AI Accelerator Chip Market Size & Trends:

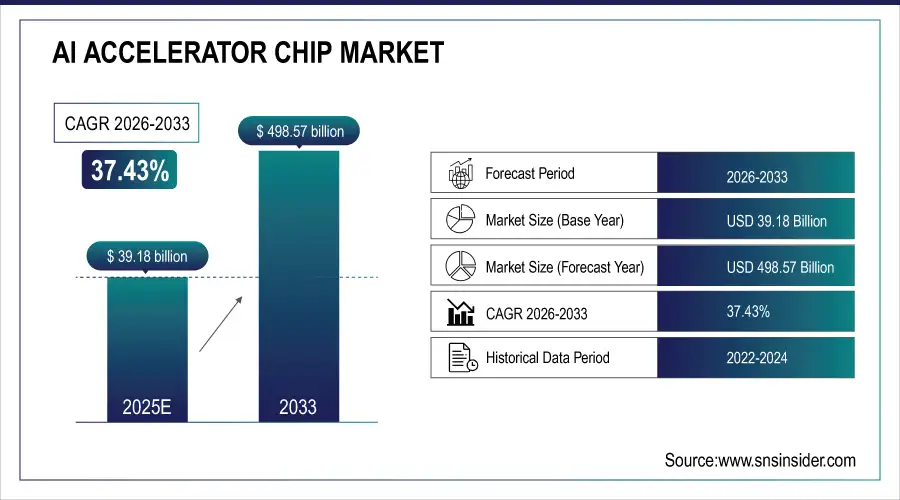

The AI Accelerator Chip Market Size is estimated at USD 39.18 Billion in 2025E and is projected to reach USD 498.57 Billion by 2033, growing at a CAGR of 37.43% during 2026–2033.

The AI Accelerator Chip Market analysis report describes the AI processor chips solutions that are specially designed semiconductor architectures for accelerating artificial intelligence workloads such as machine learning (ML), deep learning (DL), natural language processing (NLP) and computer vision. The increasing adoption of generative AI, large language models (LLMs), autonomous systems, and edge AI applications is driving demand for high-performance, energy-efficient acceleration hardware. Development of new chip architectures, memory bandwidth squeezing and implementing AI-specific instruction sets will be witnessing continuous innovation, helping to fuel the market growth during the forecast period.

AI accelerator chips are expected to be deployed across over 8.5 million AI-enabled servers and edge systems by 2025, driven by exponential growth in AI model complexity, cloud infrastructure expansion, and enterprise AI adoption.

AI Accelerator Chip Market Size and Growth Projection:

-

Market Size in 2025: USD 39.18 Billion

-

Market Size by 2033: USD 498.57 Billion

-

CAGR: 37.43% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on AI Accelerator Chip Market - Request Free Sample Report

AI Accelerator Chip Market Trends:

-

Rapid adoption of generative AI and foundation models is driving demand for GPU- and ASIC-based accelerators, with AI training workloads growing at over 35% annually.

-

Expansion of edge AI is increasing adoption of low-power accelerators, as around 40% of AI inference is expected to run at the edge by 2028.

-

Rising investments in hyperscale data centers are fueling large-scale procurement, with hyperscalers accounting for over 55% of AI accelerator demand.

-

Focus on performance-per-watt efficiency is accelerating development of custom AI ASICs, delivering 30–50% higher energy efficiency.

-

Integration of HBM, chiplets, and 3D packaging is boosting memory bandwidth by 3–5× and improving compute density.

-

Growing AI adoption in automotive, healthcare, and industrial automation is expanding demand beyond data centers, with these segments growing at 20%+ CAGR.

U.S. AI Accelerator Chip Market Analysis

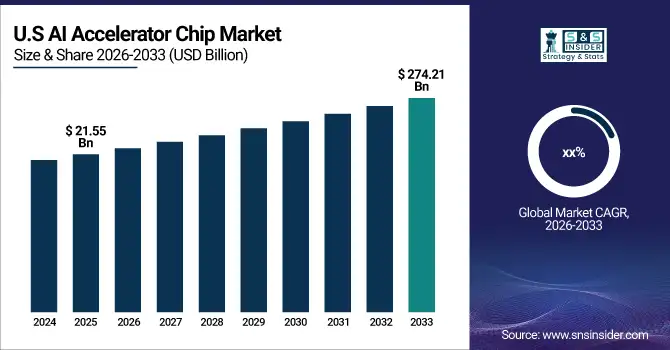

The U.S. AI Accelerator Chip Market size was valued at USD 21.55 Billion in 2025E and is projected to reach USD 274.21 Billion by 2033. The need for more computing power from generative AI, huge expenditures in hyperscale data centers, the fight for proprietary silicon by big U.S. tech companies, and the ubiquitous use of cloud, automotive, and healthcare technologies by businesses are all driving growth.

AI Accelerator Chip Market Growth Drivers:

-

Surging Demand for Generative AI and Large Language Models Boost Market Expansion Globally

The main reason for the growth of the AI Accelerator Chip Market is the rising demand for generative AI and huge language models. Businesses and cloud service providers are using AI models that are getting more and more complicated. These models need a lot of parallel computing power, high memory bandwidth, and low-latency processing. GPUs and bespoke AI ASICs are necessary for training and using LLMs, recommendation engines, and multimodal AI systems.

Traditional CPUs can't keep up with AI model sizes that are in the trillions of parameters. AI accelerators cut down on training time, energy use, and costs of running a business by a lot. The growing application of AI in business analytics, content creation, and software development is speeding up the implementation of large-scale accelerators. Shipments of AI accelerators are expected to rise by more than 18% in 2025 as generative AI workloads are growing and cloud infrastructure is getting bigger.

AI Accelerator Chip Market Restraints:

-

High Development Costs and Supply Chain Complexity Can Restrain Market Growth Globally

The AI Accelerator Chip Market is limited by high development costs and a complicated supply chain. To design sophisticated accelerators, you need a lot of research and development money, specialized skills, and access to the most advanced semiconductor production nodes. The supply is further hampered by rising wafer costs, a lack of modern production capability, and geopolitical uncertainties.

Some businesses also have trouble adopting AI accelerators because they need customized frameworks, compilers, and development tools to interact with existing software ecosystems. Small and medium-sized businesses may have trouble deploying due to the high upfront expenses and complicated integration.

Even though there is a lot of demand for AI compute acceleration, these problems make it harder for the market to grow.

AI Accelerator Chip Market Opportunities:

-

Expanding Edge AI and Industry-Specific Accelerators Provide Better Growth Opportunities Globally

The growing use of edge AI and industry-specific accelerators is a big chance for the market to flourish. Real-time processing with minimal power use is needed for applications including self-driving cars, smart manufacturing, healthcare imaging, and IoT analytics. This is making people want specialized AI accelerators that are tuned for inference at the edge.

Vendors that sell domain-specific designs and software-optimized accelerators can take advantage of new growth prospects. More cooperation between chipmakers, cloud providers, and industry verticals should speed up the development and use of new technologies.

By 2025, edge AI accelerators are estimated to make up more than 32% of all new AI accelerator deployments.

AI Accelerator Chip Market Segmentation Analysis:

-

By Chip Type, GPU held the largest market share of 46.18% in 2025, while ASIC is expected to grow at the fastest CAGR of 16.92% during 2026–2033.

-

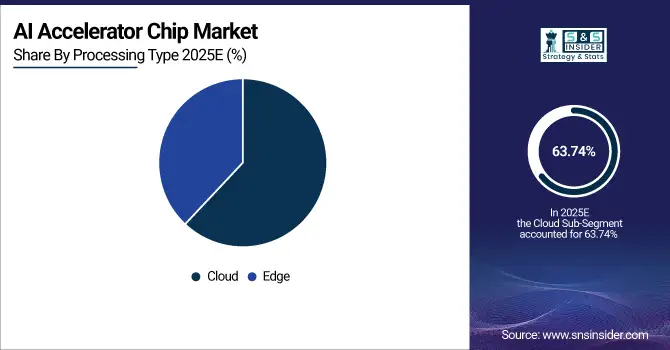

By Processing Type, Cloud accounted for the highest market share of 63.74% in 2025, while Edge is projected to expand at the fastest CAGR of 17.08% over the forecast period.

-

By Industry, Consumer Electronics dominated with a 28.56% share in 2025, while Automotive is expected to grow at the fastest CAGR of 18.21% through 2026–2033.

By Processing Type, Cloud Dominates While Edge Expands Rapidly in the Market

The Cloud segment led the market as hyperscale data centers require massive AI compute resources for training and inference services. Over 6.8 million AI accelerator units were deployed in cloud environments in 2025, supporting AI-as-a-Service platforms and enterprise AI workloads.

Edge processing is projected to be the fastest-growing segment, driven by real-time AI applications in automotive systems, smart devices, and industrial automation. Approximately 2.1 million edge AI accelerators were deployed in 2025, reflecting rising demand for low-latency, power-efficient AI inference solutions.

By Chip Type, GPUs Dominate, While ASICs Expand Rapidly in the Market

The GPU segment dominated the market owing to its versatility, high parallel processing capabilities, and mature software ecosystem. GPUs are largely used for AI model training, inference, and data analytics across various data centers and cloud platforms. Over 5.2 million GPU-based AI accelerators were deployed globally in 2025 to support LLM training and AI workloads.

ASICs are expected to be the fastest-growing segment, driven by demand for custom, application-specific acceleration with superior performance-per-watt efficiency. In 2025, more than 1.4 million ASIC-based AI accelerators were deployed, particularly for cloud inference and proprietary AI workloads.

By Industry, Consumer Electronics Dominates While Automotive Expands Rapidly in the Market

The Consumer Electronics segment dominated the market due to widespread integration of AI accelerators in smartphones, smart TVs, wearables, and personal computing devices. Over 1.9 billion AI-enabled consumer devices incorporated accelerator chips in 2025.

Automotive is the fastest-growing segment, driven by autonomous driving, advanced driver-assistance systems (ADAS), and in-vehicle AI processing. In 2025, more than 42 million vehicles incorporated AI accelerator chips, supporting perception, decision-making, and real-time analytics.

Asia-Pacific AI Accelerator Chip Market Insights:

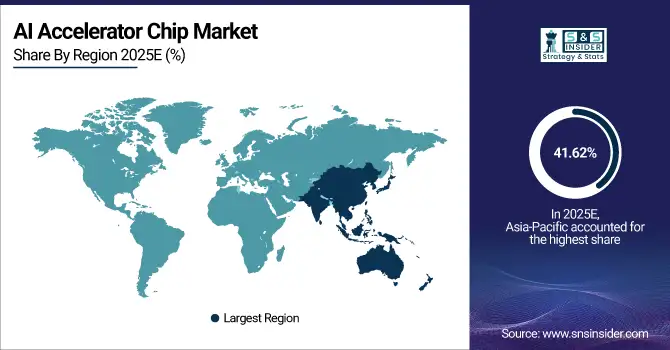

In 2025, Asia Pacific had the biggest share of the AI Accelerator Chip Market, with 41.62%. Strong semiconductor manufacturing, quick adoption of AI technology, and growth in the consumer electronics and automotive sectors in China, South Korea, Taiwan, and Japan are all factors that are driving growth. Government-backed AI projects and big investments in data centers also help the region flourish.

Get Customized Report as per Your Business Requirement - Enquiry Now

China AI Accelerator Chip Market Insights:

The Chinese AI Accelerator Chip Market is increasing as the government supports AI self-sufficiency, cloud infrastructure is getting bigger, and AI is being used more and more in smart cities and factories. China is a major contributor to growth since it is developing more and more AI accelerators and using them in consumer electronics on a massive scale.

North America AI Accelerator Chip Market Insights

North America is the region that is growing the fastest, with a predicted CAGR of 15.86% for the forecast period. Hyperscale cloud providers, advanced AI research, and the broad use of AI technology in businesses across the U.S. and Canada are all helping growth.

U.S. AI Accelerator Chip Market Insights:

The U.S. market benefits from strong presence of leading AI chip developers, cloud service providers, and technology companies. Continuous investments in AI infrastructure, defense, and autonomous systems reinforce U.S. leadership in AI accelerator adoption.

Europe AI Accelerator Chip Market Insights

The market in Europe is growing because more and more businesses in the automotive, healthcare, and industrial sectors are using AI. Germany, France, and the U.K. are all putting money into AI research and development, semiconductor research and development, and data center expansion. This helps the market grow steadily.

Germany AI Accelerator Chip Market Insights:

Germany is a key market, driven by AI deployment in automotive manufacturing, Industry 4.0 initiatives, and advanced robotics. Strong engineering expertise and industrial automation adoption support accelerator chip demand.

Latin America AI Accelerator Chip Market Insights:

Latin America is slowly growing as more people are using the cloud and AI in telecom, retail, and financial services. Digital transformation projects are helping Brazil and Mexico become developing markets.

Middle East and Africa AI Accelerator Chip Market Insights:

The Middle East & Africa market is expanding due to rising investments in smart cities, data centers, and AI-driven digital infrastructure, particularly in the UAE and Saudi Arabia.

AI Accelerator Chip Market Competitive Landscape:

NVIDIA, which was founded in 1993, is the world's top maker of graphics processing units (GPUs), AI accelerators, and high-performance computing platforms. The company's solutions are used in data centers, gaming, self-driving cars, and AI workloads in many other fields. NVIDIA's CUDA ecosystem and AI software stack help them stay at the top of the industry for accelerated computing and generative AI.

-

In March 2024, NVIDIA introduced the Blackwell GPU architecture, delivering significant performance and energy-efficiency gains for large-scale AI training and inference.

Advanced Micro Devices (AMD), which was formed in 1969, makes high-performance CPUs, GPUs, and adaptive computing solutions for data centers, PCs, game consoles, and embedded devices. AMD's EPYC CPUs and Instinct accelerators are quite popular for AI and cloud computing applications, and they compete directly with the biggest semiconductor companies.

-

In December 2023, AMD introduced the Instinct MI300 series, combining CPU and GPU architectures to accelerate AI and HPC applications in hyperscale environments.

Intel Corporation, founded in 1968, this company is one of the biggest makers of semiconductors. It makes CPUs, AI accelerators, networking chips, and offers foundry services. Intel works with businesses, consumers, and the government. Its main goals are to restore its leadership in the process and grow its AI and data center offerings.

-

In September 2023, the new Intel Gaudi 3 AI accelerators have been launched by the company, targeting generative AI training and inference with improved performance-per-watt for data centers.

Google, founded in 1998, is a global technology company specializing in internet services, cloud computing, and artificial intelligence. Through Google Cloud, the company develops custom AI hardware, including Tensor Processing Units (TPUs), optimized for machine learning workloads at scale.

-

In April 2024, Google unveiled TPU v6 “Trillium”, delivering enhanced performance and efficiency to support large language models and enterprise AI workloads on Google Cloud.

Qualcomm, is a top semiconductor and telecommunications business that is recognized for its Snapdragon processors and wireless technologies. It was founded in 1985. Qualcomm makes AI-capable system-on-chips (SoCs) for smartphones, edge devices, automotive platforms, and IoT apps. These chips let AI processing happen on the device itself.

-

In October 2023, Qualcomm launched the Snapdragon X Elite, a high-performance AI-focused PC processor designed to support advanced on-device generative AI and improved power efficiency.

AI Accelerator Chips Companies are:

-

AMD (Advanced Micro Devices)

-

Intel Corporation

-

Google LLC

-

Qualcomm Technologies, Inc.

-

Tesla, Inc.

-

Baidu, Inc.

-

Huawei Technologies Co., Ltd.

-

Samsung Electronics Co., Ltd.

-

Apple Inc.

-

Microsoft Corporation

-

Amazon Web Services (AWS)

-

IBM Corporation

-

Alibaba Group Holding Limited

-

Broadcom Inc.

-

MediaTek Inc.

-

Cerebras Systems Inc.

-

Groq, Inc.

-

Tenstorrent Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 39.18 Billion |

| Market Size by 2033 | USD 498.57 Billion |

| CAGR | CAGR of 37.43 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Chip Type (GPU, ASIC, FPGA, CPU, Others) • By Processing Type (Edge, Cloud) • By Industry (Automotive, Consumer Electronics, Healthcare, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | NVIDIA, AMD (Advanced Micro Devices), Intel Corporation, Google LLC, Qualcomm Technologies, Inc., Graphcore Limited, Tesla, Inc., Baidu, Inc., Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., Apple Inc., Microsoft Corporation, Amazon Web Services (AWS), IBM Corporation, Alibaba Group Holding Limited, Broadcom Inc., MediaTek Inc., Cerebras Systems Inc., Groq, Inc and Tenstorrent Inc. |