Service Robotics Market Size:

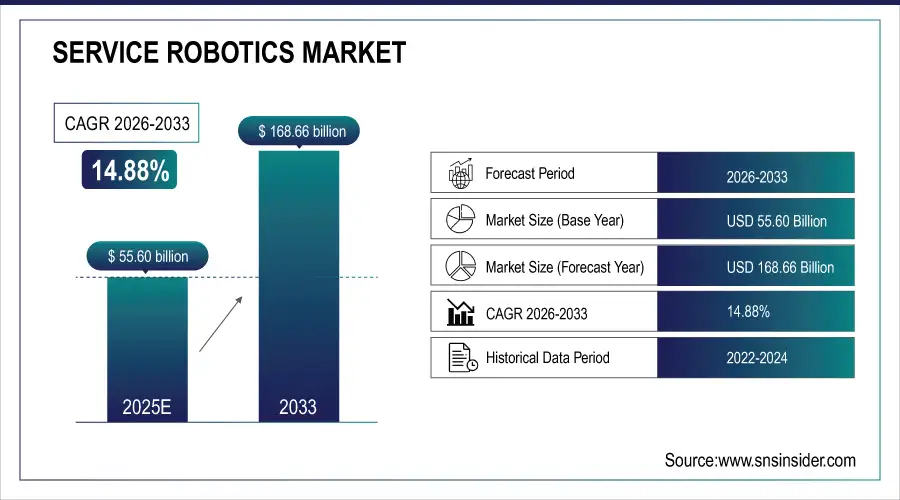

The Service Robotics Market size was valued at USD 55.60 billion in 2025E and is expected to reach USD 168.66 billion by 2033 and grow at a CAGR of 14.88% over the forecast period 2026-2033.

The service robotics market is growing intensely due to the development of artificial intelligence, sensor technology, and machine learning. The use of service robots in healthcare, domestic, agricultural, and a variety of other industries is increasingly common. The use of artificial intelligence is an increasingly transformative phenomenon being experienced globally. With the current application on 77% of devices in 2023, the possible tuning-in growth is supported by the highly anticipated 63% subscription rates in the next three years as the market grows by at least 120% year-over-year. However, the pre-existing understanding of this tool remains at a pitfall, as only 33% of consumers recognize its usage.

Market Size and Forecast: 2025E

-

Market Size in 2025E USD 55.60 Billion

-

Market Size by 2033 USD 168.66 Billion

-

CAGR of 14.88% From 2026 to 2033

-

Base Year 2025E

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

Get More Information on Service Robotics Market - Request Sample Report

Service Robotics Market Trends:

-

Growing integration of IoT in robotics for real-time monitoring and predictive maintenance to reduce downtime and operational costs.

-

Increasing adoption of swarm intelligence enabling decentralized decision-making and coordinated multi-robot collaboration for complex tasks.

-

Rising use of cloud-connected robotic systems that enhance remote diagnostics, data sharing, and automated performance optimization.

-

Expansion of cyber-physical systems where robotics, IoT, and automation converge to deliver smarter, self-learning maintenance capabilities.

-

Rapid advancements in autonomous robotic fleets for logistics, rescue operations, and industrial workflows powered by collective intelligence.

The U.S. Service Robotics market size was valued at an estimated USD 24.30 billion in 2025 and is projected to reach USD 75.80 billion by 2033, growing at a CAGR of 14.2% over the forecast period 2026–2033. Market growth is driven by increasing adoption of service robots across healthcare, logistics, hospitality, retail, defense, and domestic applications. Rising labor shortages, growing demand for automation, and advancements in artificial intelligence, machine learning, and sensor technologies are accelerating market expansion. Additionally, expanding use of autonomous mobile robots (AMRs), collaborative robots, and AI-powered service platforms, along with strong investments in robotics R&D and supportive government initiatives, further strengthen the growth outlook of the U.S. service robotics market during the forecast period.

Service Robotics Market Growth Drivers:

-

IoT is increasingly being used in robots for cost-effective predictive maintenance.

There has been a marked trend in leveraging Internet of Things (IoT) technologies to make robotics more efficient and less expensive. Being integrated into the cloud, it has become possible to implement cost-effective predictive maintenance strategies which have transformed how robots are managed and serviced. By adding IoT sensors and connectivity to the mix, robots can continuously track how well they're working in real-time on a wide range of parts with their performance components as that data is made available for minimal warning before downtime takes place.

Service Robotics Market Restraints:

-

Inaccurate findings make usage in essential processes impossible

When assessing robots made by different companies, the typical range a robot can travel on one battery charge is 10 km, limiting its operational area to nearby locations from the hub or warehouse. These robots are specifically developed to move on sidewalks but cannot climb stairs. Manufacturers face a noteworthy obstacle when it comes to operating fully autonomous delivery robots, as they must simultaneously handle tasks like mapping the environment, localizing the robot on the map, and devising a motion plan using the map. This guarantees that the robots can move or function effectively in uncontrolled settings without needing input from humans.

Service Robotics Market Segment Analysis:

By Type

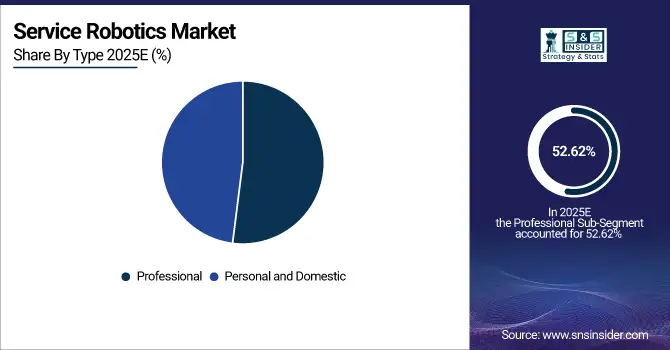

The professional segment captured a market share of over 52.62% in 2025E. This surge is primarily attributed to the escalating demand for service robots in diverse sectors, including defense, medical, construction, logistics, and others. Additionally, the widespread adoption of automation and mobility in industrial domains significantly impacts the overall market share of the service robot industry. During the projected period, the expansion of this segment is further reinforced by factors such as increasing labor costs, heightened investments in research and development, a shortage of skilled labor, and growing awareness regarding service robots and industrial automation.

The personal segment is poised for faster growth during the forecast period 2026-2033. Typically employed to assist, educate, and guide individuals in home settings, these robots find utility in tasks like floor cleaning, vacuuming, pool cleaning, lawn mowing, and entertainment.

By Component

The hardware segment dominates the market with more than 57% market share in 2025E. The growth of this market is because hardware service robotics are inherently variable and can be implemented across a broad spectrum of applications, including both service and industrial disruptions. This type of robotics ranges from healthcare, hospitality, logistics, and assistance to the home, and diverse hardware features depending on the application but is usually perceived on sensors, actuated and mobile actuators, and energy-yielding devices. Meanwhile, the most intelligent robotic units can be equipped with high-tech processors and communicative devices.

The software segment is to grow at a faster CAGR during the forecast period 2026-2033. Service robotics require the development of complex software to enable robots to communicate with humans and help them in different environments. For instance, delivery drones would require real-time software that takes into consideration environmental variables such as weather. The majority of developments in robotic vacuum cleaners have occurred in software, with capabilities like as live floor mapping and remote activation via interaction with voice assistants.

By Environment

The ground segment dominates the market with a market share of more than 38% in 2025E. Such robots are used to perform any ground service on the territory of airports from baggage handling and loading to cleaning of the territory and servicing the passengers. Electromechanics move relative to the surface or through the air, have a high level of performance, and can work in complex conditions, communicate with people, and adapt to them.

The aerial segment is growing at a faster CAGR during the forecast period 2026-2033. Growth is due to the increasing use of business drones on account of agricultural field surveys, and traffic monitoring among others, and the higher selling price of commercial drones as compared to consumer drones. An increase in their growth rate can be attributed to the growth of solar cells as a power source for drones, and the decline in the cost of UAV manufacturing processes reduces the cost of propulsion systems.

Service Robotics Market Regional Analysis:

North America Service Robotics Market Insights

The North American market has the largest market share of over 38.5% in 2025E, due to rising market use of service robots in nations such as the United States and Canada. Hospitals are increasingly accepting surgical robots, making investments in assistive technology research more feasible, and the availability of advanced service robotics will drive market growth in the region.

Need any customization research on Service Robotics Market - Enquiry Now

Asia Pacific Service Robotics Market Insights

The Asia-Pacific to experience a faster growth rate during the forecast period 2026-2033. The growth in usage of service robotics in this area is a result of the rising incorporation of these technologies in research and development efforts within the industrial robot industry. Investments in robotics, artificial intelligence, automation, and other technologies are on the rise in the Asia Pacific region's government. Additionally, the market for service robotics in China dominated in terms of market share, while the service robotics market in India experienced the highest growth rate among countries in the Asia-Pacific region.

Europe Service Robotics Market Insights

The Europe service robotics market is expanding steadily, driven by rising automation demand across healthcare, logistics, agriculture, and domestic applications. Strong government support for Industry 4.0, high labor costs, and rapid digitalization are accelerating adoption. Advancements in AI, IoT, and collaborative robotics are enabling smarter, safer, and more efficient robotic solutions. Growing investments in robotic research, smart factories, and aging-population healthcare needs further strengthen market growth across the region.

Latin America (LATAM) and Middle East & Africa (MEA) Service Robotics Market Insights

The LATAM and MEA service robotics markets are gaining momentum due to increasing digital transformation, rising labor shortages, and growing demand for automation in healthcare, agriculture, logistics, and security sectors. Governments and enterprises are investing in smart infrastructure and robotics-enabled services to enhance operational efficiency. Expanding IoT connectivity, urbanization, and the adoption of cost-effective robotic solutions support market growth, while emerging economies benefit from rising interest in autonomous systems and AI-driven service applications.

Service Robotics Market Key Players:

The key players in the service robotics market are Intuitive Surgical, Panasonic Corporation, Samsung Electronic, robert bosch, AB Electrolux, iRobot Corporation, Honda Motor, Aethon, Yujin Robot, DeLaval & Other Players.

Competitive Landscape for Service Robotics Market:

Pudu Robotics is a leading developer of commercial service robots specializing in autonomous delivery, hospitality, and cleaning solutions. The company leverages advanced AI, LiDAR navigation, and multi-sensor fusion to enhance operational efficiency across restaurants, hotels, healthcare facilities, and commercial buildings. With strong global expansion and continuous innovation, Pudu Robotics plays a significant role in advancing automation within the service robotics market.

- April 2024: Pudu Robotics launched BellaBot Pro, the next-gen of its service robot. It uses AI for personalized interactions, improved dish identification, and features a curved screen for advertising. This update enhances safety, efficiency, and customer experience.

LG is a prominent player in the service robotics market, offering advanced autonomous robots for hospitality, logistics, cleaning, and customer assistance. Leveraging AI, IoT integration, and smart navigation technologies, LG’s service robots enhance operational efficiency across commercial and public environments. The company’s strong R&D capabilities and global presence position it as a key innovator driving the adoption of intelligent service robotics solutions.

- July 2024: LG Business Solutions USA introduced the LDLIM31, a door-type, AI-powered delivery robot in their CLOIi ServeBot line. Designed for hospitality and healthcare, it boasts four compartments holding 66 lbs each for versatile deliveries.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 55.60 Billion |

| Market Size by 2033 | USD 168.66 Billion |

| CAGR | CAGR of 14.44% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Programmable (FPGA & PLD) DSP IC, Application-Specific DSP IC, General-Purpose DSP IC) • By Type (Personal And Domestic, Professional) • By Component (Hardware, Software) By Environment (Aerial, Marine, Ground) • By Application (Domestic, Medical, Field, Defense, Entertainment, Logistics, Research And Space Exploration) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Intuitive Surgical, Panasonic Corporation, Samsung Electronic, robert bosch, AB Electrolux, iRobot Corporation, Honda Motor, Aethon, Yujin Robot and DeLaval. |