Fertilizer Spreader Market Report Scope & Overview:

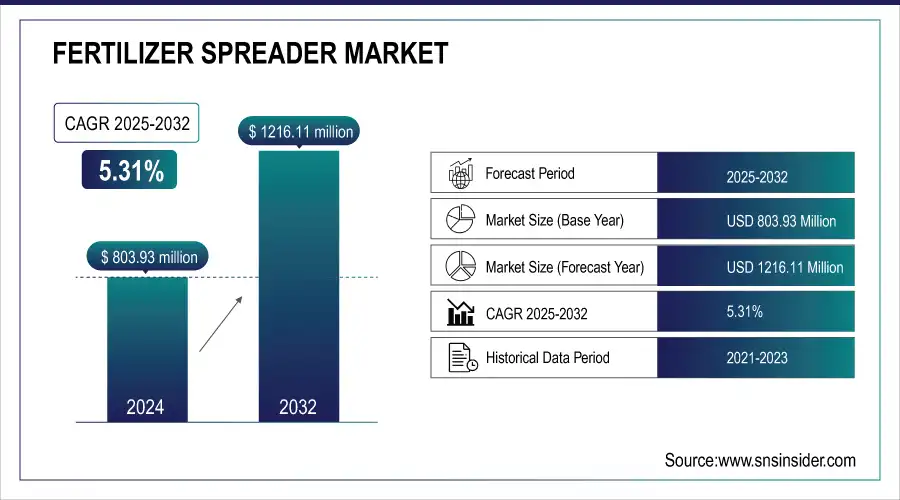

The Fertilizer Spreader Market was valued at USD 803.93 million in 2025E and is expected to reach USD 1216.11 million by 2033, growing at a CAGR of 5.31% from 2026-2033.

The fertilizer spreader market is expanding rapidly due to rising urbanization, mechanization, and technological advancements. Traditional fertilizer application often leads to uneven spreading, reducing crop productivity, driving demand for precise, automated systems. Models like the Four Multiplier Ready and NL5000 G5 offer wide spread widths, swath control, and durable components, ensuring efficient, cost-effective application across terraces, small fields, and rolling hills. Increasing crop cultivation and the push toward natural farming for 1 crore farmers in the next two years further fuel adoption. Automated and semi-automatic spreaders reduce labor, save time, and enhance efficiency, positioning the market for significant growth.

Fertilizer Spreader Market Size and Forecast

-

Fertilizer Spreader Market Size in 2025E: USD 803.93 Million

-

Fertilizer Spreader Market Size by 2033: USD 1216.11 Million

-

CAGR: 5.31% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To get more information on Fertilizer Spreader Market - Request Free Sample Report

The U.S. Fertilizer Spreader market size was valued at an estimated USD 295.00 million in 2025 and is projected to reach USD 450.00 million by 2033, growing at a CAGR of 4.8% over the forecast period 2026–2033. Market growth is driven by increasing adoption of mechanized farming practices, rising demand for efficient and precise fertilizer application, and the growing emphasis on improving crop yields and soil health. Advancements in precision agriculture technologies, including GPS-enabled and variable-rate fertilizer spreaders, are accelerating market adoption across large-scale and commercial farming operations. Additionally, supportive government initiatives, expanding agricultural infrastructure, and continuous innovation by equipment manufacturers further strengthen the growth outlook of the U.S. fertilizer spreader market during the forecast period.

Fertilizer Spreader Market Trends

-

Rising demand for efficient farming practices and precision agriculture is driving the fertilizer spreader market.

-

Growing adoption of mechanized equipment to enhance crop yield and reduce labor dependency is boosting sales.

-

Advancements in GPS-enabled, variable-rate, and automated spreaders are improving accuracy and resource optimization.

-

Expansion of large-scale farming and commercial agriculture is fueling equipment demand.

-

Increasing focus on reducing fertilizer waste and improving soil health is shaping market trends.

-

Government initiatives and subsidies supporting modern agricultural machinery adoption are accelerating growth.

-

Collaborations between equipment manufacturers and agri-tech firms are fostering innovation in smart spreaders.

Fertilizer Spreader Market Growth Drivers:

- Precision agricultural output and cut down on resource waste, precision agriculture techniques are growing in popularity. Spreaders for fertilizer are an essential part of precision farming.

Precision agriculture methods have become popular in the agricultural sector because they are capable of increasing the overall productivity and reducing the waste of resources. Specifically developed using technologies such as GPS, remote sensing, and data analysis, this approach to monitoring farm activities and managing crops allows for agricultural production to be surveilled and controlled in a very precise manner. One of the instruments that play a critical part in the management of fertilizers in precision farming is the fertilizer spreader, which is intended for distributing fertilizers across a farm plot: “Each product variant is adapted to the type of fertiliser and the area it can cover”. Overfertilizing and under fertilising plants becomes a much less likely issue. Consequently, fertilizers are used with maximum efficiency because of the precision of the application. Many types of crops benefit from precision farming methods. Since precision farming with the help of GPS reduces the volume of fertilisers unaccounted for, their effect on the environment is minimised. The overuse of fertilisers causes the release of harmful gases, whereas their excess runs off into the nearest water sources, leading to the death of fish and other aquatic creatures.

- In many nations, government subsidies and incentives for the agricultural industry encourage farmers to embrace cutting-edge farming techniques, including the use of machinery like fertilizer spreaders.

The Governments provide financial supports to farmers in the form of subsidies and other incentives in order to lower the initial cost burden on the farmers facilitating them to go for modern-day tools and technologies that have resulted in increased productivity and efficiency. The fertilizers spreaders are designed to use the fertilizer in such a way that it could have an even distribution of fertilizers across the field of cultivation supporting proper sunlight and air to let into the inner portion of the crops. These advances have definitely more efficient and productive than the convectional way or older way of fertilizing and spreading seeds which increases waste and the yield level simply declines. Governments are aware of the fact that if they want to ensure food security and sustainability of the country, then they must encourage the farmers to go for innovative tools and technologies, which help increase productivity and efficiency.

Fertilizer Spreader Market Restraints:

- The misuse or overuse of fertilizers can cause problems for the environment, such as soil erosion and water contamination. This can result in tighter guidelines and limitations on fertilizer use.

One of the reasons governments around the world are introducing or simply considering changes in the legislation regarding the use of fertilizers is the significant risk to the environment that is associated with their misuse or overuse. In particular, soil erosion and water contamination seem to be some of the major nuisances causing significant damage to ecosystems and the population living there. The application of too much fertilizer to the soil results in the fast depletion of this latter, and the dust and humus that give the soil structure and fertility erode. It is the improper structure that promotes the rapid spread of water running down surface soil. Moreover, the water running through underlay canals and pipes, collecting fertilizers on the way, enters the rivers, lakes, seas, and oceans, resulting in the growth of harmful algal blooms and hypoxia. Therefore, the adverse environmental impact associated with the use of fertilizers calls for more accurate regulations and guidelines limiting this factor.

Fertilizer Spreader Market Segment Analysis

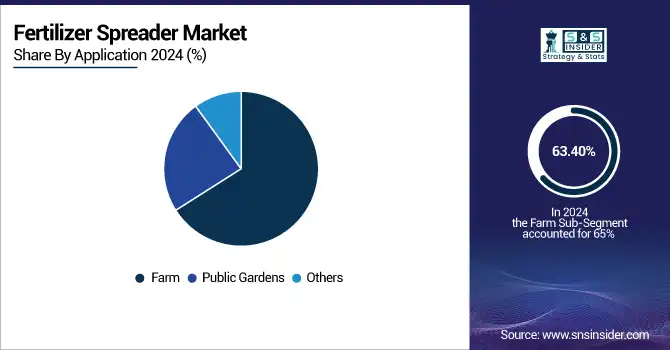

By Application, Farms lead market growth, public gardens segment shows steady expansion globally.

The farm segment is estimated to see a largest market growth 63.40% in 2025, as “there are a less farm worker same as raise in the usage of these products in all farming operations”. This category uses the produced spreaders on most of the land, and especially for spreading fertilizers throughout the aspect. It leads to proper distribution of the fertilizers which enable sustainable productions. In addition, the value of the spreaders is cheap for both small and big farms.

The public gardens segment is estimated to see a steady growth of especially in the countries such as France, India, Italy, and others. In the public gardens, small spreader or the handheld spreaders are used for spreading the chemicals or fertilizers.

By Type, Broadcast spreaders dominate, drop spreaders grow fastest due to precision and ease of use.

The Broadcast spreader segment is expected to be the largest category at a CAGR of around 4.6% during the forecast period 2026-2033. The broadcast spreader is the key aspect of the spreader market growth to an extent, the broadcasting spreader results in on-going product development contribution that spreads fertilizer over the farms, public gardens, commercial turf application, golf course, and home lawns. broadcast spreader smaller than the hopper of drop spreader. The drop spreader segment is expected to witness significant growth due to it carefully determines to make sure different parts of the lawn and garden receive an even coverage. Moreover, it is easy and simple to use and highly accurate when compared with broadcasting spreader and works well in lawns or spaces up to 5,000 square feet.

Fertilizer Spreader Market Regional Analysis

Asia Pacific Fertilizer Spreader Market Insights

Asia-Pacific region is leading the market 36% in 2025. This is owing to the expanding acreage under agricultural domain notably in the developing economies such as India and China. Growing awareness, more personal disposable money, increased reliance on fertilizers to boost crop yield, and increased government backing are some of the other major elements promoting the expansion of this region.

Need any customization research on Fertilizer Spreader Market - Enquiry Now

North America Fertilizer Spreader Market Insights

The North America fertilizer spreader market is witnessing significant growth due to increasing adoption of advanced agricultural equipment and precision farming techniques. Rising demand for efficient fertilizer application, labor shortage, and the need to enhance crop productivity are key factors driving the market. Automated and semi-automatic spreaders help reduce human effort, save time, and ensure uniform distribution. Strong government support, technological innovations, and mechanization in agriculture further bolster market expansion across the region.

Europe Fertilizer Spreader Market Insights

The Europe fertilizer spreader market is growing steadily, driven by the adoption of precision farming and sustainable agricultural practices. Increasing focus on crop productivity, efficient fertilizer usage, and labor reduction is boosting demand for automated and semi-automatic spreaders. Technological advancements, including GPS-guided and section-controlled systems, enhance accuracy and minimize overlap. Supportive government initiatives, rising awareness of environmental sustainability, and mechanization in farming are further fueling the market’s expansion across Europe.

Middle East & Africa and Latin America Fertilizer Spreader Market Insights

The Middle East & Africa and Latin America fertilizer spreader markets are expanding due to rising agricultural mechanization and the need to improve crop yields. Limited labor availability and increasing adoption of automated and semi-automatic spreaders drive efficiency and reduce operational costs. Governments are promoting modern farming practices, while technological advancements such as GPS-guided and precision spreading systems enhance productivity. These factors collectively support steady market growth in both regions.

Fertilizer Spreader Market Competitive Landscape:

Kubota Corporation

Kubota Corporation, founded in 1890 in Japan, is a global leader in agricultural machinery, construction equipment, and industrial engines. The company focuses on delivering innovative, high-performance solutions for farming, landscaping, and industrial applications. With advanced precision agriculture technologies, Kubota enhances operational efficiency, productivity, and sustainability for farmers worldwide. The company continues to integrate automation, smart systems, and durable machinery to meet evolving agricultural and industrial demands.

-

2024: Kubota integrated its Tractor Implement Management (TIM) system with the DSX-W GEOSPREAD disc fertilizer spreader and M7 tractor, automating settings (disc RPM, height, inclination) for improved precision. (KUBOTA GROUP SOLUTIONS HUB)

-

2023: Kubota released the VS220 Spreader, with manual, electronic, or hydraulic control options, capable of spreading fertilizer, seeds, or granules up to 46 ft with high accuracy and symmetric pattern.

AGCO Corporation

AGCO Corporation, founded in 1990 and headquartered in the United States, is a leading global manufacturer of agricultural equipment and technologies. The company offers a wide range of tractors, harvesters, seeding, and precision farming solutions under brands such as Fendt, Massey Ferguson, and Challenger. AGCO focuses on innovation in autonomous machinery, smart agriculture systems, and sustainable farming practices, enabling farmers worldwide to increase efficiency, productivity, and operational sustainability through advanced technology integration.

-

2025: AGCO will exhibit retrofit equipment, autonomous tech, and precision agriculture solutions at the 2025 Farm Progress Show, including equipment from Fendt, Massey Ferguson, and PTx brands.

Key Players

-

Kubota Corporation

-

AGCO Corporation

-

CNH Industrial N.V

-

Bucher Industries AG (KUHN Group)

-

Dalton AG Inc

-

Teagle Machinery Ltd

-

Bogballe A/S

-

Artex Manufacturing

-

Meyer's Equipment Manufacturing

-

H&S Manufacturing

-

Chandler Equipment Co.

-

Newton Crouch Company LLC

-

Simonsen Industries

-

Epoke A/S

-

Rauch Landmaschinenfabrik GmbH

-

MASCHIO GASPARDO

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 803.93 Mn |

| Market Size by 2033 | US$ 1216.11 Mn |

| CAGR | CAGR of 5.31% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Drop Spreader, Broadcast Spreader) • By Application(Farm, Public Gardens, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Deere & Company, Kubota Corporation, Mahindra & Mahindra Ltd, AGCO Corporation, CNH Industrial N.V, Claas KGaA mbH, Bucher Industries AG (KUHN Group), Adams Fertilizer Equipment, Dalton AG Inc, Teagle Machinery Ltd, Bogballe A/S, Artex Manufacturing, Meyer's Equipment Manufacturing, H&S Manufacturing, Chandler Equipment Co., Newton Crouch Company LLC, Simonsen Industries, Epoke A/S, Rauch Landmaschinenfabrik GmbH, MASCHIO GASPARDO |