Organic Rankine Cycle Market Report Scope & Overview:

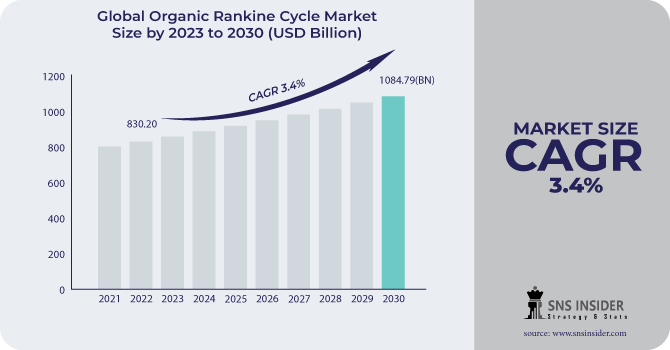

The Organic Rankine Cycle Market size was valued at USD 830.20 billion in 2022 and is expected to grow to USD 1084.79 billion by 2030 and grow at a CAGR of 3.4 % over the forecast period of 2023-2030.

The organic Rankine cycle (ORC) may be a technique with great potential for increasing the use of low-grade industrial waste heat. The purpose of this work is to offer an enhanced mixed integer nonlinear programme (MINLP) model based on a superstructure for the integration of an ORC inside a complete site to recover low-grade waste heat. The energy-capital trade-off, which takes into account utility costs, ORC power production, and related capital costs for ORC and heat exchangers, may be taken into account by the model. This approach allowed for the simultaneous determination of the ORC's operating conditions and the choice of waste heat stream matching. The use of this approach is demonstrated through a case study. Recovery of waste heat During numerous operations, the industrial sector produces a sizable quantity of waste heat. The recovery of this waste heat and conversion of it into useful power is made possible by ORC technology. Businesses are implementing ORC systems more often to increase operational effectiveness, lower operating expenses, and achieve sustainability goals.

To Get More Information on Organic Rankine Cycle Market - Request Sample Report

MARKET DYNAMICS

KEY DRIVERS:

-

Strict emission standards

-

Growing need for clean energy

-

Growing use of renewable energy

As attention shifts to lowering greenhouse gas emissions and switching to cleaner energy sources, there is an increase in demand for renewable energy technology. ORC systems are a desirable alternative for a variety of applications because they provide an effective and dependable technique of turning low-temperature heat into electricity.

RESTRAIN:

-

Solar thermal

-

Supply deficit of raw material

OPPORTUNITY:

-

Growing adoption in renewable energy

-

Developing economic ORC manufactures

CHALLENGES:

-

Availability of other alternative technologies

-

Waste Heat Recovery from Electric Vehicles

As EV usage rises, waste heat produced by their batteries, motors, and power electronics represents an untapped resource for ORC systems. Integration of waste heat recovery systems in EVs, where the waste heat is transformed into additional electricity to extend the range of the vehicle or power auxiliary systems, might lead to future ORC market growth. This application could help EVs use less energy and have longer ranges when driving.

KEY MARKET SEGMENTATION

By Application

-

Waste Heat Recovery

-

Petroleum Refinery

-

Chemical

-

Glass

-

Cement

-

Metal Production and Casting (Iron & Steel)

-

-

Geothermal

-

Solar Thermal

-

Oil & Gas (Gas Pipeline Pressure Stations)

REGIONAL ANALYSIS

In 2022, North America became one of the key geographical areas for the ORC market. In 2022, geothermal will have the greatest market share in the ORC market's application segment. Because geothermal projects typically have higher capacities than biomass and waste heat recovery projects, the ORC market will be larger for geothermal applications in 2022 as a result of the recent deployment of large-scale geothermal projects.

The market in Europe would have a sizably substantial revenue share.

The region's market revenue development is attributed to the presence of well-established manufacturing and industrial sectors as well as the expanding usage of renewable energy sources. Due to the expanding use of ORC technology in a variety of applications, such as geothermal, waste heat recovery, and biomass, the market in this area is anticipated to rise. It is anticipated that rising consumer awareness of the benefits of energy-efficient systems would fuel this region's market revenue growth.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

RECENT DEVELOPMENTS

-

In 2021, Veolia disclosed plans to acquire Matrix Technologies, a provider of waste heat recovery technologies. Veolia wanted to boost its position in the energy recovery sector and increase the range of products it offered in the ORC market through the purchase.

-

Veolia introduced the ORC GEN 4.0 series of ORC modules in 2021. These modules may be utilised in a variety of sectors, including steel, glass, cement, and paper, and they are created to transform low-grade waste heat into power.

-

In March 2021, a study on the economic evaluation of the ORC power plant with low-temperature waste heat recovery was published in the International Journal of Low-Carbon Technologies. This investigation came to the conclusion that the ORC system's connection to thermal power plants helps to increase operating efficiency by cutting back on the use of fossil fuels.

KEY PLAYERS

The Major Players are Turboden S.p.A., Exergy International Sr, Zhejiang Kaishan Compressor Co., Ltd., Enogia SAS, Triogen, Calnetix Technologies, LLC, ABB, Atlas Copco AB, TAS Energy Inc. (TAS), Elvosolar, a.s. and other players

Exergy International Sr-Company Financial Analysis

| Report Attributes | Details |

| Market Size in 2022 | US$ 830.20 Bn |

| Market Size by 2030 | US$ 1084.79 Bn |

| CAGR | CAGR of 3.4% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application, (Waste Heat Recovery, Biomass, Geothermal, Solar Thermal, Oil & Gas (Gas Pipeline) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Turboden S.p.A., Exergy International Sr, Zhejiang Kaishan Compressor Co., Ltd., Enogia SAS, Triogen, Calnetix Technologies, LLC, ABB, Atlas Copco AB, TAS Energy Inc. (TAS), Elvosolar, a.s. |

| Key Drivers | • Strict emission standards • Growing need for clean energy • Growing use of renewable energy |

| Market Restraints | • Waste heat recovery • Solar thermal • Supply deficit of raw material |