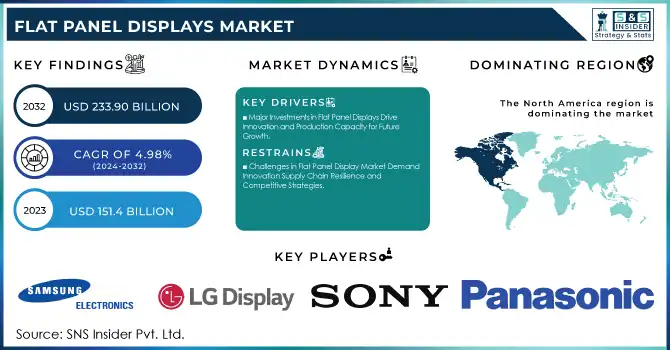

FLAT PANEL DISPLAYS MARKET KEY INSIGHTS:

To Get More Information on Flat Panel Displays Market - Request Sample Report

The Flat Panel Displays Market Size was valued at USD 151.4 Billion in 2023 and is expected to reach USD 233.90 Billion by 2032 and grow at a CAGR of 4.98% over the forecast period 2024-2032.

With gadgets like smartphones, televisions, and laptops becoming increasingly integral to nearly every aspect of modern life, consumers have begun opting for better display quality, subsequently driving manufacturers to innovate in OLED, Quantum Dot, and micro-LED technologies. These improve image quality, device energy efficiency, and flexibility to meet the needs of consumers who increasingly expect clear images with detail, color, and complexity. In addition, the increasing gaming and streaming activities, as well as higher data consumption for digital content also push displays with better visual experiences to the FPD industries to keep renewing.

OLED panel shipment volume worldwide was about 225 million units in 2023, compared to 190 million in 2022. Quantum Dots predicted to capture 25% of LCD TV market within Q Dot Technology by 2024.

Micro-LED displays are expected to run over 50 million units of production in 2024. 80% of gamers in the U.S. own flat panel displays, 45% will choose a better-quality display over other feature. Compared to conventional LCDs, OLED displays use 40% less power.

Nearly 70% of new televisions that shipped in 2023 were at least 4K resolution, while the worldwide volume for flat panel TVs topped out at 220 million units.

In addition, the increasing application of displays in emission applications such as automotive and healthcare supports the demand for FPD. Within the automotive segment, integrated digital displays are being used in dashboards, instrument clusters, infotainment systems, and head-up displays in support of industry trends toward more intelligent and interactive vehicles. Flat panel displays in healthcare applications are used in diagnostic and monitoring equipment where HD visuals are essential for precise analysis. Smart wearables and digital signage are also growing applications that drive the market due to the incorporation of long-lasting displays with high-quality features, providing an immersive experience. The adoption of FPDs across many sectors demonstrates its versatility and significance in modern technology.

MARKET DYNAMICS

KEY DRIVERS:

-

Major Investments in Flat Panel Displays Drive Innovation and Production Capacity for Future Growth

Big FPD companies like LG Display, Samsung, and BOE Technology are pouring remarkable sums of investments into several manufacturing facilities & research activities to scale up capacity & make it cost-efficient. Some of these investments have a heavy emphasis on high-end display technologies for which those processes are complex, such as OLED, and micro-LED. It will, in turn, push manufacturers to scale up production capabilities and thereby economies of scale, bringing down prices for advanced displays so more people can enjoy them. On top of this, governments in countries such as South Korea, China, and Japan which have large electronics sectors are underpinning these investments with generous subsidies and incentives boosting production capabilities by another order of magnitude. Such impetus in infrastructure development has become paramount to cater to this rising demand for numerous sectors including consumer electronics, automotive as well as healthcare which thus propels growth for the global market. For example, The South Korean company aims to spend USD 2.2 billion on new QD-OLED production facilities, with the goal of boosting their output foliages.

-

Smart Home Device Expansion Fuels Demand for Flat Panel Displays in the IoT Ecosystem

The major reason is the increased deployment of smart home devices which will be integrated with Flat panel displays for a better human interaction interface on the device. Smart refrigerators, home assistants with video screens, and smart thermostats are turning consumer electronics into display-driven interactive hubs for information entertainment and control over them. With the growth of an Internet of Things ecosystem, there is an increasing demand for smart displays that are not only high quality and long-lasting but can also seamlessly integrate into different smart home applications. Close to 45% of the smart home devices contain some kind of flat panel display as of 2023.

About 10 million smart thermostats with flat panel displays were sold in 2023, a growth of around 20% year-over-year. Not only will this trend continue to accelerate as smart home devices grow even smarter and more connected, but demand for FPDs across non-applications like electronics will also persist. Collectively these drivers emphasize the need for infrastructure and the impact of lifestyle changes due to IoT in sustaining FPD market growth.

RESTRAIN:

-

Challenges in Flat Panel Display Market Demand Innovation Supply Chain Resilience and Competitive Strategies

A key challenge faced is the fast-changing world of technology which requires manufacturers to continuously innovate and adapt. Different display technologies such as OLED and micro-LED are getting better each year, so companies have to invest thousands of dollars continuously into improving aspects such as resolution and energy efficiency. Moreover, the supply chain is disrupted with great scarcity of materials required to manufacture display boards which can greatly influence manufacturing timelines. Another challenge is that environmental regulations governing electronic waste and sustainability are becoming stricter, compelling companies to create eco-friendly manufacturing processes and disposal methods. In addition, fierce competition between major players such as LG Display, Samsung and BOE Technology may turn into a price war which will affect profit margins. Finally, the changes in consumer tastes and the international economy can impact demand which puts manufacturers at risk of being insensitive to the market and not profitable.

KEY SEGMENTATION ANALYSIS

BY TECHNOLOGY

LCD technology dominated the market in 2023 with 32% market share due to its matured status across many applications and sub-segments, together with cost-effective solutions for all major fields such as consumer electronic products, automotive displays, and industrial use cases. For quite some time now, LCDs have been the preferred solution for most manufacturers due to the combination of cost-effective performance, energy efficiency, and decent picture quality across a wide range of use cases, from TVs to smartphones.

OLED technology is estimated to grow at the fastest CAGR from 2024-2032. There are multiple reasons for this increase. Well, because OLED displays have deeper blacks, higher contrast ratios and much faster response times than LCDs. Moreover, the trend of OLED technology is gaining momentum due to growing demand for UHD televisions, smartphones and wearables, as viewers are continuing to choose a superior viewing experience. In addition, improvements in manufacturing techniques and decreasing production costs are opening up OLED displays to a wider array of products, which is also contributing to market growth.

BY APPLICATION

Smartphones and tablets accounted for 36% of the market share in 2023 largely because these devices are ubiquitous these days and have become essential tool for everyday life. Bridges the gap between portability, almost all functions and connectivity. They are mass-adopted because of regular improvements in processor speeds, high-definition rendering, and better design/UI- which continues to captivate consumer interest and increase replacement rates regularly.

Smart wearables are projected to register the fastest CAGR during the forecast span 2024 to 2032. It is likely driven by growing consumer interest in health and fitness tracking, an expansion of the Internet of Things ecosystem, and advances in wearable tech. Since then, consumers have started using devices with features such as heart rate monitoring, sleep tracking, and fitness coaching, which are increasingly shifting them to wearables. Moreover, smart wearables and smartphone integration enable premium user experience boosting adoption. With the growing trend of health-conscious consumers and seeking connected solutions, the smart wearable market is poised for rapid growth.

BY END USE

In 2023, the automotive sector held the largest market share of 27% and is expected to see fastest growth from 2024-2032. The dominance of Automotive Software market is primarily attributed to high demand for technology in automobiles, like infotainment systems, navigation aids and other safety features that are expected by the consumers. The quick transition to electric vehicles and the increasing focus on sustainability are also boosting automotive demand, as automakers pour R&D into developing products that comply with laws addressing climate change by contributing cleaner transportation technology. For the automotive market, it is also fueled by adaption and integration capability of advanced technology such as autonomous driving systems, connected vehicle platform smart X-in-car. The automotive industry gets an edge in the large market ecosystem as urbanization rises and consumers demand a more connected, convenient and greener world. Such fusion between technological innovation and evolving consumer preferences is what keeps the automotive industry on top of market trends.

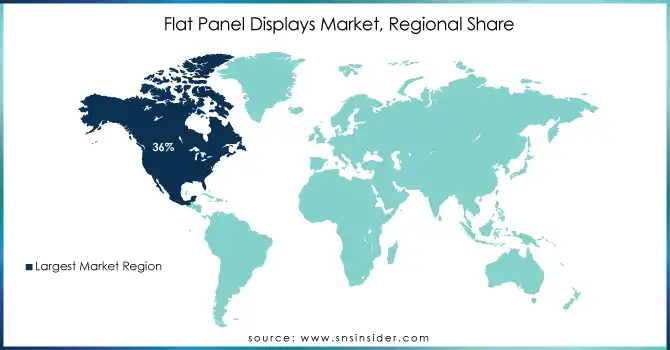

REGIONAL ANALYSIS

In 2023, North America retained a significant share of the market at 36% as it is propelled by numerous factors such as developed nature of technological infrastructure, high consumer expenditure on technology-based products, and a greater focus on innovation. This is a region where Silicon Valley-meeting the automotive industry has an established pedigree with plenty of investments in electric vehicles and smart technologies. For example, electric vehicle adoption has exploded in the United States with companies like Tesla leading the way thanks to government policies and incentives to promote clean energy and lower emissions.

Asia Pacific is projected to exhibit the fastest CAGR over the forecast period from 2024 to 2032. This growth is supported by rapid urbanization, rising disposable incomes and an expanding middle class in countries such as China and India. China is the world largest market for electric vehicles, and companies such as BYD and NIO are gaining significant share in such a market with growing government push for solutions in e-mobility and sustainable transportation. Also, smart manufacturing and the IoT revival in South Korea and Japan is heightening technological developments among fields. The interplay of development factors laid below will ramp-up level of activities to the Asia Pacific sales region in following years while reshaping global market landscape.

Do You Need any Customization Research on Flat Panel Displays Market - Inquire Now

Key Players

Some of the major players in the Flat Panel Displays Market are:

-

Samsung Electronics Co. Ltd (QLED TVs, OLED Displays)

-

LG Display Co. Ltd (OLED TVs, LCD Panels)

-

Sony Corporation (Bravia OLED TVs, LCD TVs)

-

AU Optronics Corp. (LCD Panels, OLED Displays)

-

Panasonic Corporation (OLED TVs, Plasma Displays)

-

Toshiba Mobile Display Co. Ltd (LCD Panels, OLED Screens)

-

Chimei Innolux Corporation (LCD Panels, Touch Displays)

-

Emerging Display Technologies Corp. (LCDs, OLEDs)

-

Japan Display Inc. (LCD Displays, OLEDs)

-

Universal Display Corporation (OLED Technology, Phosphorescent OLEDs)

-

Clover Display Limited (LCD Displays, Touch Screens)

-

Densitron Technologies PLC (Industrial Displays, Touch Screen Monitors)

-

Chunghwa Picture Tubes Ltd. (LCD Panels, LED Displays)

-

Optronics Corp. (LCDs, OLEDs)

-

Sharp Corporation (Aquos LCD TVs, IGZO Displays)

-

Innolux Corporation (LCD Panels, Touch Displays)

-

Taiwan Semiconductor Manufacturing Company (TSMC) (Display Driver ICs, Advanced Panel Technologies)

-

BOE Technology Group Co. Ltd (LCD Panels, AMOLED Displays)

-

Rohm Semiconductor (Display Drivers, Power Management ICs)

-

E Ink Holdings Inc. (E-Paper Displays, Flexible Displays)

Some of the Raw Material Suppliers for Flat Panel Displays Companies:

-

3M Company

-

DuPont

-

Covestro AG

-

LG Chem

-

Samsung SDI

-

BASF SE

-

Sumitomo Chemical Co.

-

Hitachi Chemical Co.

-

Asahi Glass Co.

-

Nippon Electric Glass Co.

RECENT TRENDS

-

In April 2024, Sharp Plans Largest Display Fab Unit Outside Japan, Eyes 1,000-Acre Facility In India To Produce Latest High-End Displays.

-

In January 2024, Lawrence Berkeley National Laboratory has developed "supramolecular ink," a new technology for OLED displays and electronic devices. Made from inexpensive, Earth-abundant elements, this ink offers a more affordable and environmentally sustainable alternative to costly rare metals, paving the way for greener flat-panel screens.

-

In October 2024, RGB Communications launched a new line of Hikvision Interactive Flat Panel Displays (IFPDs) that enhance collaboration in education and business. Featuring Ultra 4K resolution, precise writing, and intuitive whiteboard software, these displays offer exceptional versatility.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 151.4 Billion |

| Market Size by 2032 | USD 233.90 Billion |

| CAGR | CAGR of 4.98% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (OLED, Quantum Dot, LED, LCD, Others) • By Application (Smartphone and Tablet, Smart Wearable, Television and Digital Signage, PC and Laptop, Vehicle Display, Others) • By End Use (Healthcare, Retail, BFSI, Military and Defense, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Electronics Co. Ltd, LG Display Co. Ltd, Sony Corporation, AU Optronics Corp., Panasonic Corporation, Toshiba Mobile Display Co. Ltd, Chimei Innolux Corporation, Emerging Display Technologies Corp., Japan Display Inc., Universal Display Corporation, Clover Display Limited, Densitron Technologies PLC, Chunghwa Picture Tubes Ltd., Optronics Corp., Sharp Corporation, Innolux Corporation, Taiwan Semiconductor Manufacturing Company (TSMC), BOE Technology Group Co. Ltd, Rohm Semiconductor, E Ink Holdings Inc |

| Key Drivers | • Major Investments in Flat Panel Displays Drive Innovation and Production Capacity for Future Growth • Smart Home Device Expansion Fuels Demand for Flat Panel Displays in the IoT Ecosystem |

| Restraints | • Challenges in Flat Panel Display Market Demand Innovation Supply Chain Resilience and Competitive Strategies |