Downhole Tools Market Key Insights:

The Downhole Tools Market size was valued at USD 5.32 Billion in 2023. It is expected to grow to USD 7.99 Billion by 2032 and grow at a CAGR of 4.41% over the forecast period of 2024-2032.

To Get More Information on Downhole Tools Market - Request Sample Report

The Downhole Tools Market is pivotal in the oil and gas sector, especially during drilling and completion operations, where specialized tools function under extreme conditions of high pressure and temperature to optimize hydrocarbon extraction. Among the major categories of downhole tools, drilling tools such as polycrystalline diamond compact (PDC) bits have improved drilling efficiency by up to 30% compared to traditional bits, significantly reducing both time and costs associated with drilling operations. Additionally, completion tools, including packers and plugs, are essential for preparing wells for production, with smart technologies facilitating real-time monitoring and optimization. As the industry progresses, there is a marked rise in the demand for coiled tubing and wireline intervention services, projected to grow at approximately 5% annually. This growth is driven by an increase in well maintenance and repair activities, with intervention tools enabling operators to perform necessary repairs without fully removing the drilling assembly, thus minimizing downtime. Furthermore, about 70% of oil and gas companies are investing in smart downhole tools that incorporate sensors and data analytics, reflecting a broader shift toward automation and enhanced operational monitoring.

| Types of Downhole Tools | Description | Commercial Products |

|---|---|---|

| Drill Bits | Tools used to create holes in the earth, are available in various designs like PDC, roller cone, and diamond bits. | Schlumberger, Halliburton |

| Completion Tools | Equipment used to finish the well and prepare it for production, including packers, plugs, and completion risers. | Baker Hughes, Weatherford |

| Wireline Tools | Tools for well intervention and data collection, including logging tools and valves, are often deployed on wireline cables. | GE Oil & Gas, NOV |

| Mud Motors | Downhole motors that utilize drilling fluid to power the drill bit, enhancing efficiency and control during drilling. | Schlumberger, Halliburton |

| Pressure Control Equipment | Tools to manage and control the pressure in the well, including blowout preventers and surface safety systems. | Cameron, Dril-Quip |

| Wellbore Cleaning Tools | Tools designed to clean and maintain the wellbore, such as scrapers, magnets, and chemical cleaners. | Baker Hughes, Weatherford |

| Formation Evaluation Tools | Tools used for assessing the geological formation, including logging while drilling (LWD) and measurement while drilling (MWD) technologies. | Schlumberger, Halliburton |

| Coiled Tubing Equipment | Equipment for deploying coiled tubing into the well for various applications like stimulation and intervention. | National Oilwell Varco, Halliburton |

The integration of digital technologies is expected to lead to operational cost reductions of around 10% to 15%, boosting profitability for operators. Concurrently, the industry is increasingly focused on reducing its environmental footprint. According to research eco-friendly downhole tools can help decrease emissions during drilling and production processes by up to 25%. Enhanced materials and designs are also contributing to tool longevity, with modern tools designed to last 30% longer than earlier models under harsh conditions. Moreover, the utilization of intervention tools, such as slickline and coiled tubing units, has been growing, now accounting for over 60% of total intervention activities, particularly in mature oil fields. Ongoing research and development efforts are aimed at creating downhole tools that not only enhance productivity but also align with sustainability goals, underscoring the market's dynamic evolution in response to technological advancements and environmental concerns.

MARKET DYNAMICS

DRIVERS

- The demand for downhole tools is propelled by the surge in exploration and production activities in the oil and gas sector, especially in offshore and unconventional reserves.

The surge in oil and gas exploration activities, especially in offshore and unconventional reserves, significantly drives the demand for downhole tools. As of recent years, nearly 40% of global oil production comes from offshore sources, with the U.S. and Brazil leading the charge in deepwater drilling operations. This shift towards deeper and more challenging environments necessitates advanced downhole tools that can operate efficiently under high pressures and extreme temperatures. Moreover, unconventional resources, such as shale gas and tight oil, have seen a notable rise in extraction, with shale production in the U.S. alone accounting for approximately 70% of the country’s total natural gas production. The extraction of these resources requires specialized downhole tools, including drilling bits, casing, and completion equipment, designed to handle unique geological formations and enhance recovery rates.

The increased complexity of drilling operations is reflected in the growing number of active rigs, which reached over 700 globally in recent years. The heightened exploration efforts, driven by the need for energy security and rising global energy demand, particularly from emerging economies, emphasize the importance of efficient and reliable downhole tools. Additionally, advancements in technology, such as automated drilling systems and real-time monitoring solutions, further enhance exploration capabilities and operational efficiency. Consequently, the growing focus on both offshore and unconventional oil and gas reserves underlines the critical role of downhole tools in meeting the industry's evolving challenges and demands.

- Technological advancements in downhole tools, including automated systems and smart technologies, improve operational efficiency and safety, driving higher adoption rates in the industry.

Technological advancements in downhole tool technologies are transforming the oil and gas industry, significantly improving operational efficiency and safety. Innovations such as automated systems and smart tools enable operators to optimize drilling processes, reduce downtime, and enhance overall productivity. Automated drilling systems utilize advanced algorithms and real-time data analytics to make instantaneous adjustments to drilling parameters. This not only accelerates drilling speed but also minimizes the risk of human error, leading to safer operations. Smart tools, equipped with sensors and IoT capabilities, facilitate remote monitoring and data collection, allowing operators to gain insights into well performance and equipment status. A study indicated that implementing smart technologies in drilling operations can result in a reduction of non-productive time (NPT) by up to 30%. Furthermore, these advancements support predictive maintenance strategies, enabling companies to address potential equipment failures before they occur, thereby avoiding costly interruptions.

Additionally, innovations in materials and design, such as corrosion-resistant coatings and enhanced durability, increase the lifespan of downhole tools, further promoting their adoption. According to research, approximately 60% of oil and gas companies are prioritizing investments in advanced technologies to improve their operational capabilities. This trend underscores the industry's commitment to leveraging cutting-edge solutions to enhance safety, efficiency, and sustainability in drilling operations.

RESTRAIN

- High initial investment costs for downhole tools, encompassing installation, maintenance, and operation, can discourage smaller operators from entering the market, hindering overall growth.

High initial investment costs pose a significant barrier to entry in the downhole tools market, particularly for smaller operators. These costs encompass several components, including the purchase price of advanced equipment, installation expenses, and ongoing maintenance requirements. The price of downhole drilling tools can range from tens of thousands to several hundred thousand dollars per unit, depending on their complexity and technology. Moreover, installation costs can further inflate the initial investment, with estimates indicating that proper installation can add 20% to the total equipment cost. Maintenance is another critical factor, as these tools require regular servicing to ensure optimal performance and longevity. The maintenance costs can account for approximately 10-15% of the total operational expenses over the equipment’s lifecycle.

This financial burden disproportionately affects smaller operators who may not have the capital reserves of larger companies. According to research conducted by the International Association of Drilling Contractors, about 60% of small to mid-sized operators reported that high initial costs prevented them from upgrading their equipment. Consequently, many smaller firms may opt to delay or forego investments in downhole tools, stunting their growth and innovation capabilities. This reluctance to invest not only limits individual operators but also constrains overall market growth, as a less competitive landscape can lead to stagnation in technological advancements and operational efficiencies across the industry.

KEY SEGMENTATION ANALYSIS

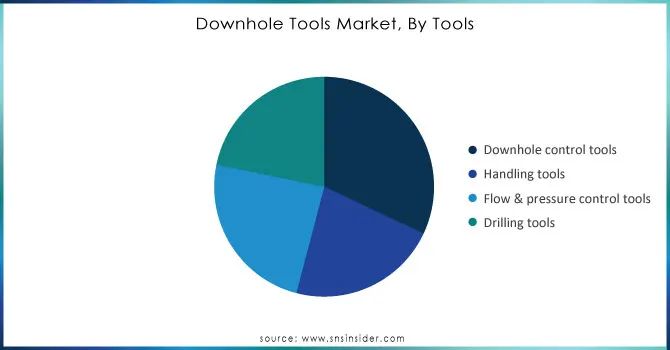

By Tools

In 2023, the downhole control tool segment dominated the market share by over 32.02%, highlighting its importance in complex oil and gas exploration, especially in unconventional reservoirs. According to research 50% of new oil wells globally require advanced downhole technologies to ensure precise control in challenging conditions. Tools like flow control valves and pressure management systems contribute significantly, as they can increase well productivity by up to 25% while reducing operational risks by nearly 20%. Additionally, global energy consumption is expected to rise by about 1.3% per year, fueling oil companies' investments in advanced downhole control technologies. In the U.S. alone, adoption rates for these tools have grown by 15% over the past five years, driven by the need to maximize resource recovery and maintain well integrity. This trend highlights the segment's critical role in meeting both production efficiency and sustainability goals.

Do You Need any Customization Research on Downhole Tools Market - Inquire Now

By Application

In 2023, the drilling segment dominated the market share over 36.02%, accounting for a substantial share of revenue. This growth is primarily driven by the surge in oil and gas exploration activities, particularly in unconventional resources like shale formations. With global energy consumption projected to rise significantly, oil companies are increasingly investing in advanced drilling technologies to enhance efficiency and access deeper reserves. The U.S. shale oil production saw a notable increase, with an average of 9.2 million barrels per day reported in 2023.

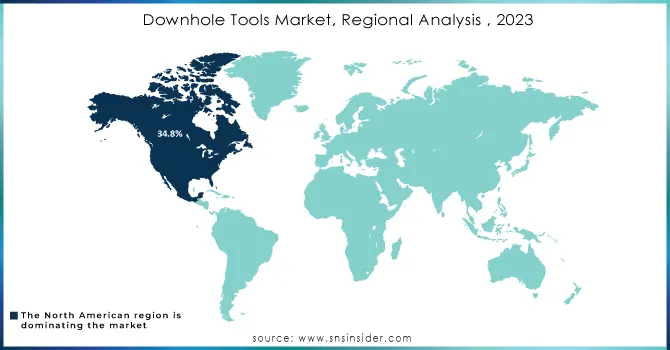

KEY REGIONAL ANALYSIS

North America region dominated the market share over 34.8% in 2023. This leadership stems from significant investments in oil and gas exploration, especially in unconventional resources like shale formations within the U.S. The region's market growth is driven by advancements in hydraulic fracturing and horizontal drilling, which enhance efficiency in accessing tight oil and shale gas reserves. The U.S. stands out in the region, as stabilized oil prices have led to increased investments in both new well developments and the maintenance of existing wells. These activities demand high-performance downhole tools for drilling, wellbore intervention, and completion processes, supporting safe and efficient extraction operations.

Asia Pacific is the fastest-growing region in the Downhole Tools Market, driven by rapid oil and gas exploration across China, India, and Australia. Asia Pacific is witnessing significant momentum due to its rising energy demand and substantial investments in both onshore and offshore extraction projects. Countries like China and India are prioritizing domestic energy production, which has led to increased exploration activities, especially in unconventional reserves. Advanced downhole tools are critical to this expansion, providing solutions that boost drilling efficiency and lower operational costs.

KEY PLAYERS

Some of the major key players of Downhole Tools Market

- Halliburton Company (drill bits, reamers, hole openers, packers)

- Excalibre Downhole Tools Ltd. (drilling motors, stabilizers, jars, shock tools)

- Schlumberger Ltd. (drill bits, reamers, mud motors, packers)

- Bilco Tools Inc. (stabilizers, hole openers, centralizers, whipstocks)

- Baker Hughes Inc. (drilling motors, drill bits, liner hangers, whipstocks)

- Wenzel Downhole Tools Ltd. (mud motors, jars, shock tools, reamers)

- Oil States International Inc. (drilling tools, tubing hangers, packers)

- National Oilwell Varco Inc. (drill bits, reamers, stabilizers, hole openers)

- Weatherford International Ltd. (fishing tools, whipstocks, reamers, drilling jars)

- Vertex Downhole (mud motors, measurement-while-drilling tools, rotary steerable systems)

- NOV Downhole (mud motors, reamers, drill bits, stabilizers)

- Schramm, Inc. (mud motors, downhole drilling tools, centralizers)

- Teledrill Inc. (rotary steerable systems, directional drilling tools, mud motors)

- Antelope Oil Tool & Mfg. Co. (casing tools, centralizers, float equipment)

- Drill King International (drill bits, hammers, rotary drilling tools)

- Downhole Drilling Services Inc. (mud motors, downhole drilling tools, stabilizers)

- Logan International Inc. (drilling jars, fishing tools, packers)

- Bench Tree Group (measurement-while-drilling tools, downhole sensors)

- Ulterra Drilling Technologies (polycrystalline diamond compact (PDC) bits, downhole motors)

- Hunting Energy Services (drill bits, pressure control equipment, downhole tools)

Suppliers for Offers comprehensive solutions for drilling, production, and reservoir evaluation of Downhole Tools Market:

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- National Oilwell Varco (NOV)

- TechnipFMC plc

- Oceaneering International, Inc.

- Schlumberger Oilfield Services

- Rubicon Oilfield International

- Weatherford International

RECENT DEVELOPMENTS

-

In April 2024: SLB entered into an agreement to acquire ChampionX in an all-stock transaction. ChampionX shareholders will receive 0.662 shares of SLB stock for each ChampionX share, boosting SLB's energy services by integrating ChampionX’s chemical and surface technology capabilities.

-

In February 2024: KCF Technologies partnered with Nabors Industries to integrate its machine health data with Nabors' RigCLOUD platform. This enables customers to access predictive maintenance data from wireless sensors through an open cloud system.

-

In November 2023: Halliburton and Sekal AS announced a partnership to provide advanced well construction automation solutions. The collaboration includes combining Halliburton’s digital well construction tools with Sekal’s DrillTronics platform, with both companies offering remote operational support.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.32 Billion |

| Market Size by 2032 | USD 7.99 Billion |

| CAGR | CAGR of 4.41% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Tools (Downhole control tools, Handling tools, Flow & pressure control tools, Drilling tools) • By Application (Drilling, Completion, Formation & evaluation, Production, Intervention) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Halliburton Company, Excalibre Downhole Tools Ltd., Schlumberger Ltd., Bilco Tools Inc., Baker Hughes Inc., Wenzel Downhole Tools Ltd., Oil States International Inc., National Oilwell Varco Inc., Weatherford International Ltd., Vertex Downhole, NOV Downhole, Schramm, Inc., Teledrill Inc., Antelope Oil Tool & Mfg. Co., Drill King International, Downhole Drilling Services Inc., Logan International Inc., Bench Tree Group, Ulterra Drilling Technologies, Hunting Energy Services. |

| Key Drivers | • The demand for downhole tools is propelled by the surge in exploration and production activities in the oil and gas sector, especially in offshore and unconventional reserves. • Technological advancements in downhole tools, including automated systems and smart technologies, improve operational efficiency and safety, driving higher adoption rates in the industry. |

| RESTRAINTS | • High initial investment costs for downhole tools, encompassing installation, maintenance, and operation, can discourage smaller operators from entering the market, hindering overall growth. |