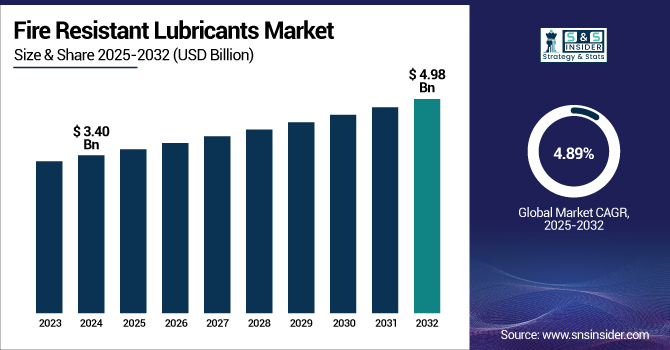

The Fire Resistant Lubricants Market size was USD 3.40 billion in 2024 and is expected to reach USD 4.98 billion by 2032 and grow at a CAGR of 4.89% over the forecast period of 2025-2032.

To Get more information on Fire Resistant Lubricants Market - Request Free Sample Report

Rising usage in the metal processing & mining industry drives the fire resistant lubricants market growth. The increasing use of fire-resistant lubricants in the metal processing and mining industries is a significant factor due to the nature of these high-risk and high-temperature environments. Extreme heat and heavy loads in metal processing increase the fire hazard of conventional lubricants. Flame retardant replacements not only ensure the safety and efficiency of operation, but also help attain rigid safety standards set out by various industries.

The fire resistant lubricants market companies focused on development. For instance, in January 2024, Shell U.K. Limited purchased synthetic and natural ester-based transformer fluids, MIDEL and MIVOLT brands, from M&I Materials Ltd., offering solutions with improved fire safety and environmental performance.

Drivers:

Expansion of Automation and Robotics in Industry Drive Market Growth

The rise in automation and robotics in diverse industries is majorly contributing to the fire resistant lubricants industry expansion, as such systems require specialized lubricants to function in high-performance and automated systems. With industries, from manufacturing to mining to the automotive sector, evolving to more robotic processes and automated machines, the equipment becomes greater and more complicated, resulting in a higher risk of it overheating and facing a mechanical breakdown.

For instance, in 2024, The market saw its industrial robot density increase to 470 robots per 10,000 workers, more than twice its figure of 2019, to overtake Germany's level and to become third globally after South Korea and Japan. This increase in automation is driven by huge investments in automation, and China is already in first place in robot adoption, even before Japan and Germany.

Moreover, with a growing dependence on automated systems in industries, the need for fire resistant lubricants is expected to increase to facilitate the operation of high-performance machinery safely and effectively.

Restraints:

Complexity in Formulation and Application May Hamper the Market Growth

Complexity in the formulation and application of fire-resistant lubricants can hinder the growth of the market. Many fire-resistant lubricants use special synthetic blends and formulations to maintain extreme temperatures and pressures without sacrificing performance. Generating these specialty formulations necessitates extensive research, technical capabilities, and high-end raw materials, which all result in elevated production prices. The use of these lubricants also demands both equipment and specialized knowledge for their application, mainly in mining, manufacturing, and aerospace sectors.

Trends:

Development of Smart Lubricants Trends Propel Market Growth

Smart lubricants development is one of the trends that is expected to witness growth in demand in the fire resistant lubricants market. These newly advanced lubricants are embedded with a sensor that can help to monitor lubricant health through real-time data transmission by monitoring various parameters, such as temperature, viscosity, contamination, and overall lubricant health. This allows for predictive maintenance, minimal equipment downtime, and improved operational safety, especially for industries, such as metal processing, mining, and power generation, where equipment malfunction could pose fire risks.

In 2024, several key players focused on the fire resistant lubricants market trends, came up with substantial developments in smart lubricants that utilize sensor technologies and real-time surveillance. Such innovations are designed to improve safety, performance, and lower maintenance costs in aggressive industrial applications.

For instance, ExxonMobil launched new smart thermally conductive fire-resistant lubricants and anchoring sensors that allow real-time monitoring of temperature and other lubricant condition and performance metrics. The advancement allows for predictive maintenance and improves operational efficiency in industries, such as metal processing and power generation.

By Type

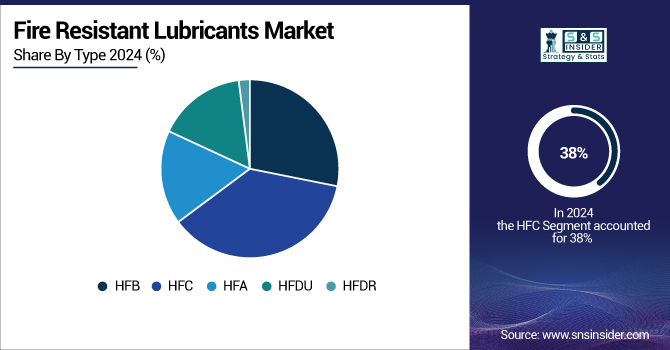

HFC held the largest fire resistant lubricants market share, around 38%, in 2024 owing to their favorable safety features and broad industrial acceptability. These are water-based lubricants that provide superior fire resistance, minimizing the risk of burning in high-temperature or high-pressure applications. Being non-flammable, they are suited for use in high-danger regions including steel production factories, mining, and generating regions, in which the danger of fire is excessive. Moreover, HFC fluids not only offer automatic lubrication and corrosion protection but are also the cheapest alternative to other, more costly fire-resistant alternatives, such as phosphate esters.

HFDU held a significant market share due to the great performance characteristics of these fluids in high-temperature and high-pressure industrial applications. HFDU fluids are fully synthetic and not water-based alternatives, which gives them an additional boost in thermal stability, oxidation resistance, and their lubricating properties.

By End-Use Industry

In 2024, the construction segment held the largest market share of approximately 38%. This is due to the construction relies on machinery including excavators, cranes, bulldozers, and hydraulic systems that need lubricants able to endure tough working conditions and maintain equipment safety. Fire-resistant lubricants are essential to mitigate fire risks in these high-risk applications, particularly in confined spaces or high-heat areas of construction such as tunnels, high-rise buildings, and infrastructure projects.

Mining segment held a significant market share. The segment’s expansion is driven by the high exposure to accident at the work site, inherent dangers of mining operations, and a heavy usage of power-driven machines in a limited space of a combustible atmosphere. Drills, conveyors, crushers, hydraulic systems, and similar machinery work in extreme conditions of extreme pressure and temperature and under high friction rates, which increases the fire hazard. Fireproof lubricants play a crucial role in minimizing these hazards by lowering the risk of ignition and ensuring proper functioning in critical conditions.

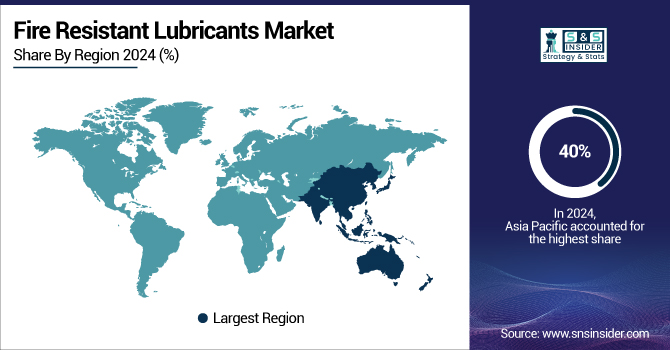

Asia Pacific held the largest market share of approximately 40% in 2024. The region’s growth is driven by the rapid industrialization in the region, along with higher demand for industrial safety solutions and a large manufacturing base. The hydraulic machinery and high-performance lubricants market has continued to grow rapidly in countries such as China, India, Japan, and South Korea, on the back of booming sectors including construction, mining, steel, automotive, and power generation. This is further being supported by increasing implementation of workplace safety regulations and growing adoption of automated and heavy-duty equipment, boosting the regional demand for fire resistant lubricants.

For instance, in 2024, Chevron Oronite's OLOA® 59361 won the F&L Asia Product Development of the Year Award. FORMULA 1400 is a next-generation additive for heavy-duty lubricants used in a wide range of engines, including those in Asia Pacific countries, such as China and India. Its compatibility with re-refined base oils and biodiesel blends most often found in markets abroad, including Indonesia, Malaysia, and Thailand, also demonstrates its ability to adapt to regional market requirements.

North America held a significant market share and is expected to be the fastest-growing segment during the forecast period due to its well-established advanced manufacturing industry, along with a strong industrial core and stringent regulatory system. High-performance lubricants that provide safe operation under extreme conditions are required by industries, which are common throughout the U.S. and Canada, including aerospace, metal processing, construction, and mining.

The U.S held the largest market share, which was around 76% in 2024, and is projected to growth with the highest CAGR of 6.17% during the forecast period. The region’s growth is driven by the companies' focus on production. In 2022, Eastman Chemical Company announced its investment in new capacity at the Anniston, Alabama, plant to expand production of its fire-resistant fluid for Therminol 66 heat transfer fluid. Scheduled to be completed in 2024, this expansion will increase the U.S.-based capacity by 50%, strengthening Eastman's capacity to support the growing demand for fire resistant lubricants used across many industrial applications.

Europe is expected to hold a significant market share during the forecast period due to the existence of stringent government regulations backed with advanced technology, along with the presence of various industries that require high-performance lubricants. With strict safety and environmental standards implemented in the European Union, industries, such as aerospace, automotive, mining, pan & plant, and manufacturing, have switched to fire-resistant lubricants as per the need for compliance with the regulations that are accomplishing requirements for fire safety.

Middle East & Africa also held a significant market share. The region has substantial oil & gas and mining activities, which require high-performance lubrication under extreme conditions. Saudi Arabia, the UAE, South Africa, etc. have some of the planet's biggest oil refineries and mineral extraction operations, and fire hazards are significant in high-pressure, high-temperature machinery. As a result, these industries also need specific fire-resistant lubricants to ensure safe and going operations. Moreover, the adoption of the region's lubricants is boosted by government regulations and industry standards towards worker safety and environmental protection.

Get Customized Report as per Your Business Requirement - Enquiry Now

The fire resistant lubricants market companies include ExxonMobil Corporation, Shell plc, BP p.l.c, TotalEnergies SE, Fuchs Petrolub Se, Quaker Houghton, Chevron Corporation, The Dow Chemical Company, Eastman Chemical Company, and American Chemical Technologies Inc.

Recent Developments:

In 2024, Kodiak acquired Aztech Lubricants to enhance its specialty chemical portfolio to provide new markets and high-performance fire-resistant hydraulic fluids. The acquisition is expected to position Kodiak to expand its offering of advanced fluid solutions to industries.

In 2024, Shell U.K. Limited announced the completion of the acquisition of MIDEL and MIVOLT brands from M&I Materials Ltd., placing Shell in the pole position for fire-resistant hydraulic fluids.

| Report Attributes | Details |

| Market Size in 2024 | USD 3.40 Billion |

| Market Size by 2032 | USD 4.98 Billion |

| CAGR | CAGR of4.89% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (HFA, HFB, HFC, HFDU, HFDR) • By End-Use Industry (Metal Processing, Mining, Power Generation, Aerospace, Marine, Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ExxonMobil Corporation, Shell plc, BP p.l.c., TotalEnergies SE, Fuchs Petrolub Se, Quaker Houghton, Chevron Corporation, The Dow Chemical Company, Eastman Chemical Company, American Chemical Technologies Inc. |

Ans: The Fire Resistant Lubricants Market was valued at USD 3.40 billion in 2024.

Ans: The expected CAGR of the global Fire Resistant Lubricants Market during the forecast period is 4.89%

Ans: Construction will grow rapidly in the Fire Resistant Lubricants Market from 2025 to 2032.

Ans: Expansion of automation and robotics in industry drives the market growth.

Ans: Asia Pacific led the Fire Resistant Lubricants Market in the region with the highest revenue share in 2024.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization by Country, By Type, 2024

5.2 Feedstock Prices by Country, and Type, 2024

5.3 Regulatory Impact by Country and By Type 2024.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives by Region

5.5 Innovation and R&D, Type, 2024

6. Competitive Landscape

6.1 List of Major Companies By Region

6.2 Market Share Analysis By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion Plans and New Product Launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Fire Resistant Lubricants Market Segmentation By Type

7.1 Chapter Overview

7.2 HFA

7.2.1 HFA Trend Analysis (2021-2032)

7.2.2 HFA Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 HFB

7.3.1 HFB Market Trends Analysis (2021-2032)

7.3.2 HFB Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 HFC

7.4.1 HFC Market Trends Analysis (2021-2032)

7.4.2 HFC Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 HFDU

7.5.1 HFDU Market Trends Analysis (2021-2032)

7.5.2 HFDU Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 HFDR

7.6.1 HFDR Market Trends Analysis (2021-2032)

7.6.2 HFDR Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Fire Resistant Lubricants Market Segmentation By End-Use Industry

8.1 Chapter Overview

8.2 Metal Processing

8.2.1 Metal Processing Market Trends Analysis (2021-2032)

8.2.2 Metal Processing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Mining

8.3.1 Mining Market Trends Analysis (2021-2032)

8.3.2 Mining Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Power Generation

8.4.1 Power Generation Market Trends Analysis (2021-2032)

8.4.2 Power Generation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Aerospace

8.5.1 Aerospace Market Trends Analysis (2021-2032)

8.5.2 Aerospace Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Marine

8.6.1 Marine Market Trends Analysis (2021-2032)

8.6.2 Marine Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Construction

8.7.1 Construction Market Trends Analysis (2021-2032)

8.7.2 Construction Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2021-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Fire Resistant Lubricants Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.2.3 North America Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.2.4 North America Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.2.5.2 USA Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.2.6.2 Canada Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.2.7.2 Mexico Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.3 Europe

9.3.1 Trends Analysis

9.3.2 Europe Fire Resistant Lubricants Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.3.3 Europe Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.3.4 Europe Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.3.5 Germany

9.3.5.1 Germany Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.3.5.2 Germany Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.3.6 France

9.3.6.1 France Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.3.6.2 France Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.3.7 UK

9.3.7.1 UK Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.3.7.2 UK Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.3.8 Italy

9.3.8.1 Italy Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.3.8.2 Italy Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.3.9 Spain

9.3.9.1 Spain Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.3.9.2 Spain Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.3.10 Poland

9.3.10.1 Poland Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.3.10.2 Poland Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.3.11 Turkey

9.3.11.1 Turkey Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.3.11.2 Turkey Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.3.12 Rest of Europe

9.3.12.1 Rest of Europe Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.3.12.2 Rest of Europe Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Fire Resistant Lubricants Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.4.3 Asia Pacific Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.4.4 Asia Pacific Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.4.5.2 China Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.4.5.2 India Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.4.5.2 Japan Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.4.6.2 South Korea Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.4.7 Singapore

9.4.7.1 Singapore Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.4.7.2 Singapore Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

8.4.8 Australia

8.4.8.1 Australia Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

8.4.8.2 Australia Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.4.9 Rest of Asia Pacific

9.4.9.1 Rest of Asia Pacific Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.4.9.2 Rest of Asia Pacific Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.5 Middle East & Africa

9.5.1 Trends Analysis

9.5.2 Middle East & Africa Fire Resistant Lubricants Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.5.3 Middle East & Africa Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.5.4 Middle East & Africa Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.5.5 UAE

9.5.5.1 UAE Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.5.5.2 UAE Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.5.6 Saudi Arabia

9.5.6.1 Saudi Arabia Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.5.6.2 Saudi Arabia Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.5.7 Qatar

9.5.7.1 Qatar Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.5.7.2 Qatar Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.5.8 South Africa

9.5.8.1 South Africa Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.5.8.2 South Africa Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.5.9 Middle East & Africa

9.5.9.1 Middle East & Africa Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.5.9.2 Middle East & Africa Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Fire Resistant Lubricants Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.6.3 Latin America Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.6.4 Latin America Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.6.5.2 Brazil Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.6.6.2 Argentina Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.6.7 Rest of Latin America

9.6.7.1 Rest of Latin America Fire Resistant Lubricants Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.6.7.2 Rest of Latin America Fire Resistant Lubricants Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

10. Company Profiles

10.1 ExxonMobil Corporation

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Product / Services Offered

10.1.4 SWOT Analysis

10.2 Shell plc

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Product/ Services Offered

10.2.4 SWOT Analysis

10.3 BP plc.

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Product/ Services Offered

10.3.4 SWOT Analysis

10.4 TotalEnergies SE

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Product/ Services Offered

10.4.4 SWOT Analysis

10.5 Fuchs Petrolub Se

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Product/ Services Offered

10.5.4 SWOT Analysis

10.6 Quaker Houghton

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Product/ Services Offered

10.6.4 SWOT Analysis

10.7 Chevron Corporation

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Product/ Services Offered

10.7.4 SWOT Analysis

10.8 The Dow Chemical Company

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Product/ Services Offered

10.8.4 SWOT Analysis

10.9 Eastman Chemical Company

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Product/ Services Offered

10.9.4 SWOT Analysis

10.10 American Chemical Technologies Inc

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Product/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

HFA

HFB

HFC

HFDU

HFDR

By End-Use Industry

Metal Processing

Mining

Power Generation

Aerospace

Marine

Construction

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Germany

France

UK

Italy

Spain

Poland

Turkey

Rest of Europe

Asia Pacific

China

India

Japan

South Korea

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

UAE

Saudi Arabia

Qatar

South Africa

Rest of Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players