System on Chip Market Report Scope & Overview:

Get More Information on System on Chip Market - Request Sample Report

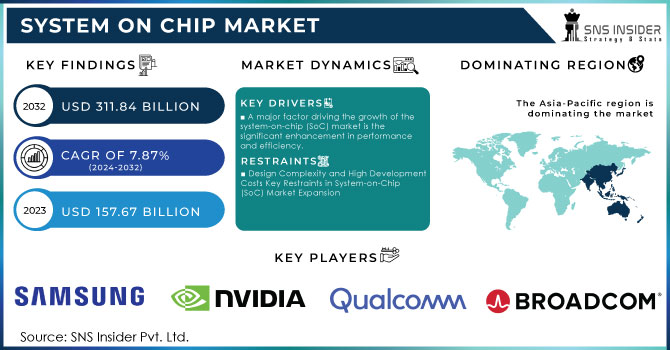

The System on Chip Market size was valued at USD 157.67 Billion in 2023 and is expected to reach USD 311.84 Billion by 2032 and grow at a CAGR of 7.87% over the forecast period 2024-2032.

The growing integration of artificial intelligence (AI) and machine learning (ML) technologies is a key driver for the expansion of the system-on-chip (SoC) market. As businesses in sectors like healthcare and finance aim to boost operational efficiency, the demand for specialized SoCs tailored for AI and ML applications is increasing. Notably, a report reveals that 78% of mainframe shops are now piloting AI applications, signaling a significant shift toward the adoption of advanced computing solutions. Companies such as Google and MediaTek are responding to this trend by developing AI chips that optimize data processing, highlighting the urgent need for innovative SoC designs. Various industries are witnessing a notable rise in AI adoption, with organizations increasingly depending on intelligent systems to enhance patient outcomes and streamline their operations. This trend is further supported by findings indicating that security concerns related to AI and AIOps are among the top challenges for mainframe users, reinforcing the necessity for robust SoCs capable of managing intricate AI tasks. The collaboration among system and chip manufacturers to create cohesive AI platforms also highlights the industry's momentum in utilizing SoCs for AI progress. In conclusion, the increasing demand for AI capabilities is propelling the SoC market forward, as companies aim to produce chips that align with the rapidly evolving technological landscape. This trend not only boosts processing power in data centers but also sets the stage for innovative solutions across diverse sectors, thereby driving future growth within the semiconductor industry.

The automotive applications sector is experiencing significant growth in the system-on-chip (SoC) market, largely fueled by the increasing demand for advanced driver-assistance systems (ADAS) and autonomous vehicles. Integrating SoCs into vehicles greatly enhances safety features and enriches in-car experiences. Major companies, including GM and Mercedes, are making substantial investments in chip technology, with reports highlighting a qualification for a USD 750 million U.S. chip grant aimed at advancing automotive chip development. Collaborations like the one between Bosch and Tenstorrent focus on standardizing automotive chips, highlighting the industry’s dedication to improving performance and integration. This momentum reflects the ongoing push for smarter and more connected vehicles, which is shaping the future of automotive technology while enhancing safety and user experience. Such trends underline the immense growth potential for SoCs within the automotive sector, aligning with broader advancements in semiconductor innovation

System on Chip Market ynamics

Drivers

-

A major factor driving the growth of the system-on-chip (SoC) market is the significant enhancement in performance and efficiency.

Recent advancements in semiconductor manufacturing technologies have led to the creation of more robust and efficient SoCs. Innovations such as smaller process nodes and refined architectural designs enable these chips to achieve superior performance while minimizing power consumption, making them highly attractive across various applications. This trend is particularly pronounced as industries increasingly turn to SoCs to handle demanding tasks, including artificial intelligence (AI) and machine learning (ML), which necessitate considerable computational resources. For instance, substantial investments are being made in the U.S. semiconductor industry to develop AI-integrated circuits, underscoring a strong commitment to technological advancement. Collaborations between key players like Synopsys and Taiwan Semiconductor Manufacturing Company highlight ongoing efforts to enhance chip performance. Such innovations not only fulfill the requirements of device manufacturers but also align with consumer expectations for faster and more efficient technology. As businesses aim for operational efficiency and improved user experiences, the demand for high-performance SoCs is expected to grow, further propelling expansion within the semiconductor sector.

Restraints

-

Design Complexity and High Development Costs Key Restraints in System-on-Chip (SoC) Market Expansion

The development of system-on-chip (SoC) technologies faces significant market restraints primarily due to the complexity of design and integration processes. As applications become more demanding, the architectural requirements for SoCs are evolving, leading to longer development cycles and increased costs. This intricate design landscape can deter smaller companies from entering the market or expanding their product offerings, as they may lack the necessary resources to navigate these challenges. Furthermore, developing cutting-edge SoCs necessitates substantial investment in research and development, specialized equipment, and highly skilled personnel. These high costs create barriers to entry for startups and smaller firms, making it difficult for them to compete with established players in the semiconductor industry. As a result, this dynamic may lead to market consolidation and reduced innovation, stifling the potential for new entrants to introduce novel solutions and technologies. Overall, the complexities associated with SoC development not only challenge smaller firms but also pose significant obstacles to the overall growth and evolution of the semiconductor market.

System on Chip Market Segmentation Overview

By Type

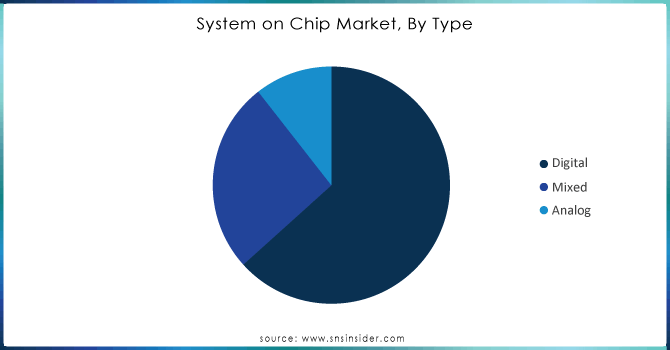

The digital segment of the System on Chip (SoC) market captured 58% of the revenue share in 2023, reflecting its significant role across various industries such as consumer electronics, telecommunications, and automotive. This segment includes critical components like microcontrollers, digital signal processors (DSPs), and application-specific integrated circuits (ASICs), essential for running complex algorithms and efficiently processing large data volumes, particularly in AI and machine learning. The growing adoption of connected devices, especially in the Internet of Things (IoT) domain, further enhances the demand for digital SoCs. Continued advancements in semiconductor technology are expected to sustain this growth.

Need Any Customization Research On System on Chip Market - Inquiry Now

By Application

In the System on Chip (SoC) market, portable electronic devices captured around 41% of the revenue share in 2023, reinforcing their dominance as the largest segment. This growth stems from the widespread use of smartphones, tablets, wearables, and smart home devices, all of which demand advanced SoCs that integrate processing power, connectivity, and sensor management to enhance user experience. The need for high-performance SoCs is fueled by consumer expectations for faster processing, better graphics, and longer battery life. Additionally, trends in miniaturization and the rise of Internet of Things (IoT) devices contribute to this segment's expansion. Companies like Qualcomm and Apple have introduced new SoCs, including the Snapdragon 8 Gen 2 and M2 chip, which focus on machine learning and graphics improvements, catering to the demand for immersive experiences.

System on Chip Market Regional Analysis

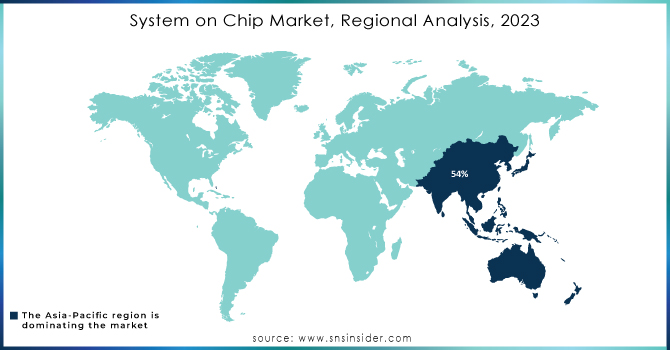

In 2023, the Asia-Pacific region emerged as a leader in the System on Chip (SoC) market, commanding approximately 54% of global revenue. This dominance stems from a surge in demand for electronic devices across multiple sectors, including consumer electronics, automotive, and telecommunications. Key semiconductor manufacturers in China, South Korea, Japan, and Taiwan have played a pivotal role in this growth, leveraging their advanced manufacturing capabilities and innovative technologies. Recent product launches highlight this trend; for example, Samsung introduced the Exynos 2200 SoC, designed for high-end smartphones and gaming devices, featuring advanced graphics and enhanced AI performance. MediaTek also made headlines with its Dimensity 9200 chip, aimed at flagship smartphones and optimized for AI applications and battery efficiency. Moreover, Qualcomm has solidified its presence in the region through collaborations with companies like Xiaomi and Oppo to integrate its Snapdragon chips into new devices.

In 2023, the North American System on Chips (SoC) market experienced notable growth, driven by advancements in technology and a focus on autonomous driving and advanced driver-assistance systems (ADAS). Key players such as Qualcomm, NVIDIA, and Intel are instrumental in this evolution, particularly within the automotive sector, where SoCs are integrated into ADAS and infotainment systems. The healthcare industry also shows increased adoption of SoCs for remote monitoring and wearable devices. Recent developments include Global Foundries' partnership with Microchip Technology on advanced memory solutions, Intel's innovations in high-performance computing, and NVIDIA's expansion in AI-driven automotive SoCs.

Key Players in System on Chip Market

-

Intel Corporation (Meteor Lake SoCs, Intel Core processors)

-

Qualcomm Technologies, Inc. (Snapdragon processors, Snapdragon Ride™ Flex SoC)

-

Samsung Electronics Co., Ltd. (Exynos processors, Exynos ModAP)

-

NVIDIA Corporation (Tegra processors, Orin SoC)

-

Texas Instruments Incorporated (Sitara processors, Jacinto SoCs)

-

Broadcom Inc. (BCM series SoCs, StrataGX SoCs)

-

MediaTek Inc. (Dimensity processors, Helio series)

-

MaxLinear, Inc. (MXL17xxx series, Sierra platform)

-

Apple Inc. (Apple Silicon M-series, A-series chips)

-

Advanced Micro Devices, Inc. (AMD) (Ryzen Embedded, EPYC SoCs)

-

ARM Holdings (SoftBank Group) (Cortex series, Neoverse processors)

-

STMicroelectronics (STM32 microcontrollers, STR9 series)

-

Infineon Technologies AG (AURIX microcontrollers, XMC series)

-

ON Semiconductor Corporation (RSLK series SoCs, image sensors)

-

NXP Semiconductors N.V. (i.MX series, Layerscape SoCs)

-

Renesas Electronics Corporation (RZ/A series, RX microcontrollers)

-

Marvell Technology Group Ltd. (ThunderX processors, Armada SoCs)

-

Xilinx, Inc. (now part of AMD) (Zynq UltraScale+, Versal SoCs)

-

Siemens AG (Mentor Graphics)(Veloce emulation solutions, various ASIC designs)

-

Dialog Semiconductor (DA14531, DA1469x series)

List of suppliers of raw materials used in chip manufacturing, particularly for semiconductor and System-on-Chip (SoC) production:

Silicon Wafer Suppliers

-

SUMCO Corporation

-

Siltronic AG

-

Shin-Etsu Chemical Co., Ltd.

Chemical Suppliers

-

BASF SE (Photoresists, specialty chemicals)

-

Dow Inc. (Silicones, encapsulants)

-

Merck KGaA (Chemicals for semiconductor fabrication)

-

Cabot Microelectronics Corporation (Chemical Mechanical Planarization (CMP) slurries)

Metal Suppliers

-

Albemarle Corporation (Gallium, lithium, and specialty metals)

-

KMG Chemicals, Inc. (Chemicals and materials for electronic applications)

-

Heraeus Holding GmbH (Precious metals and materials for electronics)

Substrate Suppliers

-

NTT Advanced Technology Corporation (Wafer and substrate materials)

-

Kyocera Corporation (Ceramic substrates for electronic applications)

Epoxy and Adhesive Suppliers

-

Henkel AG & Co. KGaA (Adhesives and encapsulants for semiconductors)

-

3M Company (Adhesive solutions for electronic components)

Gas Suppliers

-

Air Products and Chemicals, Inc. (Specialty gases for semiconductor manufacturing)

-

Linde plc (Industrial gases for electronics and semiconductor processes)

Recent Development

-

In June 2024, Intel Corporation announced its upcoming processor series, featuring significant enhancements over the Meteor Lake SoCs, including improved power efficiency, a fourfold increase in NPU processing capability, and a 50% faster Intel Arc GPU using the next-gen Arc Battlemage architecture, alongside integrated on-chip memory for a more compact design.

-

In February 2024, MaxLinear, Inc. launched the MXL17xxx series, known as the 'Sierra' platform, designed for 4G/5G radio units in O-RAN, offering a versatile, all-in-one solution for various RU applications.

-

In January 2024, Robert Bosch GmbH and Qualcomm Technologies, Inc. revealed a vehicle computer combining infotainment and ADAS features within a single SoC, powered by the Snapdragon Ride™ Flex SoC as part of their ongoing collaboration in software-defined vehicle solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 157.67 Billion |

| Market Size by 2032 | USD 311.84 Billion |

| CAGR | CAGR of 7.87% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Digital, Mixed, Analog) • By Applications (Home Appliance, ADAS System) • By End Use (Consumer Electronics, Automotive and Transportation, IT & Telecommunication, Aerospace & Defense, Healthcare, Power & Utility, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Intel Corporation, Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., NVIDIA Corporation, Texas Instruments Incorporated, Broadcom Inc., MediaTek Inc., MaxLinear, Inc., Apple Inc., Advanced Micro Devices, Inc. (AMD), ARM Holdings (SoftBank Group), STMicroelectronics, Infineon Technologies AG, ON Semiconductor Corporation, NXP Semiconductors N.V., Renesas Electronics Corporation, Marvell Technology Group Ltd., Xilinx, Inc. (now part of AMD), Siemens AG (Mentor Graphics), and Dialog Semiconductor. |

| Key Drivers | • A major factor driving the growth of the system-on-chip (SoC) market is the significant enhancement in performance and efficiency. |

| RESTRAINTS | • Design Complexity and High Development Costs Key Restraints in System-on-Chip (SoC) Market Expansion |