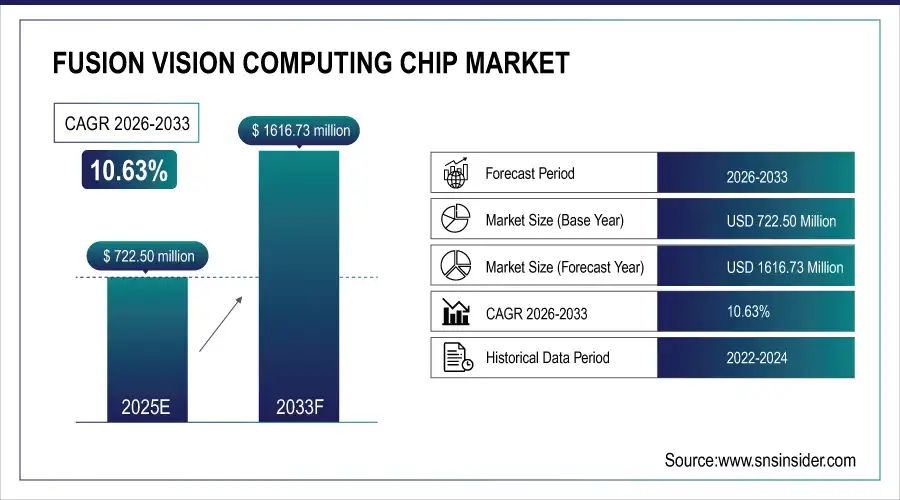

Fusion Vision Computing Chip Market Size Analysis:

The Fusion Vision Computing Chip Market size was valued at USD 722.50 Million in 2025E and is projected to reach USD 1616.73 Million by 2033, growing at a CAGR of 10.63% during 2026-2033.

The Fusion Vision Computing Chip market is growing due to the increasing demand for real-time, AI-enabled visual intelligence across automotive, industrial, and consumer applications. Rapid adoption of autonomous vehicles and advanced driver-assistance systems is driving the need for high-performance sensor fusion and vision processing. Growth in robotics, smart manufacturing, and edge AI accelerates deployment of integrated vision chips. Additionally, rising use of smart surveillance, AR/VR devices, and advancements in heterogeneous integration and low-power semiconductor technologies further support market expansion.

Market Size and Growth Projection:

-

Market Size in 2025E USD 722.50 Million

-

Market Size by 2033 USD 1616.73 Million

-

CAGR of 10.63% From 2026 to 2033

-

Base Year 2025E

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

To Get more information On Fusion Vision Computing Chip Market - Request Free Sample Report

Key Fusion Vision Computing Chip Market Trends

-

Increasing adoption of autonomous vehicles and ADAS, driving demand for high-performance fusion vision computing chips.

-

Rapid growth in industrial automation and robotics, leveraging advanced vision processing for navigation, inspection, and human–machine interaction.

-

Expansion of AR/VR devices, edge AI, and smart surveillance systems, requiring compact, real-time vision compute solutions.

-

Rising shift toward edge computing and low-latency real-time processing, enabling AI and sensor fusion applications outside centralized data centers.

-

Advancements in heterogeneous integration, System-on-Chip, and hybrid architectures, enhancing performance, energy efficiency, and multi-sensor data processing capabilities.

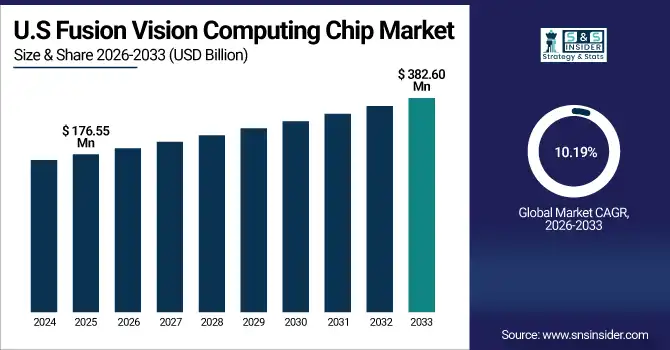

U.S. Fusion Vision Computing Chip Market Outlook

The U.S. Fusion Vision Computing Chip Market size was valued at USD 176.55 Million in 2025E and is projected to reach USD 382.60 Million by 2033, growing at a CAGR of 10.19% during 2026-2033. The U.S. Fusion Vision Computing Chip market is growing due to strong investments in autonomous vehicles, AI-driven defense systems, robotics, and smart manufacturing, supported by advanced semiconductor R&D, a robust tech ecosystem, and early adoption of edge AI and vision technologies.

Fusion Vision Computing Chip Market Growth Drivers:

-

Rising Demand for AI-Enabled Real-Time Vision and Sensor Fusion Drives Global Fusion Vision Computing Chip Market Growth

The global Fusion Vision Computing Chip market is primarily driven by the rising demand for real-time visual intelligence combined with AI and sensor fusion across multiple industries. The rapid deployment of autonomous vehicles and advanced driver-assistance systems (ADAS) significantly increases the need for high-performance vision computing chips capable of processing data from cameras, LiDAR, radar, and other sensors simultaneously. Growing adoption of robotics and industrial automation in smart factories further fuels demand, as these systems rely on advanced vision processing for quality inspection, navigation, and human–machine interaction. Additionally, expanding use of smart surveillance systems, drones, and defense imaging platforms, along with the proliferation of AR/VR and edge AI devices, is accelerating market growth. Continuous advancements in heterogeneous integration, low-power chip architectures, and AI accelerators also enhance performance efficiency, making fusion vision chips more attractive for mass deployment.

Shipments of AI-enabled smart glasses surged, with global AI smart glasses reaching ~600,000 units in Q1 2025, marking ~216 % year-on-year growth, showing fast adoption of wearable vision devices.

Fusion Vision Computing Chip Market Restraints:

-

High Design Complexity and Regulatory Challenges Limit Fusion Vision Computing Chip Adoption Across Key Industries

The Fusion Vision Computing Chip market faces restraints such as high design complexity, challenges in integrating multi-sensor data reliably, increased power and thermal management requirements, lack of standardized architectures, and stringent functional safety and regulatory requirements, particularly in automotive, defense, and healthcare applications, which can slow development cycles and adoption rates.

Fusion Vision Computing Chip Market Opportunities:

-

Edge Computing and AI-Driven Applications Unlock Massive Growth Opportunities for Fusion Vision Computing Chips Globally

Significant opportunities exist in the increasing shift toward edge computing, where real-time processing with low latency is critical. Emerging applications such as autonomous mobile robots, intelligent transportation systems, smart cities, and medical imaging offer strong growth potential for fusion vision chips. The integration of AI, computer vision, and multi-sensor processing into single System-on-Chip and hybrid architectures presents opportunities for differentiation and cost reduction. Moreover, expanding investments in semiconductor manufacturing, government-backed AI initiatives, and the growing demand for customized, application-specific vision chips across automotive, industrial, and defense sectors are expected to create long-term revenue opportunities for global market participants.

Waymo’s autonomous fleet completed over 400 million autonomous miles by 2025, demonstrating large-scale deployment of multi-sensor fusion and AI vision compute systems.

Fusion Vision Computing Chip Market Segment Analysis

-

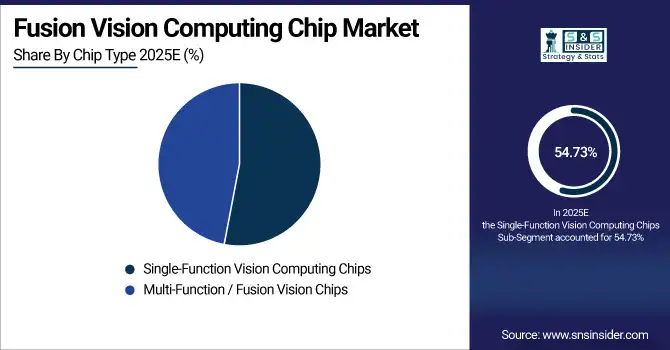

By Chip Type, Single-Function Vision Computing Chips dominated with 54.73% in 2025E, and Multi-Function / Fusion Vision Chips is expected to grow at the fastest CAGR of 10.90% from 2026 to 2033.

-

By Integration Level, System-on-Chip (SoC) dominated with 49.53% in 2025E, and Hybrid / Heterogeneous Integrated Chips is expected to grow at the fastest CAGR of 11.45% from 2026 to 2033.

-

By Application, Autonomous Vehicles & ADAS dominated with 38.67% in 2025E, and AR/VR & Consumer Electronics is expected to grow at the fastest CAGR of 11.51% from 2026 to 2033.

-

By End-User Industry, Automotive OEMs & Tier-1 Suppliers dominated with 44.34% in 2025E, Defense, Aerospace & Healthcare is expected to grow at the fastest CAGR of 12.20% from 2026 to 2033.

By Chip Type, Single-Function Chips Lead Market While Multi-Function Fusion Chips Accelerate Growth in Advanced Vision Applications

Single-Function Vision Computing Chips dominated the market in 2025 due to their widespread use in cost-sensitive and well-established applications such as surveillance cameras, basic ADAS features, and industrial inspection systems. These chips benefit from proven reliability, simpler architectures, and easier integration. Meanwhile, Multi-Function and Fusion Vision Chips are gaining strong traction as industries increasingly require integrated AI, sensor fusion, and real-time processing capabilities to support advanced applications in autonomous driving, robotics, AR/VR, and edge intelligence platforms.

By Integration Level, System-on-Chip Dominance and Hybrid Integrated Chips Drive Next-Generation AI Vision Computing Performance Globally

System-on-Chip solutions led the market in 2025 due to their compact design, lower power consumption, and ability to integrate processing, memory, and vision functions on a single platform. SoCs are widely adopted across automotive, consumer electronics, and industrial applications. In contrast, Hybrid and Heterogeneous Integrated Chips are gaining momentum as they enable higher performance by combining CPUs, GPUs, NPUs, and image signal processors, making them suitable for complex sensor fusion and advanced AI-driven vision workloads.

By Application, Autonomous Vehicles and ARVR Consumer Electronics Propel Rapid Growth in Advanced Fusion Vision Computing Chips

Autonomous Vehicles and ADAS led the market in 2025 due to the strong demand for real-time perception, sensor fusion, and AI-driven decision-making in modern vehicles. These applications rely heavily on advanced vision computing chips to process data from cameras, radar, and LiDAR for safety and automation. Meanwhile, AR/VR and consumer electronics applications are gaining rapid momentum as immersive devices increasingly require compact, high-performance vision processing for gesture recognition, spatial mapping, and real-time visual interaction at the edge.

By End-User Industry, Automotive and Emerging Sectors Drive High Demand for Advanced Fusion Vision Computing Chips Globally

Automotive OEMs and Tier-1 suppliers dominated the market in 2025, driven by the large-scale integration of vision computing chips in ADAS and autonomous vehicle platforms. High production volumes and stringent safety requirements support sustained demand. Meanwhile, defense, aerospace, and healthcare sectors are emerging as high-growth areas, supported by increasing adoption of AI-enabled imaging, autonomous surveillance systems, unmanned platforms, and advanced medical imaging solutions requiring real-time, high-precision vision processing capabilities.

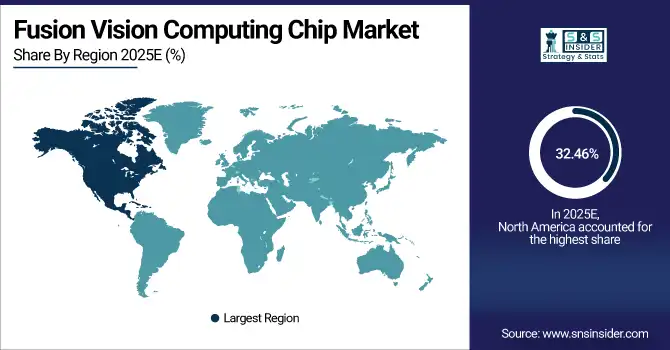

North America Fusion Vision Computing Chip Market Insights

North America accounted for 32.46% of the global Fusion Vision Computing Chip market, driven by strong adoption of advanced AI and vision technologies across automotive, defense, industrial automation, and consumer electronics sectors. The region benefits from the presence of leading semiconductor companies, robust R&D infrastructure, and early deployment of autonomous vehicles and ADAS solutions. High investments in edge computing, smart surveillance, robotics, and government-backed AI and semiconductor initiatives further support market growth and technological leadership in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Fusion Vision Computing Chip Market Insights

The United States dominated the North American Fusion Vision Computing Chip market, supported by strong semiconductor R&D, presence of leading chipmakers, high adoption of autonomous vehicles and AI technologies, robust defense spending, and early deployment of edge computing and advanced vision-based systems across industries.

Europe Fusion Vision Computing Chip Market Insights

Europe accounted for 20.64% of the global Fusion Vision Computing Chip market, supported by strong demand from the automotive, industrial automation, and robotics sectors. The region benefits from advanced automotive manufacturing capabilities, particularly in ADAS and autonomous driving technologies, as well as growing investments in smart factories and Industry 4.0 initiatives. Additionally, increasing focus on AI-driven surveillance, aerospace applications, and government-backed semiconductor and digitalization programs is strengthening adoption of advanced vision computing chips across European countries.

Germany Fusion Vision Computing Chip Market Insights

Germany dominated the European Fusion Vision Computing Chip market, driven by its strong automotive manufacturing base, leadership in ADAS and autonomous driving technologies, advanced industrial automation ecosystem, and significant investments in AI, semiconductor research, and Industry 4.0 initiatives across automotive and industrial sectors.

Asia Pacific Fusion Vision Computing Chip Market Insights

Asia Pacific dominated the Fusion Vision Computing Chip market in 2025, accounting for 37.68%, driven by rapid industrialization, increasing automotive production, and widespread adoption of AI, robotics, and smart devices. Countries like China, Japan, and South Korea are leading in automotive ADAS, industrial automation, and consumer electronics, fueling strong demand for advanced vision computing solutions. The region is expected to grow at the fastest CAGR of 11.25% from 2026 to 2033, supported by large-scale investments in semiconductor manufacturing, edge AI deployment, smart cities, and next-generation AR/VR and defense applications.

China Fusion Vision Computing Chip Market Insights

China dominated the Asia Pacific Fusion Vision Computing Chip market, driven by its large automotive and consumer electronics industries, rapid adoption of AI and robotics, extensive semiconductor manufacturing capabilities, and strong government support for smart cities, autonomous vehicles, and edge computing technologies.

Latin America (LATAM) and Middle East & Africa (MEA) Fusion Vision Computing Chip Market Insights

The Latin America (LATAM) and Middle East & Africa (MEA) Fusion Vision Computing Chip market is relatively smaller compared to other regions but is steadily growing. Demand is driven by emerging adoption of smart surveillance, industrial automation, and automotive applications. Governments in MEA are investing in smart city initiatives and defense modernization, while LATAM countries are gradually integrating AI-enabled vision systems in automotive and industrial sectors. Increasing awareness of AI, robotics, and IoT technologies presents opportunities for market expansion in these emerging regions.

Competitive Landscape for Fusion Vision Computing Chip Market:

NVIDIA Corporation is a leading U.S.-based technology company specializing in GPUs, AI accelerators, and vision computing platforms. In the Fusion Vision Computing Chip market, NVIDIA drives innovation with high-performance AI SoCs, edge computing solutions, and integrated sensor-fusion processors for autonomous vehicles, robotics, AR/VR, and industrial vision applications globally.

-

In August 2025, NVIDIA released the Jetson AGX Thor developer kit and production modules, offering significantly higher AI compute and energy efficiency for real‑time robotics and edge physical AI applications, advancing vision processing performance for robotics and autonomous systems.

Intel Corporation is a major U.S. semiconductor company advancing AI and vision processing technologies. In the Fusion Vision Computing Chip market, Intel delivers integrated vision and AI compute platforms, edge processors, and accelerator solutions for autonomous systems, robotics, industrial automation, and smart devices, leveraging its strong R&D and ecosystem partnerships.

-

In January 2026, Intel unveiled its Core Ultra Series 3 Panther Lake processors, built on its advanced 18A process, with enhanced AI and vision compute performance for PCs and edge systems.

Fusion Vision Computing Chip Companies are:

-

NVIDIA

-

Intel

-

Qualcomm

-

Ambarella

-

Huawei HiSilicon

-

Mobileye (Intel)

-

Black Sesame Technologies

-

OmniVision Technologies

-

Renesas Electronics

-

Texas Instruments

-

Samsung Electronics

-

Apple

-

Google

-

SiMa.ai

-

Tenstorrent

-

Nextchip

-

Analog Devices

-

MediaTek

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 722.50 Million |

| Market Size by 2033 | USD 1616.73 Million |

| CAGR | CAGR of 10.63% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Chip Type (Single-Function Vision Computing Chips, and Multi-Function / Fusion Vision Chips) • By Integration Level (System-on-Chip (SoC), Discrete Vision Processors, and Hybrid / Heterogeneous Integrated Chips) • By Application (Autonomous Vehicles & ADAS, Robotics & Industrial Automation, Smart Surveillance & Security, and AR/VR & Consumer Electronics) • By End-User Industry (Automotive OEMs & Tier-1 Suppliers, Electronics & Device Manufacturers, Industrial & Robotics Companies, and Defense, Aerospace & Healthcare) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | NVIDIA, Intel, Qualcomm, NXP Semiconductors, Ambarella, Huawei HiSilicon, Mobileye, Horizon Robotics, Black Sesame Technologies, OmniVision Technologies, Renesas Electronics, Texas Instruments, Samsung Electronics, Apple, Google, SiMa.ai, Tenstorrent, Nextchip, Analog Devices, MediaTek. |