Articulated Robot Market Size & Growth:

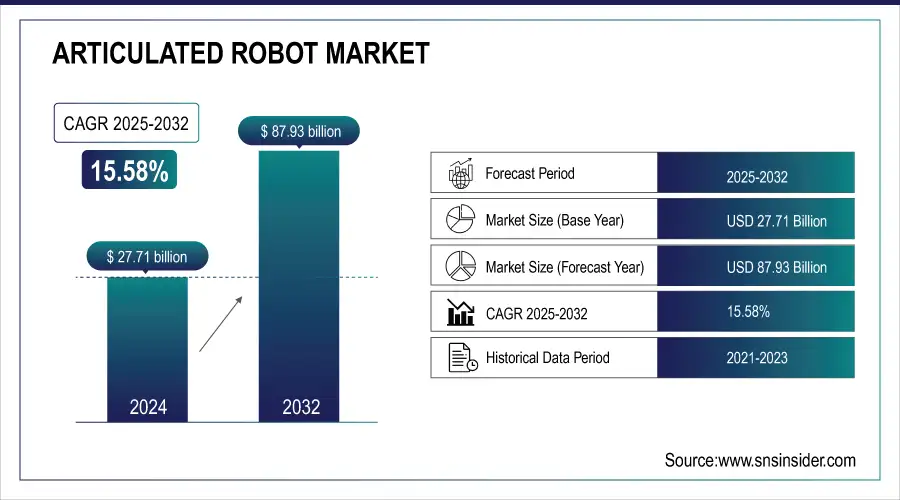

The Articulated Robot Market size was valued at USD 32.02 billion in 2025E and is expected to grow at a CAGR of 15.58% to reach USD 101.99 billion by 2033.

Articulated robot market trends are increasing adoption in SMEs, AI-enabled robotics, and Industry 4.0 integration. Advancements in collaborative robots and lightweight designs are also transforming flexible manufacturing processes.

The demand for industrial automation across various sectors, such as automotive, electronics, and pharmaceuticals has led to the articulated robot market growth, given their ability to improve productivity, precision, and safety. Rising labor costs, shrinking workforces, and constant quality demand from customers are also pushing companies to robotics. Integration of new technologies (such as AI), IoT to monitor properties in a local scale or collaborative capabilities are further broadening application areas. Furthermore, the growing government initiatives for smart and infrastructure and investment play an important role in deploying articulated robots globally in developed and developing economies.

To Get more information on Articulated Robot Market - Request Free Sample Report

Collaborative articulated robots (cobots) saw a 20% rise in adoption in 2024, especially in SMEs and pharmaceutical packaging environments due to their safety and ease of use.

Market Size and Forecast: 2025E

-

Market Size in 2025E USD 32.02 Billion

- Market Size by 2033 USD 101.99 Billion

- CAGR of 15.58% From 2026 to 2033

- Base Year 2025E

- Forecast Period 2026-2033

- Historical Data 2021-2024

Articulated Robot Market Trends:

• Industries such as automotive, electronics, pharmaceuticals, and metalworking are increasingly adopting articulated robots to improve efficiency, precision, and safety.

• Rising labor costs and the need for high-speed, high-quality production are accelerating demand for automation.

• Integration of AI, machine learning, and sensor-based real-time feedback enhances robot reliability, functionality, and predictive maintenance.

• Adoption of articulated robots is expanding among small and mid-sized enterprises (SMEs) seeking compact, lightweight, and flexible automation solutions.

• Smart factory initiatives and Industry 4.0 programs in emerging economies, particularly Asia Pacific and Latin America, are driving market growth.

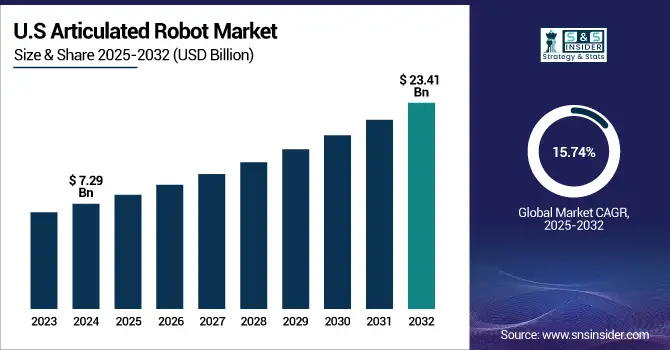

The U.S articulated robot market size was valued at USD 7.29 billion in 2025E and is expected to reach USD 23.41 billion by 2033, growing at a CAGR of 15.74% over the forecast period of 2026-2033. Articulated Robot market in the U.S. is expanding due to reshoring of manufacturing, steep labor shortages and costs, rising EV and smart‐factory investments, and broader AI‑IoT enabled automation adoption.

Articulated Robot Market Growth Drivers:

-

Automation Demand and AI Integration Propel Growth of Articulated Robots in High-Precision Manufacturing Industries

A key factor in driving the global articulated robot market is an increase in automation in industries such as automotive, electronics, pharmaceuticals and metalworking, where the goal is to increase efficiency, safety, and precision by reducing human intervention. Demand for articulated robots is being driven by factors, such as rising labor costs, increasing demand for high-speed and high-quality production, and furthering focus on eliminating human error among the manufacturers. Furthermore, the increasing adoption of robotics across industries is complemented by rapidly developed technologies, for example in artificial intelligence (AI), real-time feedback systems based on sensors, and machine learning are increasing reliability and functionality of the robots.

AI-enabled robotics in manufacturing is delivering tangible gains of 25%–40% improvements in efficiency, defect reduction, predictive maintenance uptime, and waste minimization have been reported.

Articulated Robot Market Restraints:

-

Complex Integration and Lack of Standards Restrain Articulated Robot Deployment Across Low-Tech Manufacturing Sectors

The high complexity of system integration and programming is a key restraint in the global articulated robot market, especially in industries with low technical knowledge. Robots can be customized for a variety of applications, but doing so typically requires a pipeline of expertise in software, motion control, and safety compliance, all of which, can introduce delays in deployment. Moreover, the absence of uniform communication standards among various robotics and automation systems can obstacle smooth interoperability in smart factories.

Articulated Robot Market Opportunities:

-

Smart Factories and SME Demand Unlock New Growth Opportunities for Articulated Robots in Emerging Markets

The growing smart factories and Industry 4.0 initiatives provides lucrative opportunities especially in the emerging economies of Asia Pacific and Latin America. In addition, the increasing demand for lightweight, compact articulated robots in small and mid-sized enterprises (SME) is expected to generate new channels for scalable and flexible automation solutions.

In Q1 2025, cobots represented 11.6 % of all robot orders and 6.8 % of revenue in North America evidence of broad uptake among small and mid-sized manufacturers.

Articulated Robot Market Segment Analysis:

By Payload Capacity

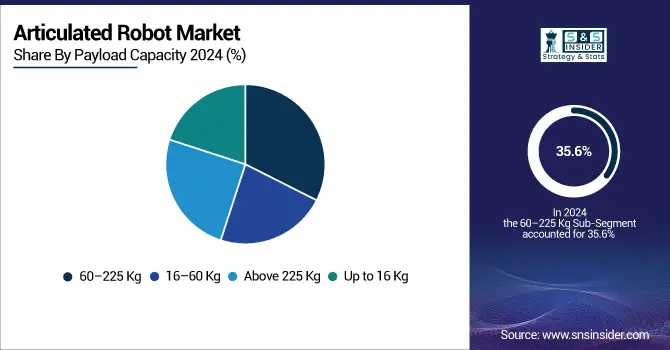

The articulated robot market was led by the 60–225 Kg payload segment, which accounted approximately 35.6% of the global articulated robot market share in 2025E. This dominance is driven by its widespread utilization in heavy heavy-duty applications, primarily in automotive, metal fabrication, and industrial machinery markets. The robots also provide the required power and range for high-volume production, making them the preferred class for large manufacturers for tasks such as welding, material handling, and assembly. The Up to 16 Kg segment is projected to show the fastest CAGR over 2026-2033, owing to the increase in demand from electronics, food and beverage, and the pharmaceutical sectors. Flexible, lightweight, and compact, these robots are perfect for accuracy tasks in limited space and are particularly appealing for SMEs.

By Function

In 2025E, Welding function segment accounted for the largest share of the articulated robot market at 31.5% on account of the versatile usage of these robot types across automotive and metalworking industry. This makes these robots essential for quality spot and arc welding, for instance, in vehicle production lines, where quality and consistency are critical. Due to their continuous, high-precision, and low-margin-of-error operational capabilities, they have become a staple part of production for extensive, high-throughput industrial scenarios. The fastest growth from 2026-2033 is anticipated for the dispensing segment, driven by the high demand in electronics, pharmaceuticals, and packaging. With high repeatability and cleanliness being two key requirements in cleanroom and precision manufacturing environments, dispensing robots are perfect for applications where precise fluid application, such as adhesives, sealants, and coatings, are needed.

By Industry Vertical

The articulated robot market was dominated by the Automotive industry in 2025E, with a 39.4% share, due to large-scale applications in welding, assembly, painting, and material handling. This, along with a continuing drive in the industry for increased efficiency, accuracy, and scalability of production especially with the electric vehicle (EV) manufacturing boom all over the global has assured its continued leadership in robots. To adapt to changing demand, this has also led major automakers to further investments in automation to decrease downtime and provide consistency of product. The pharmaceuticals & cosmetics segment is projected to exhibit the highest CAGR during 2026-2033, driven by a growing requirement for cleanroom automation, sterile handling, and accurate dispensing. With increasing restrictions and global production, articulated robots are gradually being used for packaging, inspection, and formulation operations under controlled settings.

By Component

The robot arm segment held the largest market share in the articulated robot market, constituting a share of 36.4% in 2025E, since it provides the main framework for the multi-axis movement and flexibility. Robot arms are used widely across automotive, metal, and machinery industries to provide the strength, range of motion, and accuracy needed in processes such as welding, assembly, and material handling. Due to their rugged design and tailor ability or fit to payload, they are a foundational investment class for industrial automation systems. The end effector segment is projected to register the highest CAGR during the forecast period during 2026-2033, owing to the rising need for task-specific tools including grippers, welding torches, suction cups, and dispensers. With the needs of industries increasing for more flexible and customizable functions from industrial robotics, advanced end effectors are increasingly required for high-precision, multi-purpose tasks.

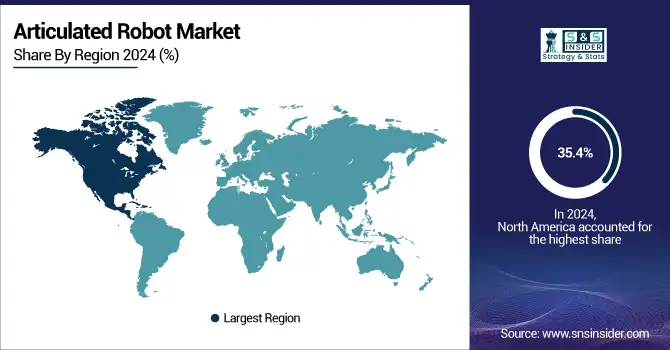

Articulated Robot Market Regional Analysis:

North America Articulated Robot Market Insights

North America held lead position in articulated robot market and accounted for 35.4% share in 2025E, owing to automation deployment by sectors such as automotive, electronics, aerospace and pharmaceuticals. The rapidly growing manufacturing infrastructure, high labor costs, and drive toward operational efficiency in the region has further accelerated the adoption rate of articulated robots. The market expansion was also supported by the reshoring production incentives from the government, and the investment in the smart factory. North America is dominating the industrial automation landscape as it is home to several major players offering robotic technology, along with the significant R&D capabilities over the last few years, this is providing high precision and modular robotic systems to support OEMs.

Get Customized Report as per Your Business Requirement - Enquiry Now

The vast penetration of automation in automotive and electronics manufacturing sectors aided market growth in North America with the U.S. leading this market.

Asia Pacific Articulated Robot Market Insights

With rapid industrialization, labor shortages, and increased investment in smart manufacturing, the articulated robot market is forecasted to witness fastest growth in Asia-Pacific and will grow at a 16.45% CAGR over 2026-2033. The fast-growing production of automotive, electronics, and semiconductors in the region, particularly in China, Japan, South Korea, and India, is contributing to the increasing demand for automation. The growth is also attributed to industry 4.0 initiatives supported by the government, favourable policies, and an increase in number of small and mid-sized manufacturers. Moreover, the diminishing cost of robots and technology around miniaturized, AI-enabled systems are expanding accessibility of articulated robots across various applications.

Owing to massive investments in industrial automation in China and higher penetration levels of local robot manufacturers, the country continued to dominate the overall Asia-Pacific market in 2025E.

Europe Articulated Robot Market Insights

Europe held its position as a major region in the articulated robot market during 2025E owing high level of sophistication in manufacturing abilities, stringent regulations, and heightened emphasis on sustainability, and precision engineering. Strong demand across automotive, food & beverage, electronics, and pharmaceutical sectors with growing focus on automation to improve productivity and mitigate operational risk were key trends in the region. With the permeation of Industry 4.0 practices and the incorporation of AI, IoT, and machine vision into robots, these automation capabilities are developing further. Furthermore, strong government backing for the development of smart factories and for robotics R&D, skilled labor, and the continuing growth of export-driven industries has spurred articulated robot adoption throughout Europe.

Latin America (LATAM) and Middle East & Africa (MEA) Articulated Robot Market Insights

The articulated robot market in Latin America and Middle East & Africa witnessed a stable growth in 2024 due to growing industrialization and initiatives to upgrade manufacturing. Robots are being used in industries, such as automotive, food processing, and pharmaceuticals in order to improve efficiency and ease the burden of reliance on human labor. Automation is being bolstered by government efforts to diversify economies, improve manufacturing capabilities, and attract foreign investment. Both regions are still regarded as emerging markets, but improved infrastructure fueled with rising demand for production at a competitive price has offered some new growth potential for both regions.

Articulated Robot Market Key Players:

The articulated robots companies are FANUC, ABB, Yaskawa, KUKA, Kawasaki, Mitsubishi Electric, DENSO, Nachi-Fujikoshi, Comau, Epson, Staubli, Universal Robots, Techman, Omron, Seiko Epson, Hyundai Robotics, Bosch Rexroth, Siasun, Hanwha Robotics, and Shibaura Machine.

Competitive Landscape for Articulated Robot Market:

FANUC is a global leader in industrial automation, specializing in articulated robots for high-precision manufacturing. The company provides AI-enabled, compact, and high-speed robotic solutions that enhance efficiency, accuracy, and safety across automotive, electronics, pharmaceuticals, and metalworking industries. FANUC supports smart factories and scalable automation for SMEs worldwide.

-

In November 2024, FANUC introduced the M‑1000/550F‑46A, a 550 kg payload, long‑reach (4.6 m) robot designed for giga‑cast automotive applications, expanding motion range via a serial‑link arm architecture.

Yaskawa is a leading industrial robotics company offering articulated robots for diverse manufacturing sectors. Its AI-integrated, high-precision robots improve production speed, quality, and safety in automotive, electronics, pharmaceuticals, and metalworking industries. Yaskawa’s solutions support smart factory initiatives and flexible automation, catering to both large enterprises and SMEs globally.

-

In March 2025, Yaskawa and Toyota unveiled Sequence Freezing Arc‑Welding (SFA), slashing roll cage welding times from weeks to days while improving rigidity and precision through controlled heat input.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 32.02 Billion |

| Market Size by 2033 | USD 101.99 Billion |

| CAGR | CAGR of 15.58% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Payload Capacity (Up to 16 Kg, 16–60 Kg, 60–225 Kg, and Above 225 Kg) • By Function (Welding, Material Handling, Assembly, Painting, Dispensing, and Others) • By Industry Vertical (Automotive, Electrical & Electronics, Metals & Machinery, Plastics, Rubbers, & Chemicals, Food & Beverages, Pharmaceuticals & Cosmetics, and Others) • By Component (Robot Arm, Controller, End Effector, Drive System, Sensors, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | FANUC, ABB, Yaskawa, KUKA, Kawasaki, Mitsubishi Electric, DENSO, Nachi-Fujikoshi, Comau, Epson, Staubli, Universal Robots, Techman, Omron, Seiko Epson, Hyundai Robotics, Bosch Rexroth, Siasun, Hanwha Robotics, and Shibaura Machine. |