Edge AI Hardware Market Size:

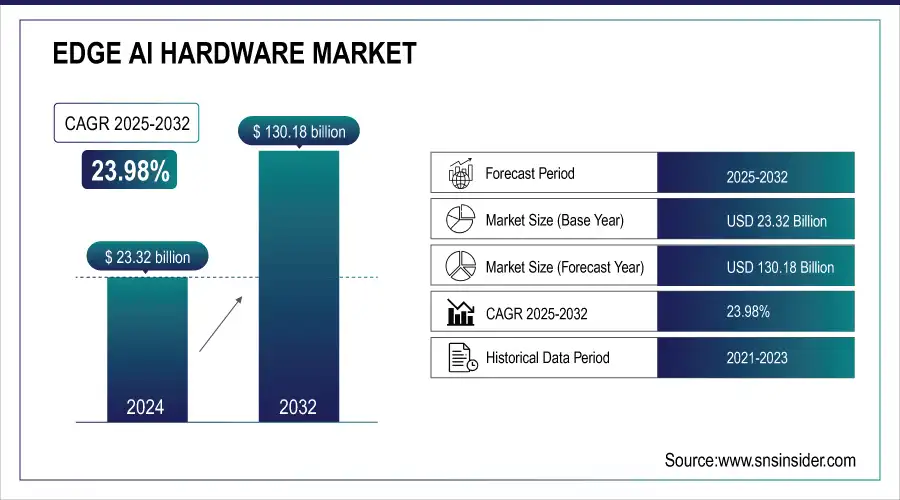

The Edge AI Hardware Market Size was valued at USD 23.32 Billion in 2025E, It is estimated to reach USD 130.18 Billion by 2033, growing at a CAGR of 23.98% over the forecast period from 2026 to 2033.

Driven by the increasing demand for real-time data processing for Edge AI applications across various verticals, the Edge AI hardware market camera is growing rapidly. Increasing number of IoT devices across healthcare, manufacturing, and agriculture is propelling the demand for powerful artificial intelligence hardware at the edge to locally conduct intensive data loads.

Edge AI Hardware Market Size and Forecast:

-

Market Size in 2025E: USD 23.32 Billion

-

Market Size by 2033: USD 130.18 Billion

-

CAGR: 23.98% (2026–2033)

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on Edge AI Hardware Market - Request Sample Report

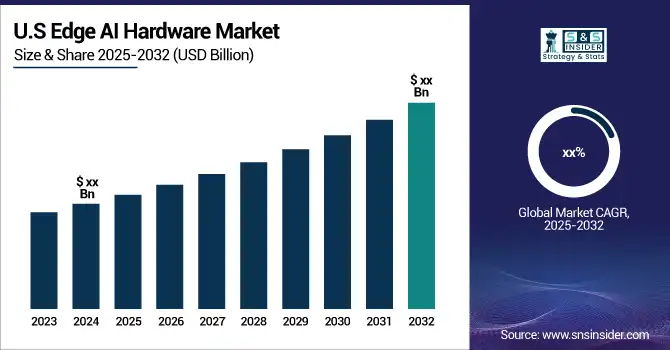

The U.S. Edge AI Hardware market size was valued at an estimated USD 9.15 billion in 2025 and is projected to reach USD 51.10 billion by 2033, growing at a CAGR of 21.31% over the forecast period 2026–2033. Market growth is driven by the increasing adoption of AI-enabled devices and applications across industries such as automotive, healthcare, manufacturing, and consumer electronics. Rising demand for low-latency data processing, real-time analytics, and energy-efficient AI hardware is accelerating market expansion. Additionally, advancements in edge computing processors, neural processing units (NPUs), and integration with IoT and 5G networks, along with strong investments from technology companies, further support the robust growth outlook of the U.S. edge AI hardware market during the forecast period.

Edge AI Hardware Market Highlights:

-

Incredible growth of Edge AI hardware market driven by rising demand for ultra-low latency in VR applications

-

Real-time on-device processing enables seamless VR, gaming, simulations, training, and live streaming experiences

-

Media and entertainment adoption increasing as platforms like Netflix, YouTube, and Amazon Prime Video leverage Edge AI for low-latency, high-quality content delivery

-

Advanced AI chips, processors, and GPUs supporting expansion into autonomous vehicles, robotics, and healthcare industries

-

High upfront costs for GPUs, TPUs, edge servers, and proprietary hardware remain a major restraint for SMEs and budget-limited sectors

-

Lack of standardized pricing, ongoing maintenance, and power consumption challenges further limit adoption despite technological progress

The shift makes them less dependent on cloud infrastructure that means quicker decision making which helps them run their operations faster. Moreover, the increasing popularity of virtual reality (VR) applications demanding ultra-low latency for realizable experiences is driving the market forward. Edge AI hardware enables real-time processing on-device, eliminating lag and latency that impacts virtual reality, gaming, simulations and training programs. The expansion of the market is also driven by the media, and entertainment industries, as streaming platforms including Netflix, YouTube, and Amazon Prime Video utilize Edge AI for efficient low-latency, and high-quality, content delivery. Moreover, real-time high-definition video editing, upscaling, and AI-based video compression on edge devices further improve user experiences, especially in the case of live streaming. Nevertheless, many hurdles exist in the market as specialized hardware components (GPUs, TPUs, and other processors) can be pricey in terms of capital expense and are nearly always replete with up-front costs for AI inference along with real-time data processing. Such overheads can inhibit adoption, particularly for smaller companies, and sectors harnessing limited budgets.

Edge AI Hardware Market Drivers:

-

Incredible Growth of Edge AI Hardware Market Driven by Low-Latency Demand in Virtual Reality

Low-latency performance is essential for VR applications, and this is one of the key factors propelling the Edge AI hardware market, says the report. VR demands ultra-low latency to deliver seamless and immersive user experiences Edge AI hardware has made a huge leap forward. For example, VR apps like gaming, simulations, and training programs need to process data instantly to prevent it from lagging behind reality and ruining the feeling of presence and immersion. Edge AI allows processing on the device rather than needing to transfer data to and from the cloud, allowing localized decision-making, reducing latency providing a low-latency environment that is something that VR applications need to deliver. Continued advances in AI chips, processors, and GPUs are essential for VR technologies, as manufacturers are increasingly implementing Edge AI to reduce latencies for immersive VR experiences. Besides VR, this demand for real-time performance is also shaping the way other industries like autonomous vehicles, robotics, and healthcare are adopting Edge AI hardware; enabling their operations to achieve the desired rapid accuracy and efficiency of data processing. Having the possibility to execute many data from the edge, without relying on faraway data centers, brought economical solutions to many markets.

Edge AI Hardware Market Restraints:

-

The significant upfront costs associated with edge AI hardware continue to be a major obstacle to its market expansion.

Massive investments are required in high-performance AI chips, processors, GPUs, TPUs and edge servers, stifling the adoption of the technologies by SMEs or budget-restricted segments of an economy. Adding further to the costs, edge AI applications require their own near computer powerful (and often proprietary) hardware & setup. Barriers to entry: As demand for AI-powered solutions continues to rise, many potential users are dissuaded from purchasing this hardware and the support infrastructure to run it because it's too expensive. According to the reports, massive investment necessary for hardcore edge AI systems in hardware (AI servers, edge computing devices, etc.) can be prohibitively expensive, especially with ongoing maintenance costs, software updates, and power consumption. Adding to the difficulties for companies is that they face no-standard nor transparent pricing. Despite all the performance improvements from companies such as TSMC, Marvell, and NVIDIA, costs associated with high-performance AI hardware continue to be an insurmountable hurdle. limiting the adoption of edge AI, particularly in budget-constricted industries, as the entry cost for high-performance edge native hardware remains too high.

Edge AI Hardware Market Segment Analysis:

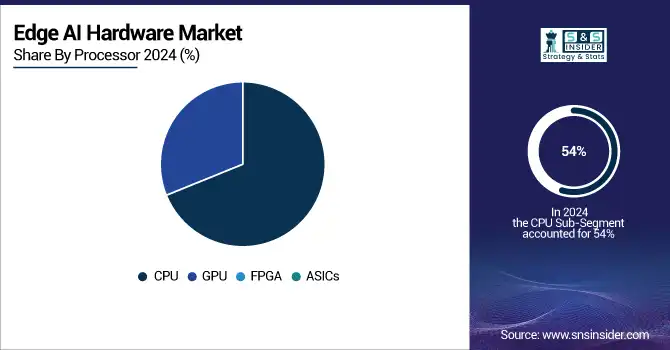

By Processor

Processor segment, dominated by CPU, holds the highest share revenue of 54% in Edge AI Hardware market in 2025 due to heterogeneity and versatility, CPUs are needed in a wide range of edge AI applications, from smartphones to industrial IoT devices. You learn these kinds of devices power edge AI systems that need on-board computing to perform it must have capabilities of processing data and algorithms but also to overcome heavy workloads.

The GPU segment is the fastest-growing segment in Edge AI Hardware market over the forecast periods (2026-2033), the strength of GPUs is in parallel processing, and they are better suited for data-intensive, high-performance workloads (such as deep learning and image processing). As deep learning models become larger and more data-hungry (and things like CNNs will typically need at least terabytes of power and memory to train) The huge significance of these hardware elements for AI model training and inference is also driving demand faster to the edge with applications of low latency at the edge both in terms of decision and in terms of context where the need for decision and context is real-time with applications to robots, autonomous vehicles, and cameras.

By Devices

The camera segment currently dominates the Edge AI hardware market, with a market share of 35% in 2025. For example, in numerous edge AI use cases like CCTV, ADAS, robotics, etc. where high quality of visual data is required that needs be processing at real time, cameras plays an imperative role. Camera with edge AI hardware is also gaining importance with developments in AI powered Image recognition and object detection, to help deliver increased situational awareness and enable making smarter decisions at the edge.

The smartphone segment to be the fastest-growing segment in the Edge AI hardware market during 2026-2033. With the rise of smartphones, phone makers are making them smart by making great AI capabilities, available to the users i.e., face ID, AR features, voice assistants, and more, which requires power strong edge AI hardware. This is primarily fueled by the ongoing development of AI-enabled mobile chips and processors, allowing smartphones to carry out artificial intelligence activities locally rather than through cloud computing.

Edge AI Hardware Market Regional Analysis

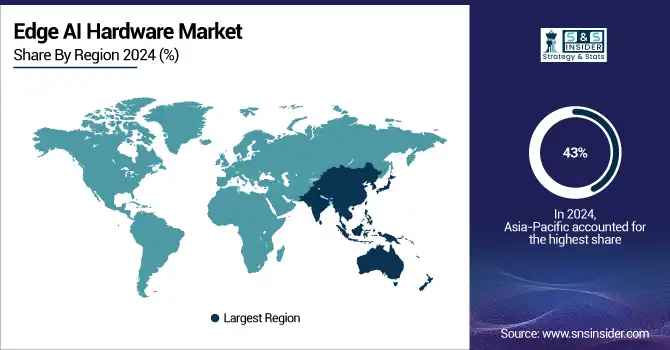

Asia-Pacific Edge AI Hardware Market Trends:

The Edge AI hardware market is projected to be dominated by the Asia-Pacific region, estimates are Asia-Pacific alone will account for about 43% of the market by 2025. due to the rapid technology developments across the region with much focus in countries like China, Japan, South Korea, and India towards rising innovations in artificial intelligence, robotics, and IoT (Internet of Things). Especially China has been implementing large-scale investments on the edge computing infrastructure and AI chips manufacturing, thus it constitutes a significant part of the globalAI landscape. Furthermore, the heavy penetration of AI in healthcare, automotive, and industrial applications within the region has supported the edge AI hardware market, making a significant contribution to the overall growth of the edge AI hardware in the developed and emerging economies.

Get Customized Report as per your Business Requirement - Request For Customized Report

North America Edge AI Hardware Market Trends:

North America region is expected to see the fastest growth in the forecast period from 2026 to2033. Edge AI is being popularized in the USA, which is a hub for technological innovation, home to the top chip manufacturers like NVIDIA, Intel and Google. Application-wise, automotive segment is expected to witness high CAGR during the forecast period owing to high deployment of AI-based applications in various applications including autonomous vehicles and smart cities; major share will be to North America owing to high deployment of AI-based applications for enterprise solution. In addition, the growing shift towards low-latency, real-time processing in edge computing systems is driving them to deploy advance ai chips & processor across the industries.

Europe Edge AI Hardware Market Trends:

Europe is witnessing steady growth in edge AI hardware adoption, particularly in Germany, France, and the U.K. The region’s focus on smart manufacturing, Industry 4.0, and AI-enabled industrial automation is propelling the market. Investments in edge computing infrastructure, along with supportive government AI initiatives, are enhancing market penetration. Key applications include automotive, healthcare, and industrial robotics, with enterprises integrating AI-driven edge solutions to improve efficiency and reduce latency.

Latin America Edge AI Hardware Market Trends:

Latin America is emerging as a developing market for edge AI hardware, driven by adoption in smart cities, industrial automation, and healthcare. Brazil, Mexico, and Argentina are leading the region in AI deployment, supported by government-led digital transformation initiatives and growing investments in AI startups. Enterprises in manufacturing and logistics are increasingly leveraging edge AI solutions for real-time data processing and low-latency applications, though infrastructure gaps remain a challenge.

Middle East & Africa (MEA) Edge AI Hardware Market Trends:

MEA is gradually adopting edge AI hardware across industries such as oil & gas, healthcare, and smart city projects. Investments in AI research, innovation hubs, and government initiatives are boosting adoption, particularly in countries like the UAE, Saudi Arabia, and South Africa. The region is focusing on deploying AI-enabled edge systems for real-time decision-making and operational efficiency, though challenges like connectivity and infrastructure development continue to impact widespread adoption.

Edge AI Hardware Market Key Players:

-

NVIDIA Corporation (Graphics Processing Units, AI Accelerators)

-

Google (Alphabet Inc.) (Edge TPU, Google Cloud AI)

-

Intel Corporation (Xeon Processors, Movidius AI Chips)

-

Huawei Technologies Co., Ltd. (Ascend AI Processors, Kirin Chips)

-

Apple Inc. (A-Series Chips, Neural Engine)

-

Qualcomm Incorporated (Snapdragon Processors, AI Engine)

-

Samsung Electronics Co., Ltd. (Exynos Chips, AI Hardware)

-

IBM Corporation (Power AI, IBM Edge Computing Solutions)

-

Dell Technologies Inc. (Edge Computing Servers, VxRail Systems)

-

Microsoft Corporation (Azure AI, Azure Percept)

-

ARM (Cortex-A Processors, AI Edge Processors)

-

Hailo (Hailo-8 AI Processor)

-

MediaTek Inc. (Dimensity AI Chips)

-

Xilinx Inc. (Versal AI Acceleration, FPGAs)

-

Micron Technology (Memory and Storage Solutions for AI)

-

Marvell Technology, Inc. (AI-Optimized Processors and Networking Solutions)

-

Baidu, Inc. (Kunlun AI Chips, Edge AI Solutions)

-

Ambarella, Inc. (AI Vision Processors)

-

Advanced Micro Devices (AMD) (Ryzen Embedded, AI GPUs)

-

Cambricon Technologies (AI Processors for Edge and Cloud)

List of Suppliers who provide raw material and component

-

Taiwan Semiconductor Manufacturing Company (TSMC)

-

Samsung Electronics

-

Micron Technology

-

SK Hynix

-

GlobalFoundries

-

ASML

-

Broadcom

-

NXP Semiconductors

-

ON Semiconductor

-

Qualcomm Technologies

-

ARM Holdings

-

Xilinx

Edge AI Hardware Market Competitive Landscape:

NVIDIA Corporation (established in 1993) is a global leader in accelerated computing, AI, and graphics technologies, renowned for its GPUs that power gaming, data centers, and supercomputing. The company drives innovation in AI, robotics, and autonomous systems, with solutions spanning from high-performance chips to advanced AI platforms for enterprises and researchers.

-

November 20, 2024, Nvidia AI's role in supercomputing was further solidified with the introduction of the Weka AI RAG Reference Platform. Created by WekaIO, this platform addresses challenges in RAG inferencing using GPUs and Run:ai's software frameworks to streamline the process.

Samsung Electronics Co., Ltd. (founded in 1969) is a global technology leader headquartered in South Korea, specializing in consumer electronics, semiconductors, and display solutions. With strong innovation in AI, 5G, and IoT, Samsung develops advanced products from smartphones to interactive displays, enhancing connectivity, digital transformation, and smart solutions across education, enterprise, and consumer markets.

-

On January 21, 2025, Samsung unveiled its AI-powered Interactive Display (WAFX-P model) at Bett 2025. The display, equipped with Samsung AI Assistant, combines advanced hardware and AI features like generative AI and real-time transcription to revolutionize classroom learning.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 23.32 Billion |

| Market Size by 2033 | USD 130.18 Billion |

| CAGR | CAGR of 23.98% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Processor(CPU, GPU, FPGA ,ASICs) • By Devices(Smartphones, Cameras, Robots, Wearables, Smart Speaker, Other Devices) • By End Use Industry(Government, Real Estate, Consumer Electronics, Automotive, Transportation, Healthcare, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | NVIDIA Corporation, Google (Alphabet Inc.), Intel Corporation, Huawei Technologies Co., Ltd., Apple Inc., Qualcomm Incorporated, Samsung Electronics Co., Ltd., IBM Corporation, Dell Technologies Inc., Microsoft Corporation, ARM, Hailo, MediaTek Inc., Xilinx Inc., Micron Technology, Marvell Technology, Inc., Baidu, Inc., Ambarella, Inc., Advanced Micro Devices (AMD), Cambricon Technologies. |