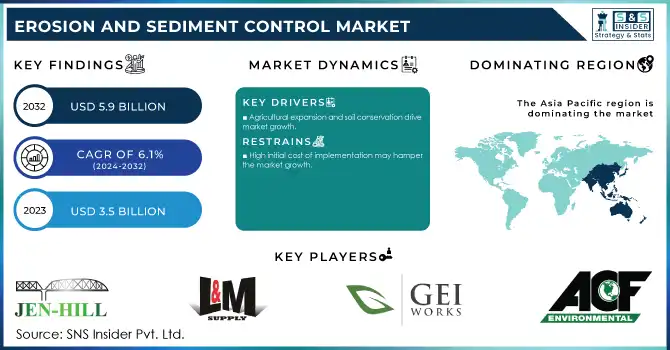

The Erosion and Sediment Control Market size was USD 3.5 billion in 2023 and is expected to reach USD 5.9 billion by 2032 and grow at a CAGR of 6.1% over the forecast period of 2024-2032.

To get more information on Erosion and Sediment Control Market - Request Free Sample Report

The increased adoption of vegetative erosion control solutions is a significant trend in the Erosion and Sediment Control (ESC) market, driven by their eco-friendly, sustainable, and cost-effective nature. As opposed to mechanical solutions, vegetation-based approaches can restore natural habitats, improve water quality, and enhance biodiversity. Also, they are usually easier to maintain and adapt to environmental changes. As more and more people are conscious of the benefits that environmental sustainability can bring and the need for greener practices, these solutions are fast becoming the default method of controlling erosion, especially in sensitive areas like agricultural fields, construction sites, and areas with the potential for flooding. This is likely to drive the vegetative erosion control products market over the coming years.

The EPA has set specific guidelines under the Clean Water Act to control soil erosion and sedimentation from construction sites. According to the EPA, nearly 70% of water pollution in the U.S. is attributed to sedimentation, often due to erosion.

The growth of the Erosion and Sediment Control (ESC) market, is primarily driven by construction and infrastructure development, as the land must be cleared and landforms altered for large-scale construction projects, increasing soil erosion and sediment runoff. As urbanization and infrastructure expansion continue notably in emerging economies so grows the demand for effective erosion control solutions. Road building, along with housing, and other construction is a big concern in rapidly developing areas of Asia, and Latin America, as it can kick up massive soil disturbances. If the disbursement is not managed, it will lead to sedimentation in the nearby water bodies, in turn affecting the water quality and the aquatic ecosystem. The rising number of developmental projects guided by construction companies to adhere to environmental regulation and control their environmental effect is resulting in the increasing demand for erosion and sediment control solutions, which in turn is positively impacting the growth of the erosion and sediment control market. Besides, increasing attention towards green or sustainable building practices which include options like low impact development (LID) and stormwater management is propelling the demand for ESC products in the construction sector.

The EPA’s National Pollutant Discharge Elimination System (NPDES) program regulates stormwater discharges from construction sites, requiring developers to implement effective erosion and sediment control measures. In 2021, over 100,000 construction sites in the U.S. were subject to these regulations, emphasizing the growing demand for ESC solutions.

Erosion and Sediment Control Market Dynamics:

Drivers

-

Agricultural expansion and soil conservation drive market growth.

Soil conservation and agricultural expansion are the prominent drivers towards the growth of the Erosion and Sediment Control (ESC) market, as the agricultural sector continues to face soil erosion and degradation. Increasing food demand worldwide and the conversion of new agricultural areas (especially in developing countries) means greater land disturbance and therefore, if not properly managed, higher rates of soil erosion. This loss can deplete soil nutrients, increase sediment in waterways, and ultimately lower crop yields. Today, governments and organizations across the world have realized that soil conservation is important especially soil erosion-prone areas, encouraging soil conservation through sustainable farming. As a result, the agriculture sector is looking to ESC approaches, including contour farming, cover crops, and vegetative barriers, to reinforce the soil and forestall erosion. Moreover, organizations such as the U.S. Natural Resources Conservation Service (NRCS) as well as the Food and Agriculture Organization (FAO) are also promoting programs that advocate practices that promote soil strength and soil conservation practices because they support soil health and achieve agricultural productivity. Such initiatives have helped promote the use of ESC products including but not limited to geotextiles, mulches, and other erosion-control materials that have become integral to modern agricultural practices. This will be further aided by the evolving environmental policies and the need for better soil conservation methods, yielding a larger market for erosion and sediment control over the forecast period as the demand for sustainable agricultural solutions is fueling.

Restraint

-

High initial cost of implementation may hamper the market growth.

High initial implementation cost high upfront investment cost required for certain erosion control solutions can be a major restraint in the Erosion and Sediment Control (ESC) market, especially for smaller construction companies, farmers and businesses in developing regions. Many erosion control techniques, like geotextiles, sediment control barriers, hydroseeding, and erosion control blankets, involve significant material and labor costs. This can make things very difficult for those companies operating with a string budget or limited manpower. Besides, some new ESC technologies and items might also require regular upkeep expenditure which would keep piling the overall cost burden on the owner. On a more micro scale, these costs may deem as too great for some not-so-large projects or operations, resulting in delays in utilizing an effective erosion control measure to avoid a larger problem in the future.

Erosion and Sediment Control Market Segmentation Analysis

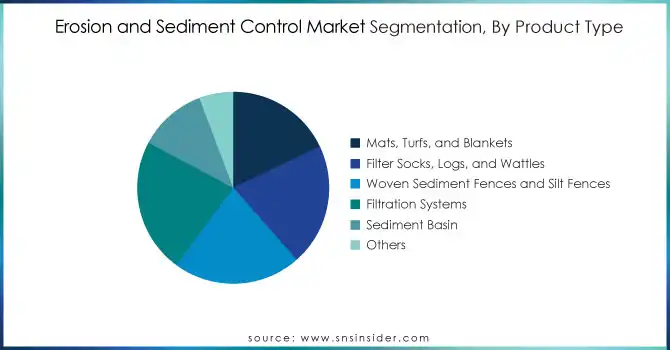

By Product Type

Mats, turfs, and blankets fastest growing segment at a highest CAGR of 6.51% in 2023. It is due to their easy installation and versatility over a wide range of application areas. These products, especially for erosion control mats (ECMs) and turf reinforcement mats (TRMs), are commonly used for soil and erosion control in construction, agriculture, and land reclamation. Mats, turfs, and blankets are also popular, as they can be used to create instant ground cover, shielding the soil from wind and water erosion, fostering vegetation establishment. Usually applied to lands with high erosion and sediment risk areas, like slopes, highway, and disturbed land. Also, they are not as complex as other erosion control solutions when it comes to installation and maintenance. Their customization for specific soils and environmental conditions drives their use in different industries.

By End-User Industry

Highway and road construction held the largest market share around 29.62% in 2023. These types of construction have considerable environmental repercussions on soil stability and water quality. Land disturbances associated with large-scale road and highway construction can contribute to erosion and sedimentation to surface waters. As such, proper erosion and sediment control is essential to maintaining environmental compliance and to protecting the land from degradation. With government and regulatory agencies imposing stringent environmental standards to safeguard water resources, construction firms must deploy ESC solutions including sediment barriers, silt fences, and erosion control blankets to minimize these risks

Erosion and Sediment Control Market Regional Outlook

Asia Pacific held the largest market share around 42.40% in 2023. Due to rapid industrialization, urbanization, and infrastructure development in several countries, the Erosion and Sediment Control (ESC) market has the largest market share of Asia-Pacific region. Rapid development in construction and agriculture, specifically in countries that are a part of China, India, Japan, and Southeast Asian countries, will necessitate the demand for proper erosion control products in the region. Highways, railways, and urban development have created huge land disturbance; agricultural development to meet the increasing food demand has also caused greater soil disturbance and put them at higher risks of erosion and sedimentation. To minimize damage from the adverse environmental effects of these activities, regional governments have built up rigorous environmental regulations and sustainability policies, thereby bolstering the demand for ESC products. Besides, the countries in Asia-Pacific are investing significantly in sustainable development and green building practices, which focus on erosion control techniques to preserve the environment. Another contributing factor to the region's dominance is the availability of affordable ESC solutions and increased awareness of the environmental impacts of erosion. Consequently, the Asia-Pacific market is projected to exhibit the highest growth where the demand for erosion and sediment control products continues to mount due to investments from the public as well as private sector.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

Triton Environmental (Silt Fence, Erosion Control Mat)

-

ACF Environmental (Silt Fence, Erosion Control Blankets)

-

Silt Management Supplies (Sediment Control Tubes, Erosion Control Products)

-

Construction Eco Services (Silt Fence, Erosion Control Blankets)

-

Geosolutions, Inc. (Turf Reinforcement Mats, Geotextiles)

-

GEI Works (Silt Fence, Erosion Control Products)

-

SMI Companies (Sediment Barriers, Erosion Control Mats)

-

L & M Supply (Sediment Control Products, Erosion Control Blankets)

-

Aussie Erosion Pty Ltd (Erosion Control Blankets, Sediment Control Products)

-

Jen-Hill Construction Materials (Silt Fencing, Erosion Control Matting)

-

Royal Environmental (Erosion Control Blankets, Turf Reinforcement Mats)

-

North American Green (Turf Reinforcement Mats, Erosion Control Blankets)

-

TenCate Geosynthetics (Geotextiles, Erosion Control Blankets)

-

Curlex (Erosion Control Blankets, Silt Fencing)

-

EnviroSeal (Sediment Control Logs, Silt Fence)

-

Rantec Corporation (Erosion Control Blankets, Sediment Control Barriers)

-

Propex GeoSolutions (Geotextiles, Erosion Control Blankets)

-

Keymark Enterprises (Sediment Control Products, Erosion Control Matting)

-

Erosion Control Products, Inc. (Silt Fence, Straw Wattles)

-

Acme Environmental (Silt Fence, Erosion Control Mats)

Recent Development:

-

In 2023: Triton Environmental launched an innovative biodegradable silt fence product aimed at reducing environmental impact, aligning with increasing demand for sustainable solutions in the ESC market.

-

In 2023: Silt Management Supplies introduced an advanced sediment control tube that improves filtration and reduces maintenance costs, designed for use in construction, mining, and infrastructure projects.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.5 Billion |

| Market Size by 2032 | USD 5.9 Billion |

| CAGR | CAGR of 6.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By product type ( Mats, Turfs, and Blankets, Filter Socks, Logs, and Wattles, Woven Sediment Fences and Silt Fences, Filtration Systems, Sediment Basin, Others) • By end-user industry ( Highway and Road Construction, Energy and Mining, Government and Municipality, Landfill Construction and Maintenance, Infrastructure Development, Industrial Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Triton Environmental, ACF Environmental, Silt Management Supplies, Construction Eco services, Geosolutions, Inc (US)., GEI Works (US), SMI Companies, L & M Supply (US), Aussie Erosion Pty Ltd (Australia), Jen-Hill Construction Materials |

| Key Drivers | • Agricultural expansion and soil conservation drive market growth. |

| Restraints | • High initial cost of implementation may hamper the market growth. |