Flip Chip Market Size & Growth Trends:

The Flip Chip Market was worth USD 30.61 billion in 2023 and is expected to grow to USD 48.70 billion by 2032, at a compound annual growth rate (CAGR) of 5.40% over the forecast period from 2024 to 2032. This is due to rising demand for high-performance electronic devices, advancements in semiconductor packaging technologies, and growing adoption of flip chip packaging across applications such as consumer electronics, automotive, and industrial. Also, miniaturization in electronic devices and the demand for increased input/output density are driving the market's growth globally further.

To Get more information on Flip Chip Market - Request Free Sample Report

The U.S. Flip Chip market was worth USD 4.46 billion in 2023 and is estimated to grow at a compound annual growth rate (CAGR) of 5.95% during the forecast period. This growth is driven by the surging demand for sophisticated semiconductor packaging solutions, particularly in high-performance computing, consumer electronics, and automotive applications. The robust technological infrastructure of the country, complemented by consistent R&D expenditures, drives innovation in flip chip technology.

Besides, the increasing trend towards device miniaturization and better efficiency in performance is also propelling market growth, making the U.S. a major contributor to the overall development of the global flip chip market.

Flip Chip Market Dynamics

Key Drivers:

-

Growing Integration of Advanced Semiconductor Devices in Consumer Electronics Fuels Flip Chip Market Growth

Growing demand for high-performance, miniaturized, and energy-efficient electronic devices is fueling the use of flip chip packaging in consumer electronics. With the advancement of smartphones, laptops, and wearable devices, manufacturers are looking for advanced packaging technologies such as flip chips that allow improved thermal management, increased processing speed, and miniaturization. Large technology companies are incorporating flip chip technology into CPUs, GPUs, and chipsets to advance device capabilities. This trend is also complemented by the increasing IoT and AI-driven devices, which are fueling the need for effective chip interconnection and driving a spurt in the use of flip chip technology across electronics industries worldwide.

Restrain:

-

High Initial Costs of Flip Chip Packaging Limit Market Adoption in Small and Medium Enterprises

Although its performance advantages, flip chip technology is expensive in terms of setup and operating costs, particularly for bumping processes, substrate production, and testing. Such costs are a major challenge for small and medium-sized enterprises (SMEs) and start-ups with minimal capital. Conventional wire bonding techniques, while less efficient, are still more cost-effective for lower-scale manufacturing. Moreover, the requirement of specialized equipment and trained personnel increases the barrier to entry, inhibiting wider market penetration. The large investment needed remains hindering adoption in industries with a limited budget, holding back the overall market growth in regions with tight budgets.

Opportunities:

-

Emerging Applications in Automotive Electronics and 5G Infrastructure Create Lucrative Opportunities for Flip Chip Technology

With the automotive sector quickly embracing electric and autonomous cars, the demand for high-speed, small, and thermally efficient chips has increased. Flip chip technology addresses these requirements by providing better electrical performance and reliability. At the same time, the worldwide deployment of 5G networks requires high-performance chips for base stations and communication equipment, creating new growth opportunities. Firms that invest in R&D and automotive-grade packaging solutions stand to gain from these trends. This combined pressure from automotive and telecom industries will likely raise demand substantially, with good prospects for market players to increase product breadth and geographic scope.

Challenges:

-

Thermal and Reliability Challenges in High-Density Flip Chip Packaging Pose Technical Barriers to Widespread Adoption

With devices becoming smaller and more performance-oriented, thermal management is a vital consideration in flip chip designs. Thermal dissipation in high-density packages can result in performance loss or failure of components. Beyond that, reliability under extreme conditions, particularly in automotive or industrial applications, raises issues of material selection, substrate integrity, and bump durability. This demands that manufacturers invest in innovative thermal interface materials and advanced substrates, which add complexity and cost. To overcome these issues of reliability is imperative to expanding the application of flip chip in high-demand uses, rendering thermal management and long-term reliability prime technical challenges facing the market.

Flip Chip Industry Segmentation Analysis

By Packaging Technology

The 2.5D packaging technology segment owns the largest share in the Flip Chip Market at 45.60% of revenue in 2023. This is due to its cost-effectiveness and the fact that it accommodates several dies on an interposer, delivering improved electrical performance as well as thermal efficiency. Organizations such as Intel and AMD use 2.5D IC packaging for high-performance processors, with AMD's EPYC and Radeon GPUs being examples that feature this architecture. Moreover, ASE Group and TSMC have introduced 2.5D packaging solutions to cater to data center and AI needs. This technology fills the gap between traditional and advanced packaging, driving Flip Chip Market growth significantly.

3D packaging segment is expected to grow at the highest CAGR of 7.14% over the forecast period, led by ultra-high-density integration needs in small devices. 3D packaging is a vertical stack of chips, which enhances performance and minimizes latency—perfect for smartphones, AR/VR, and AI processors. Intel's Foveros and Samsung's X-Cube are critical 3D IC programs driving this momentum. These technologies minimize power and size while maximizing computing resources. As sectors aim for increased functionality within compact space, 3D flip chip packaging is gaining prominence, playing a strong role in the growth of the Flip Chip Market in next-generation electronic and computing applications.

By Bumping Technology

The Copper Pillar segment dominates the Flip Chip Market with a commanding 61.36% revenue share in 2023 because of its better electrical performance, thermal management, and fine-pitch capability. Copper pillars are gaining ground over conventional solder bumps in high-density and high-performance applications like processors, FPGAs, and memory devices. Industry leaders such as TSMC and Amkor Technology have upgraded their copper pillar bumping capabilities to address advanced packaging requirements. For instance, TSMC's implementation of InFO and CoWoS technologies utilizes copper pillars for improved performance in AI and 5G chips. These technologies directly drive Flip Chip Market growth in consumer and industrial electronics.

The Gold Stud Bumping segment is expected to advance at the highest CAGR of 7.79% throughout the forecast period, mainly because of its low-temperature bonding and low-contamination advantages. This bumping process is well-suited for prototypes, niche medical devices, and aerospace applications that require precision and reliability. Palomar Technologies and Finetech are among the companies that have released enhanced gold stud bumping tools for microelectronics packaging, which support increased interconnect densities. Growing applications of gold stud bumping in miniaturized medical devices and military electronics are driving segment growth, and substantially contributing to the Flip Chip Market's transformation in niche, high-reliability applications.

By End-use

Consumer Electronics accounted for the largest share of 39.64% of revenue in the Flip Chip Market in 2023 due to increasing demand for high-performance, smaller-sized products such as wearables, smartphones, and tablets. Flip chip technology supports high processing speed with better thermal performance, essential in consumer products. Apple and Samsung are some companies that have used flip chip packaging in their processors continuously to improve functionality. Moreover, ASE Technology and Intel have upgraded their flip chip packaging solutions to meet increasing demand in this area. The ongoing advancements in chip integration and miniaturization further fuel Flip Chip Market expansion in consumer electronics.

The Automotive segment is expected to advance at the highest CAGR of 7.46% owing to the growing use of electronics in cars for ADAS, infotainment, EV battery management, and autonomous applications. Flip chip packaging plays a vital role in maintaining the reliability and performance of automotive electronics under extreme conditions. NXP Semiconductors and Infineon Technologies are investing heavily in automotive-grade flip chip solutions. For example, NXP's recent introduction of S32 automotive processors incorporates flip chip packaging to improve processing power and heat efficiency. Such technological thrust complements automotive trends, driving the Flip Chip Market's growth in the automotive industry.

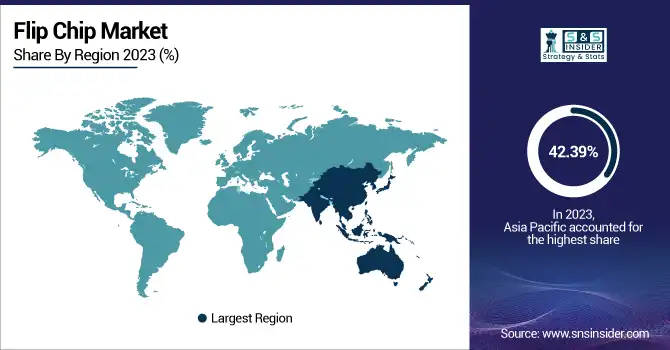

Flip Chip Market Regional Overview

The Asia Pacific region led the Flip Chip Market in 2023 with a 42.39% share, following the availability of dominant semiconductor production centers like Taiwan, South Korea, China, and Japan. Key players TSMC, Samsung Electronics, and ASE Technology are market leaders in producing and driving flip chip technology in the region. Recent advancements, such as TSMC's expansion of advanced packaging technologies and Samsung's addition of high-density packaging lines, underscore leadership in the region. Strong electronics manufacturing facilities, along with government promotion of semiconductor innovation, continues to propel the Flip Chip Market's growth in Asia Pacific.

North America is likely to advance with the fastest CAGR of 7.07% in the Flip Chip Market through the forecast period, driven by higher R&D investments and growing demand for superior packaging solutions in AI, automotive, and high-performance computing. Players like Intel and AMD are heavily investing in developing next-generation flip chip packaging technologies, including Intel's EMIB and Foveros. In addition, the CHIPS Act is supporting local semiconductor manufacturing, providing conducive conditions for market expansion. These developments are making North America a fast-growing region in flip chip technology, leveraging innovation and reshoring movements in semiconductor production.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in the Flip Chip Market are:

-

Amkor Technology –(SWIFT Packaging, Chip-on-Wafer-on-Substrate (CoWoS))

-

Intel Corporation –(Foveros 3D Packaging, Embedded Multi-die Interconnect Bridge (EMIB))

-

Fujitsu –(FC-BGA (Flip Chip Ball Grid Array), High-density Flip Chip Interposer)

-

Taiwan Semiconductor Manufacturing Company Limited (TSMC) – (InFO (Integrated Fan-Out), CoWoS (Chip on Wafer on Substrate))

-

Texas Instruments Incorporated – (Flip Chip BGA Processors, Power Management ICs with Flip Chip Technology)

-

SAMSUNG – (FOPLP (Fan-Out Panel Level Packaging), HBM2E Memory with Flip Chip)

-

ASE Technology Holding Co., Ltd. – (ASE SiP (System in Package), Flip Chip WLCSP (Wafer Level Chip Scale Package))

-

Advanced Micro Devices, Inc. (AMD) – (Ryzen 7000 Series (Foveros-style packaging), EPYC Processors with Flip Chip Die Stacking)

-

APPLE INC. – (M1 Ultra with Flip Chip Interconnect, A15 Bionic Flip Chip SoC)

-

Powertech Technology Inc. – (Flip Chip BGA Services, Wafer Level Flip Chip Packaging)

Recent Trends

-

March 2025, Samsung's Exynos 990 System-on-Chip (SoC) employs a 3D package-on-package solution with flip-chip interconnects. This design integrates the SoC and memory devices into a single package, reducing interconnection length and improving signal integrity and power efficiency.

-

March 2025, TSMC is progressing with its 2nm chip factory in Kaohsiung, Taiwan, expected to begin mass production in 2025. The facility adopts the most advanced 2nm process, aiming to meet the growing demand for high-performance computing and mobile devices.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 30.61 Billion |

| Market Size by 2032 | USD 48.70 Billion |

| CAGR | CAGR of 5.40 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Packaging Technology- ( 3D,2.5D,2.1D) •By Bumping Technology-(Copper Pillar,Tin-Lead Eutectic Solder,Lead-Free Solder,Gold Stud Bumping) •By End-use – (Military and Defense,Medical and Healthcare,Industrial Sector,Automotive,Consumer Electronics,Telecommunications ) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amkor Technology,Intel Corporation,Fujitsu,Taiwan Semiconductor Manufacturing Company Limited,Texas Instruments Incorporated,SAMSUNG,ASE Technology Holding Co., Ltd.,Advanced Micro Devices, Inc.,APPLE INC.,Powertech Technology Inc. |