Sodium Benzoate Market Report Scope & Overview:

Get E-PDF Sample Report on Sodium Benzoate Market - Request Sample Report

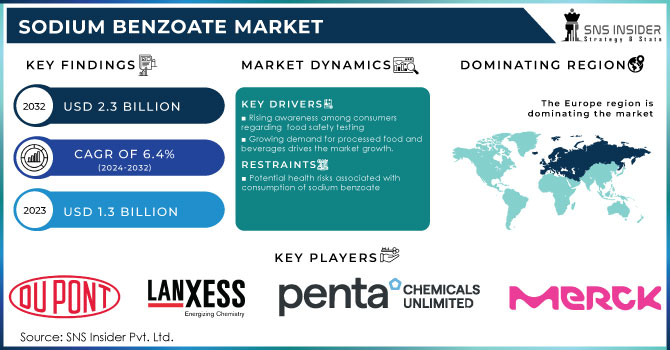

The Sodium Benzoate Market size was valued at USD 1.3 Billion in 2023. It is expected to grow to USD 2.3 Billion by 2032 and grow at a CAGR of 6.4% over the forecast period of 2024-2032.

The sodium benzoate market is driven by the rising demand for processed and packaged food products, especially in developing economies. The convenience and longer shelf life offered by these products have made them increasingly popular among consumers. Additionally, the expanding beverage industry, including carbonated drinks, juices, and energy drinks, has further fueled the demand for sodium benzoate. In Europe, the European Food Safety Authority (EFSA) regulates sodium benzoate usage and considers it generally safe when used within specified limits, typically up to 0.1% in foods. The EFSA conducts periodic assessments to ensure that levels remain within safe limits and considers factors such as increased processed food consumption when setting these regulations.

Sodium benzoate, a chemical compound widely used as a preservative in various industries, has become an essential ingredient in the food and beverage sector. This compound effectively inhibits the growth of bacteria, yeast, and fungi, thereby extending the shelf life of products. In recent times, there has been a growing concern among consumers regarding the safety of food and beverage products. In 2023, when Tate & Lyle, a global leader in food ingredients and solutions, announced the launch of a new line of sodium benzoate-based preservatives specifically designed for the food and beverage industry.

The sodium benzoate demand is increasing in pet food industry due to it’s a preservative quality in the pet food product. The trend results from the increasing concerns of preserving and making pet food products safe. Continually, the market is influenced by customers taking more concern in pet food nutrition and safety. Also, the process has been encouraged by the available regulations that support the use of safe preservatives.

The pet market, especially in the North American region, undergoing massive expansion has increased the demand for preservatives like sodium benzoate. For instance, pet food accounted for the largest share of the USD123.6 billion estimated U.S pet spending in 2021, according to the American Pet Products Association.

Drivers

-

Rising awareness among consumers regarding food safety testing

-

Growing demand for processed food and beverages drives the market growth.

The main factors driving the growth of the sodium benzoate market is the increasing demand for processed food and beverages. Sodium benzoate is a widely used preservative that has become indispensable for extending the shelf life of many foods, thus ensuring their safety. People’s fast-paced lifestyles and focus on convenience have led to a significant growth of the processed food sector, especially in North America and Europe. According to the U.S. Department of Agriculture study, processed foods constitute nearly 70% of Americans’ diets. As demand for processed food and beverages grows, the manufacturers increase the usage of preservatives, including sodium benzoate, to ensure customers’ expectations for safety and durability are satisfied.

Furthermore, urbanization and the shortage of free time have increased the need for ready-to-eat meals, thus pushing the processed food market, especially in developing countries where the growing disposable income nourishes the trend. Thus, sodium benzoate plays a role in compliance with the current safety regulations and provides people with the convenience they seek, ensuring that their newly found taste for the ready-to-eat meals remains satisfied.

Restraint

-

Potential health risks associated with consumption of sodium benzoate

Sodium benzoate, a commonly used food preservative, has been linked to certain health concerns. Studies have suggested that when combined with certain ingredients, such as vitamin C, sodium benzoate can form benzene, a known carcinogen. This has raised concerns among consumers and regulatory bodies regarding its safety. The presence of potential health risks has led to a decline in the demand for sodium benzoate in various industries, including food and beverages. Consumers are becoming increasingly conscious of the ingredients they consume and are seeking alternatives that are perceived as safer and healthier.

Opportunities

-

Increasing demand for clean-label products and natural preservatives

In recent years, there has been a notable shift in consumer preferences towards natural and healthier food products. As a result, the food and beverage industry has witnessed a surge in the demand for preservatives derived from natural sources. Sodium Benzoate offers several advantages over its synthetic counterparts. It not only effectively inhibits the growth of bacteria, yeast, and molds but also extends the shelf life of food and beverage products. Additionally, it does not alter the taste, color, or texture of the preserved items, ensuring that the original quality is maintained. The Sodium Benzoate Market has witnessed a significant upsurge due to these factors.

Market segmentation

By Form

The powder form segment dominated the sodium benzoate market with the highest revenue share of about 61.4% in 2023. The powder segment's dominance is attributed to the convenience and ease of use. It can be effortlessly mixed with other ingredients, ensuring a seamless integration into various products. The powder form's ability to prolong the shelf life of perishable goods contributes significantly to its market dominance.

The granules segment is expected to grow at a highest CAGR of about 6.6% over the forecast period. Sodium benzoate granules are in white color. Also, it is used as a preservative in food such as fruit juices, pickles, salad dressings, carbonated drinks, jams, etc. Sodium benzoate is used as an antifungal as it balances the pH inside individual cells, increasing the overall acidity of a product and making it more difficult for fungi to grow and reproduce. Fungi that are punctual of spoil food and these balances to kept it fresh, otherwise it can trim down its shelf life substantially.

By Application

The food and beverage end-user segment dominated the sodium benzoate market with a revenue share of about 46.8% in 2023. Increasing demand for convenience foods and ready-to-drink beverages has propelled the growth of the food and beverage end-user segment. As consumers seek quick and easy meal options, manufacturers have responded by incorporating sodium benzoate into their products to ensure their longevity and safety. This has led to an increased demand for natural and organic preservatives. However, sodium benzoate continues to dominate the market due to its effectiveness, affordability, and wide availability.

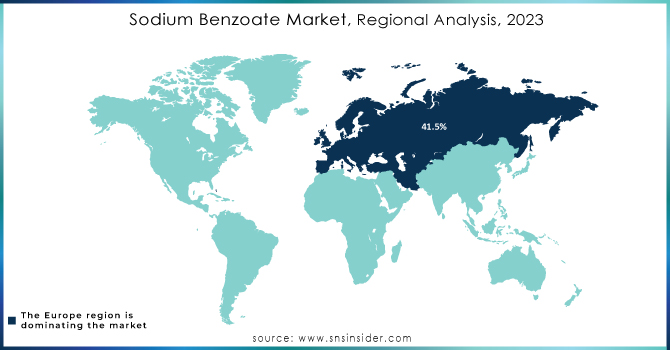

Regional Analysis

Europe dominated the sodium benzoate market with a revenue share of about 41.5% in 2023. Europe's strong regulatory framework and stringent quality standards have played a pivotal role in establishing its dominance. The European Union has implemented rigorous regulations regarding food safety and additives, including sodium benzoate. These regulations ensure that only products meeting the highest quality standards are allowed in the market, giving European manufacturers a competitive edge. Moreover, growing awareness among consumers regarding the importance of food safety and the harmful effects of microbial contamination has also contributed to the increased adoption of sodium benzoate in the region. According to the European Food Safety Authority the EFSA reaffirmed the acceptable daily intake (ADI) for sodium benzoate at 0-5 mg/kg body weight, emphasizing its safety when used within regulated limits. This standard reflects the strict regulatory environment in Europe concerning food additives and underscores consumer protection.

The Asia Pacific region is expected to grow with the highest CAGR of about 6.2% during the forecast period of 2024-2032. The Asia Pacific region boasts a burgeoning population, coupled with increasing disposable incomes. As a result, there is a rising demand for processed food and beverages, which often utilize sodium benzoate as a preservative. This trend is further fueled by changing lifestyles and a preference for convenience foods. Moreover, the Asia Pacific region is witnessing rapid urbanization and industrialization, leading to the establishment of numerous food and beverage manufacturing facilities. These industries rely heavily on sodium benzoate to extend the shelf life of their products and maintain their quality during transportation and storage.

Get Customised Report as per Your Business Requirement - Enquiry Now

Key Players

-

Lanxess AG

-

PENTA CHEMICALS

-

Merck KGaA

-

Avantor Inc.

-

Tulstar Products Inc.

-

Wuhan Youji Industries Co. Ltd.

-

FBC Industries Inc.

-

Aldon Corporation

-

Shandong Jinhe Industrial Co., Ltd.

-

Kraton Corporation

-

Nantong Yongyu Chemical Co., Ltd.

-

Hubei Greenhome Chemical Co., Ltd.

-

Jiangshan Chemical Co., Ltd.

-

Jiangsu Shuchang Chemical Co., Ltd.

-

Guangdong Jialin Pharmaceutical Co., Ltd.

-

Zhejiang Xinhai Technology Co., Ltd.

-

Wuxi Huashun Chemical Co., Ltd.

Recent Development:

-

In March 2023, LANXESS, a leading specialty chemicals company, showcased its extensive range of preservatives, multifunctional, and fragrances for cosmetics and personal care products at the prestigious In-Cosmetics event held in Barcelona from March 28 to 30.

-

In July 2022, LANXESS successfully completed the acquisition of the microbial control business unit of the renowned U.S. group, International Flavors & Fragrances Inc. (IFF). This strategic acquisition was valued at approximately USD 1.3 billion.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.3 Bn |

| Market Size by 2032 | US$ 2.27 Bn |

| CAGR | CAGR of 6.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Form (Granules, Powder, Flakes, and Others) • By Application (Antimicrobial Agent, Antifungal Agent, Preservative, Rust and Corrosion Inhibitor, and Others) • By End-user (Cosmetics, Pharmaceuticals, Food & Beverages, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | DuPont de Nemours Inc., Lanxess AG, PENTA CHEMICALS, Merck KGaA, Avantor Inc., Foodchem International Corporation, Tulstar Products Inc., Wuhan Youji Industries Co. Ltd., Spectrum Chemicals, FBC Industries Inc. |

| Key Drivers | • Growing demand for processed food and beverages • Rising awareness among consumers regarding food safety |

| Market Restraints | • Potential health risks associated with consumption of sodium benzoate |