Female Infertility Diagnosis Market Report Scope & Overview:

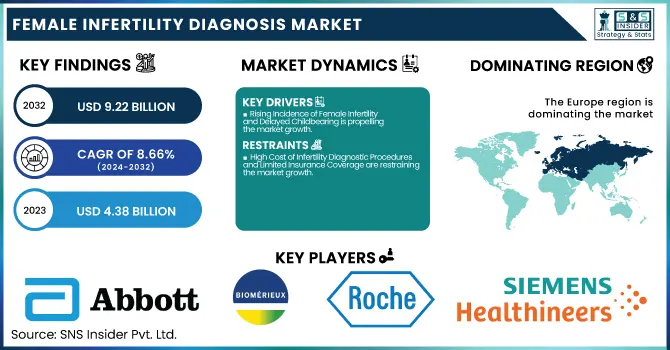

The Female Infertility Diagnosis Market was valued at USD 4.38 billion in 2023 and is expected to reach USD 9.22 billion by 2032, growing at a CAGR of 8.66% from 2024-2032.

To Get more information on Female Infertility Diagnosis Market - Request Free Sample Report

The Female Infertility Diagnosis Market presents targeted statistical information and developing trends usually not seen in standard reporting. The report identifies the global and regional prevalence and incidence of female infertility and provides insight into the top medical causes. Diagnostic testing patterns by key geographies are also presented, enabling disparities in test uptake to be detected. Moreover, it analyzes healthcare spending by payer types—government, private, commercial, and out-of-pocket—providing a more financial insight. The report analyses awareness and accessibility dynamics, focusing on regional preparedness and digital health integration in diagnostics.

The U.S. Female Infertility Diagnosis Market was valued at USD 0.66 billion in 2023 and is expected to reach USD 1.40 billion by 2032, growing at a CAGR of 8.70% from 2024-2032. The United States dominates the Female Infertility Diagnosis Market in North America because of a high rate of infertility, with an estimated 1 out of 5 women suffering from it, as per CDC estimates. The nation's leadership is further fueled by easy access to sophisticated diagnostic technologies, high healthcare spending, and considerable advocacy of assisted reproductive care in both public and private healthcare facilities.

Market Dynamics

Drivers

-

Rising Incidence of Female Infertility and Delayed Childbearing is propelling the market growth.

One of the major drivers for the Female Infertility Diagnosis Market is the growing prevalence of infertility among women, especially because of lifestyle and increased childbearing age. The World Health Organization (WHO) states that approximately 17.5% of the adult population, or roughly 1 in every 6 individuals worldwide, suffer from infertility. Age is an important factor in women, and with the world trend of delayed childbirth because of education, career, and economic reasons, infertility levels keep increasing. Research indicates that female fertility starts to decline beyond the age of 30 and decreases substantially after 35. Such a trend is particularly noticeable in urban and developed countries. Therefore, there is an increasing need for prompt diagnostic tools like AMH testing and ultrasound follicle monitoring, which are being made standard in fertility testing and assisted reproduction therapy (ART) planning.

-

Technological Advancements in Diagnostic Testing and Biomarkers are driving the market growth.

Diagnostic technology innovations are enhancing the validity and availability of female infertility evaluations. The availability of more sophisticated biomarker-based tests like Anti-Müllerian Hormone (AMH) assays, genetic panels for screening, and hormone-level diagnostics is revolutionizing the way clinicians assess ovarian reserve and reproductive potential. For instance, in March 2024, Siemens Healthineers introduced its AMH Assay to make ovarian reserve testing faster and more accurate. Thermo Fisher Scientific also launched next-generation sequencing instruments for preimplantation genetic testing to assist in the identification of chromosomal abnormalities. These developments are not only enhancing diagnostic accuracy but also facilitating individualized reproductive care. Improved point-of-care and automated laboratory systems are further increasing access in clinical and non-clinical environments, thereby enhancing early detection and patient outcomes in the management of infertility.

Restraint

-

High Cost of Infertility Diagnostic Procedures and Limited Insurance Coverage are restraining the market growth.

One major restraint in the Female Infertility Diagnosis Market is the expense of diagnostic testing and the inadequate insurance coverage available in most nations. More advanced tests like Anti-Müllerian Hormone (AMH) testing, transvaginal ultrasounds, and genetic testing can be costly, particularly when more than one test is needed for a full fertility workup. In most low- and middle-income nations, these expenses are all out-of-pocket, which restricts access to timely and precise diagnosis. Even in the developed world, such as the U.S., medical insurance plans tend to cover less or nothing for infertility tests unless certain medical conditions are diagnosed. This financial constraint causes most women to postpone or skip testing, which can complicate treatment further. The issue of affordability is still limiting the growth of the market, particularly in underserved areas where fertility awareness and financial support are constrained.

Opportunities

-

Expansion of At-Home Diagnostic Testing Solutions creates a significant opportunity in the market.

The growing demand for home diagnostic kits offers a major opportunity in the Female Infertility Diagnosis Market. Customers increasingly favor convenient, discreet, and low-key testing methods that avoid the usual clinical visit. Advances in diagnostic technologies have made it possible to create accurate home tests for determining ovulation, Anti-Müllerian Hormone (AMH) levels, and Follicle-Stimulating Hormone (FSH) tests. Firms such as Modern Fertility and Everlywell have introduced easy-to-use home kits that provide laboratory-quality results with digital guidance for interpretation. The trend facilitates wider usage among tech-savvy, busy women and those in rural areas with limited fertility clinic accessibility. With growing awareness of infertility and women taking proactive approaches to reproductive health management, the demand for in-home fertility diagnostics will grow, providing new streams of revenue and opportunities for market penetration for diagnostic firms.

Challenges

-

Socio-Cultural Stigma and Lack of Awareness in Emerging Markets are challenging the market growth.

One of the most important issues hindering the expansion of the Female Infertility Diagnosis Market is the ongoing socio-cultural stigma and unawareness of infertility, especially in developing economies. Infertility in several cultures is viewed as a sensitive issue, and disproportionate blame is often laid on women, thus deterring them from undergoing early diagnosis or consulting doctors. In addition, inadequate education on reproductive health and a dearth of available healthcare infrastructure compound the issue. This leads to underdiagnosis and delayed treatment, which has a detrimental effect on treatment effectiveness. Healthcare professionals also experience challenges in promoting fertility diagnostics because of low patient interest and societal pressure. These barriers can be overcome through not only public health education campaigns but also by making diagnostic services more socially acceptable and culturally sensitive among the diverse populations.

Segmentation Analysis

By Test

The Ovarian Reserve Testing segment dominated the Female Infertility Diagnosis Market with 44.61% market share in 2023 because it plays a crucial part in evaluating a woman's reproductive potential and making fertility treatment decisions. Anti-Müllerian Hormone (AMH) testing, a major aspect of ovarian reserve assessment, has been widely used for its reliability in estimating the number of a woman's remaining eggs. Clinicians often depend upon these tests before starting fertility treatment like IVF, as they can predict how a patient will react to ovarian stimulation. The trend towards delayed childbearing has also promoted the expansion in the demand for assessment of ovarian reserve, with an increasing number of women actively testing their fertility level. Also, the widespread availability of at-home and clinical AMH tests has increased ease of access as well as customer interaction, helping to propel the segment to greater market leadership.

By End Use

The Hospitals and Clinics segment dominated the female infertility diagnosis market with around 51.23% market share in 2023, with their comprehensive facilities and ease of access to specialized medical care. These organizations are usually the first port of call for females requiring infertility diagnosis, providing varied services such as hormonal tests, imaging modalities, and consulting reproductive endocrinologists, all in one place. They also have sophisticated diagnostic equipment and built-in laboratory services, which help facilitate faster and more accurate diagnostic procedures. Also, the increase in the number of fertility clinics in hospitals and greater awareness about women's reproductive health have boosted patient preference for these environments. Their capacity for providing follow-up treatments and fertility interventions like IVF also enables greater patient volume and retention.

The Pathology and Diagnostic Centers segment will be the fastest-growing segment in the female infertility diagnosis market in the forecast years, with the increasing trend towards decentralized care and ease of access to stand-alone diagnostics. These centers provide affordable and effective diagnostics like hormone assays, AMH tests, and ultrasound imaging without usually needing specialist referrals. With the increasing popularity of preventive health check-ups and self-management fertility awareness, more women are seeking these centers for early assessment of infertility. Advances in diagnostic platforms and growth in fertility-oriented lab chains in urban and semi-urban areas have also spurred growth. In addition, digital connectivity and collaborations with telemedicine facilities are enhancing diagnostic assessment access, with pathology and diagnostic centers becoming a fast-growing force in the field of fertility diagnostics.

Regional Analysis

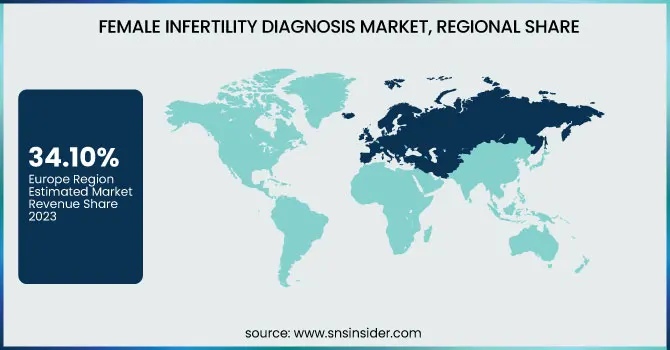

Europe dominated the female infertility diagnosis market with 34.10% market share in 2023 due to strong healthcare infrastructure, early embracement of cutting-edge diagnosis technologies, and high government support for fertility interventions. Nations such as Germany, France, and the UK have comprehensive coverage of infertility testing and therapy under national health plans, enhancing accessibility and patient care. The region also has a high level of infertility consciousness among women, resulting in early diagnosis and intervention. In addition, rising maternal age and lifestyle-related reproductive issues have added to the growing patient base. The availability of many top diagnostic firms and fertility clinics also makes Europe a center for fertility-related research and clinical innovation, further consolidating its market leadership.

Asia Pacific is the fastest-growing region in the female infertility diagnosis market with a 9.41% CAGR over the forecast period as a result of a mix of growing infertility levels, improving healthcare infrastructure, and growing awareness regarding reproductive health. Accelerated urbanization, postponement of childbearing, and lifestyles are resulting in increased rates of infertility in China, India, and Japan. The region's governments and private healthcare institutions are investing substantially in reproductive health care, such as sophisticated diagnostic technologies. Furthermore, the region's expanding middle-class population and rising acceptance of assisted reproductive technologies (ART) are driving demand for infertility diagnosis. Cross-border fertility tourism and the affordability of treatment in most countries of Asia are further boosting regional growth momentum.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Market Players

-

Abbott Laboratories (Alinity m System, ARCHITECT Estradiol Assay)

-

BioMérieux SA (VIDAS Estradiol II, VIDAS Progesterone)

-

F. Hoffmann-La Roche Ltd. (Elecsys AMH Plus, Cobas e411 Analyzer)

-

Siemens Healthineers AG (ADVIA Centaur AMH Assay, IMMULITE 2000 XPi System)

-

Thermo Fisher Scientific Inc. (Invitrogen AMH ELISA Kit, QuantStudio 5 Real-Time PCR System)

-

Sysmex Corporation (HISCL AMH Assay Kit, HISCL-800 System)

-

Danaher Corporation (Beckman Coulter) (Access AMH Assay, UniCel DxI Immunoassay System)

-

PerkinElmer Inc. (Genomic Microarray Platform, AMH ELISA Kit)

-

CooperSurgical Inc. (SAS FSH/LH Test, Plan Ahead Genetic Screening)

-

Merck KGaA (EMD Millipore Estradiol ELISA Kit, Merck AMH Diagnostic Kit)

-

Randox Laboratories Ltd. (AMH Immunoassay, RX daytona+ Analyzer)

-

QuidelOrtho Corporation (Sofia hCG FIA, QuickVue FSH Test)

-

FUJIFILM Wako Pure Chemical Corporation (AMH Assay Kit, Estradiol Test Kit)

-

Tosoh Bioscience, Inc. (AIA AMH Assay, AIA-900 Immunoassay Analyzer)

-

Biomerica, Inc. (FertilityStat Ovulation Test, FSH Home Test)

-

MP Biomedicals, LLC (AMH Diagnostic ELISA, Estradiol RIA Kit)

-

Bio-Rad Laboratories, Inc. (Bio-Plex Pro Hormone Assays, Liquichek Immunoassay Plus Control)

-

Nova Biomedical (Stat Profile Prime Plus Analyzer, Reproductive Hormone Panels)

-

MedGyn Products, Inc. (AMH Rapid Test, Fertility Diagnostic Panel)

-

Wuhan Fine Biotech Co., Ltd. (AMH ELISA Kit, FSH ELISA Kit)

Suppliers (These suppliers commonly provide diagnostic reagents, antibodies, and assay kits that are essential for hormone detection, genetic testing, and biomarker quantification. They also supply analyzers and molecular diagnostic platforms used across various infertility diagnostic tests) in the Female Infertility Diagnosis Market

-

Thermo Fisher Scientific

-

MilliporeSigma (Merck Group)

-

Bio-Rad Laboratories

-

Roche Diagnostics

-

Qiagen N.V.

-

LGC Biosearch Technologies

-

Sigma-Aldrich

-

Abbott Diagnostics

-

Agilent Technologies

-

PerkinElmer Inc.

Recent Development

-

March 2024 – Siemens Healthineers has launched its Anti-Müllerian Hormone (AMH) Assay, aimed at effectively evaluating ovarian reserve in women. The assay boosts lab reproductive endocrinology testing by aiding physicians in making timely decisions regarding the start of in vitro fertilization (IVF). The test evaluates the level of AMH to estimate the egg supply remaining, providing information about a patient's possible reaction to IVF treatment.

-

July 2023 – Thermo Fisher Scientific released two next-generation sequencing (NGS)-based research instruments for preimplantation genetic testing for aneuploidy (PGT-A): the Ion ReproSeq PGT-A Kit and the Ion AmpliSeq Polyploidy Kit. The first reproductive health research used only (RUO) assays on the Ion Torrent Genexus Integrated Sequencer to support IVF and intracytoplasmic sperm injection (ICSI) pipelines.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.38 Billion |

| Market Size by 2032 | US$ 9.22 Billion |

| CAGR | CAGR of 8.66 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Test (Ovarian Reserve Testing, Hysterosalpingography, Hormone Testing, Other Tests) •By End Use (Hospitals and Clinics, Homecare, Pathology and Diagnostic Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, BioMérieux SA, F. Hoffmann-La Roche Ltd., Siemens Healthineers AG, Thermo Fisher Scientific Inc., Sysmex Corporation, Danaher Corporation (Beckman Coulter), PerkinElmer Inc., CooperSurgical Inc., Merck KGaA, Randox Laboratories Ltd., QuidelOrtho Corporation, FUJIFILM Wako Pure Chemical Corporation, Tosoh Bioscience, Inc., Biomerica, Inc., MP Biomedicals, LLC, Bio-Rad Laboratories, Inc., Nova Biomedical, MedGyn Products, Inc., Wuhan Fine Biotech Co., Ltd., and other players. |