Halal Food and Beverage Market Report Scope & Overview:

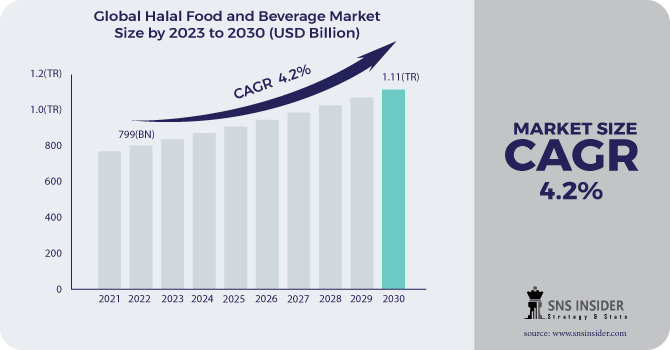

Halal Food and Beverage Market Size was valued at USD 799 billion in 2022 and is expected to reach USD 1.11 trillion by 2030, and grow at a CAGR of 4.2% over the forecast period 2023-2030.

Halal food is a food that complies with Islamic regulations, as characterized in the Quran. Halal rules normally disallow food sources, for example, pork or other meat not butchered by Islamic guidelines and blood-based items like liquor, while allowing just fit meats (like hamburgers) and chicken with halal confirmation. The word Halal means passable and it applies to any object that is permitted by Islam, similar to meat or anything overall.

Halal food is ready with a certain goal in mind and in view of Islamic regulations. To convey the halal confirmation, a creature should be butchered by a Muslim who summons Allah for gift (Bismillah) prior to butchering them with a sharp blade while slitting their jugular, windpipe, and jugular veins at the same time. Halals is otherwise called 'halāl' or ṭayyib, meaning unadulterated or healthy which alludes to any object that has been made clean as indicated by Islam's rules when it comes into contact with pork items like bacon or ham. An individual can devour such food on the off chance that they see if there was any defilement of these fixings from non-pork sources during handling.

Halal beverages are any refreshment that contains no illegal fixings. Instances of allowed drinks incorporate water, espresso, and tea without caffeine or milk items as well as natural product juice with no added sugar. Cocktails from the Islamic confidence likewise fall under this classification notwithstanding cola and caffeinated drink blends. Halal beverages are not allowed to contain any fixings precluded by the Islamic confidence, including meat concentrates, for example, hamburgers remove for drinks containing nutrients; yeast or different substances got from either creatures or bugs.

Market Dynamics:

Driving Factors:

- The tendency towards nutritious and safe quality food.

Restraining Factors:

- The stoppage popular for meat items because of wellbeing and cleanliness concerns.

Opportunities:

- The rising interest among buyers in the utilization of veggie lover food and drink alongside item presentation by halal makers for these cognizant customers.

- Tender fresh produces halal-guaranteed items which will use an upper hand.

Challenges:

- Complex regulatory system of halal food and rebeverages.

Impact of Covid-19:

The disturbance of the food inventory network inferable from the quick spread of COVID-19 impacted the food and refreshment market including the halal food industry. Driving makers overall encountered a decrease in labor and disturbance in the import and commodity of halal food which fundamentally impacted the utilization and deal capacity. Likewise, the log jam popular for meat items because of wellbeing and cleanliness worries during the pandemic adversely affected the business.

Market Estimations:

Product type:

The meat and options portion held the biggest piece of the pie and is supposed to keep up with predominance during the figure time frame. Developing shopper inclination for microscopic organisms free meat inferable from wellbeing, cleanliness, and security concerns, the interest for these items will observe an ascent in the predictable period. In any case, grain items are projected to enroll the quickest development during the conjecture time frame. Oats or grain items are picking up speed among purchasers because of their dietary advantages. These items incorporate wheat, rice, pasta, bread, and breakfast oats.

Distribution Channel:

Hypermarkets and store were a bigger conveyance channel with a portion of the overall industry. A rising number of these stores across different districts have encountered a flood in the conveyance of halal food on the lookout. The web-based circulation channel is expected to enlist quicker development during conjecture years. The quick computerized change welcomed on by Muslim and non-Muslim customers searching for solid, tasty, and advantageous dinners that can be conveyed at home, will support the section development.

Key Market Segmentation:

By Product:

-

Meat & Alternatives

-

Milk & Milk Products

-

Fruits & Vegetables

-

Grain Products

-

Others

By Distribution Channel:

-

Hypermarket & Supermarket

-

Departmental Store

-

Online

-

Others

.png)

Regional Analysis:

-

North America

-

The USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Asia Pacific held the most extreme halal food and drinks portion of the overall industry. The biggest Islamic populace is engaged in the Asia Pacific district as the four greatest countries as far as the Muslim populace are arranged on this mainland, containing India, Indonesia, Pakistan, and Bangladesh. The Middle East and Africa have enormous idle for the market development as the clients in this district are basically Muslim with expanding per capita incomes. Europe is noticing huge development on the lookout. Flooding adaptable earnings combined with a rising Muslim populace is assessed to lift the interest for halal items.

Key Players:

Nestlé S.A, Cargill, Incorporated, Unilever, American Halal Company, Inc., Al-Falah Halal Foods, Prima Agri-Products, One World Foods Inc., Midamar Corporation, QL Foods, Rosen's Diversified Inc.

Cargill-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 799 Billion |

| Market Size by 2030 | US$ 1.11 Trillion |

| CAGR | CAGR 4.2% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •by Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores and Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, +D11UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Nestlé S.A, Cargill, Incorporated, Unilever, American Halal Company, Inc., Al-Falah Halal Foods, Prima Agri-Products, One World Foods Inc., Midamar Corporation, QL Foods, Rosen's Diversified Inc. |

| Key Drivers | •The tendency towards nutritious and safe quality food. |

| Market Restraints | •The stoppage popular for meat items because of wellbeing and cleanliness concerns. |