Fiber Optic Circulators Market Size Analysis:

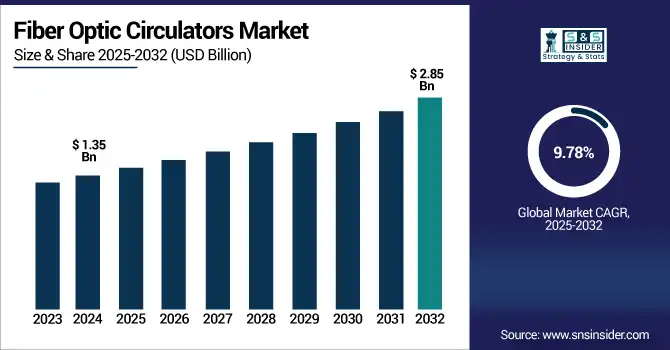

The Fiber Optic Circulators Market size was valued at USD 1.35 Billion in 2024 and is projected to reach USD 2.85 Billion by 2032, growing at a CAGR of 9.78% during 2025-2032. The fiber optic circulators market is gaining significant traction in the cables and connectors industry with the growing demand for high-speed fiber-optic networks and a need for low-loss optical signal routing. They are important pieces of DWDM, FTTH, and high capacity backbone systems to achieve efficient bi-directional traffic. The Demand for robust, high-performance circulators is growing as 5G and ultra-fast broadband spreads to remote and underserved areas.

To Get more information on Fiber Optic Circulators Market - Request Free Sample Report

Moreover, increasing adoption of high-speed optical modules (400G and 800G) and data centers, AI workloads, and smart infrastructure is further augmenting the demand for fiber optic circulators, thereby validating the demand for fiber optic circulators in current communication networks.

In February 2024, China announced that 2023 saw the installation of 4.74 million km of optical fibre which raised the national aggregate total to 64.32 million km. The country also said it would extend 1,000 Mbps fiber and 5G networks to all border counties and townships across by the end of 2025.

Fiber Optic Circulators Market Dynamics:

Drivers:

-

Policy Shift to Tech-Neutral Broadband Drives Demand for High-Performance Fiber Optic Circulators

The evolving broadband infrastructure policy is reshaping the fiber optic circulators market by shifting deployment strategies. As funding shifts from fiber-centric programs to a technology-agnostic one, a hall break could come from an overall fiber buildout slowdown. But this shift has refocused attention on how to optimize and fortify already-in-place, high-capacity fiber networks. With investment increasingly targeted to strategic infrastructure - including 5G backhaul, data centers, and metro-core networks - the market for advanced fiber optic circulators is growing. These materials are essential for preserving signal integrity, providing high bandwidth, and delivering efficient bidirectional transmission in performance-demanding environments. As a result, the policy shift is spurring innovation and targeted deployment of high-efficiency circulators in situations where fiber performance is mission critical.

The US government has stripped the USD 42.45 billion BEAD (broadband) program of its preference for fibre, instead opting for a more technology neutral approach. That shift could place USD 10–USD 20 billion in orbit around satellite offerings (like Starlink), in turn prompting complaints about reduced quality and speed elsewhere.

Restraints:

-

High Costs, Alternatives, and Technical Barriers Slow Adoption and Deployment of Fiber Optic Circulators

The fiber optic circulators market is restrained by several interconnected factors. Cause: High manufacturing costs, technical complexity, and competition from alternative technologies like satellite and wireless broadband reduce the appeal of fiber-based systems in certain regions. Additionally, issues such as insertion loss, polarization sensitivity, and supply chain disruptions hinder performance and production. Effect: These challenges slow down the adoption of circulators, especially in cost-sensitive or remote markets, limiting their use to high-performance applications and reducing the pace of broader infrastructure deployment.

Opportunities:

-

Trade Tensions and Regulatory Actions Drive Diversified Sourcing and Regional Demand for Fiber Optic Circulators

Trade policy shifts and regulatory enforcement are creating new opportunities for the fiber optic circulators market. As global supply chains face increased scrutiny, manufacturers are moving toward diversified and regionally balanced production models to ensure compliance and minimize risk. With global supply chains under closer scrutiny, manufacturers are shifting to more diversified and regionally balanced production structures in a bid to remain compliant and mitigate risk. This shift is driving the requirement for high-performance circulators at new manufacturing hubs and regional infrastructure projects. Increasing emphasis on local supply, robust supply integrity and stable trade partnerships means circulator suppliers are poised to scale throughout mature and emerging economies. They are also favorable to investing in innovation, quality improvement and production flexibility – crucial elements to remain competitive and drive Fiber Optic Circulators Market growth in today’s changing optical communications space.

On March 4, 2025, China’s Ministry of Commerce launched its first anti-circumvention investigation into fiber optic products imported from the U.S., citing suspected tariff code manipulation to bypass existing anti-dumping duties.

Challenges:

-

Technical Complexities, Cost Pressures, and Supply Chain Risks Drive Operational and Adoption Challenges in the Fiber Optic Circulators Market

The fiber optic circulators market faces several key challenges that impact growth and scalability. Precision manufacturing requirements and tough performance standards complicate and drive up cost of production, which in turn hinders accessibility to smaller players and emerging markets. Furthermore, fluctuations in raw material prices and disturbances in global supply chains may cause delays in deliveries and inflation of production costs. Technical issues—such as insertion loss, polarization sensitivity, and wavelength dependence—also hamper performance enhancement when applied to complex optical components. In addition, regulatory mismatches and unstable policies related to broadband infrastructure across regions result in market uncertainty, which hinders long-term planning and investment. These factors together lead to formidable operational burdens and adoption barriers for the players in the fiber optic circulators space.

Fiber Optic Circulators Market Segmentation Analysis:

By Type

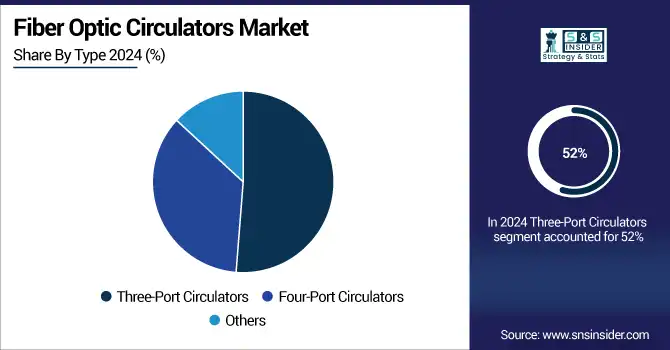

The Three-Port Circulators segment held a dominant Fiber Optic Circulators Market share of around 52% in 2024, due to its extensive utilization in dense wavelength division multiplexing (DWDM), bidirectional communication systems, and optical amplifiers. Because of their small form factor, low cost, and low power consumption, they are also attractive to network equipment providers in telecom, data center, and broadband infrastructure facets.

The Four-Port Circulators segment is expected to experience the fastest growth in the Fiber Optic Circulators Market over 2025-2032 with a CAGR of 11.15%, due to the rising requirement for advanced signal routing in complex optical systems. The capability of performing multiplexing, demultiplexing and high network flexibility make them suitable for next-generation telecom networks, high-speed data center, photonic integrated circuits, etc.

By Application

The Telecommunications segment held a dominant Fiber Optic Circulators Market share of around 40% in 2024, due to the widespread high-speed bandwidth and 5G network expansion. The rise of DWDM systems and fiber-optic backhauling technology has created a surge in the requirement cfor circulators, which allow higher speed, more efficient bi-directional data transport while cutting down on signal loss and increasing bandwidth in the core of telecom systems.

The Data Centers segment is expected to experience the fastest growth in the Fiber Optic Circulators Market over 2025-2032 with a CAGR of 12.73%, driven by surging data traffic and demand for high-speed, low-latency connectivity. Circulators play a critical role in enhancing signal integrity and routing efficiency in dense optical networks, supporting hyper scale infrastructure and cloud-based applications.

By End User

The IT and Telecommunications segment held a dominant Fiber Optic Circulators Market share of around 38% in 2024, fueled by the accelerating rollout of 5G, rising data consumption, and growing adoption of cloud services. The demand for high-speed, reliable data transmission has boosted the integration of circulators in fiber-optic networks, enabling efficient, bidirectional signal flow and enhanced network scalability.

The Healthcare segment is expected to experience the fastest growth in the Fiber Optic Circulators Market over 2025-2032 with a CAGR of 12.91%, owing to rising adoption of fiber optics in medical imaging, diagnostics, and minimally invasive surgical procedures. Circulators improve the performance of optical coherence tomography (OCT) machines allowing for accurate imaging along with high-speed data communication in state-of-the-art healthcare solutions.

Fiber Optic Circulators Market Regional Outlook:

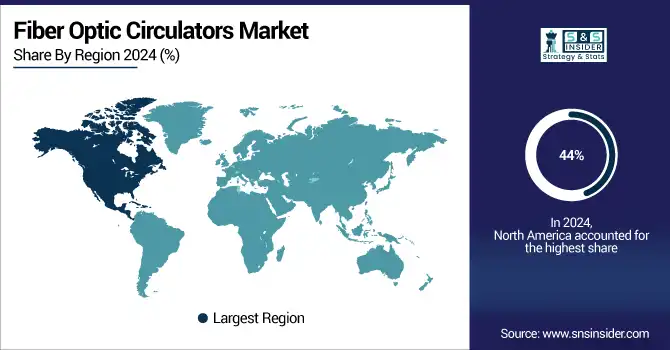

In 2024, North America led the Fiber Optic Circulators market with a 44% share, due to increasing deployment of high speed broadband and 5G infrastructure and growing investment in data centers. Active government support, policy-driven fiber expansion programs, and rising demand for robust, high-bandwidth communication networks have boosted the uptake of fiber optic circulators in telecom, cloud services, and enterprise network applications.

The Fiber Optic Circulators market in the U.S. is expanding steadily, driven by the rapid deployment of fiber networks, rising internet usage, and the growing demand for high-speed connectivity. The surge in 5G rollouts, cloud computing, and data-intensive applications is boosting the need for efficient optical components like circulators, which are essential for maintaining signal integrity and network performance.

T-Mobile is reportedly planning a USD 1 billion fiber joint venture with Lumos Networks to expand fiber-optic infrastructure in Virginia.The move marks T-Mobile’s strategic push to strengthen its fiber footprint alongside ongoing national broadband expansions.

Asia-Pacific is expected to witness the fastest growth in the Fiber Optic Circulators Market over 2025-2032, with a projected CAGR of 11.03%, due to surge in the investments for telecom infrastructure, such as new data centers and space for future development, increased share of internet using devices and smart city initiatives. The increasing number of 5G deployments, the pace of urbanizations, and the need for high capacity data transmission drive the adoption of circulators across dynamic optical communications landscape in the region.

China FIBERTalk 2024, held in Optics Valley, spotlighted AI-driven advancements in fiber optic networks, emphasizing high-speed, intelligent infrastructure.Industry leaders and researchers discussed innovations enabling AI-era demands, highlighting fiber's critical role in accelerating data transmission and next-gen connectivity.

In 2024, Europe emerged as a promising region in the Fiber Optic Circulators market, as a result of rising investments in fiber broadband infrastructure, smart city projects, and cross-border data connectivity projects. With government support, many digitalization programs and the rapid deployment of high-speed networks have been driving demand for advanced optical components such as circulators that enable the efficient routing of signals and enable higher performance in expanding optical communications systems.

In early 2024, Russia’s Rostelecom expanded LTE and fiber infrastructure to underserved regions under the UCN 2.0 program, connecting remote communities with government-backed support.This initiative, in collaboration with the Ministry of Digital Affairs, aims to reduce digital inequality in rural areas across the country.

LATAM and MEA is experiencing steady growth in the Fiber Optic Circulators market, due to the increasing broadband penetration, digital divide and mobile network developments. Surge in initiatives taken by the government, growth in internet penetration, and demand for better and reliable high-speed communication infrastructure would further foster the demand for circulators, ensuring effective optical signal management.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The Fiber Optic Circulators Companies Corning, Fujikura, Finisar, Thorlabs, Lumentum, Furukawa, Santec, AC Photonics, Agiltron, DK Photonics. and Others.

Recent Developments:

-

In May 2025, Fujikura launched high-density SWR®/WTC® optical fiber cables, enabling compact, flame-retardant, and efficient deployments for advanced communication networks.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.35 Billion |

| Market Size by 2032 | USD 2.85 Billion |

| CAGR | CAGR of 9.78% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Light Source(LED, High-intensity Discharge (HID) Lighting, Fluorescent Lighting) • By Product Type(High/Low Bay Lighting, Flood/Area Lighting) • By End User Application(Oil and Gas, Mining, Pharmaceutical, Manufacturing, Warehouse, Other End-user Applications) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The Fiber Optic Circulators market market companies Corning, Fujikura, Finisar, Thorlabs, Lumentum, Furukawa, Santec, AC Photonics, Agiltron, DK Photonics. and Others. |