FPD Robots Market Size Analysis:

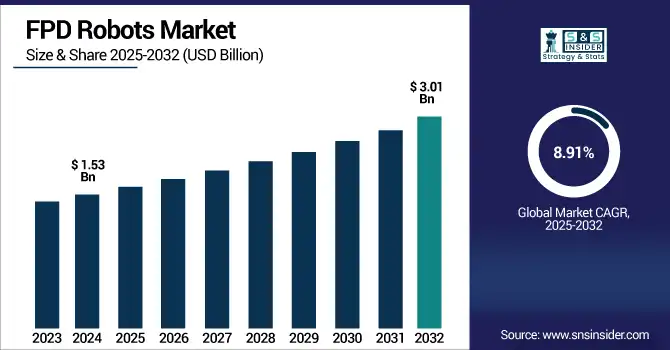

The FPD Robots Market Size was valued at USD 1.53 billion in 2024 and is expected to reach USD 3.01 billion by 2032 and grow at a CAGR of 8.91 % over the forecast period 2025-2032.

To Get more information on FPD-Robots-Market - Request Free Sample Report

The Growth of the Global FPD Robots Market is driven by rising automation in manufacturing of displays, growing demand for sophisticated handling, and the constant development in robotics. Robots are increasingly being combined with AI and ML to provide for better accuracy and control and to help reduce errors. All of these make for the growth of the market and its increasing value in high-tech production.

According to research, AI-powered robotic systems have been shown to reduce manufacturing errors by up to 30%, improving yield and lowering operational costs.

The U.S. FPD Robots Market size was USD 0.29 billion in 2024 and is expected to reach USD 0.61 billion by 2032, growing at a CAGR of 9.66 % over the forecast period of 2025–2032.

The US FPD Robots Market growth will be supported by growing penetration of automation across manufacturing domains, surge in FPD production for needs of precision, and continued investments in advanced robotics. The increasing cost of labor and the preference for operational efficiency in high-tech manufacturing have further prompted the use of FPD robots in industrial facilities in the U.S.

According to research, FPD production in the U.S. is projected to expand at an annual rate of around 8-9%, fueled by demand for high-resolution displays in consumer electronics and industrial applications.

FPD Robots Market Dynamics

Key Drivers:

-

Increasing need to enhance production speed and operational efficiency supports widespread integration of FPD robots

Growing demand to improve rate of production and efficiency in operation is prompting manufacturers to make substantial investments for FPD robots in all their plants. The human hand can simply not compete with the throughput, accuracy or consistency of robots, particularly in high volume production environments. Robots increase efficiency for repetitive tasks, optimal resource utilization and shortened lead times, assisting manufacturers to satisfy increasing worldwide demand for displays. Combined with the benefits of real-time monitoring and system integration, robotics provide for higher operating standards, increased repeatability, and substantial long term savings, and are an indispensable tool in competitive electronics manufacturing.

According to research, Robots can increase production throughput by up to 30-50% compared to manual operations, significantly reducing cycle times in high-volume manufacturing.

Operational efficiency improvements of 25-40% have been reported in plants integrating FPD robots for repetitive tasks.

Restrain:

-

Limited skilled workforce to manage, program, and maintain robotics systems affects smooth implementation of FPD automation

The lack of a qualified workforce to operate, program and service robotics systems is one of the major factors hampering the effective deployment of automation solutions in display manufacturing. With the advancement of robots, also comes an increase in demand of technicians with expertise in robotics, AI integration, and system diagnostics. But lack of talent in these domains creates inefficiencies and more dependence on third-party services. components Even in parts of the world with good training environment this is a bottleneck for scalability and responsiveness. The issue of the skill gap is limiting, for the companies, that is, who want to exploit robotic potential to the fullest in their production facility.

Opportunities:

-

Rising demand for flexible display panels creates new opportunities for robotic solutions tailored to emerging form factors

Growing need for flexible display panels have paved way for new opportunities for robots which can effectively deal with bendable and ultra-thin materials. With products such as foldable smartphones, wearable displays, or rollable TVs becoming more and more popular on the market, manufacturers are turning away from traditional robots and they are now replacing them with robotic systems that can manipulate them without the risk of damaging those fragile substrates. The change in product design requires development in both the robotic grippers, motion control and in quality inspection tools. Adaptive robotic solutions providers are poised to take advantage of the increased penetration of new generation displays, opening new doors for design-specific automation solutions.

According to research, Use of adaptive robotic grippers and precision motion control systems reduces substrate damage rates by up to 35% compared to traditional handling methods.”

Advanced inspection tools powered by robotics increase defect detection accuracy by 20-30%, enabling higher quality production.

Challenges:

-

Technical complexities in robot adaptation for evolving display technologies challenge consistent and reliable deployment in production

Technical issues related to robot adaptation regarding changing display technologies is causing difficulties in uniform deployment. With display type changing from LCD to OLED and further, production demand and manipulation means have to switch. In the prior art, robots have to be reprogrammed or have to be changed in order to be able to deal with different size/ sensitivity/ and process steps, resulting in excess cost and time. And robotic systems and software face even more pressure to be perfect when product designs change frequently. As the frequent transitions cause the scalability in lack of seamlessness and standardization, it becomes a burden to both time-to-market and engineering overheads.

FPD Transfer Robot Market Segment Analysis:

By Robot Type

Articulated Robots dominated the FPD Robots Market in 2024, accounting for about 30.90% of the total revenue. This rapid growth is driven due to their high flexibility, multi-axial motion, and accurate complex flat panel display assembly processes. Acts glass robots are considered a versatile and ideal solution for rapid, precise and flexible production in tasks like glass handling, bonding and inspection. Articulated robot solutions with high-performance levels have been offered to the FPD industry from companies such as Yaskawa Electric Corporation.

Collaborative Robots (Cobots) are projected to grow at the fastest CAGR of approximately 10.01% from 2025 to 2032. This rapid growth is driven by increasing demand for flexible, safe and user-friendly automation solutions within the FPD market. One company helping to drive this growth is Universal Robots which manufactures lightweight, user-friendly cobots designed to be operated by humans. Cobots are also space and cost efficient and are suitable for highmix low-volume production, which has led to their implementation in flat panel display (FPD) manufacturing.

By End-user Industry

The automotive segment dominated the FPD Robots Market in 2024, capturing the highest revenue share of around 32.86%. This dominance due to the growing penetration of high-resolution flat panel screens on the vehicle dashboards, infotainment systems, and advanced driver-assistance systems. High precision and high-speed Fanuc Robots for the automotive production lines by Fanuc Corporation The demand for intelligent, network-like Cars and extremely high quality and reliability standards have made the use of robotics in the FPD assembly processes for this industry an indispensable requirement.

The pharmaceuticals segment is expected to register the fastest CAGR of 10.50% from 2025 to 2032. There is an increase in the demand for cleanroom-compatible automation by robotic systems for preventing contaminants in the pharmaceutical manufacturing process which is a major driver for the sector. There are companies like ABB Ltd. that provide robots systems, which are specifically designed for sterile, high precision applications in pharma environments. These robots aid in packaging, labeling, inspection and maintaining compliance as well as strengthen routine operations of the pharmaceutical industry to enhance productivity and minimize operational risks.

By Component

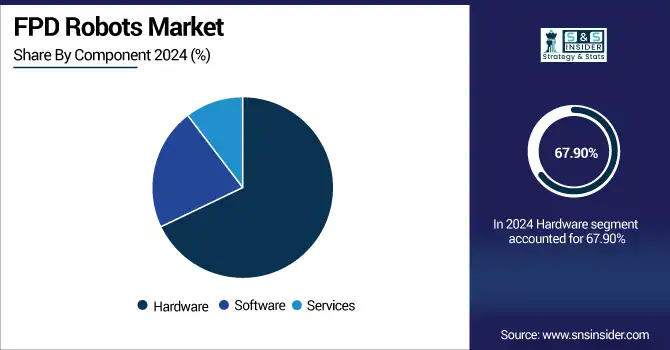

The hardware segment dominated the highest share of the FPD Robots Market, contributing about 67.90% of the total revenue. This dominance is attributable primarily to the huge amount invested in the robotic arms, sensors, controls and other materials that are needed for proper FPD production. Robotics KUKA AG One of the leading suppliers of innovative and advanced robotics-based technology for high speed and precision flat panel displays handling. This segment holds a prime position in the marketplace based on ongoing need for durable, cutting-edge hardware.

The software segment is anticipated to expand at the fastest CAGR of 10.67% from 2025 to 2032. Market growth in this segment is driven by focus on smart automation capacities, which necessitates sophisticated control algorithms, real-time data analytics, and predictive maintenance solutions. FPD Robots Companies like Siemens AG are developing industrial software platforms that enable better robot integration and a data-driven control system. Growth has been further accelerated by factories embracing Industry 4.0 technologies and demanding ever smart- software capabilities.

By Technology

Artificial Intelligence (AI) dominated the highest FPD Robots Market share of approximately 35.85% in 2024. AI integration increases the efficiency, flexibility and accuracy in robotic systems applied in flat panel display making. Omron Corporation is one such major player offering AI integrated robotic solutions for quality inspection, alignment, and error correction tasks. AI to reduce human error, increase yields and fit in with industry’s push for smart automation.

Machine Learning (ML) is projected to grow at the fastest CAGR of around 10.18% from 2025 to 2032. Increasing demand for predictive maintenance, adaptive process control, and high quality assurance encourages the usage of ML into FPD robotic systems. Rockwell Automation is also working on ML-based control systems that can enable robots to learn from operating data and improve performance. And as displays get smarter, through machine learning, robots can maximise the process in real-time, minimising downtime and ensuring a predictable level of productivity.

FPD Robots Market Regional Outlook:

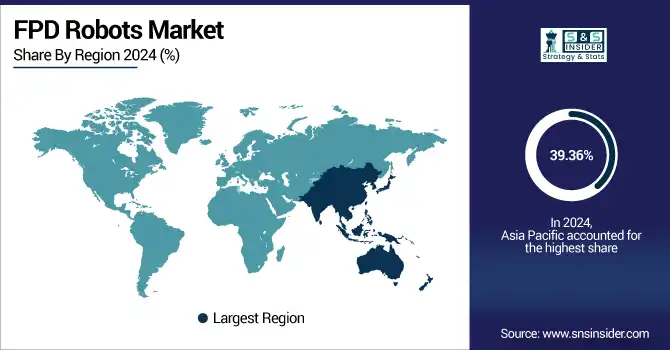

Asia Pacific dominated the FPD Robots Market in 2024, securing the highest revenue share of approximately 39.36%. This dominance is due to the heavy presence of leading flat panel display manufacturers in such as China, Japan, and South Korea. The region has the advantage of well-developed electronics supply chains, cheaper production prices and favourable policies to encourage automation and advanced manufacturing. These factors together propel the growth of the FPD robot market in Asia Pacific as this is dominating the overall market.

-

Asia Pacific Market is dominated by China on account of large-scale manufacturing of flat panel display in the country, with a huge demand and significant support by the governments for automation and an easy availability of raw materials. This combination helps the display industry in the country to adopt robotics technology at a higher rate.

North America is projected to witness the fastest CAGR of about 10.25% from 2025 to 2032. The growth is primarily attributed to the rapid developments in smart manufacturing and industry 4.0, coupled with the surging demand for high-resolution consumer electronics. The region’s emphasizing innovation, bringing production back to the domestic market, and incorporation of state-of-the-art robotics and AI technologies in production operations has significantly contributed to the growing adoption of FPD robots in North America.

-

US leads the North American Market owing to the superior technology infrastructure along with focus on innovation, substantial investments in automation, and leading electronics manufacturers. These are the forces behind the very fast penetration of state-of-the-art robotics in flat panel display manufacturing.

Europe holds a significant position in the Market, driven by its prevalent automobile and electronics industries that necessitate high-precision flat panel displays. The area is primarily based on advanced manufacturing technology, sustainability and automation to produce the goods with higher quality and faster production. Growing research and development activities and favorable government policies are promoting the adoption of robotics in display manufacturing in leading European nations.

-

Germany dominates Europe Market due to the presence of developed manufacturing industry along with robust automotive and electronics segment and high focus on automation. Its emphasis on precision engineering and innovation results in minimal use of robots in flat panel display manufacturing.

In Middle East & Africa FPD Robots market, UAE is leading the pack due to its solid industrial infrastructure and government support for automation and in Latin America, Brazil primarily due to increasing electronics manufacturing and increasing applications of robots. Both are fast developing in terms of smart manufacturing and display.

Get Customized Report as per Your Business Requirement - Enquiry Now

FPD Robots Companies are:

Major Key Players in FPD Robots Market are Samsung Electronics Co., Ltd., Sony Corporation, Panasonic Corporation, JUKI Corporation, Kawasaki Heavy Industries, Ltd., Yamaha Motor Co., Ltd., ABB Ltd., FANUC Corporation, KUKA AG, Mitsubishi Electric Corporation.

Recent Development:

-

In November 2024, FANUC introduced the M-1000/550F-46A, a large handling robot designed for heavy payloads in FPD manufacturing. Additionally, the company unveiled the CRX-10iA/L Paint, the world's first global explosion-proof collaborative paint robot, expanding automation capabilities in FPD coating applications.

-

In January 2024, Sony introduced the ISOCELL Vizion63D and Vizion931 image sensors, designed for next-generation mobile, commercial, and industrial applications, including robotics. These sensors are expected to enhance visual capabilities in FPD robot systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.53 Billion |

| Market Size by 2032 | USD 3.01 Billion |

| CAGR | CAGR of 8.91% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Robot Type (Mobile Robots, Articulated Robots, Collaborative Robots (Cobots), Humanoid Robots, Autonomous Guided Vehicles (AGVs)) • By End-user Industry (Automotive, Electronics, Food and Beverage, Pharmaceuticals, Retail) • By Component (Hardware, Software, Services) • By Technology (Artificial Intelligence, Machine Learning, Computer Vision, Natural Language Processing, Internet of Things (IoT) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Samsung Electronics Co., Ltd., Sony Corporation, Panasonic Corporation, JUKI Corporation, Kawasaki Heavy Industries, Ltd., Yamaha Motor Co., Ltd., ABB Ltd., FANUC Corporation, KUKA AG, Mitsubishi Electric Corporation. |