FinFET Technology Market Size & Trends:

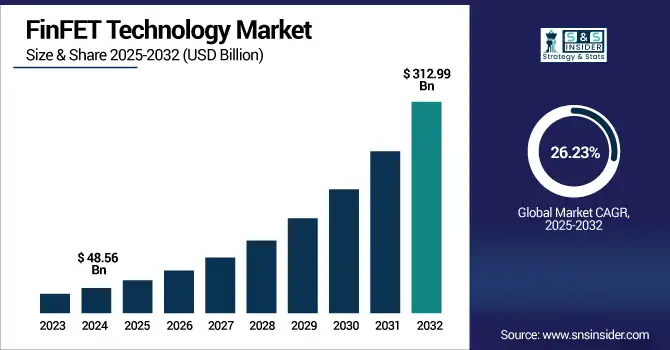

The FinFET Technology Market Size was valued at USD 48.56 Billion in 2024 and is expected to reach USD 312.99 Billion by 2032 and grow at a CAGR of 26.23% over the forecast period 2025-2032.

To Get more information on FinFET Technology Market - Request Free Sample Report

The FinFET technology market is experiencing robust growth, due to rising demand for high performance, low power consuming semiconductors for multiple applications such as the AI, smart phones, automotive electronics and data centers. FinFET, an acronym which stands for Fin Field-Effect Transistor, possess superior switching speed, lower leakage current, and better scalability than the conventional planar transistor. With chipmakers driving toward advanced process nodes below 7nm, the FinFET architecture is necessary in order to deliver escalating device performance while consuming reduced energy. The market is also driven by the increasing penetration of advanced processors, rising R&D investments and growing demand for small size devices. With the development trend of semiconductor industry towards advanced process technology, FinFETs continue to be the key element in the future electronics.

Chinese researchers have developed a silicon-free transistor, as published in a recent study, that could allow chips to operate 40% faster while using 10% less power compared to leading U.S. silicon-based processors. This breakthrough in 2D materials represents a significant shift in transistor technology and has the potential to transform the future of chip manufacturing.

The U.S FinFET Technology Market Size was valued at USD 7.55 Billion in 2024 and is expected to reach USD 53.48 Billion by 2032 and grow at a CAGR of 27.68%over the forecast period 2025-2032, driven by rising demand for high-performance and energy-efficient chips in sectors like AI, consumer electronics, and automotive. With increasing investments in advanced semiconductor manufacturing and strong R&D capabilities, the market is set to expand significantly, reflecting the country’s leadership in next-generation chip innovation and miniaturization.

Fin Field Effect Transistor Technology Market Dynamics:

Drivers:

-

Rising Chip Demand Fuels FinFET Innovation and Advanced Manufacturing Growth

The FinFET technology market is driven by very high demand for high-performance, and energy-efficient semiconductors that are used in advanced applications such as automotive electronics, industrial automation, and smart devices. Since these applications need chips with higher performance and lower power, the industry is rapidly migrating from planar transistors to FinFET design. Consequently, investment in advanced manufacturing processes, such as 12nm and below, is surging. This will offer superior scalability, enhanced switching efficiency, and significantly reduced leakage current that are important for future devices. Overall, this transition is driving worldwide market adoption of FinFET technology, promoting innovation in chip design and broadening its use in emerging high-growth segments.

TSMC and parters ground break a EUR10 billion FinFET-capable semiconductor fab in Dresden with a 40,000 wafers/month capacity for Europe’s automotive and industrial markets. Supported by EU and German government aid, the facility is a significant step in consolidating Europe’s chip supply chain and developing its semiconductor ecosystem.

Restraints:

-

Shift Toward GAAFETs Threatens Long-Term FinFET Market Stability

As the semiconductor industry pushes beyond 3nm nodes, manufacturers are increasingly transitioning from FinFETs to Gate-All-Around FETs (GAAFETs) due to their superior electrostatic control and scalability. Because GAAFETs offer better performance, power efficiency, and reduced leakage at smaller geometries, they are becoming the preferred architecture for future chip designs. As a result, the long-term demand for FinFET technology is expected to decline, especially in high-end applications where advanced nodes are critical. This shift may deter future investments in FinFET-based R&D and infrastructure, particularly as leading foundries reallocate resources toward GAAFET development. While FinFETs will remain relevant at mature nodes, their dominance in cutting-edge semiconductor fabrication may gradually diminish.

Opportunities:

-

Growing Autonomy Requirements Fuel Demand for Advanced Radar Processing Solutions

The increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving are providing major growth opportunities in radar processor market. Once available only for expensive ultra-luxury vehicles, imaging radar and AI/Machine Learning (ML) in an enhanced implementation are now available for all cars and light trucks, as the automotive industry needs high-resolution, accurate object detection and real-time environmental analysis for safe driving. Semiconductor companies therefore are concentrating on radar processors to provide more processing power, power efficiency and flexibility of integration. This translates into broader adoption among automotive OEMs seeking to improve safety capabilities and accommodate greater levels of vehicle automation. In the final analysis, the growing worldwide attention being paid to road safety and intelligent mobility is contributing to the growth in advanced radar processing technologies, placing it firmly in the camp of key area for innovation and investment.

NXP Announces New Generation Radar Processing Platform with Double the Channel Capability for Autonomous DrivingS32R47 offers best performance and best power efficiency for automotive radar while increasing the functionality of the platform by 2x.

Challenges:

-

Scaling Complexity and Tech Transition Challenge FinFET Market Growth

The FinFET technology market faces mounting challenges as the semiconductor industry advances toward smaller nodes and new architectures. Due to the complex 3D structures of FinFETs and expensive fabrication processes, FinFETs have high barriers to design, integration and mass production. And only a handful of giant foundries could ever afford to do it, making it difficult to spread the practice. Moreover, FinFETs suffer from thermal challenges and yield variation with advanced nodes. This results in higher cost of production and technical limitations, particularly as computer chips get smaller, more powerful and more in demand. Additionally, the evolution of the industry into the era of Gate-All-Around FETs (GAAFETs) for process nodes below sub-3nm, puts the long-term momentum in Fin-FETs into question. In the end, these all present strategic and technical risks that can impede ongoing market growth.

FinFET Technology Market Segmentation Overview:

By Product Type

The CPU segment held a dominant FinFET Technology Market share of around 29% in 2024, driven by increasing demand for high-performance computing across consumer electronics, data centers, and AI applications. FinFET's ability to deliver enhanced processing power and energy efficiency makes it ideal for modern CPU architectures, supporting faster execution, reduced power leakage, and improved thermal management in advanced computing systems.

The GPU segment is expected to experience the fastest growth in the Plasma Lighting Market over 2025-2032 with a CAGR of 30.26%, This growth is fueled by rising demand for high-performance graphics in gaming, AI, machine learning, and data-intensive applications. FinFET architecture enables superior parallel processing, power efficiency, and speed, making it ideal for next-generation GPU designs.

By Technology

The 14nm segment held a dominant FinFET Technology Market share of around 19% in 2024, owing to its widespread use in mainstream CPUs, GPUs, and SoCs. This node offers a balanced trade-off between performance, power efficiency, and cost, making it a popular choice for high-volume consumer electronics and computing devices, especially in markets prioritizing mature, reliable FinFET production.

The 5nm segment is expected to experience the fastest growth in the Plasma Lighting Market over 2025-2032 with a CAGR of 30.99%, this surge is driven by increasing demand for ultra-high-performance and energy-efficient chips in smartphones, AI, and advanced computing. The 5nm node offers enhanced transistor density, lower power consumption, and superior speed, supporting next-gen device innovation.

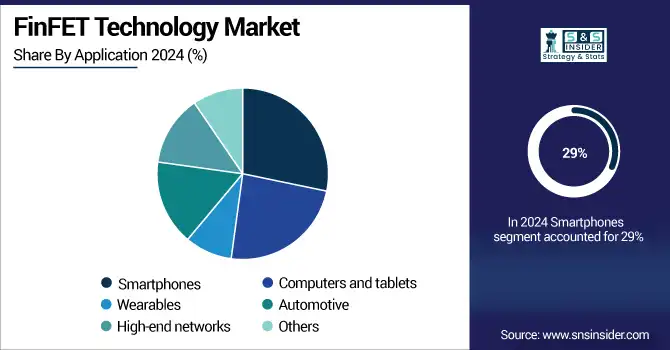

By Application

The Smartphones segment held a dominant FinFET Technology Market share of around 29% in 2024, driven by the increasing demand for high-speed, power-efficient processors in premium mobile devices. The widespread rollout of 5G, rising adoption of AI-powered applications, and growing consumer preference for enhanced performance and battery life in smartphones have accelerated the integration of FinFET chips by leading OEMs and chipmakers globally.

The Wearables segment is expected to experience the fastest growth in the Plasma Lighting Market over 2025-2032 with a CAGR of 30.29%, fueled by rising demand for lightweight, energy-efficient lighting solutions in smartwatches, fitness bands, and AR/VR devices. Increasing focus on health monitoring, compact design requirements, and extended battery life in wearable electronics are encouraging manufacturers to adopt plasma lighting technologies, which offer high brightness, durability, and low thermal output in miniature form factors.

FinFET Technology Market Regional Analysis:

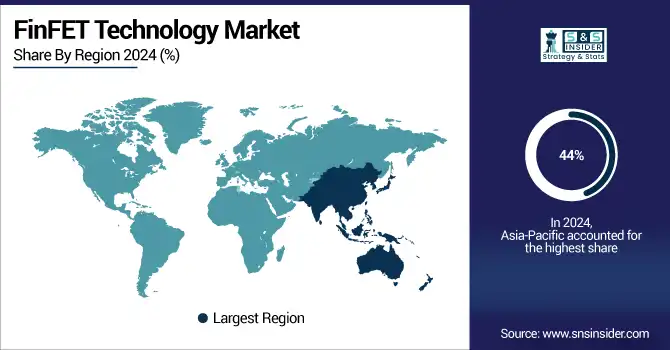

In 2024, Asia-Pacific dominated the FinFET Technology Market and accounted for 44% of revenue share, driven by the strong presence of semiconductor foundries, robust electronics manufacturing infrastructure, and high consumer demand for advanced smartphones and computing devices. Countries like China, South Korea, and Taiwan continue to invest heavily in chip fabrication and R&D, while government initiatives supporting digitalization and 5G deployment further fuel FinFET adoption across the region’s automotive, consumer electronics, and industrial sectors.

China leads the Asia-Pacific FinFET Technology Market due to its massive semiconductor investments, expanding 5G infrastructure, booming consumer electronics demand, and strong government support for chip self-sufficiency and innovation.

North is expected to witness the fastest growth in the FinFET Technology Market over 2025-2032, with a projected CAGR of 29.44%, driven by increasing adoption of advanced semiconductor technologies in AI, autonomous vehicles, and high-performance computing. Strong investments in R&D, presence of major chipmakers, and growing demand for energy-efficient processors across data centers and consumer electronics further boost regional market expansion.

In 2024, Europe emerged as a promising region in the FinFET Technology Market, supported by rising investments in semiconductor manufacturing, growing demand for electric vehicles, and advancements in industrial automation. The presence of key automotive OEMs, increasing focus on digital sovereignty, and strategic collaborations for chip innovation further enhance the region’s potential in adopting FinFET-based solutions.

LATAM and MEA is experiencing steady growth in the FinFET Technology market, driven by increasing digitalization, expanding telecom infrastructure, and rising demand for smart consumer devices. Government initiatives to boost local semiconductor capabilities, growing interest in AI and IoT applications, and gradual adoption of 5G technologies are contributing to the market’s expansion across emerging economies in these regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The FinFET Technology Market Companies are SAP SE, BluJay Solutions LLC, ANSYS Inc., Keysight Technologies, Analog Devices Inc., Infineon Technologies AG, NXP Semiconductors, Renesas Electronics Corporation, Robert Bosch GmbH, Texas Instruments Incorporated.

Recent Developments:

-

In 2024, Keysight launched ADS 2024, introducing improved support for Smart Mount, PDK interoperability, and layout verification—boosting RF/mmWave design workflows connected to FinFET production processes.

-

In Nov 2024, Renesas launched the R‑Car X5H, its first 3 nm multi-domain automotive SoC, pushing further miniaturization in FinFET-based automotive electronic

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 48.56 Billion |

| Market Size by 2032 | USD 312.99 Billion |

| CAGR | CAGR of 26.23% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (CPU, FPGA, GPU, SoC, MCU, Network processors, Others) • By Technology (22nm, 20nm, 16nm, 14nm, 10nm, 7nm, 5nm) • By Application (Smartphones, Computers and tablets, Wearables, Automotive, High-end networks, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The FinFET Technology market companies are SAP SE, BluJay Solutions LLC, ANSYS Inc., Keysight Technologies, Analog Devices Inc., Infineon Technologies AG, NXP Semiconductors, Renesas Electronics Corporation, Robert Bosch GmbH, Texas Instruments Incorporated. |