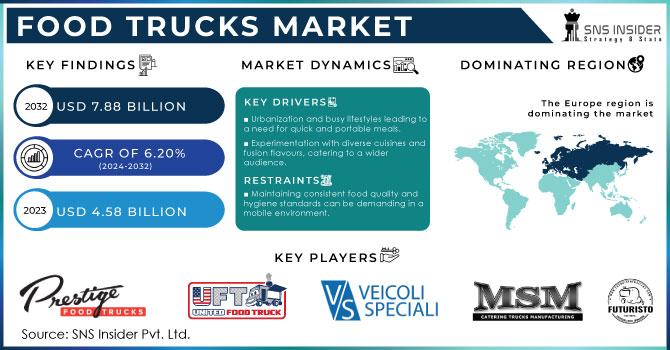

Food Trucks Market Size & Overview:

Get More Information on Food Trucks Market - Request Sample Report

The Food Trucks Market size was valued at USD 4.58 billion in 2023 and is expected to reach USD 7.88 billion by 2032 and grow at a CAGR of 6.20% over the forecast period 2024-2032.

There's a global trend towards adventurous eating, with consumers, especially younger generations, seeking out new and exciting culinary experiences. Food trucks deliver this perfectly, offering diverse cuisines and unique menus that traditional restaurants can't match. The high cost of restaurant makes food trucks a much more attractive option for entrepreneurs. They offer lower operational costs and the flexibility to move to locations with high foot traffic, like office areas or festivals. This mobility allows them to tap into a wider customer base and cater to events, creating a vibrant and social dining atmosphere.

Online ordering systems and mobile apps make it easier for customers to find food trucks, browse menus, and place orders for pickup, reducing wait times and enhancing convenience. For example, a food truck specializing in gourmet tacos could leverage a popular food ordering app to reach a wider audience and allow customers to pre-order their tacos before arriving at the truck's location. Regulations and permitting processes can be complex and vary depending on the location, making it challenging for new vendors to enter the market. Thus, finding prime locations with consistent customer flow can be difficult, especially in crowded urban areas.

Food Trucks Market Dynamics:

Key Drivers:

-

Urbanization and busy lifestyles leading to a need for quick and portable meals.

-

Experimentation with diverse cuisines and fusion flavours, catering to a wider audience.

-

Rise of social media driving food truck popularity through viral trends and customer recommendations.

-

Lower operational costs compared to traditional restaurants, allowing for competitive pricing.

Traditional restaurants require significant investments in rent, staff, and infrastructure like kitchens and dining areas. Food trucks, on the other hand, can operate with a much smaller footprint. Their kitchens are streamlined for efficiency, often focusing on specific cuisines or menu items that require less equipment. The staffing needs are typically lower compared to a full-service restaurant. This translates to lower operational costs for food truck owners. These savings can then be passed on to customers through competitive pricing, making their offerings more affordable compared to traditional restaurants. This price advantage is particularly attractive to younger demographics and budget-conscious consumers seeking a delicious and convenient meal option. The lower overhead allows food trucks to experiment with unique menus and niche offerings, catering to specific customer preferences without the risk associated with a high-investment restaurant.

For example, "Kogi Truck," a Los Angeles-based Korean-Mexican fusion food truck. Their mobile kitchen eliminates the need for a large dining area and dedicated wait staff. They likely require fewer cooks compared to a full-service restaurant as their menu focuses on specific items like tacos and burritos. This streamlined operation allows them to cut down on expenses, allowing them to price their delicious Korean BBQ tacos competitively, perhaps even lower than similar Korean tacos offered at a sit-down establishment.

Restraints:

-

Maintaining consistent food quality and hygiene standards can be demanding in a mobile environment.

-

Parking restrictions and regulations can limit operational flexibility and customer convenience.

Limited parking availability, especially in popular areas with high customer foot traffic, restricts their ability to set up shop in prime locations. This can limit their visibility and customer reach. The restrictions on parking duration or specific zones can force frequent relocations, disrupting customer routines and hindering the ability to build a consistent presence. The regulations like time limits or designated parking zones can limit operational flexibility. Food trucks might miss peak lunch hours due to parking restrictions or be unable to capitalize on evening crowds in certain areas. This lack of flexibility can affect their ability to optimize sales and cater to customer demand effectively. Thus, parking restrictions create a challenge for food trucks to find convenient and strategic locations, ultimately impacting their customer convenience and overall profitability.

Food Trucks Market Segments:

by Type

-

Expandable

-

Boxes

-

Buses & Vans

-

Customized Trucks

-

Others

Buses & Vans is the dominating sub-segment in the Food Trucks Market by type holding around 60-65% of market share, due to its perfect balance of affordability, functionality, and mobility. Compared to other options, buses and vans offer a larger workspace, allowing for more extensive kitchens and a wider menu variety. This caters to the growing consumer demand for diverse and unique food options. Their movability allows them to navigate crowded urban areas and access events or festivals, maximizing customer reach. While customized trucks offer a unique appeal, their high cost often deters new entrants. Expandable trucks, while space-efficient, might limit menu options. Boxes and "other" categories often represent niche solutions or are less common due to limitations in functionality.

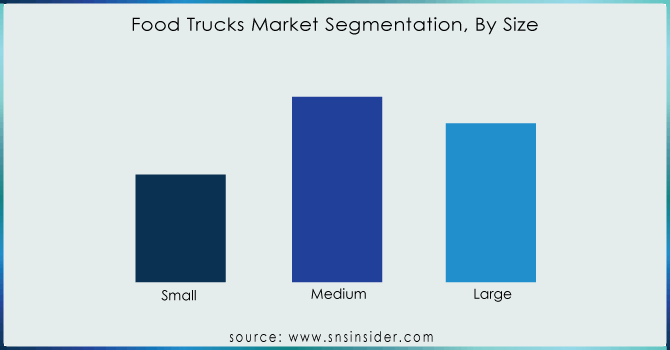

by Size

-

Small

-

Medium

-

Large

Medium is the dominating sub-segment in the Food Trucks Market by size holding around 40-45% of market share. They offer a sweet spot between affordability and functionality. They are larger than small trucks, allowing for a more comfortable workspace and a wider range of equipment compared to their smaller counterparts. This translates to a more diverse menu and improved efficiency in food preparation. However, unlike large trucks, they incur lower operational costs and require less maintenance. This cost-effectiveness is crucial for new food truck businesses and allows for competitive pricing. Small trucks, while highly mobile, may struggle with limited menu options. Large trucks, though offering the most space, come with higher costs and require more permits, making them less suitable for most food truck businesses.

Get Customized Report as per your Business Requirement - Request For Customized Report

by Food Type

-

Barbecue & Snacks

-

Fast Food

-

Desserts & Confectionary

-

Bakery

-

Vegan & Meat Plant

-

Others

Fast Food & Barbecue and Snacks are the dominating sub-segment in the Food Trucks Market by food type due to their focus on convenient, flavourful, and familiar food options. These segments cater to busy lifestyles and the growing demand for on-the-go meals. Fast food options like burgers, fries, and ethnic street food staples are popular choices for quick lunches or casual dining. Barbecue and snacks, on the other hand, offer a delicious and portable option for grabbing a bite between errands or enjoying a casual outdoor meal. This focus on familiar and crowd-pleasing food allows these segments to attract a wider customer base and maintain consistent demand.

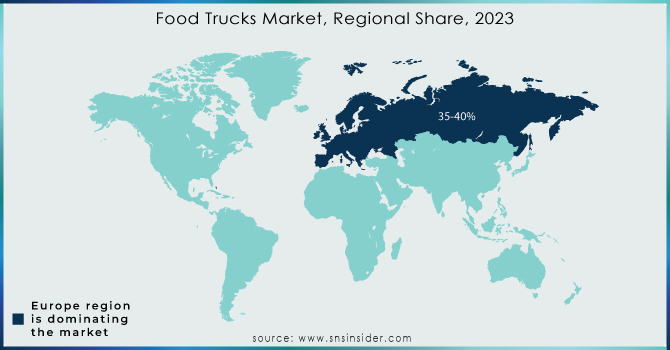

Food Trucks Market Regional Analyses

Europe is the dominating region in the Food Truck Market, holding a market share of around 30-35%. Europe has a rich history of street food culture, with established events and festivals dedicated to showcasing diverse culinary options. This ingrained love for street food creates a strong customer base for food trucks. The relaxed regulations compared to other regions, particularly regarding permitting and licensing, make it easier for new food truck businesses to enter the market.

North America is the second highest region in this market. The popularity of food trucks in this region is driven by a growing consumer demand for convenient and flavourful food options. Busy lifestyles and a culture of on-the-go dining make food trucks a perfect fit. The entrepreneurial spirit in North America fosters a diverse range of food truck concepts, offering unique culinary experiences that traditional restaurants might not.

The Asia Pacific region is experiencing the fastest growth in the Food Truck Market. This rapid rise can be attributed to a strong existing street food culture and a growing preference for convenient and affordable meals. The increasing urbanization in the region creates a demand for mobile food solutions. The growing middle class with disposable income is willing to explore diverse culinary options, which food trucks provide.

Regional Coverage:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Food Trucks Market Key Players

The major key players are Prestige Food Trucks, United Food Trucks, M&R Trailers, VS Veicoli Speciali, Futuristo Trailers, MSM Catering Trucks Manufacturing, The Fud Trailer Company, Bostonian Body, Inc., Roaming Hunger, Roundup World Street Kitchen, Custom Concessions and other key players.

Food Trucks Market Recent Development

-

In June 2023: Volta Trucks partners with METRO Germany to add electric Volta Zero trucks to their delivery fleet. The initial deployment starts in North Rhine-Westphalia, with expansion planned for Bavaria and Berlin as METRO aims for a sustainable delivery future.

-

In June 2023: Hyzon Motors, a hydrogen fuel cell truck maker, signed a deal with Performance Food Group, a major North American food distributor, to deliver five eco-friendly electric trucks.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.58 Billion |

| Market Size by 2031 | US$ 7.88 Billion |

| CAGR | CAGR of 6.20% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type ( Expandable, Boxes, Buses & Vans, Customized Trucks, Others ) • by Size ( Small, Medium, Large ) • by Food Type ( Barbecue & Snacks, Fast Food, Desserts & Confectionary, Bakery, Vegan & Meat Plant, Others ) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Prestige Food Trucks, United Food Trucks, M&R Trailers, VS Veicoli Speciali, Futuristo Trailers, MSM Catering Trucks Manufacturing, The Fud Trailer Company, Bostonian Body, Inc., Roaming Hunger, Roundup World Street Kitchen, Custom Concessions |

| Key Drivers | • Urbanization and busy lifestyles leading to a need for quick and portable meals. • Experimentation with diverse cuisines and fusion flavours, catering to a wider audience. • Rise of social media driving food truck popularity through viral trends and customer recommendations. • Lower operational costs compared to traditional restaurants, allowing for competitive pricing. |

| Restraints | • Maintaining consistent food quality and hygiene standards can be demanding in a mobile environment. • Parking restrictions and regulations can limit operational flexibility and customer convenience. |