Computer Microchips Market Size & Growth:

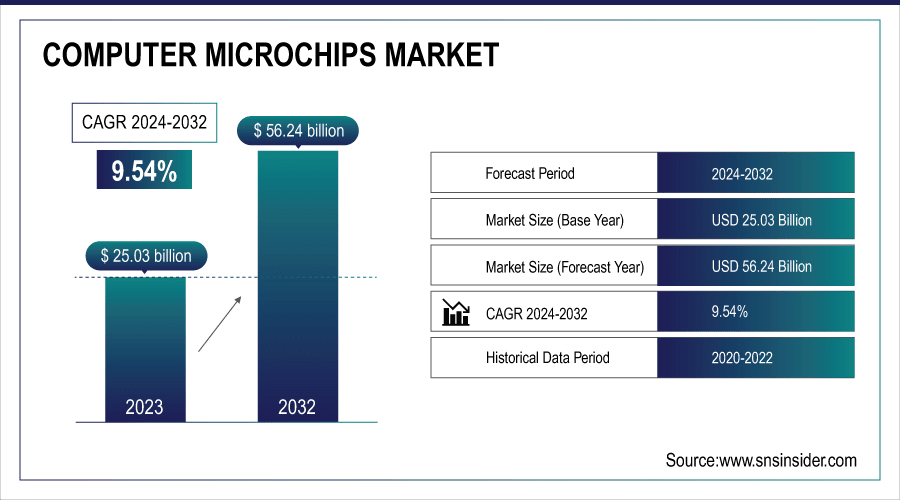

The Computer Microchips Market Size was Valued USD 25.03 billion in 2023 and expected to reach USD 56.24 billion with a CAGR of 9.54% During 2024 to 2032.

This expansion is driven by growing demand from different sectors, including consumer electronics, automotive, telecommunications, and AI. As the adoption of newer technologies such as AI, IoT, and 5G continues to grow, the demand for high-performance microchips is also speeding up. Moreover, the efforts of governments to boost local semiconductor manufacturing and the world's transformation to digitalization are also contributing to market growth. The data processing segment continues to dominate, and AI and machine learning applications are becoming the most rapidly growing.

To Get More Information On Computer Microchips Market - Request Free Sample Report

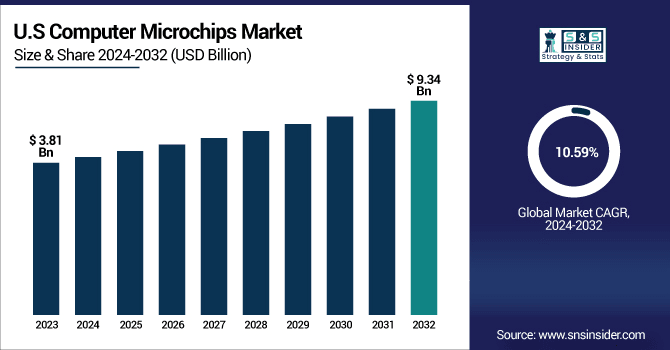

The U.S. Computer Microchips Market was worth USD 3.81 billion in 2023 and is expected to grow to USD 9.34 billion by 2032, growing at a strong CAGR of 10.59% from 2024 to 2032.

This expansion is fueled by the nation's robust position in advanced semiconductor design and fabrication, with industry leaders such as Intel, AMD, and NVIDIA having their headquarters in the U.S. The industry is fueled by increasing demand for microchips in AI, cloud computing, data centers, and defense. Government initiatives, including the CHIPS and Science Act, are also fueling domestic manufacturing and R&D spending. With the pace of technological innovation continuing to increase, America remains the main force driving the global computer microchips market.

Computer Microchips Market Dynamics

Key Drivers:

-

Rising Adoption of Artificial Intelligence and Machine Learning Accelerates Growth in the Computer Microchips Market.

The increasing use of artificial intelligence (AI) and machine learning (ML) across sectors is a major growth driver for the computer microchips market. AI and ML-based applications require high-performance microchips with the ability to process complex calculations and data at scale. Industries like healthcare, finance, automotive, and manufacturing are increasingly employing AI for predictive analytics, automation, and decision-making, further driving the use of microchips. As the technology of AI develops, so does the demand for special chips such as GPUs, ASICs, and FPGAs that can optimize power and performance. Such increased demand is prompting businesses to invest in revolutionary chip designs, boosting speed as well as efficiency, thereby fueling huge market growth during the forecast period.

Restrain:

-

High Production Costs and Complex Manufacturing Processes Hinder the Growth of the Computer Microchips Market.

One of the key constraints working against the computer microchips market growth is the complexity and expense of its production. It takes advanced fabrication facilities (fabs), precision instrumentation, and years of research and development, with all of that requiring huge upfront capital investment.

Moreover, managing cleanroom facilities, procuring scarce raw material, and defining chip precision in the nanometric scale make its production expensive as well as highly technical. Smaller firms tend to have difficulty competing against industry leaders as a result of these obstacles, which restricts wider market engagement. Additionally, any supply chain disruption, for example, a shortage of semiconductors or raw materials, can extend production timelines quite considerably, thus creating additional impediments in expanding operations effectively.

Opportunities:

-

Rising Government Initiatives and Investments in Semiconductor Infrastructure Present Lucrative Opportunities for Market Expansion.

Governments worldwide are increasingly focusing on the growth of local semiconductor capabilities, offering a huge opportunity for the computer microchips market. Strategic policies and incentives, including the U.S. CHIPS and Science Act, are intended to increase local chip manufacturing, lower dependence on imports, and promote technological innovation. These programs tend to involve subsidies for constructing fabs, tax credits, and direct funding for R&D in microchip technology. This assistance not only enhances national security but also creates development opportunities for incumbent players and new entrants alike. As nations strive to become independent in chip production, the market is set to gain from enhanced investment, innovation, and growth across different geographies.

Challenges:

-

Supply Chain Vulnerabilities and Geopolitical Tensions Pose Persistent Challenges for the Global Computer Microchips Market.

The market for computer microchips is subject to persistent difficulties associated with supply chain weaknesses globally and increasing geopolitical tensions. The manufacture of microchips relies on a very sophisticated, interdependent global supply chain that traverses several nations, from raw material extraction countries through chip design, fabrication, packaging, and distribution. Interruptions from trade limitations, political unrest, or conflicts like U.S.-China tensions can seriously affect the timely supply of critical components. In addition, reliance on a small group of nations to produce key chips, especially Taiwan and South Korea, puts the industry at high risk. Such issues require diversification policies and measures to mitigate risk, which are cost-driven and affect profitability and efficiency throughout the industry.

Computer Microchips Market Segment Analysis

By Type

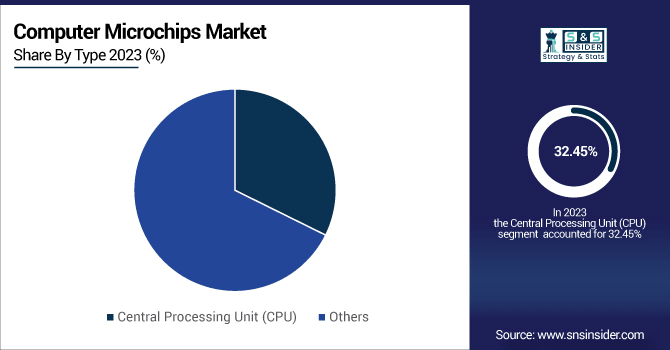

The Central Processing Unit (CPU) category held the highest revenue share of 32.45% in the computer microchips market during 2023 due to its presence in every computing device. Major companies, including Intel and AMD, have led the pack in innovation, with Intel releasing its 14th Gen Core processors and AMD increasing its Ryzen 7000 series, designed for better multitasking and gaming capabilities. These innovations are driven by increasing demand in consumer electronics and business applications. As workloads go digital, the CPU segment remains the bedrock of the market, fueling much of the expansion of high-performance computing and data-driven ecosystems.

The Memory Chips segment, including RAM, ROM, and Flash memory, is expected to expand at the highest CAGR of 11.70% during 2032, driven by the explosion in data creation, cloud computing, and AI usage. Micron Technology and Samsung Electronics have introduced high-capacity DDR5 and LPDDR5X memory solutions, which improve speed, power consumption, and capacity. These innovations are vital for servers, mobile phones, and data centers. With increasing adoption of connected technologies and AI-based systems across industries, the need for high-speed, dependable memory chips is picking up momentum, making this segment a major growth driver for overall growth in the computer microchips market over the forecast period.

By End-Use Industry

The consumer electronics sector contributed the maximum revenue share of 28.41% in the market for computer microchips in 2023 due to speedy technological development and increasing worldwide demand for smartphones, tablets, PCs, and gaming consoles. Brands like Apple and Qualcomm have introduced high-speed chips like the Apple A17 Pro and Snapdragon 8 Gen 3, delivering improved experiences through enhanced speed, AI performance, and power efficiency. The growing integration of smart technologies, 5G, and AI capabilities into daily devices keeps the segment driving. Constant innovation and upgrading of products keep consumer electronics a pillar in driving growth in the microchip market globally.

The automotive sector is anticipated to advance at the Fastest CAGR of 12.18% over the forecast period due to increasing adoption of electric vehicles (EVs), autonomous driving, and advanced driver-assistance systems (ADAS). Industry leaders such as NVIDIA, NXP Semiconductors, and Tesla are creating AI-driven automotive chips like NVIDIA's DRIVE Thor and NXP's S32G3 processors to drive next-generation vehicle architectures. These chips enable real-time processing, connectivity, and safety-critical functionality. As cars become more software-defined and connected, the demand for high-performance, reliable microchips is growing steadily, putting the automotive industry in a position to become a major growth driver in the computer microchips market.

By Application

In 2023, the data processing segment dominated the computer microchips market with a 40.50% revenue share, fueled by record-high demand for computing horsepower in data centers, enterprise use cases, and cloud infrastructure. Industry giants like Intel, AMD, and IBM continue to innovate higher-end processors such as Intel's Xeon Scalable chips and AMD's EPYC series to support high-throughput, low-latency workloads. The growth of big data, analytics, and virtualization has increased the demand for high-performance microchips that can handle data efficiently. With companies heavily investing in IT infrastructure, the data processing segment continues to be the bedrock of overall market growth and innovation in chip performance.

The AI/ML market is projected to grow at the Fastest CAGR of 12.45% during 2032, driven by growing AI adoption in industries such as healthcare, automotive, and finance. NVIDIA, Google, and AMD are driving innovation through products like NVIDIA's H100 Tensor Core GPU and Google's TPU v5, which are primarily aimed at speeding up AI training and inference. These chips provide augmented compute power focused on deep learning and real-time data processing. With increased deployment of AI-enabled applications and intelligent devices, the AI/ML segment is an important driver forming the future of the computer microchips market.

Computer Microchips Market Regional Analysis

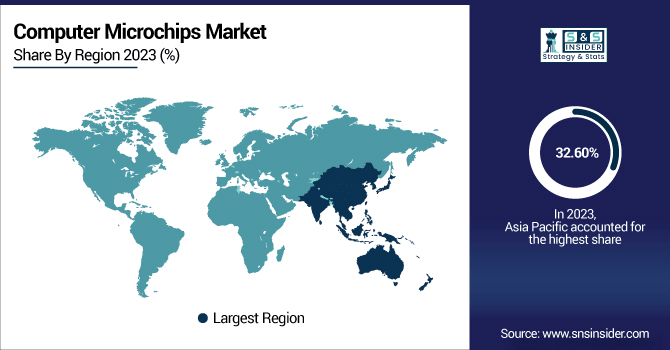

In 2023, the Asia Pacific accounted for the highest share of 32.60% in the international market for computer microchips due to its strong semiconductor industry base and increasing demand in consumer electronics and auto industries. Nations such as China, South Korea, Taiwan, and Japan boast chip leaders like TSMC, Samsung Electronics, and SMIC. Samsung's development of its 3nm process node and TSMC's innovations in 2nm chip technology demonstrate the region's technological dominance. Asia Pacific also enjoys firm government backing and increasing local consumption. Such a dominant regional standing supports global supply chains and continues to drive overall market expansion.

North America is expected to grow at the fastest CAGR of 11.87% in the computer microchips market during the forecast period due to increasing demand for AI, cloud computing, and defense technologies. The United States dominates the region, with Intel, AMD, and NVIDIA being the prominent ones that have been making tremendous progress. Intel has ramped up local production with new Arizona fabs, and NVIDIA continues to lead in AI chip development with H100 GPUs. The CHIPS and Science Act has also further ramped up investment in semiconductor manufacturing and R&D. This conducive environment and robust innovation pipeline put North America on the map as a key growth driver in the global microchips market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Key Companies Listed in the Computer Microchips Market Report are:

-

Samsung Electronics – (Exynos 2200, LPDDR5X DRAM)

-

Intel Corporation – (Intel Core i9-14900K, Xeon Scalable Processor (4th Gen))

-

Advanced Micro Devices (AMD) – (Ryzen 9 7950X, EPYC 9654)

-

Taiwan Semiconductor Manufacturing Company (TSMC) – (N3E Process Technology, CoWoS (Chip-on-Wafer-on-Substrate) Packaging)

-

Micron Technology – (Crucial DDR5 RAM, Micron 9400 NVMe SSD)

-

NVIDIA Corporation – (H100 Tensor Core GPU, RTX 4090 GPU)

-

Broadcom Inc. – (Trident 4 Ethernet Switch Chip, BCM4389 Wi-Fi 6E Chip)

-

Qualcomm Incorporated – (Snapdragon 8 Gen 3, Qualcomm AI Engine)

-

STMicroelectronics – (STM32H7 Microcontroller, STiH418 Set-Top Box SoC)

-

Texas Instruments Incorporated – (Sitara AM62 Processor, TMS320C6678 DSP)

Computer Microchips Market Trends

-

April 2025, NVIDIA announced plans to manufacture artificial intelligence supercomputers and Blackwell chips in the United States for the first time. The company has secured over one million square feet for production and testing facilities in Arizona and Texas, aiming to build up to $500 billion in AI infrastructure over the next four years. Production has commenced at TSMC’s Phoenix facility, with supercomputing plants under construction in Houston and Dallas through partnerships with Foxconn and Wistron.

-

April 2025 , AMD is advancing its Zen 5 microarchitecture, with the Ryzen 9000 series desktop processors (codenamed "Granite Ridge") and Epic 9005 server processors (codenamed "Turin") launched in the latter half of 2024. These processors are fabricated on TSMC's N4P process, offering improved performance and efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 25.03 Billion |

| Market Size by 2032 | USD 56.24 Billion |

| CAGR | CAGR of 9.54 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type of Microchip – (Central Processing Unit (CPU), Graphics Processing Unit (GPU), Memory Chips, Application-Specific Integrated Circuit (ASIC), Field-Programmable Gate Array (FPGA), Others) •By End-Use Industry – (Consumer Electronics Automotive, Industrial, Healthcare, Aerospace and Defense, Telecommunications, Others) •By Application – (Data Processing, Graphics Rendering, Artificial Intelligence and Machine Learning, Networking and Connectivity, Sensor Integration, Encryption and Security, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Intel Corporation,Advanced Micro Devices (AMD),Taiwan Semiconductor Manufacturing Company (TSMC), Micron Technology, NVIDIA Corporation, Broadcom Inc., Qualcomm Incorporated, STMicroelectronics, Texas Instruments Incorporated. |