Thermal Interface Materials Market Key Insights:

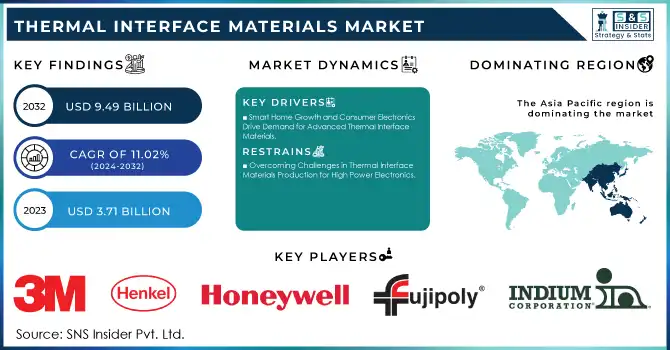

The Thermal Interface Materials Market size was valued at USD 3.71 billion in 2023 and is expected to reach USD 9.49 billion by 2032, with a growing at CAGR of 11.02% over the forecast period 2024-2032. The growth of the Thermal Interface Materials market is primarily driven by the increasing need for efficient thermal management solutions in various industries. The rise in electronic device usage, such as smartphones, laptops, and wearables, has increased the demand for heat dissipation, driving the growth of the TIMs market. At the same time, rapid growth in data centers and 5G infrastructure places greater demands on thermal management to avoid overheating high-performance computing systems. With the increasing emphasis on miniaturization and packed designs, TIMs have become a key requirement for sustained reliability and performance. Smartphone shipments are projected to be about 1.2 billion units globally in 2023 and wearables are forecasted to go beyond 200 million units in 2024, boosting soaring demand for thermal interface materials (TIMs). According to Statista, data center traffic is expected to increase 25% per year until 2024, which only exacerbates the demand for efficient thermal management. Also, the electric vehicle market is forecasted to increase 35-40% in 2024, as global EV sales hit more than 12 million units, sparking demand for TIMs used in battery and electronics cooling.

Get more information on Thermal Interface Materials Market - Request Sample Report

Additionally, the growing demand for electric vehicles and innovation in automotive electronics are acting as key market growth driving factors. TIMs also have an important impact on the heat management of EV batteries, inverters, and power control units, essential for effective battery operation and life. The increasing deployment of advanced high-precision equipment in medical devices, telecommunications, and industrial machinery is also expected to contribute significantly to revenue generation for TIMs. Marketing growth is also propelled by the expanding regulatory requirement for energy efficiency and sustainability, and the use of high-performance materials. Novel phase change materials and metal-based TIM innovations are anticipated to reveal new opportunities for growth in the forecast period. Canalys estimates global EV registrations of 13.7 million units for 2023, a year-on-year growth of 27.1% to 17.5 million in 2024. There were 3.2 million new EV registrations in Europe (20% more than in 2022) and 1.4 million new electric cars in the U.S. (40% more than in 2022). Moreover, worldwide 5G infrastructure investment was USD 26.4 billion in 2023 and is forecasted to grow 30% in 2024, boosting demand for TIMs quite nicely.

Thermal Interface Materials Market Dynamics

KEY DRIVERS:

-

Smart Home Growth and Consumer Electronics Drive Demand for Advanced Thermal Interface Materials

As the world trends towards more smart homes and things getting smarter, consumer electronics are going through constant advancements making them smaller, more powerful, and connected. Advanced thermal management is also required for devices like smart TVs, gaming consoles, smart speakers, and wearables, to ensure that these components operate at their highest efficiency and to combat overheating. With the rise in consumer expectations for thin, light devices with greater processing power the thermal burden also rises on these devices, thereby increasing the need for effective Thermal Interface Materials. Modern TIMs like phase change materials and thermally conductive adhesives provide better performance than traditional methods, allowing effective heat transfer between surfaces between compact designs. Moreover, the growing global trend towards energy-efficient and environmentally friendly operating electronics has made sustainability a big focus for manufacturers, who need these properties to drive innovation and growth in the TIM market. Smart home device installations in U.S. households in 2023 reached 434.6 million units Also, 37.7 million smart appliances such as refrigerators and dishwashers were part of 19% of U.S. households. The gaming console environment is large but needs advanced thermal management to grow Global gaming console shipments are projected to grow by 10% in 2024, reaching 40M units. Something else, in developed markets in 2023 more than 60% of new appliances sold were energy-efficient devices as consumers sought to meet rising energy costs and government regulations were also pressure for this.

-

Driving TIM Market Growth through Renewable Energy and Smart Grid Advancements in 2024

Renewable energy sources like solar and wind are prevalent and require advanced power electronics for energy conversion and storage. To operate these efficient devices like solar inverters, power modules, and energy storage systems such as lithium-ion batteries, high-performance thermal management is required due to the significant amount of generated heat. The growing demand for TIMs is directly driven by the need for power management systems over the green energy transition accelerated by the countries. Additionally, the use of solid-state transformers and smart grid technologies is leading to greater complexity and thermal requirements for power control devices. Thermal Interface Materials play a crucial role in sustaining the functionality of these devices and are responsible for maximizing the heat output. Increasing clean energy generation and smart grid development globally by government authorities is expected to keep the TIM market sustainable in the long run, contributing to market growth. In 2023, approximately 18.5 million solar inverters were shipped around the globe. As of the end of 2023, wind energy produced 10% of all power globally, with more than 1,000 GW of installed capacity. For instance, the development also predicts a 40% increase in the global smart grid market in 2024 as utilities move to advanced infrastructure for energy efficiency and grid modernization.

RESTRAIN:

-

Overcoming Challenges in Thermal Interface Materials Production for High Power Electronics

The biggest obstacle in the TIM market is the complexity of production and incorporation of these materials into electrical devices. However, the application of TIMs (such as greases, phase change materials, or adhesives) needs to be sufficiently accurate to ensure no air gaps, no air gaps, a uniform distribution, and no material leakage, otherwise, the heat transfer performance will suffer. These implications mean that producers have to package it according to different surfaces and different surfaces before. This is further complicating the production and increasing the production time. However, creating a material that can possess high thermal conductivity along with flexibility, electric insulators, and mechanical strength has proven to be difficult despite significant advancement in the field of material science. Compared to metal-based TIMs, organic-based TIMs such as elastomeric pads and greases have poor thermal conductivity. As a consequence of this limitation, they lose ground in those high-power electronics (for example, EV batteries and high-performance computing devices), in which enhanced thermal dissipation is required. A major developing challenge for market players is to provide materials that offer an optimum blend of conductivity, flexibility, and cost-efficiency.

Thermal Interface Materials Market Segment

BY MATERIAL TYPE

In 2023, Tapes and films held 31.8% of the market share, largely due to their popularity in consumer electronics, automotive, and telecommunications sectors. This unique blend of flexibility, thermal conductivity, and ease of application makes them dominate. They are lightweight, thin, and sticky, making the materials suitable for automated manufacturing processes a factor needed in mass production. When tapes and films are used, they tend towards being always used on various surfaces which guarantees consistent function yet under differing operating conditions (high temperatures, vibrations, etc), but they possess durability and good compatibility. As a result, they are ideal for uses like heat sinks, electronic circuits, and LED modules. Having a cost-effective solution has only strengthened their position in the market, already catering to some industries that demand scale-reliable thermal management solutions.

The phase change materials (PCMs) segment is estimated to be the fastest growing segment during the period 2023-2031 due to advanced thermal management capabilities and effective thermal management properties associated with the ever-demanding adoption of high-performance and energy-efficient technologies. PCMs work by absorbing and releasing heat during the phase change (from solid to liquid and vice versa), allowing the temperature to be controlled accurately. As a result, they are extremely ideal for electric vehicles (EV), high-performance computing, and renewable energy systems. PCMs are vital in EV applications for the effective thermal management of maintaining battery temperature, ultimately improving battery performance and lifespan. The increasing demand for compact and powerful computing systems, including data centers and 5G devices, is also providing a boost to PCMs, which are particularly effective at removing heat from constrained spaces. PCMs are a premium solution for next-gen thermal management solutions, and with the world moving towards sustainability and energy efficiency, they are witnessing rapid growth in the Thermal Interface Material (TIM) market.

BY APPLICATION

In 2023, the telecom sector accounted for a maximum market share of 26%, this growth is attributed to the rapid rollout of 5G networks across the globe which is contributing to widespread telecommunication infrastructure expansion. The installation of 5G base stations, antennas, and related devices has driven significant demand for Thermal Interface Materials (TIMs) to dissipate the additional heat that high-frequency, high-power devices generate. In telecom equipment, stable performance, reduced downtime, and eliminating the risk of overheating in climate are vital to ensure a not-so-dense network environment; hence effective thermal management is the key. In addition to this, developments in fiber optic networks and data transmission technologies boosted the strength of the telecom sector. Thermal Interface Materials (TIMs) including thermal pads and phase change materials are critical to enable telecom devices like transceivers, servers, and signal amplifiers to function efficiently. The requirements of telecom applications for high-performance TIMs are not being alleviated, as the demand for connectivity and data usage continues to grow.

The automotive electronics segment is projected to grow at the fastest CAGR of 11.38% from 2024 to 2032, owing to the transformation of EVs, ADAS systems, and infotainment systems in vehicles. Specifically, TIMs are used extensively in electric vehicles (EVs) for thermal management of key components (e.g., batteries, inverters, and power electronics). It is therefore necessary to properly ensure the heat dissipation of these components to maintain the optimal performance, safety, and longevity of the vehicle. Moreover, the ongoing trend of integrating ADAS technologies, such as sensors and radar systems, has also increased the demand for reliable TIMs for thermal management of the heat generated by high-performance processors and electronics. With the rising need for electrification across the globe and evolving automotive innovation, the automotive electronics segment continues to be the leading driver of the TIM market. As manufacturers continue to focus on energy efficiency along with their thermal management, the penetration of advanced TIM solutions in automotive applications is anticipated to accelerate at a rapid pace.

Get Customized Report as per your Business Requirement - Request For Customized Report

Thermal Interface Materials Market Regional Analysis

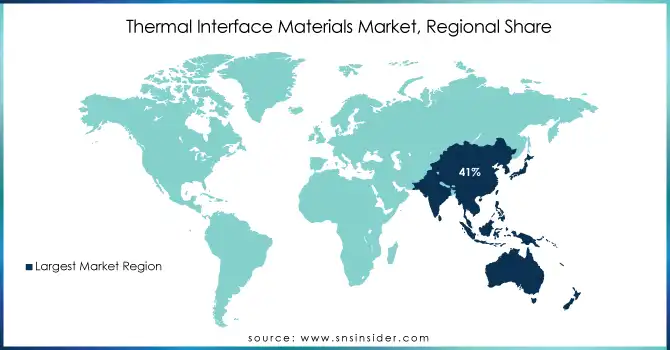

In 2023, Asia Pacific accounted for the largest market share of 41%, owing to its prominent manufacturing platform, technological progress, and extensive consumer electronics market. Driven primarily by the strong demand for electronics such as smartphones, computers, and home appliances, this dominance has been increasingly significant over time. Thermal interface material demand is driven by local major tech players in China (TSMC), Korea (Samsung), Japan (Sony), and Taiwan (TSMC). Samsung Electronics, which produces the largest volume of smartphones, consumer electronics, and semiconductors in the world, employs thermal interface materials (TIMs) for smartphones, tablets, and high-performance semiconductor chips for effective heat dissipation. Likewise, both Huawei and Lenovo are also deploying more TIMs in their data center and greater computing systems. Increasing penetration of 5G infrastructure in Asia Pacific particularly China and India will also create the demand for advanced TIM solutions in telecom equipment such as base stations and antennas, thereby boosting the global thermal interface materials market. In light of these technological developments and high-volume production, Asia Pacific continues to be an important region for thermal interface materials.

North America is anticipated to exhibit the fastestCAGR over the forecast period 2024-2032, due to an upsurge in demand for HPC, EVs, and telecommunications advancements. The consumption of advanced thermal management solutions is also sizable in the U.S. due to the presence of automotive (EVs), telecommunications (5G), and electronics major players. A perfect example is Tesla, one of the largest manufacturers of EVs at this time. TIMs are vital to the company to transfer heat in the batteries, power electronics, and inverters of its electric vehicle. However, as manufacturers innovate better and more powerful machines, thermal management will continue to play an important role in the performance, safety, and longevity of the evaporative vehicle. Furthermore, in telecoms, North America is home to Qualcomm and Intel which are key to 5G and HPC. With increasing data servers, edge computing, and 5G networks installed, the demand for high-performance TIM(S) which is used to manage heat from processors and telecom equipment.

Major Players in the Thermal Interface Materials Market are:

-

3M (Thermal pads, Thermal adhesives)

-

Henkel AG & Co. KGaA (Bergquist gap fillers, Thermal tapes)

-

Indium Corporation (Thermal paste, Thermal fluxes)

-

Fujipoly (Gap filler pads, Thermal tapes)

-

The Dow Chemical Company (Thermal gap filler, Phase change materials)

-

Honeywell International Inc. (Thermal insulators, Thermal gap fillers)

-

Sibelco (Thermal greases, Phase change materials)

-

Momentive Performance Materials Inc. (Thermal pastes, Silicone-based gap fillers)

-

Laird Technologies, Inc. (Thermal pads, Thermal gap fillers)

-

Parker Hannifin Corp (Thermal gap fillers, Thermal tapes)

-

Wakefield-Vette (Thermal pastes, Thermal pads)

-

Heraeus Holding GmbH (Thermal tapes, Thermal pads)

-

KITAGAWA INDUSTRIES America, Inc. (Silicone-based thermal pads, Thermal heat spreaders)

-

Macron (Thermal gels, Phase change materials)

-

Thermaltronics (Thermal greases, Adhesive films)

-

Nexthermal (Thermal pads, Phase change materials)

-

BASF (Thermal pads, Thermal foams)

-

Sumitomo Electric (Thermal adhesives, Thermal pads)

-

Saint-Gobain (Thermal pads, Heat spreaders)

-

T-Global Technology (Thermal gels, Thermal pastes)

Some of the Raw Material Suppliers for Thermal Interface Materials companies:

-

BASF

-

DuPont

-

Solvay

-

Arkema

-

Mitsubishi Chemical

-

Evonik Industries

-

ExxonMobil

-

SABIC

-

Wacker Chemie AG

-

LG Chem

RECENT TRENDS

-

In November 2024, Smart High-Tech and Henkel formed a partnership to accelerate the adoption of Smart High-Tech's GT-TIM® graphene-based thermal materials for electronics.

-

In February 2024, Indium Corporation is showcasing its high-performance metal Thermal Interface Materials (TIMs) at TestConX 2024, designed for burn-in and test applications with superior thermal conductivity.

-

In October 2024, Dow and Carbice partnered to advance thermal interface materials by combining silicone and carbon nanotube technologies. This collaboration targets improved thermal efficiency and reliability for high-performance electronics.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.71 Billion |

| Market Size by 2032 | USD 9.49 Billion |

| CAGR | CAGR of 11.02% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type (Tapes and films, Elastomeric pads, Greases and adhesives, Phase change materials, Metal-based materials) • By Application (Telecom, Computer, Medical Devices, Industrial Machinery, Consumer Durables, Automotive Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M, Henkel AG & Co. KGaA, Indium Corporation, Fujipoly, The Dow Chemical Company, Honeywell International Inc., Sibelco, Momentive Performance Materials Inc., Laird Technologies, Inc., Parker Hannifin Corp, Wakefield-Vette, Heraeus Holding GmbH, KITAGAWA INDUSTRIES America, Inc., Macron, Thermaltronics, Nexthermal, BASF, Sumitomo Electric, Saint-Gobain, T-Global Technology. |

| Key Drivers | • Smart Home Growth and Consumer Electronics Drive Demand for Advanced Thermal Interface Materials • Driving TIM Market Growth through Renewable Energy and Smart Grid Advancements in 2024 |

| Restraints | • Overcoming Challenges in Thermal Interface Materials Production for High Power Electronics |