Syntactic Foam Market Report Scope & Overview

Get E-PDF Sample Report on Syntactic Foam Market - Request Sample Report

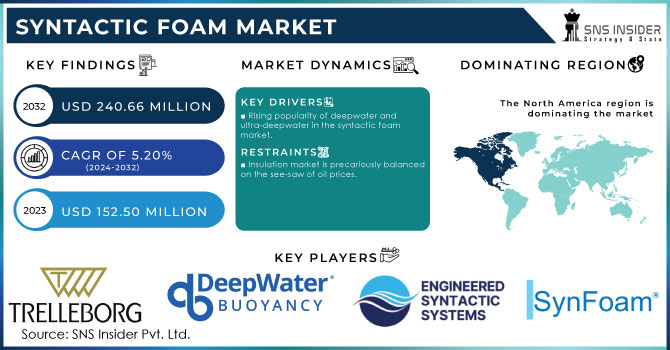

The Syntactic Foam Market Size was valued at USD 152.50 million in 2023 and is expected to reach USD 240.66 million by 2032 and grow at a CAGR of 5.20% over the forecast period 2024-2032.

Developments in submarine and marine technology have increased the demand for lightweight high-performance materials that can outperform traditional metals hence syntactic foam is into play. Its unique properties make it both buoyant and will repel water on the surface or underwater in a laid line out of shot form perfect for an endless variety of uses in and underwater which drives the market growth.

For instance, in 2023, Trelleborg launched a new line of advanced thermoplastic syntactic foams specifically designed for deep-sea applications. These materials offer enhanced buoyancy and durability, catering to the growing needs of submarine and marine engineering sectors.

Moreover, synthetic foam is becoming more popular in industries that value sustainability and environmental protection because of its strong resistance to challenging environmental conditions such as exposure to chemicals, extreme temperatures, and high-pressure environments. Syntactic foam is perfect for long-term use in tough environments, like deep-sea exploration, offshore oil and gas operations, and environmental monitoring equipment, due to its superior durability compared to traditional materials.

According to the U.S. Environmental Protection Agency (EPA), in 2022, there has been a 15% increase in the adoption of environmentally resilient materials in the offshore energy sector, driven by stricter regulations on environmental protection and sustainability. This ability to bounce back, in addition to being lightweight, helps decrease energy consumption when being transported and set up, which also supports the objectives of industries focused on sustainability.

Furthermore, the use of syntactic foam in sports equipment, such as surfboards and protective gear, is growing due to its lightweight, durable, and impact-resistant properties which drive the market growth.

MARKET DYNAMICS

KEY DRIVERS:

-

Rising popularity of deepwater and ultra-deepwater in the syntactic foam market.

The rising popularity of deepwater and ultra-deepwater exploration is significantly driving the demand for syntactic foam in the market. Driven by rising global demand for oil and gas, deepwater drilling activity is booming, particularly in the Gulf of Mexico, North Sea, and emerging regions like Brazil and Guyana. In February 2024, around 43% of all wells drilled by these companies were classified as ultra-deepwater. Technological advancements and cost reductions are making these projects more feasible, with Brazil leading the pack in ultra-deepwater production and attracting foreign investment with favorable policies. This surge in deepwater exploration is expected to fuel the market for materials like syntactic foam, crucial for these challenging operations. Syntactic foam, known for its low density and high compressive strength, is ideal for these conditions, making it a crucial material for subsea buoyancy modules, Unmanned Underwater Vehicles (UUVs), and other underwater equipment.

RESTRAIN:

-

Insulation market is precariously balanced on the see-saw of oil prices.

The insulation sector is greatly affected by changes in oil prices, leading to a delicate situation for the industry. During periods of high oil prices, the expense of insulation products' raw materials, which are mainly derived from petroleum, usually rises. This results in increased production expenses, which can lower demand due to higher prices for consumers and businesses. On the other hand, if oil prices decrease, the price of these supplies also goes down, leading to cheaper insulation products and potentially increasing the demand for them. Still, decreased oil prices may decrease the need for energy efficiency steps, since lower energy expenses lessen the economical motivation to spend on insulation. The fluctuation of oil prices closely links the insulation market, causing a back-and-forth impact on supply and demand.

Market Segmentation

By Matrix Type

The polymer matrix held the largest market share of 40.35% in 2023. This is due to the versatility of various resin systems like epoxy and phenol. However, the future might be hybrid. This innovative type boasts superior strength, making it a rising star in aerospace and defense. Experts predict the hybrid segment will experience the fastest growth, potentially shaking up the current market landscape. Additionally, the growing emphasis on fuel efficiency and weight reduction in these industries has further propelled the demand for polymer matrix syntactic foams, solidifying their dominance in the market.

By Form

Based on the form the block segment held the largest market share around 52.45% in 2023. Syntactic foam blocks are preferred in industries like marine, aerospace, and automotive because they can be easily machined and customized into complex shapes and sizes to meet specific requirements. Their high strength-to-weight ratio and buoyancy make them ideal for structural components, underwater equipment, and insulation applications.

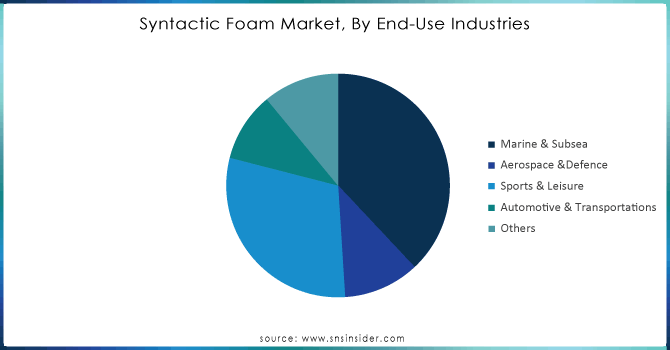

By Application

The marine and subsea held the highest market share in application segment around 37.26% in 2023. Syntactic foam's ability to handle immense water pressure and resist corrosion from seawater makes it a natural fit for buoyancy modules and other subsea equipment. aerospace and defense this segment is projected for the fastest growth, driven by the increasing use of composite materials in aircraft and other aerospace components. Syntactic foam's lightweight and high-strength properties make it an attractive option for these demanding applications. So, while the deep sea holds the crown for now, the skies might be the limit for syntactic foam in the coming years.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS

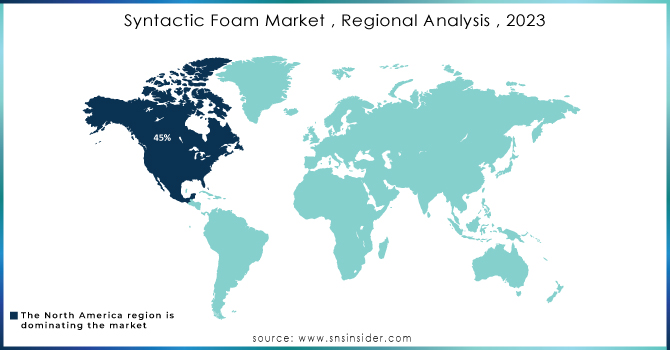

North America has a dominating region in the global syntactic foam market holding 45% in 2023. It is fueled by heavy investments in deepwater oil and gas exploration by US companies, as well as a growing appetite for composite materials in autos and aerospace. The region’s strong aerospace and defense sectors drive significant demand for advanced materials with high strength-to-weight ratios and durability, which syntactic foams provide. Additionally, North America's robust marine and offshore industries, including oil and gas exploration, leverage syntactic foams for their superior performance in extreme underwater conditions. The presence of major players and ongoing advancements in material science further bolster the market. Moreover, North America’s focus on innovation and high-tech applications supports the continued growth and dominance of syntactic foams in the region.

Europe also growing which is driven by the need for high-performance insulation and buoyancy modules in North Sea facilities, and a rise in lightweight vehicle production. Asia-Pacific is the region to watch, with the highest projected growth due to booming offshore activity in the South China Sea and a rapidly developing aerospace & defense sector.

KEY PLAYERS

Some of the major players in the Syntactic Foam Market are Trelleborg AB (Sweden), Deepwater Buoyancy (US), Engineered Syntactic Systems (US), SynFoam (US), ALSEAMAR (France), Diab (Sweden), Acoustic Polymers Ltd (United Kingdom), CMT Materials (US), Balmoral Comtec Ltd (United Kingdom), Fiba Tech Industries, and other players.

RECENT DEVELOPMENTS

-

In March 2024, CMT Materials announced a major expansion. company relocating its entire operation from Attleboro, Massachusetts to a much larger facility in Stoughton, Massachusetts. This strategic move represents a nearly 50% increase in CMT's North American footprint, signaling their commitment to growth and serving their customers even better.

-

In June 2023, The Trelleborg Marine and Infrastructure announced a new, state-of-the-art manufacturing facility in Vietnam, the company is now forging ahead with construction. It is Located in the Phu 3 Specialized Industrial Park, an economic zone in southern Vietnam, the facility is slated for completion by the end of 2025 and will begin production in 2026

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 152.50 Million |

| Market Size by 2032 | US$ 240.66 Million |

| CAGR | CAGR of 5.20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By product type ( Mats, Turfs, and Blankets, Filter Socks, Logs, and Wattles, Woven Sediment Fences and Silt Fences, Filtration Systems, Sediment Basin, Others) • By end-user industry ( Highway and Road Construction, Energy and Mining, Government and Municipality, Landfill Construction and Maintenance, Infrastructure Development, Industrial Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Trelleborg AB (Sweden), Diab (Sweden), ALSEAMAR (France), Deepwater Buoyancy (US), Engineered Syntactic Systems (US), Balmoral Comtec Ltd (United Kingdom), SynFoam (US), Acoustic Polymers Ltd (United Kingdom) |

| Key Drivers | • Increasing activity in deep and ultra-deep waters. |

| RESTRAINTS | • Fluctuation in the price of crude oil. |