FPSO Market Report Scope & Overview:

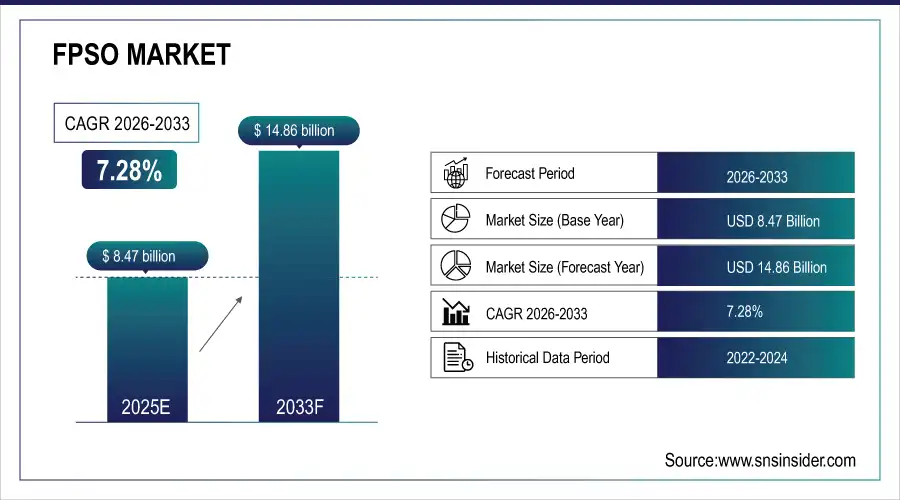

The FPSO Market Size was valued at USD 8.47 billion in 2025E and is expected to reach USD 14.86 billion by 2033, growing at a CAGR of 7.28% over the forecast period of 2026-2033.

The FPSO Market is witnessing significant growth, driven by rising offshore oil and gas exploration and increasing deepwater and ultra-deepwater production. FPSOs provide flexible, cost-effective solutions for extraction, storage, and offloading. Technological advancements, modular designs, and global investments are enhancing efficiency, safety, and operational capabilities in offshore energy projects. Increasing demand for energy security, coupled with government incentives and private-sector investments, is further fueling FPSO adoption across key regions worldwide.

For instance, Brazil's Petrobras is expanding its FPSO fleet, with new units like the Atapu-2 and Sépia-2, each capable of producing 225,000 barrels of oil per day, set to commence operations by 2029.

Market Size and Forecast:

-

FPSO Market Size in 2025E: USD 8.47 Billion

-

FPSO Market Size by 2033: USD 14.86 Billion

-

CAGR: 7.28% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On FPSO Market - Request Free Sample Report

Key FPSO Market Trends

-

Rising Offshore Exploration and Production Activities: Increasing offshore oil and gas discoveries, particularly in deepwater and ultra-deepwater regions, are driving FPSO demand.

-

Technological Advancements in FPSO Design: Modular, automated, and energy-efficient FPSOs enhance operational safety, storage capacity, and extraction efficiency.

-

Shift Towards Deepwater and Ultra-Deepwater Fields: High-value oil reserves in deeper waters are encouraging the deployment of FPSOs capable of handling extreme environments.

-

Government Incentives and Strategic Investments: Supportive policies, tax relief, and funding for offshore projects are accelerating FPSO adoption globally.

-

Growing Demand for Energy Security: Nations are focusing on self-sufficiency and reducing dependency on crude imports, boosting offshore production infrastructure.

-

Integration of Digital Monitoring and IoT Solutions: Smart sensors and real-time monitoring systems are improving operational efficiency and predictive maintenance for FPSOs.

U.S. FPSO Market Insights

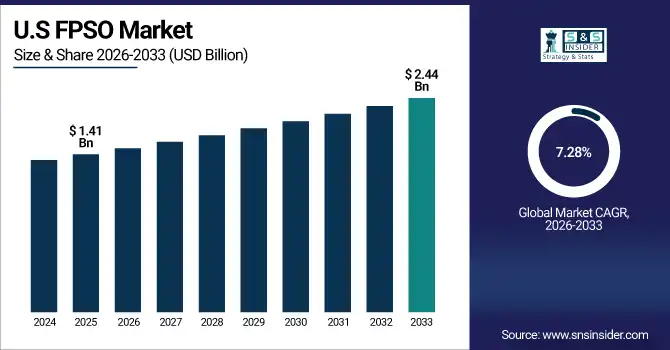

The U.S. FPSO Market size was USD 1.41 billion in 2025 and is expected to reach USD 2.44 billion by 2033 growing at a CAGR of 7.28% over the forecast period of 2026-2033. The growth is driven by increasing offshore oil and gas exploration, particularly in deepwater and ultra-deepwater fields. Rising energy demand and investments by major oil companies, including Petrobras and Shell, are accelerating FPSO deployment. Technological advancements, modular designs, and digital monitoring systems are improving storage efficiency, operational safety, and extraction capabilities, enabling oil producers to maximize production while complying with stringent environmental and safety regulations.

FPSO Market Growth Driver

-

Rising Offshore Oil and Gas Exploration in Deepwater and Ultra-Deepwater Fields Driving FPSO Market Expansion Globally

The global FPSO market growth is strongly driven by increasing offshore exploration and production activities, especially in deepwater and ultra-deepwater regions. Higher demand for energy security and the discovery of new offshore oil and gas reserves are prompting oil and gas companies to invest in FPSOs, which provide flexible, cost-effective, and efficient solutions for extraction, storage, and offloading. Technological advancements such as modular designs, digital monitoring, and automation enhance operational efficiency and safety, enabling companies to optimize production while minimizing downtime. Government support, through favorable offshore policies and incentives, is accelerating FPSO adoption in regions like Brazil, West Africa, and Southeast Asia. Increased private-sector investments and strategic partnerships are also contributing to the market’s steady expansion.

In January 2025, Petrobras announced the deployment of the Atapu-2 FPSO in Brazil’s offshore deepwater fields, capable of producing 225,000 barrels of oil per day, reflecting strong industry adoption of advanced FPSO solutions to meet rising energy demand.

FPSO Market Restraint

-

High Capital Expenditure and Operational Costs Limiting FPSO Adoption Among Emerging Offshore Oil Producers Globally

The FPSO market faces significant restraints due to the high capital expenditure required for construction, installation, and maintenance of these complex vessels. Operational costs, including crew management, insurance, and equipment upkeep, further increase financial burdens, particularly for emerging oil-producing nations. Uncertainties in crude oil prices, combined with lengthy project timelines, make FPSO investments riskier compared to conventional platforms. These challenges limit adoption, particularly among smaller operators and in regions with constrained budgets. Additionally, stringent environmental and safety compliance regulations necessitate costly modifications, further restraining market growth despite rising offshore exploration.

In March 2025, a small West African oil producer delayed FPSO deployment due to budget overruns and regulatory compliance costs, highlighting how high capital requirements limit market penetration in emerging regions.

FPSO Market Opportunity

-

Technological Advancements in Modular, Automated, and Digital FPSO Systems Opening New Growth Avenues for Offshore Production Globally

The FPSO market offers substantial growth opportunities through technological innovation, including modular construction, automation, and digital monitoring systems. These advancements improve operational efficiency, reduce downtime, enhance safety, and enable real-time monitoring of oil and gas production. Integration of IoT-enabled sensors, predictive maintenance tools, and energy-efficient designs makes FPSOs more cost-effective over their lifecycle. Such innovations are particularly attractive for operators targeting ultra-deepwater fields, where traditional production platforms are less viable. Governments and private investors increasingly support the adoption of technologically advanced FPSOs, creating opportunities to expand market share and optimize offshore oil production globally.

In September 2025, MODEC, Inc. introduced an IoT-enabled modular FPSO in the Gulf of Mexico, improving real-time monitoring and predictive maintenance capabilities, demonstrating the market potential of advanced technological solutions.

FPSO Market Segment Highlights:

-

By Type: Spread Mooring FPSO – 40%, Turret Mooring FPSO – 45% (largest), Others (Hybrid / Dynamic Positioning FPSO) – 15%

-

By Product: Crude Oil FPSO – 55% (largest), Gas FPSO – 35%, Others (Oil & Gas Blend) – 10%

-

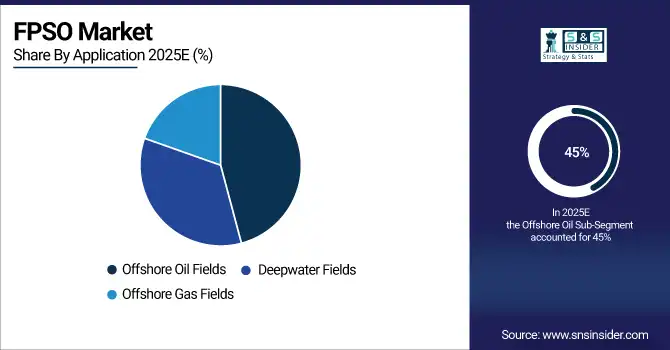

By Application: Offshore Oil Fields – 45% (largest), Offshore Gas Fields – 25%, Deepwater Fields – 20%, Ultra-Deepwater Fields – 10%

-

By Water Depth: Shallow Water (<500 m) – 30%, Deep Water (500–1,500 m) – 50% (largest), Ultra-Deep Water (>1,500 m) – 20%

-

By Contract Type: Lease FPSO – 50% (largest), Own FPSO – 30%, Build-Operate-Transfer (BOT) FPSO – 20%

FPSO Market Segment Analysis

By Type

The Turret Mooring FPSO segment holds the largest market share at 45%, driven by its stability, continuous oil/gas offloading capabilities, and suitability for deepwater operations. Spread Mooring FPSOs are growing steadily, preferred for shallow water and moderate production fields due to lower installation costs. Others (Hybrid / Dynamic Positioning FPSO) maintain moderate growth, offering flexibility in complex offshore conditions, but higher capital and operational expenses limit widespread adoption.

By Product

Crude Oil FPSO dominates with 55% market share, reflecting strong global demand for offshore oil production. Gas FPSOs are the fastest-growing segment, fueled by increasing offshore gas field developments and LNG production projects. Others (Oil & Gas Blend) show moderate growth, often deployed in hybrid extraction fields, yet integration challenges and fluctuating commodity prices constrain adoption.

By Application

Offshore Oil Fields lead with 45% share, driven by high global oil demand and extensive offshore drilling projects. Offshore Gas Fields are growing at a moderate pace due to expanding gas exploration and LNG infrastructure. Deepwater Fields account for 20%, and Ultra-Deepwater Fields 10%, reflecting limited high-capital investment in extreme water depths.

By Water Depth

Deep Water (500–1,500 m) dominates with 50% market share, as many new oil and gas discoveries are in this depth range. Shallow Water (<500 m) shows steady growth for mature fields, while Ultra-Deep Water (>1,500 m) is growing slowly due to technical and cost challenges.

By Contract Type

Lease FPSOs lead with 50% share, preferred by operators to minimize upfront capital investment and maintain operational flexibility. Own FPSOs account for 30%, adopted by large energy companies seeking long-term control. Build-Operate-Transfer (BOT) FPSOs represent 20%, often used in emerging offshore projects with public-private collaboration, though slower adoption limits growth.

FPSO Market Regional Analysis

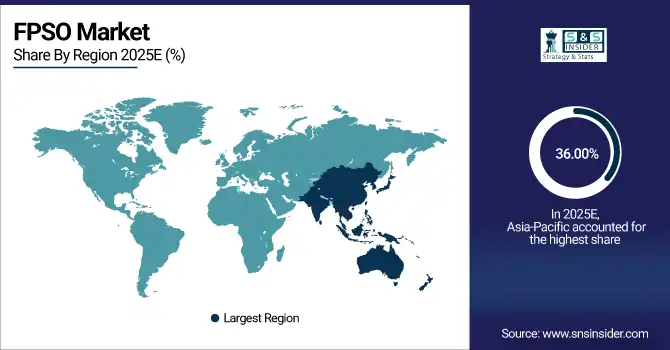

Asia-Pacific FPSO Market Insights

Asia-Pacific leads with a 36.00% share in 2025 and is the fastest-growing region, driven by increasing offshore oil and gas exploration, deepwater field developments, and technological adoption in FPSO deployment. China, Australia, Malaysia, and India are major contributors, supported by favorable government policies promoting energy infrastructure expansion and offshore investments. Adoption of turret and spread mooring FPSOs is rising, fueled by growing crude oil and gas production activities. Private investments, joint ventures, and technological advancements further accelerate regional growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America FPSO Market Insights

North America accounts for 22.00% of the market in 2025, led by offshore oil and gas projects in the Gulf of Mexico. The U.S. dominates regional growth through lease and own FPSO contracts, enhancing energy production capabilities. Investments in deepwater and ultra-deepwater fields, along with technological integration in turret mooring and hybrid FPSOs, improve operational efficiency. Government incentives, private-sector partnerships, and robust regulatory frameworks support market adoption across the energy sector.

Europe FPSO Market Insights

Europe holds 20.00% of the market in 2025, supported by established offshore oil and gas infrastructure, government-backed modernization programs, and strong financial frameworks. The U.K., Norway, and the Netherlands are key contributors, focusing on deepwater and ultra-deepwater FPSO projects. Safety, environmental compliance, and energy transition initiatives drive demand for advanced FPSO technologies, while collaborations with banks and energy firms facilitate project financing and expansion.

Latin America and Middle East & Africa (MEA) FPSO Market Insights

Latin America accounts for 10.00% and MEA 12.00% of the market in 2025, emerging as high-potential regions. Brazil, Mexico, and Argentina lead LATAM FPSO adoption for offshore oil fields, while UAE, Saudi Arabia, and Nigeria focus on deepwater and gas FPSO deployment. Government incentives, strategic infrastructure projects, and foreign investments drive market growth, supported by leasing and BOT FPSO models to optimize offshore production and energy security.

Competitive Landscape for FPSO Market:

SBM Offshore

SBM Offshore is a leading global provider of floating production, storage, and offloading (FPSO) solutions, specializing in offshore oil and gas production.

-

In December 2024, SBM Offshore and ExxonMobil Guyana Ltd completed the transaction for the FPSO Liza Destiny, with ExxonMobil assuming ownership while SBM continues operations and maintenance under a contract until 2033.

MODEC, Inc.

MODEC, Inc. specializes in FPSO design, construction, and offshore field operations for global oil and gas companies.

-

In July 2025, MODEC achieved a key construction milestone for its FPSO unit destined for ExxonMobil's offshore development in Guyana, enhancing production capabilities and offshore project execution.

BW Offshore

BW Offshore provides FPSO leasing, operations, and maintenance services for offshore oil and gas projects worldwide.

-

In May 2025, BW Offshore expanded its FPSO fleet by investing in a newbuild and purchasing an additional FPSO unit to strengthen offshore field development and production capacity.

FPSO Market Key Players

Some of the FPSO Companies

-

SBM Offshore

-

MODEC, Inc.

-

BW Offshore

-

Bumi Armada Berhad

-

Teekay Offshore Partners L.P.

-

Saipem S.p.A.

-

Exmar NV

-

Hyundai Heavy Industries

-

Samsung Heavy Industries

-

China Shipbuilding Industry Corporation (CSIC)

-

Yinson Holdings Berhad

-

Prosafe SE

-

Vantage FPSO

-

Sembcorp Marine Ltd.

-

Keppel Corporation

-

Eni S.p.A.

-

Petrobras

-

Shell PLC

-

TechnipFMC

-

Jinhai Shipbuilding & Offshore Engineering

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.79 Billion |

| Market Size by 2033 | USD 6.36 Billion |

| CAGR | CAGR of 10.83% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type: (Alkaline Electrolyzer Test Systems, Proton Exchange Membrane (PEM) Test Systems, Solid Oxide Electrolyzer (SOE) Test Systems, Others (AEM / Hybrid Systems)) • By Application: (Hydrogen Production, Power-to-Gas (PtG), Fuel Cell Vehicles (FCV), Energy Storage & Industrial Use) • By End-Use Industry: (Energy & Utilities, Chemical & Industrial Gases, Transportation, Research & Academia) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | AVL List GmbH, Green Light Innovation, HORIBA FuelCon GmbH, iASYS Technology Solutions, SANY Hydrogen, KNF Neuberger, Inc., Equilibrium, Thasar, Entech Industrial Solution Co., Ltd., KEWELL, Siemens Energy AG, Nel Hydrogen, Thyssenkrupp nucera, John Cockerill, Plug Power Inc., Bosch Manufacturing Solutions (BMG), Marposs, ATS Industrial Automation, Skyre, Inc. |