Food Premix Market Report Scope & Overview:

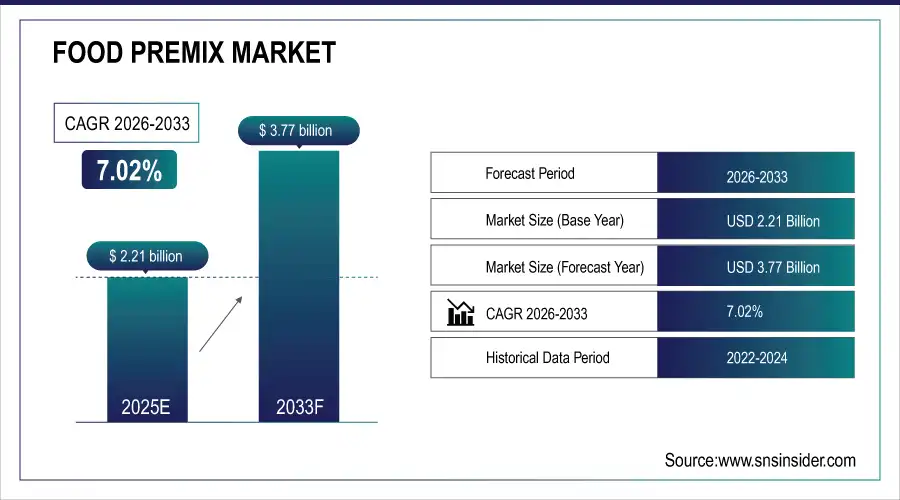

Food Premix Market was valued at USD 2.21 billion in 2025E and is expected to reach USD 3.77 billion by 2032, growing at a CAGR of 7.02% from 2026-2033.

To Get more information On Food Premix Market - Request Free Sample Report

The Food Premix Market is growing due to rising consumer demand for fortified and functional foods, increasing health awareness, and expanding dietary supplement consumption. Growth in dairy, beverage, and bakery industries, along with innovations in powder and liquid premixes, supports adoption. Manufacturers’ focus on immunity, bone health, and energy-enhancing formulations, coupled with convenience, cost-effectiveness, and regulatory support for nutritional fortification, further drives global market expansion between 2026 and 2033.

Market Size and Forecast

-

Market Size in 2025: USD 2.21 Billion

-

Market Size by 2033: USD 3.77 Billion

-

CAGR: 7.02% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Food Premix Market Trends

-

Rising demand for fortified and functional foods is driving the food premix market.

-

Growing focus on preventive healthcare and nutrition-rich diets is boosting adoption.

-

Increasing use of premixes in infant formula, bakery, beverages, and dietary supplements is fueling market growth.

-

Expansion of personalized nutrition and clean-label trends is shaping product innovation.

-

Food manufacturers are leveraging premixes for consistent quality, cost efficiency, and faster production cycles.

-

Growing prevalence of lifestyle-related diseases is pushing demand for vitamin, mineral, amino acid, and probiotic premixes.

-

Strategic partnerships and product launches are strengthening market competitiveness and global penetration.

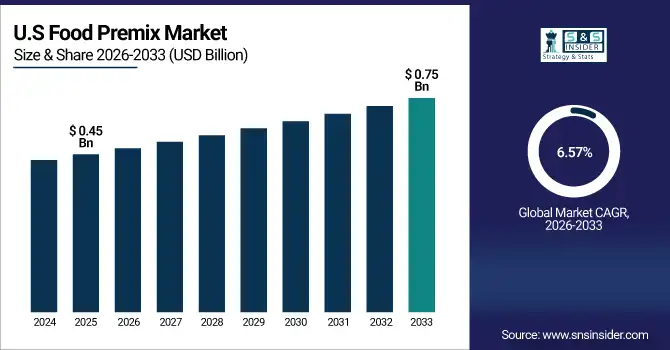

U.S. Food Premix Market was valued at USD 0.45 billion in 2025E and is expected to reach USD 0.75 billion by 2032, growing at a CAGR of 6.57% from 2026-2033.

The U.S. Food Premix Market is growing due to rising demand for fortified foods and dietary supplements, increasing health awareness, and expanding applications in dairy, beverages, and bakery products, supported by innovation and convenient premix solutions.

Food Premix Market Growth Drivers:

-

Rising consumer demand for fortified and functional foods globally is accelerating the growth of the Food Premix Market significantly

Increasing health awareness and the growing preference for fortified foods are driving the Food Premix Market. Consumers seek enhanced nutrition through dietary supplements, beverages, and fortified dairy products, boosting demand for vitamins, minerals, and hydrocolloids. Food manufacturers are integrating premixes to ensure consistency, quality, and compliance with nutritional standards. The expanding nutraceutical and functional food industry, coupled with busy lifestyles demanding convenient fortified products, fuels widespread adoption. Government initiatives promoting nutrition and wellness further support market growth. This rising consumer inclination toward healthy and fortified diets is a major driver of global Food Premix Market expansion.

Food Premix Market Restraints:

-

Stringent regulations and quality compliance standards pose challenges and restrain Food Premix Market expansion globally

Food premixes must comply with international and local regulations concerning additive levels, labeling, safety, and nutrient claims. Regulatory variations across countries create complexities for manufacturers distributing globally. Failure to meet standards can result in product recalls, financial losses, and reputational damage. Testing for contaminants, heavy metals, and stability increases operational burden. Continuous monitoring of compliance and adherence to guidelines for vitamins, minerals, and hydrocolloids requires investment in infrastructure and skilled personnel. These regulatory challenges hinder rapid expansion of the Food Premix Market and create barriers for new entrants and small-scale producers.

Food Premix Market Opportunities:

-

Growing demand for functional, fortified, and personalized nutrition products presents significant opportunities in Food Premix Market

Consumers increasingly seek products that support immunity, bone health, weight management, and energy performance. Personalized nutrition trends drive manufacturers to offer customized premix solutions for supplements, beverages, and dairy applications. Development of specialized blends, such as plant-based or organic premixes, enables entry into niche markets. Partnerships with health professionals, dieticians, and wellness brands expand product reach. Investment in R&D for enhanced bioavailability, flavor masking, and solubility creates differentiation opportunities. These factors open new revenue streams and support market expansion, allowing manufacturers to meet evolving consumer preferences in functional and fortified nutrition globally.

Food Premix Market Segment Highlights

-

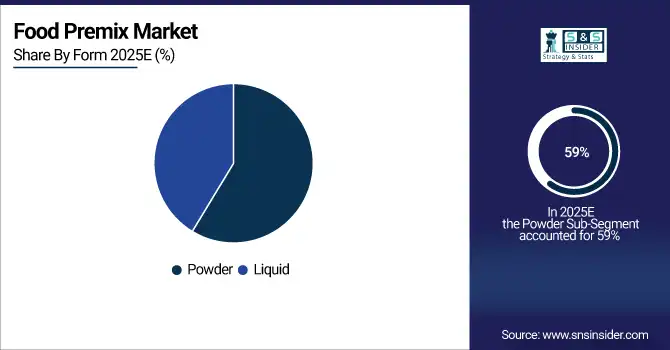

By Form, Powder dominated with ~59% share in 2025; Liquid fastest growing (CAGR).

-

By Application, Dairy Products dominated with ~36% share in 2025; Beverage fastest growing (CAGR).

-

By Type, Vitamins dominated with ~46% share in 2025; Hydrocolloids fastest growing (CAGR).

-

By Functionality, Immunity Enhancement dominated with ~32% share in 2025; Immunity Enhancement fastest growing (CAGR).

Food Premix Market Segment Analysis

By Form, Powder dominated in 2025; liquid expected fastest growth 2026–2033 due to convenience and ready-to-use formulations.

Powder segment dominated the Food Premix Market due to its longer shelf life, ease of transportation, and versatility across dietary supplements, dairy, and beverage applications. Powder premixes are cost-effective, simple to handle, and compatible with automated production processes, ensuring consistent nutrient distribution and broad industrial adoption globally.

Liquid segment is expected to grow at the fastest CAGR from 2026-2033 owing to rising demand for ready-to-use, convenient formulations in beverages, nutritional drinks, and functional liquids. Liquid premixes offer faster dissolution, improved bioavailability, and flexibility in flavoring, making them highly suitable for personalized nutrition products and innovative functional beverages worldwide.

By Application, Dairy products led in 2025; beverages projected fastest growth 2026–2033 from fortified and functional drink demand.

Dairy Products segment dominated the Food Premix Market due to strong global consumption of fortified milk, yogurt, and cheese products. Premixes enhance nutritional value, ensure consistency, and support large-scale dairy production efficiently. Rising awareness of bone health, immunity, and general wellness fuels adoption in dairy applications.

Beverage segment is expected to grow at the fastest CAGR from 2026-2033 due to increasing consumer preference for fortified drinks, energy beverages, and functional juices. Premixes simplify nutrient incorporation, maintain flavor stability, and enable scalable production. Growing demand for on-the-go, health-focused beverages drives rapid market growth in this segment.

By Type, Vitamins dominated in 2025; hydrocolloids expected fastest growth 2026–2033 due to texturizing and stabilizing needs.

Vitamins segment dominated the Food Premix Market due to widespread use in dietary supplements, fortified dairy, and beverages. Vitamins improve immunity, bone health, and overall nutrition, making them essential in premix formulations and driving high adoption across industrial and consumer applications globally.

Hydrocolloids segment is expected to grow at the fastest CAGR from 2026-2033 due to rising demand for texturizing, stabilizing, and gelling agents in beverages, dairy, and functional foods. Hydrocolloid premixes enhance product consistency, shelf life, and mouthfeel while supporting innovative applications in fortified and functional food products worldwide.

By Functionality, Immunity enhancement led in 2025 and expected fastest growth 2026–2033 driven by rising health-focused consumer demand.

Immunity Enhancement segment dominated the Food Premix Market due to rising consumer focus on health and wellness, increasing awareness of preventive nutrition, and growing demand for fortified foods and supplements. Premixes targeting immunity provide essential vitamins, minerals, and bioactive compounds, ensuring effective nutrient delivery. The segment is expected to grow at the fastest CAGR from 2026-2033 as consumers increasingly seek functional foods, fortified beverages, and personalized nutrition solutions to strengthen immune health, driving widespread adoption across dietary supplements, dairy, and beverage applications globally.

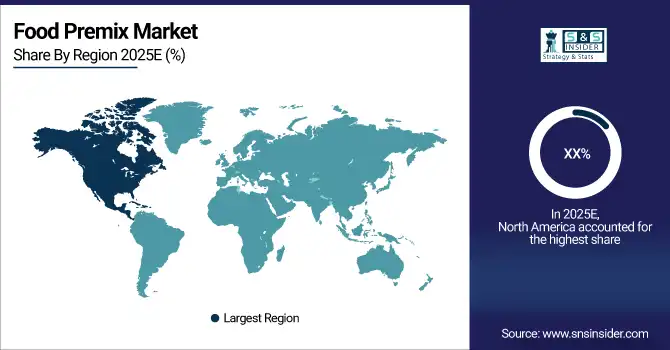

Food Premix Market Regional Analysis

North America Food Premix Market Insights

North America accounted for a significant share in the Food Premix Market in 2025 due to high consumer awareness, growing demand for fortified foods, and advanced dietary supplement industries. Strong presence of key market players, well-established distribution channels, and increasing health-consciousness among consumers drive adoption. Rising investment in research and development, coupled with regulatory support for food fortification, further enhances market growth and solidifies North America’s position as a major regional contributor.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Food Premix Market Insights

Asia Pacific dominated the Food Premix Market with the highest revenue share of about 40% in 2025 due to rapid population growth, increasing health consciousness, and rising demand for fortified and functional foods. The region’s expanding dairy and beverage industries, coupled with the strong presence of key manufacturers, are driving widespread adoption and contributing significantly to market revenue, ensuring its leading position in the global Food Premix Market.

Europe Food Premix Market Insights

Europe held a substantial share in the Food Premix Market in 2025 due to increasing demand for fortified foods, dietary supplements, and functional beverages. Growing consumer awareness about health and nutrition, along with strict regulatory standards for food safety, supports market adoption. Presence of established manufacturers, robust distribution networks, and investment in research and innovation further drive growth. Expansion of the health and wellness sector, coupled with rising preference for convenient and ready-to-use premix products, reinforces Europe’s market dominance.

Middle East & Africa and Latin America Food Premix Market Insights

Middle East & Africa and Latin America accounted for a smaller but growing share of the Food Premix Market in 2025 due to rising health awareness and increasing demand for fortified foods. Expanding retail and distribution networks, along with government initiatives promoting nutrition and food safety, are driving adoption. Growing population, urbanization, and rising disposable income further support market growth, creating opportunities for manufacturers in these emerging regions.

Food Premix Market Competitive Landscape:

Archer Daniels Midland Company (ADM)

ADM is a global leader in agricultural processing and food ingredients, providing innovative solutions in nutrition, feed, and food products. The company operates across the supply chain, from sourcing crops to delivering value-added ingredients to food, beverage, and animal nutrition markets. ADM focuses on operational efficiency, sustainability, and cost management, with a diversified portfolio including soy protein, premixes, additives, and animal feed solutions for global markets.

-

September 23, 2025: ADM announced a joint venture with Alltech, contributing 11 U.S. feed mills, streamlining operations and reducing costs while retaining U.S. premix and additive operations.

-

May 1, 2023: ADM closed its Bushnell, Illinois plant to streamline its soy protein production network as part of cost-cutting initiatives.

DSM (Koninklijke DSM N.V.)

DSM is a global science-based company active in nutrition, health, and sustainable living. The company develops innovative solutions across human, animal, and plant nutrition, including premixes, food supplements, and specialty ingredients. DSM emphasizes sustainability, quality, and technological innovation, offering tailored solutions for pet food, animal feed, and food production markets. Their premix facilities ensure precise formulation, safety, and high efficiency to meet evolving industry demands.

-

May 1, 2023: DSM announced plans to build a next-generation premix facility in Tonganoxie, Kansas, dedicated to pet food applications, expected to be operational by early 2025.

Cargill Incorporated

Cargill is a global provider of food, agriculture, and nutrition solutions. The company serves diverse markets, including pet food, human nutrition, and animal feed, offering innovative ingredients, premixes, and functional additives. Cargill focuses on sustainability, research-driven solutions, and market-driven product development, enabling manufacturers to meet health trends and regulatory standards. Their premix and specialty ingredient offerings support targeted nutritional claims and optimize product performance for global clients.

-

2024: Cargill introduced postbiotic ingredients for pet food manufacturers, supporting health claims with products like TruPet and EpiCor Pets.

Vitablend Nederland B.V.

Vitablend Nederland B.V. specializes in the production of custom vitamin and mineral premixes for the food, beverage, and feed industries. The company emphasizes flexibility, precision, and high-quality formulations to meet the specific nutritional requirements of clients. Vitablend focuses on innovation, regulatory compliance, and tailored solutions, supporting manufacturers in creating functional, nutrient-enriched products. Their premix solutions enhance nutritional value, stability, and process efficiency in various applications worldwide.

-

2024: Vitablend Nederland B.V. specializes in customized vitamin and mineral premixes catering to food and beverage industry needs.

Associated British Foods plc (AB Agri Ltd)

AB Agri Ltd, a division of Associated British Foods, focuses on animal nutrition, premixes, and feed solutions, serving global livestock and poultry markets. The company emphasizes innovation, sustainability, and operational efficiency, offering tailored premixes and nutritional solutions. AB Agri integrates advanced research and manufacturing technologies to optimize animal health and performance, supporting food security and industry growth while expanding its portfolio through strategic acquisitions.

-

August 15, 2025: Associated British Foods agreed to acquire the Hovis bread brand, strengthening its Allied Bakeries division and expanding its UK bakery portfolio.

Key Players

Some of the Food Premix Market Companies

-

Archer Daniels Midland Company

-

DSM (Koninklijke DSM N.V.)

-

Cargill Incorporated

-

BASF SE

-

Corbion N.V.

-

Glanbia plc

-

Bioven Ingredients

-

Zagro Asia Limited

-

Wright Enrichment Inc.

-

Nutreco N.V.

-

Vitablend Nederland B.V.

-

Associated British Foods plc (AB Agri Ltd)

-

Barentz International B.V.

-

Prinova Group LLC

-

Hexagon Nutrition Pvt. Ltd.

-

SternVitamin GmbH & Co. KG

-

Farbest-Tallman Foods Corporation

-

Jubilant Life Sciences

-

Watson Inc

-

Kemin Industries, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.21 Billion |

| Market Size by 2033 | USD 3.77 Billion |

| CAGR | CAGR of 7.02% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application(Dietary Supplements, Beverage, Dairy Products, Others) • By Form(Powder, Liquid) • By Type(Vitamins, Minerals, Hydrocolloids) • By Functionality(Bone Health, Immunity Enhancement, Weight Management, Digestive Health, Energy & Performance) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Archer Daniels Midland Company, DSM (Koninklijke DSM N.V.), Cargill Incorporated, BASF SE, Corbion N.V., Glanbia plc, Bioven Ingredients, Zagro Asia Limited, Wright Enrichment Inc., Nutreco N.V., Vitablend Nederland B.V., Associated British Foods plc (AB Agri Ltd), Barentz International B.V., Prinova Group LLC, Hexagon Nutrition Pvt. Ltd., SternVitamin GmbH & Co. KG, Farbest-Tallman Foods Corporation, Jubilant Life Sciences, Watson Inc, Kemin Industries, Inc. |