Substrates Market Report Size & Overview

Get More Information on Substrates Market - Request Sample Report

The Substrates Market Size was valued at USD 81.15 Million in 2023 and is expected to grow to USD 535.50 Million by 2032 and grow at a CAGR of 26.6% over the forecast period of 2024-2032.

The substrates market is crucial in various sectors like electronics, automotive, aerospace, and medical devices, as substrates are essential materials for thin-film deposition and coating processes. They play a crucial role in the production of semiconductors, printed circuit boards (PCBs), sensors, and other electronic components. The market offers a range of materials like glass, metal, silicon, and ceramics, all tailored to meet particular application needs. The increasing need for small, high-performing electronic devices such as smartphones, laptops, and wearables is a key factor in driving this market. As semiconductor technology progresses, materials like silicon wafers play a key role in creating smaller, more efficient, and powerful electronic components. The substrates market's growth is being directly impacted by manufacturers seeking materials with better electrical properties, thermal stability, and durability due to the shift towards miniaturization and higher performance. The increasing application of substrates in vital sectors emphasizes their significance in promoting creativity and facilitating the advancement of future technologies. Therefore, it is expected that the need for substrates will grow, particularly in areas with well-established electronics manufacturing industries like Asia-Pacific, leading to further growth in the market.

The automotive sector is experiencing a significant change fueled by the rapid growth of electric vehicles (EVs) and autonomous driving technologies, leading to a high demand for advanced substrates. Substrates play a crucial role in different automotive systems like battery management systems (BMS), advanced driver-assistance systems (ADAS), and in-vehicle infotainment systems. These systems need substrates that provide excellent electrical conductivity, heat resistance, and durability to accommodate the increasing complexity of automotive electronics. The IEA indicated that in 2022, electric vehicle sales worldwide increased to make up 14% of new car sales, compared to only 4% in 2020, showing a notable rise in the need for high-tech electronic parts. This expansion is also supported by government efforts to boost EV usage, like the European Union's Fit for 55 plan that aims to cut net greenhouse gas emissions by 55% by 2030 and prohibits the sale of internal combustion engine cars by 2035. The Bipartisan Infrastructure Law in the United States designates $7.5 Million for creating a nationwide network of EV chargers, continuing to boost the EV industry. These advancements are creating a demand for materials that can sustain high-voltage uses and guarantee safety and effectiveness in electric vehicles. In addition, the growth of ADAS in contemporary cars, providing functions such as lane departure alerts and adaptive cruise control, is anticipated to drive up the demand for substrates, specifically SiC and GaN, that are well-suited for high-power automotive uses. With automakers moving towards electrification and automation, there will be a significant increase in the need for high-performance substrates, highlighting the vital role of the substrates market in the future of the automotive industry.

Substrates Market Dynamics

Drivers

-

Innovation in Flexible Substrates for Solar Cells and Emerging Applications

The rise of advanced flexible substrates in renewable energy applications is becoming a key market driver in the substrates market. Flexible substrates, such as polycarbonate, are increasingly being integrated into next-generation solar technologies, particularly perovskite solar cells (PSCs), which have shown immense promise due to their flexibility, lightweight structure, and cost-effectiveness. The global shift towards sustainable energy, particularly solar power, has accelerated the demand for innovative materials capable of supporting flexible, high-performance photovoltaic (PV) applications. Polycarbonate, known for its superior flexibility and transparency, plays a crucial role in enabling lightweight solar panels for portable electronics, wearable devices, and infrastructure applications like building-integrated photovoltaics (BIPV). The ability to integrate printed electronic components onto polycarbonate substrates, combined with cost-effective, low-temperature processing, provides immense potential for scalable, low-cost solar manufacturing, driving market growth. This innovation not only supports the solar energy market, but also has ripple effects across industries relying on flexible, efficient substrates for electronic devices, pushing the substrates market to adapt to these evolving needs.An international research group demonstrated a flexible perovskite solar cell (PSC) with a 13.0% power conversion efficiency using polycarbonate substrates, marking a breakthrough in flexible PV applications. The polycarbonate, which exhibits 90% transparency in the visible spectrum, was chosen for its high glass transition temperature and low moisture absorption, outperforming traditional substrates like PET and PEN. Despite the initial challenges posed by polycarbonate's poor solvent resistance and high surface roughness, the team addressed these issues by applying a blade-coated planarization layer of ambient-curable resin, reducing the surface roughness from 1.46 µm to 23 nm and cutting the water vapor transmission rate by half. These improvements allowed for the successful deposition of precursor inks. In durability tests, the cells retained 87% efficiency after 1000 bending cycles at a radius of 20 mm. The entire manufacturing process, including the integration of SnO2 electron transport layers, perovskite layers, and Spiro-MeOTAD hole transport layers, is industrially compatible and suited for low-cost production methods. This innovation represents a leap forward in the flexible solar cell market, positioning polycarbonate substrates as an emerging solution for high-performance, lightweight PV devices .

-

The Emergence of Eco-Friendly Substrates in the Electronics Industry and the Focus on Sustainability

The increasing recognition of environmental concerns, specifically electronic waste (e-waste), is fueling the need for eco-friendly materials in the electronics sector. As the demand for electronic devices increases worldwide, the importance of efficient recycling methods and sustainable materials is more crucial than ever. The United Nations reported that in 2021, a massive amount of 57.4 million tons of electronic waste was generated globally, and it is predicted to increase to 74 million tons by the year 2030. Scientists have created a new degradable material to help with recycling single-use and wearable devices, as well as to make multilayered circuits more easily.This novel polyimide substrates, which is compatible with current manufacturing methods, aims to address the shortcomings of traditional substrates like Kapton. While Kapton is well-known for its superior thermal and insulating characteristics, it is challenging to recycle and handle. The light-cured polymer in the new material cures rapidly at room temperature, enabling quicker production and simpler integration into advanced electronic structures. Furthermore, the design includes ester groups in its polymer structure that are able to be dissolved in a gentle solution, allowing for the extraction of valuable metals and components from circuits. This technological progress is important because it provides a practical answer to the increasing e-waste issue and also offers a possible economic benefit by retrieving valuable materials. The environmentally friendly strategy follows the overall patterns in the substrates sector, as the need for sustainable and recyclable materials continues to influence manufacturing methods. As more companies aim to lessen their environmental footprint and comply with regulations, the creation of these unique substrates will be crucial in advancing the electronics sector.

Restraints

-

Striking a balance between innovation and manufacturing feasibility in substrates development.

The fast progress of technology in substrates development for flexible electronics, especially in the realms of soft robotics and the Internet of Things (IoT), poses notable market limitations that could hinder expansion. Aligning innovation with manufacturing feasibility poses a significant challenge. Especially for new substrates operations, it is important to understand that advanced technologies need to be cost-effective in order to be widely used, despite aiming to enhance material quality, yield, and decrease manufacturing expenses. The cost needed for the research and development of new materials, in addition to setting up production processes that meet strict industry standards, can be too high. This is particularly important as industries advocate for materials that can accommodate features needed for future applications such as soft robotic exoskeletons, which improve user mobility and decrease tiredness. The need for these sophisticated materials to deliver dependable performance without compromising cost-efficiency creates challenges in the market. Moreover, the incorporation of flexible hybrid electronics (FHE) into IoT devices highlights the need for superior substrates that support smooth communication and data transfer between connected devices. Nevertheless, reaching the intended level of performance using these novel materials frequently necessitates specific manufacturing methods that may not yet be fine-tuned for mass production. As a result, manufacturers might be reluctant to transition from traditional materials to new options that haven't demonstrated their dependability and cost-effectiveness in large-scale manufacturing. This unwillingness hinders market expansion and limits the advancement of materials that could bolster the growing smart technology sector. Consequently, it is necessary to find a delicate equilibrium between promoting innovation in substrates materials and guaranteeing their feasible production to meet the changing needs of the electronics industry.

Substrates Market - Segment Analysis

by Raw Material

by 2023, Bulk Gallium Nitride (GaN) had become the dominant material in the substrates market, securing a significant revenue share of 37.51%. GaN's superior electrical properties contribute to its dominance in various applications such as power electronics and high-frequency devices, allowing for high efficiency and performance. Wolfspeed and Qorvo have recently introduced new GaN-based products that improve performance in electric vehicles and 5G technology, leading to increased market expansion. As an example, Wolfspeed launched its 200mm GaN-on-SiC wafers designed to enhance the efficiency of RF devices and power systems. Moreover, Transphorm has created advanced GaN power components that cater to the growing need for effective power transformation in renewable energy installations. The increased utilization of Bulk GaN substrates in various industries has been aided by recent progress in GaN technology, including the implementation of new fabrication methods and improvements in thermal management. These advancements reaffirm Bulk GaN's foothold in the substrates market and underscore its crucial role in driving the progress of future electronic devices, ultimately backing the shift towards more effective and environmentally friendly technology solutions.

by Application

The computing sector was the leading force in the substrates market in 2023, securing an impressive 35.44% portion of the revenue. The rise is mainly due to the growing need for high-performance computing (HPC) solutions and improvements in semiconductor technology. Intel and NVIDIA have made great progress in incorporating advanced substrates to improve the performance of their processors and GPUs. Intel's new Meteor Lake design, featuring advanced substrates materials, enables better energy efficiency and increased computing power. Furthermore, NVIDIA has launched the H100 Tensor Core GPU which utilizes cutting-edge substrates to speed up AI workloads and data-heavy applications. The demand for faster data processing and energy efficiency in data centers has been accelerated by the increased emphasis on AI and machine learning. With the growth of cloud computing, it is expected that the substrates market will see more investments in materials that support greater integration and miniaturization of components. The intersection of these technological advancements with substrates innovation highlights the crucial impact that computing applications have in influencing the future direction of the substrates market, stimulating demand and progress in different sectors.

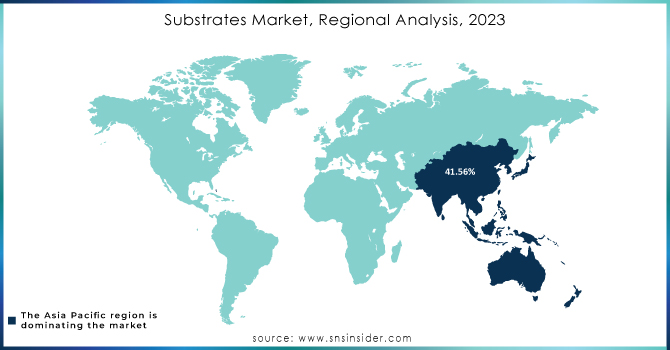

Substrates Market Regional Outlook

by 2023, the Asia-Pacific region had become the top contender in the substrates market, securing a notable 41.56% revenue share. The main reason for this expansion is the quick progress in technology and the large investments in semiconductor production in countries such as China, Japan, and South Korea. China's continuous efforts to strengthen its semiconductor sector have resulted in a growing need for top-notch substrates, enabling domestic producers to innovate and improve their production capacity. Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung Electronics are leading the way by introducing new substrates technologies that enable advanced computing and consumer electronics. An example is the recent progress made by TSMC in enhancing its 5nm and 3nm process nodes through the use of new substrates to enhance chip performance and energy efficiency. Furthermore, Japan's dedication to growing its semiconductor industry has resulted in partnerships between local companies and international corporations, improving the substrates supply chain. The coming together of these advancements underscores the strategic significance of Asia-Pacific in the substrates market, as it remains at the forefront in manufacturing, creativity, and financial backing, influencing the worldwide arena of sophisticated electronics.

In 2023, North America emerged as the fastest-growing region in the substrates market, driven by significant technological advancements and a robust demand for high-performance materials in various applications. The region accounted for a notable share of the global substrates market, fueled by the increasing need for advanced electronics in computing, telecommunications, and automotive sectors. Companies such as GlobalWafers and Silicon Valley Microelectronics have launched innovative substrates solutions that cater to the rising demand for high-efficiency semiconductor devices. For instance, GlobalWafers announced the expansion of its manufacturing capabilities in the U.S. to produce advanced silicon wafers and engineered substrates, aligning with the growing trends in electric vehicles (EVs) and renewable energy technologies. Furthermore, the U.S. government's push to strengthen domestic semiconductor manufacturing through initiatives like the CHIPS Act has attracted investments from major players, fostering innovation and growth in the substrates market. This regulatory support, combined with a vibrant ecosystem of research institutions and tech companies, positions North America as a critical hub for substrates development, ultimately contributing to advancements in the broader electronics industry and enhancing competitiveness in global markets.

Need any customization research on Substrates Market - Enquiry Now

Key Players

some key players in the substrates market along with their product offerings:

-

TTM Technologies Inc. (PCB, flexible circuits, and advanced packaging solutions)

-

BECKER & MULLER (specialty substrates for electronic applications)

-

SCHALTUNGSDRUCK GMBH (printed circuit boards and hybrid substrates)

-

Advanced Circuits (custom PCBs and quick-turn prototyping)

-

Sumitomo Electric Industries Ltd (high-performance substrates for electronic devices)

-

Wurth Elektronik Group (Wurth Group) (electronic components and substrates)

-

AMD (advanced semiconductor substrates for CPUs and GPUs)

-

Viettel High Tech (communication substrates and electronic solutions)

-

NextFlex (flexible hybrid electronics and advanced substrates)

-

Infineon Technologies Inc. (power semiconductor substrates and integrated circuits)

-

LG Innotek (multi-layer ceramic substrates and advanced electronic components)

-

Onsemi (silicon substrates for power management and automotive applications)

-

NXP Semiconductors (RF and high-performance substrates for automotive and IoT)

-

Taiwan Semiconductor Manufacturing Company (TSMC) (advanced semiconductor substrates for chips)

-

Sankyo Oilless Industry Corp. (high-quality substrates for electronic applications)

-

Imasen Electric Industrial Co., Ltd. (ceramic substrates for automotive and industrial use)

-

Mitsubishi Materials Corporation (high-performance substrates and materials for electronics)

-

Others

Recent Development

-

In December 2022, AMD and Viettel High Tech successfully deployed a field test for a 5G mobile network using AMD Xilinx Zyng UltraScalet MPSoCs. With more than 130 million mobile subscribers, Viettel High Tech, the largest telecom provider in Vietnam, has a long experience of deploying new networks more quickly thanks to new 5G remote radio heads. It is intended to satisfy the rising capacity and performance requirements worldwide mobile users.

-

In February 2022,Project Call 7.0 (PC 7.0), the most recent request for proposals, was published NextFlex, America's Flexible Hybrid Electronics (FHE) Manufacturing Institute, in order to support Department of Defense requirements. PC 7.0 seeks to fund projects that improve the creation and use of FHE while tackling important problems with enhanced production. Since NextFlex's establishment, an estimated USD 100 million has been set aside for projected investments in FHE. After the project value for PC 7.0 exceeds USD 11.5 million (project value and investment estimates including cost), it will be worth more than USD 128 million sharing).

-

In July 2023, mobility technology company Magna and Onsemi, a pioneer in intelligent power and sensing technologies, announced a long-term supply agreement (LTSA) that will allow Magna to include Onsemis EliteSiC intelligent power solutions into its eDrive systems. by utilizing the industry-leading EliteSiC MOSFET technology from Onsemi, Magna eDrive systems might increase cooling performance, accelerate charging and acceleration rates, and increase the range of electric cars (EVs).

-

LG Innotek unveiled the 2-Metal COF in March 2023 at the International Consumer Electronics Show (CES). A semiconductor substrate package called COF (Chip on Film) connects the display to the main printed circuit board. It facilitates the shrinking of display bezels and module miniaturization in electronic products including TVs, laptops, monitors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 81.15 Million |

| Market Size by 2032 | USD 535.50 Million |

| CAGR | CAGR of 26.6 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (GaSb, InSb, Bulk GaN, Ga2O3, Bulk AlN, Single crystal diamond, Engineered substrates and templates) • By Application (Computing, Consumer, Industrial/Medical, Communication, Automotive, Military/Aerospace) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | TTM Technologies Inc., BECKER & MULLER, SCHALTUNGSDRUCK GMBH, Advanced Circuits, Sumitomo Electric Industries Ltd, Wurth Elektronik Group (Wurth Group), AMD, Viettel High Tech, NextFlex, Infineon Technologies Inc., LG Innotek, Onsemi, NXP Semiconductors, Taiwan Semiconductor Manufacturing Company (TSMC), Sankyo Oilless Industry Corp., Imasen Electric Industrial Co., Ltd., and Mitsubishi Materials Corporation. & Others |

| Key Drivers | • Innovation in Flexible Substrates for Solar Cells and Emerging Applications • The Emergence of Eco-Friendly Substrates in the Electronics Industry and the Focus on Sustainability |

| Restraints | • Striking a balance between innovation and manufacturing feasibility in substrates development. |