US Stormwater Management Market Report Scope and Overview:

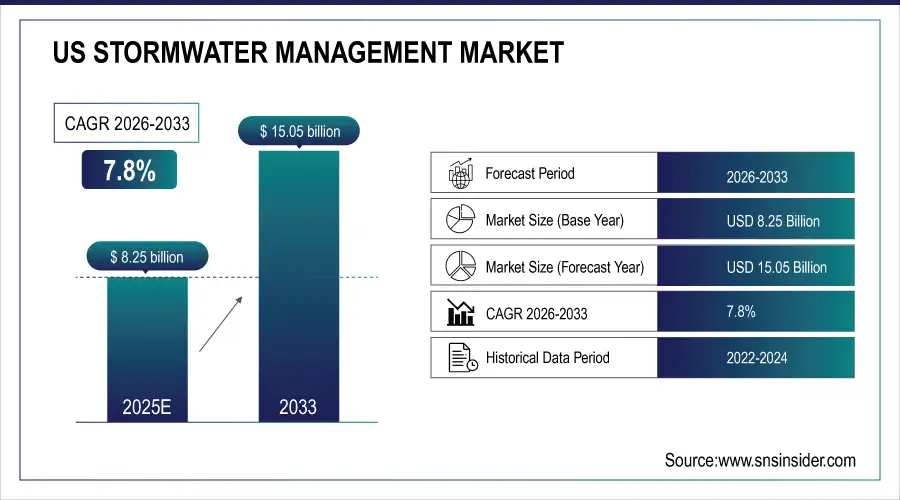

The United States Stormwater Management Market Size was USD 8.25 billion in 2025E and is projected to grow at a CAGR of 7.8% to reach USD 15.05 billion by 2033. The environmental impact of stormwater runoff can be valuable for the U.S. stormwater management market. For instance, Research shows that over 70% of U.S. cities are struggling with aging infrastructure, driving demand for modern stormwater systems. Furthermore, increasing public awareness of water conservation and environmental sustainability has led to a rise in green infrastructure projects. Data on the adoption rates of innovative solutions, such as permeable pavements and bioretention systems, further demonstrate the evolving market dynamics.

US Stormwater Management Market Size and Forecast:

-

Market Size in 2025E: USD 8.25 Billion

-

Market Size by 2033: USD 15.05 Billion

-

CAGR: 7.8% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on United States Stormwater Management Market - Request Free Sample Report

US Stormwater Management Market Highlights:

-

Rising demand for green and eco-friendly stormwater solutions such as rain gardens, permeable pavements, and green roofs is driving market growth.

-

Growing sustainability initiatives in urban planning are encouraging municipalities to adopt nature-based stormwater systems.

-

High upfront installation costs of advanced systems such as underground chambers and filtration units limit adoption, especially for small or budget-restricted municipalities.

-

Preference for traditional and low-cost solutions slows the market penetration of innovative, high-performance stormwater technologies.

-

Increasing government regulations, environmental policies, and infrastructure funding are creating strong opportunities for product innovation and market expansion.

-

Incentives for sustainable urban drainage and real-time monitoring technologies are expected to support future growth in the U.S. stormwater management market.

US Stormwater Management Market Drivers:

-

Growing Demand for Eco-Friendly Solutions and Green Infrastructure Practices Enhances the U.S. Stormwater Management Market Growth

The increasing push for sustainability in urban planning and construction has driven the demand for eco-friendly stormwater management solutions. Green infrastructure includes rain gardens, permeable pavements, and green roofs that manage stormwater with sensitivity to the environment, reducing pollution and improving water quality. These are gaining momentum across the U.S. as municipalities seek ways to meet environmental regulations and provide more resilient infrastructure. A growing awareness of the benefits that come from better integration of nature-based systems is widening the market and encouraging innovation in the range of products available for stormwater management.

US Stormwater Management Market Restraints:

-

High Initial Installation Costs of Advanced Stormwater Management Systems Hinder Widespread Adoption in the U.S. Market

One of the primary challenges limiting the widespread adoption of advanced stormwater management systems is the high initial installation cost. Advanced technologies deal with stormwater retention systems, underground chambers, and other developed filtration solutions, which are pretty capital-intensive; hence, participation is always limited by small municipalities or those on a tight budget. While these solutions ensure long-term benefits, both environmentally and economically, the initial capital cost holds them back so big. Most organizations use either traditional systems or cheaper options, hampering the full potential of the market and development opportunities for more advanced technologies.

US Stormwater Management Market Opportunities:

-

Expanding Government Regulations and Environmental Policies Open Doors for Innovation and Growth in U.S. Stormwater Management Market

The U.S. government's increasing emphasis on environmental regulations and stormwater management policies presents significant growth opportunities for the industry. Excerpts of particular relevance to flood concerns, water pollution, and climate change show that federal and local authorities continue to tighten their stormwater management regulations, while encouraging the consideration of advanced technologies. This encourages opportunities for those firms offering different solutions for stormwater, such as sustainable urban drainage systems and real-time water quality monitoring technologies. An increase in investments in infrastructure and incentives being given for the use of eco-friendly solutions would definitely boost up market growth over the next years

US Stormwater Management Market Segment Analysis:

By Service Type

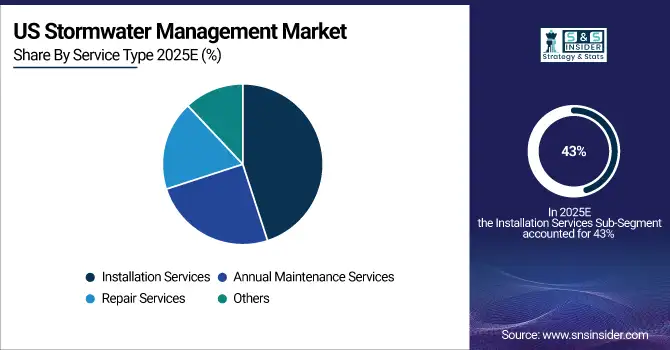

In 2024, the Installation Services segment accounted for the largest share of the U.S. stormwater management market, contributing approximately 43% of the total revenue. The demand for installation services has surged due to the increasing focus on urban development, infrastructure renewal, and the need to comply with environmental regulations.

Key players such as Advanced Drainage Systems Inc. (ADS) and Contech Engineered Solutions have developed innovative products, including advanced stormwater detention and treatment systems, to meet regulatory standards. ADS, for instance, introduced its StormTech MC² system, which offers more efficient stormwater management, reducing installation time and cost.

The Annual Maintenance Services segment is expected to grow at the largest CAGR during the forecast period in the U.S. stormwater management market. As municipalities and other entities continue to adopt ever-more complex stormwater systems, regular maintenance to long-term efficiency and environmental standards becomes the norm. Companies such as Suntree Technologies Inc. and Hydro International have expanded their operations to include maintenance solutions for their respective stormwater treatment systems.

By Solution Type

In 2024, the Detention & Infiltration segment dominated the U.S. stormwater management market, holding the largest market share. This solution type is key in the management of stormwater runoff to temporarily hold it up until the surplus parts start percolating into the ground, thus causing no flooding and possible impairment to water quality. Growth in this segment is derived from the increasing requirements to deal with flooding and growing strictness in environmental laws including the Clean Water State Revolving Fund. As urbanization increases and so do flooding problems within the urban areas, detention and infiltration of stormwater has become imperative in the design for sustainable infrastructure.

The Biofiltration segment is projected to experience the largest CAGR during the forecasted period in the U.S. stormwater management market. Biofiltration systems are an evolving trend in their application, using vegetation, soil, and microorganisms for the treatment and filtration of stormwater. It is increasingly adopted in recent times due to environmental sustainability and the cost-effectiveness of such systems. Biofiltration systems definitely help to meet regulatory requirements and are increasingly finding applications in green infrastructure projects. This shift toward nature-based solutions, coupled with technological advancements and product development, has placed the biofiltration segment in a place for serious growth within the U.S. stormwater management market.

By End-user

In 2024, the Community, Government & Military segment captured the largest market share in the U.S. stormwater management market. This sector is particularly driven by a push in stringent regulations, environmental mandates, and resilient infrastructure. Therefore, local municipalities, military installations, and non-profit organizations consider advanced approaches in stormwater management in an attempt to deal with floods, polluting, or general water stressors. While it is an emerging area of great concern globally, the US military increasingly takes green infrastructure installation in military facilities for compliance requirements with an ecological perspective besides operational preparedness. Strong growth in this segment indicates the immediate need for Storm Water Management in public areas where safety, environmental sustainability, and long-term infrastructural investment come into play.

The Commercial segment is expected to grow at the largest CAGR during the forecasted period in the U.S. stormwater management market. Commercial properties and businesses are increasingly adopting stormwater management systems due to increasing pressure on environmental standards and sustainability goals. The expanding need for commercial properties to meet regulatory requirements and adopt green infrastructure practices drives the growth of this segment. Increasing trends in sustainability, conservation of water, and stormwater management in corporate strategies will help position the commercial segment for major growth in the future, as businesses work to improve their environmental footprint.

US Stormwater Management Market Regional Analysis:

United States Dominate the Stormwater Management Market in 2024 Driven by Urbanization, Infrastructure Needs, and Stringent Regulations

In 2024, the United States dominated the stormwater management market, holding the largest market share due to its substantial infrastructure needs, increasing urbanization, and stringent environmental regulations.

This dominance is largely driven by the growing need to address stormwater runoff and flooding, particularly in large metropolitan areas, where aging infrastructure and rapid urban expansion have led to challenges in water management.

For example, cities like New York, Los Angeles, and Chicago have faced severe flooding and water pollution, prompting the adoption of advanced stormwater management systems.

The U.S. government’s regulatory push, including the Clean Water State Revolving Fund and the National Pollutant Discharge Elimination System (NPDES), has further bolstered the market by encouraging municipalities to invest in advanced stormwater solutions. These regulations, alongside rising environmental awareness, have contributed to the U.S. maintaining its leadership position in the stormwater management market.

Get Customized Report as per Your Business Requirement - Enquiry Now

US Stormwater Management Market Competitive Landscape:

-

In January 2025, Advanced Drainage Systems, in collaboration with The Harris Poll, released an annual survey revealing that more than half of Americans are concerned about flooding in and around their homes. The survey also found that 64% of Americans believe stormwater negatively impacts their communities.

US Stormwater Management Market Key Players:

-

Advanced Drainage Systems (ADS)

-

Contech Engineered Solutions

-

Oldcastle Infrastructure (CRH)

-

Forterra Pipe & Precast

-

NDS, Inc.

-

ACO Drain / ACO Technologies

-

Hydro International

-

StormTrap

-

OptiRTC (Smart Stormwater Control)

-

Resource Environmental Solutions (RES)

-

Aquasweep / Aqualis Stormwater

-

RainGrid (Smart Rainwater Systems)

-

Geosyntec Consultants

-

AECOM

-

Jacobs Engineering Group

-

Stantec

-

Tetra Tech

-

CDM Smith

-

Black & Veatch

-

Apex Companies, LLC

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 8.25 Billion |

| Market Size by 2033 | USD 15.05 Billion |

| CAGR | CAGR of 7.8% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Installation Services, Repair Services, Annual Maintenance Services, and Others) • By Solution Type (Detention & infiltration, Biofiltration, Separation, Filtration, Specialty Filters, and Others) • By End-user (Community, Government & military, commercial, Industrial, Medical and education, and others) |

| Regional Analysis/Coverage | USA |

| Company Profiles | Advanced Drainage Systems (ADS), Contech Engineered Solutions, Oldcastle Infrastructure (CRH), Forterra Pipe & Precast, NDS Inc., ACO Drain/ACO Technologies, Hydro International, StormTrap, OptiRTC (Smart Stormwater Control), Resource Environmental Solutions (RES), Aquasweep/Aqualis Stormwater, RainGrid (Smart Rainwater Systems), Geosyntec Consultants, AECOM, Jacobs Engineering Group, Stantec, Tetra Tech, CDM Smith, Black & Veatch, Apex Companies LLC. |