Maleic Anhydride Market Report Scope & Overview:

Get More Information on Maleic Anhydride Market - Request Sample Report

The Maleic Anhydride Market Size was USD 3.7 Billion in 2023 and is expected to reach USD 5.3 Billion by 2032 and grow at a CAGR of 4.1% over the forecast period of 2024-2032.

The production of lubricant additives, which help improve engine performance and reduce machinery component wear, also relies heavily on maleic anhydride. These additives, based on maleic anhydride, increase the viscosity, oxidation stability, and overall durability of the lubricant, making them crucial in high-performance applications. The growth is expected for efficient lubricants, owing to demand generated from industries, growing with the automotive, manufacturing, and transportation sectors, with the need for efficient productivity, longevity, and efficiency of equipment. For example, the rapid development of standards in the automotive industry continues to drive demand for advanced lubricants to meet the high fuel efficiency requirements as well as exciting advances in high-performance and electric vehicles.

According to the U.S. Department of Energy, advancements in vehicle technology, particularly in the electric vehicle sector, are expected to expand lubricant needs, particularly for electric motor oils and other high-performance lubricants

Moreover, manufacturers and other industries rely on lubricants to keep equipment lubricated, to help prolong the life of machinery, and to reduce downtime and cost of operations. As the need for effective solutions increases, this will continue to drive the need for maleic anhydride-based additives, a vital asset of industrial and automotive vehicles.

The rising utility of maleic anhydride in agriculture especially for the production of pesticide and plant growth regulators is projected to boost the maleic anhydride market over the coming years. They are crucial to agricultural production, in part to feed a growing population that is exerting increasing pressure on food supplies. Within these formulations, maleic anhydride serves as an active ingredient and thus enhances pest control as well as plant development. With a growing global population and food consumption increasing in parallel, farming needs to be efficient to cope with these pressures. The FAO stated the demand for new farming solutions to increase output while citing MA products to help improve crop protection growth efficiency.

Furthermore, the rapid adoption of sustainable agriculture, which is striving to decrease chemical use and increase breakout yield plants, will also further increase the demand for maleic anhydride in agriculture.

For instance, technical grade maleic hydrazide must have hydrazine content below 0.015% to ensure safety. Maleic hydrazide is commonly used in preventing pre-harvest sprouting in crops like potatoes and onions, and it can also be used to manage plant growth in other agricultural applications.

Maleic Anhydride Market Dynamics

Drivers

-

Rising Demand in automotive and construction industries drives the market growth.

With their rising trend, the automotive and construction industries for lightweight and durable materials are benefiting greatly from unsaturated polyester resins (UPR), in which the maleic anhydride serves as a key building block; The maleic anhydride in such a formulation helps the UPR to interact better with glass fibers, and thus help to comprise this beneficial material with unique properties. UPRs are preferred for applications that demand high strength, corrosion resistance, and ease of processing, and serve automotive components from body panels to infrastructure project parts. Demand for UPRs is further propelled by the construction industry, which is in search of sustainable and cost-effective materials solutions for bridges, buildings, and transportation infrastructure projects. Maleic anhydride, one of the major feedstocks in the production of UPRs, improves the mechanical properties of the resin allowing for a greater range of high-performance applications in these industries.

In 2023, several companies announced innovations aimed at introducing bio-based maleic anhydride alternatives to meet the increasing demand for sustainable products. This is seen as a response to the automotive industry's push for greener materials and the construction sector’s need for low-carbon footprint solutions. Companies such as DSM and Lanxess have also explored the potential of bio-based feedstocks to produce maleic anhydride, which could eventually lead to reduced reliance on fossil fuels and improve the market's environmental footprint.

Restraint

-

Volatility in raw material prices may hamper the market growth.

Volatility in raw materials prices impedes the growth of the maleic anhydride market. The manufacturing of maleic anhydride is heavily reliant on fossil-derived feedstocks including n-butane and benzene from crude oil and natural gas. These raw materials are being traded on markets, which means that they are affected by fluctuations often resulting from geopolitical events, global supply and demand mismatches, and energy prices. In times of geopolitical tensions or supply chain disruptions, the prices of these commodities can increase dramatically.

These raw material price fluctuations not only have an impact on total maleic anhydride production but often lead to uncertainty for manufacturers over stable pricing for maleic anhydride. This may erode margin for producers, especially in cost-sensitive markets like automotive and construction where maleic anhydride is used in resins and composites. In addition, such volatility in prices could deter investments in additional capacity or research and development, further restricting market growth.

Opportunities

-

Increasing bio-based maleic anhydride demand in the market raises the opportunity.

Increased awareness towards sustainability is one of the key drivers for the maleic anhydride market, especially in the form of bio-based maleic anhydride. Conventional manufacturing of maleic anhydride is based on fossil sources mainly coming from petrochemical routes, originating in n-butane or benzene. However, the increasing demand for green products has paved the way for bio-based alternatives synthesized from renewable natural resources, such as biomass. The bio-pathway allows for a reduced carbon intensity of maleic anhydride, which meets the needs of industries focused on achieving sustainability goals.

Similarly, DSM and Lanxess are developing new routes for making maleic anhydride from bio-based feedstocks, anticipating growth in the green chemical market. In addition to reining in the fossil fuel dependence, this transition also provides market expansion in the automotive, construction, and coating sectors that face soaring demand for green materials. In addition, several favorable government policies and incentives supporting the transition to renewable materials also contribute to the attractiveness of bio-based products in the bio-based maleic anhydride market end-use industry.

Maleic Anhydride Market Segmentation Overview

By Raw Material

Benzene held the largest market share around 68% in 2023. Because of its cheaper than other materials and well-established position in the production process, benzene holds the larger share of the maleic anhydride industry. Benzene or n-butane is subjected to a process known as catalytic oxidation to produce maleic anhydride, a proven relatively economical pathway in the use of benzene. As a result, benzene-based production is the manufacturing method of choice for many manufacturers, particularly because the complexity of the production is low, and high yields of maleic anhydride are obtained. The existing infrastructure and supply chain surrounding the use of benzene in multiple industries like petrochemical and automotive will also contribute to its market leadership. Production of UPR is heavily reliant on benzene-de-rived maleic anhydride which is critical for automotive and construction industries where high-performance materials are needed. Also, because benzene is available in high amounts and compatible with production methods already used, benzene can get or maintain a leading position in its market.

By Application

Unsaturated polyester resins (UPR) held the largest market share around 34% in 2023. The largest share of the maleic anhydride market was held by unsaturated polyester resins (UPR), due to their wide range of applications across automotive, construction, marine, and other industries. UPR is prized for its strong, lightweight, and durable materials that are perfect for creating composite materials like fiberglass. This combination of properties makes these materials commonplace in automotive parts, building panels, and even some watercraft. Rapid industrial growth has significantly increased the demand for UPR in these industries, which, in turn, has been one of the key factors driving the growth of the maleic anhydride market, as UPR requires a comparatively large amount of this chemical compound during its production.

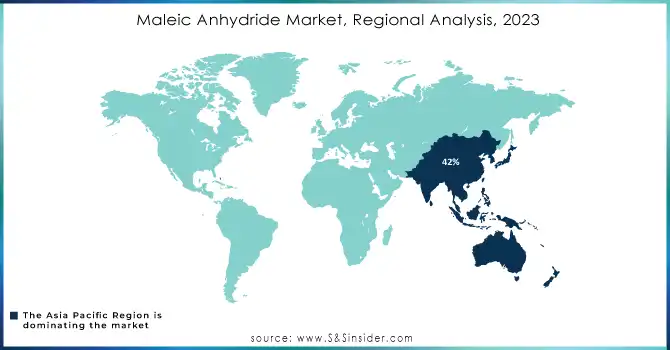

Maleic Anhydride Market Regional Analysis

Asia Pacific held the largest market share around 42% in 2023. The region possesses large manufacturing clusters (especially automotive, construction, and chemicals) that are major consumers of maleic anhydride. In the Asia-Pacific region, the high demand for unsaturated polyester resins (UPR) for automotive applications and infrastructure projects, as well as the growing production of fiberglass-reinforced composites, is a primary factor driving growth in the market for maleic anhydride. In addition, nations such as China, India, and Japan have matured domestic chemical industries using maleic anhydride for uses from functional transparent neat film coatings and adhesives to plastics and agricultural chemicals.

Additionally, the region is witnessing rapid industrial growth, especially from emerging markets, which increases the use of maleic anhydride in construction, automotive, and infrastructure applications. The Greater emphasis on urban infrastructure development in regional countries and the trend towards lightweight and energy-efficient materials in automobile sector are the key growth driving factor for this industry. In addition, the regional growth of maleic anhydride is driven by government investments in key sectors such as construction and transportation. Consequently, Asia-Pacific has remained the leader in the market, bolstered by substantial manufacturing capabilities, burgeoning industrial demand, and supportive economic policies.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players in Maleic Anhydride Market

-

BASF (MALON, Malepox)

-

Dow (MA/MAI Resin, DURABAK)

-

Lanxess (Araldit, Laromin)

-

ExxonMobil (Vistalon, Butyl)

-

Mitsubishi Chemical Corporation (Plastics, Polymers)

-

LG Chem (Maleic Anhydride, Polystyrene)

-

Huntsman Corporation (Araldite, Vondex)

-

Kraton Polymers (Kraton G, Kraton D)

-

DSM (Maleic Anhydride, EcoPA)

-

Arkema (Sartomer, Acrylic Resins)

-

UPL Limited (Herbicides, Insecticides)

-

Shandong Xinhua Pharmaceutical Company (Maleic Anhydride, Pesticides)

-

SABIC (Ammonia, Methanol)

-

Ineos (Ineos Maleic, Ineos Acrylic)

-

China National Petroleum Corporation (CNPC) (Maleic Anhydride, Polyolefins)

-

Ferro Corporation (N-methyl-2-pyrrolidone, Maleic Anhydride)

-

Toray Industries (Polyester Resins, Nylon)

-

Wanhua Chemical Group (Polyurethanes, BDO)

-

Siam Chemical (BDO, MAH)

-

Tianjin Bohai Chemical Industry Co., Ltd. (Maleic Anhydride, Industrial Chemicals)

Recent Development:

-

In June 2023, Petronas Chemicals Group Berhad (PCG) announced the acquisition of the 113 kilo-tonnes per annum (ktpa) Maleic Anhydride (MAn) plant located at Gebeng, Kuantan via the acquisition of the entire equity interest in BASF PETRONAS Chemicals Sdn. Bhd.

-

In November 2023, Clariant revealed the acquisition deal with Jiangsu Shenghong Petrochemical Co., Ltd. Under the contract, Clariant will use its proprietary SynDane 3142 LA catalyst to develop a new maleic anhydride (MA) plant in Lianyungang, Jiangsu province.

-

In October 2023, Huntsman announced an outage in the production of maleic anhydride at its Moers facility in Germany due to an unplanned maintenance shutdown. Moers is home to one of the world's largest production plants with an annual capacity of 105,000 tons of maleic anhydride.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.7 Billion |

| Market Size by 2032 | US$ 5.3 Billion |

| CAGR | CAGR of 4.1% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2023-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (N-Butane, Benzene) • By Application (Unsaturated Polyester Resin (UPR), Copolymers, Lubricant Additives, Alkenyl Succinic Anhydrides, Malic Acid, Fumaric Acid, Others) • By End-users (Construction, Automotive, Food & Beverages, Textile, Pharmaceuticals, Personal Care, Agriculture, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ningbo Jiangning Chemical (China), Changzhou Yabang Chemical Co. Ltd (China), Ashland Inc. (US), Bartek Ingredients Inc. (Canada), Huntsman Corporation (US), Lanxess (Germany), Helm AG (Germany), Marathon Petroleum Corp. (US), Fuso Chemical Co. (Japan), Mitsubishi Chemical Corporation (Japan), Thirumalai Chemicals Ltd (India), Bluestar Harbin Petrochemical Corp. (China), Polynt Group (Italy), Nan Ya Plastics Co.(China), Nippon Shokubai Co. Ltd (Japan) |

| DRIVERS | • The automotive industry is asking for more UPR and 1,4-BDO. |

| Restraints | • A rise in the number of people buying hybrid cars and a rise in the price of batteries |