Gabapentin Market Size Analysis:

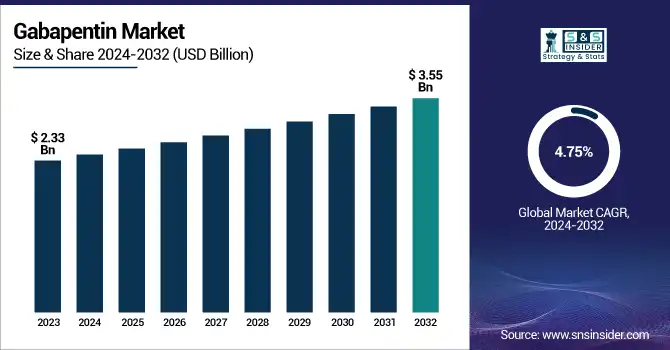

The Gabapentin Market size was valued at USD 2.33 billion in 2023 and is expected to reach USD 3.55 billion by 2032, growing at a CAGR of 4.75% from 2024-2032.

The Gabapentin Market report offers a detailed analysis of regional demand patterns and differences in the demand trends across geographies from 2023 to 2032. A thorough pricing analysis reviews fluctuations in costs, generic erosion, and reimbursement policies dictating market affordability. The regulatory landscape segment discusses market access issues, approvals, and compliance regulations to ensure a thorough understanding of changing legal paradigms. Furthermore, the report analyzes supply chain dynamics, including production, distribution, and possible market limitations. These findings give a strategic overview, enabling stakeholders to maneuver market complexities and find opportunities in the changing Gabapentin Market.

To Get more information on Gabapentin Market - Request Free Sample Report

The U.S. Gabapentin Market was valued at USD 0.62 billion in 2023 and is expected to reach USD 0.94 billion by 2032, growing at a CAGR of 4.78% from 2024-2032.

The United States leads the Gabapentin Market in North America due to high prescription levels, rising rates of neuropathic pain and epilepsy, and a well-established pharmaceutical sector. Good insurance coverage and rising off-label use for disorders such as anxiety and migraines also further its market position. The fact that large pharma companies have a presence here and research is continuously being done also makes the country a leader in the region.

Global Gabapentin Market Dynamics

Drivers

-

The rising incidence of neurological diseases like epilepsy, neuropathic pain, and restless legs syndrome is a key growth driver for the Gabapentin market.

As per the World Health Organization (WHO), epilepsy impacts close to 50 million individuals globally, with a considerable number living in North America and Europe. Gabapentin is also largely prescribed as an anticonvulsant and is utilized for the management of neuropathic pain, a disorder that is increasingly prevalent as a result of diabetes and aging populations. Recent evidence indicates that prescriptions for gabapentin have increased, particularly within the United States, where it has also been used off-label for disorders such as anxiety and migraine prophylaxis. In October 2024, Pfizer reported progress in AI-powered drug discovery, which would speed up the creation of new forms, further increasing market opportunity. The patient population's increasing number and rising awareness of treatment also account for market growth.

-

Gabapentin is increasingly being prescribed for off-label uses like generalized anxiety disorder, bipolar disorder, fibromyalgia, and migraines, which are fuelling market growth.

Within the United States, gabapentin prescriptions have substantially increased over the last ten years, with over 90% of its applications reported to be off-label based on studies. Its efficacy for the treatment of chronic pain ailments and opioid withdrawal syndrome drives the trend. During December 2024, Pfizer discussed how more powerful computing contributes to the perfection of medicine forms, such that gabapentin becomes universally available for most medical conditions. Besides, there is strict monitoring by regulatory bodies on its increasing use, which is encouraging fresh clinical trials to assess its effectiveness for other therapeutic uses. The increasing awareness of the multipurpose nature of gabapentin for pain and mental health control is the primary driver fueling its international demand.

Restraint

-

Regulatory Scrutiny and Risk of Misuse are restraining the market growth.

One of the key constraints on the Gabapentin market is growing regulatory oversight because it has the risk of abuse and misuse. Although Gabapentin is largely utilized for epilepsy and neuropathic pain, its off-label prescription use has grown exponentially, creating issues of dependency and abuse for recreational purposes. Evidence from the U.S. Drug Enforcement Administration (DEA) and the FDA points to an upward trend in the misuse of Gabapentin, especially among those suffering from opioid addiction. Certain areas, such as certain portions of the U.S. and the U.K., have labeled Gabapentin a controlled substance with more restrictive prescription controls. In November 2024, officials in several states enacted new surveillance practices, further limiting access. These policies may slow market growth, as more stringent prescriptions could limit patient access and provide difficulties for pharmaceutical firms to expand Gabapentin's therapeutic uses.

Opportunities

-

The increasing incidence of neuropathic pain and psychiatric illnesses is a key opportunity for the Gabapentin market.

With more patients suffering from chronic conditions like diabetic neuropathy, postherpetic neuralgia, and fibromyalgia, the need for effective pain management treatments is growing. Furthermore, new evidence points towards the therapeutic potential of Gabapentin in the treatment of anxiety disorders and alcohol withdrawal syndrome, further broadening its indication. In December 2024, several clinical trials were launched to investigate the effectiveness of Gabapentin in novel indications, opening up opportunities for market expansion. With pharmaceutical companies investing in formulation improvements, such as extended-release formulations for enhanced patient compliance, the potential for increased applications becomes stronger. Furthermore, the increasing popularity of Gabapentin as a safer substitute for opioids in pain management also boosts its market potential, especially in areas where opioid-reduction strategies are being adopted.

Challenges

-

A major challenge facing the Gabapentin market is the intense competition from generic drug manufacturers, leading to significant pricing pressure.

One of the key challenges for the Gabapentin market is the high level of competition from generic drug producers, resulting in tremendous pricing pressure. Since Gabapentin's patent protection has ended, several generic versions have flooded the market, lowering the profit margins of drug companies. During 2024, several new generic formulations entered the market across the world, increasing competition among producers. While this has been making patients cheaper and more accessible, it has also resulted in a decline in branded Gabapentin product revenues. Furthermore, payor systems as well as insurer systems increasingly reward low-cost generic versions over costly formulations, consequently restricting manufacturers' pricing flexibility as well. Organizations are now working on value-added products, such as extended versions and combination regimens, as a means to differentiate their product offerings. Yet, prolonged price erosion continues to be a chronic problem, especially in cost-conscious markets with tight healthcare budget constraints.

Gabapentin Market Segmentation Analysis

By Dosage Form

The capsule segment dominated the Gabapentin market with a 55.27% market share in 2023 because it is most popular among patients and healthcare professionals to facilitate ease of administration and exact dosing. Capsules are more bioavailable, easier for patients to take, and are a stable preparation, hence becoming the most suitable option for prolonged treatment in illnesses such as epilepsy and neuropathic pain. Moreover, leading pharmaceutical firms such as Pfizer, Teva Pharmaceuticals, and Aurobindo Pharma possess a robust portfolio of Gabapentin capsules, which are highly available in the market. The low cost and long shelf life of capsules also helped them dominate. In 2023, trends in prescriptions revealed that the majority of Gabapentin prescriptions were written for capsule forms, especially in Europe and North America, where regulatory approval and clinician preference determine demand for standard and effective formulations.

The oral solution market is anticipated to grow at the fastest rate in the Gabapentin market with 5.40% CAGR throughout the forecast period, as demand for pediatric, geriatric, and dysphagic (swallowing difficulty) patients with difficulty in handling solid dosage forms increases. Flexible dosing facilitated by the liquid formulation is of particular value to patients who need individualized titration, e.g., epilepsy patients and patients with chronic neuropathic pain. Moreover, pharmaceutical firms are concentrating on enhancing taste-masking technologies and increasing liquid formulations to raise patient compliance. Growth in hospital-based treatments as well as home healthcare services, particularly in Asia Pacific and Latin America, is also driving market demand for Gabapentin oral solutions. Regulatory approvals in 2024 of new oral liquid formulations by firms such as Hikma Pharmaceuticals and Lupin Pharmaceuticals are also making the segment rapidly grow, increasing market adoption.

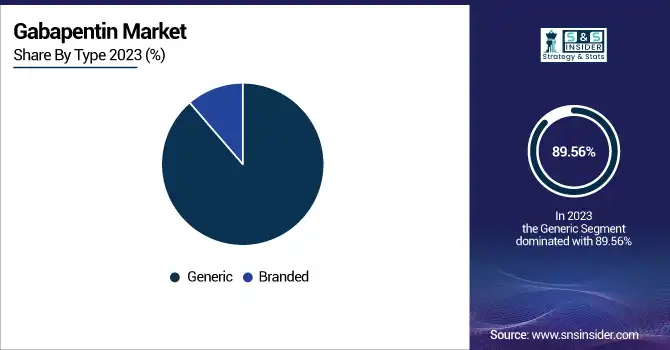

By Type

The generic segment dominated the Gabapentin market with a 89.56% market share in 2023 based on the generic availability of cheaper alternatives after Pfizer's Neurontin patent expired. Gabapentin has been a heavily prescribed medication for epilepsy, neuropathic pain, and restless leg syndrome. Its affordability factor is instrumental to its availability in price-sensitive economies like Asia Pacific and Latin America. Further, leading drug manufacturers such as Teva Pharmaceuticals, Amneal Pharmaceuticals, and Aurobindo Pharma have launched low-priced generic versions, adding competition and pushing prices lower. The addition of Gabapentin to national reimbursement schemes and government health programs has also widened patient access, especially in emerging economies. In addition, as healthcare systems increasingly focus on generic substitution policies to contain drug spending, the generic segment remains in a robust market position in Gabapentin sales.

By Application

The epilepsy segment dominated the Gabapentin market with 50.26% market share in 2023 because of its long-established application as an adjunctive treatment of partial seizures. Gabapentin is commonly used in epilepsy patients, especially in those who do not have complete seizure control with initial antiepileptic drugs (AEDs). Its tolerable safety profile, low drug interaction, and highly tolerable nature make it a highly favored drug among neurologists. The growing incidence of epilepsy, estimated at 50 million individuals across the globe, also propels the segment's demand. In Europe and North America, Gabapentin remains a prominent treatment option, bolstered by robust reimbursement policies and clinical practice guidelines. Besides, drug manufacturers like Pfizer, Teva Pharmaceuticals, and Aurobindo Pharma continue to have a consistent supply of Gabapentin preparations specific to epilepsy management, strengthening the segment's 2023 dominance.

By Distibution Channel

The hospital pharmacies segment dominated the Gabapentin market with a 48.59% market share in 2023 as a result of the strong rate of prescription of Gabapentin among inpatients and outpatients experiencing epilepsy, neuropathic pain, and post-operative pain management. Hospitals continue to be the first point of contact for serious neurological disorders, where specialists prescribe Gabapentin as a part of integrated treatment plans. Moreover, regulatory policy ensures careful supervision and controlled distribution of Gabapentin in hospital pharmacies, given that the medicine is a controlled substance in a few geographies because of worries about abuse. In Europe and North America, the availability of well-developed hospital networks along with government-backed reimbursement policies increases the dominance of the hospital pharmacy segment even further. In addition, pharma alliances with hospitals provide a steady supply of Gabapentin, further cementing its dominant position in the channel of distribution.

The online pharmacies segment is anticipated to experience the fastest growth in the forecast period based on the growing utilization of e-commerce platforms for drug purchases. Increasing digitalization, convenience, and affordable price choices are major drivers propelling the growth. Furthermore, the increased number of epilepsy and chronic pain patients looking for long-term solutions has fueled the demand for doorstep medication, especially from elderly and home-bound patients. Telemedicine and online prescription services regulatory developments have also increased the market, further expanding access to Gabapentin. Growing markets, especially within Asia Pacific and Latin America, are experiencing brisk growth in selling medicines online, driven by rising internet penetration of healthcare services and pro-government campaigns advocating digital healthcare options.

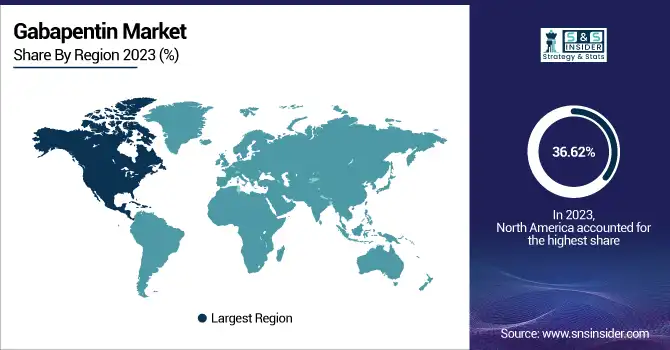

Regional Insights

North America dominated the gabapentin market with a 36.62% market share in 2023, owing to its high incidence of neurological ailments like epilepsy, neuropathic pain, and restless legs syndrome, which fuel ample demand for the drug. The region boasts a well-developed pharmaceutical establishment, robust regulatory clearance, and comprehensive healthcare reimbursement networks, enabling wide availability of gabapentin to patients. The availability of major market players like Pfizer, Teva Pharmaceuticals, and Mylan further enhances the region's leadership. Also, ramping up off-label prescriptions, such as for anxiety and migraines, has added to market growth. The United States, most notably, has the highest percentage, buoyed by high diagnosis rates and high physician adoption.

Asia Pacific is the region with the fastest growth in the Gabapentin market with 5.45% CAGR on account of growing healthcare consciousness, rising cases of epilepsy and neuropathic pain, and expanding pharma production facilities. Markets in countries such as China and India are seeing an upsurge in generic drug manufacturing, increasing the availability and affordability of gabapentin. Additionally, efforts by the government to enhance healthcare infrastructure and increase access to critical medicines are enhancing market growth. The large patient base of the region, along with rising disposable incomes and greater investments by pharma companies, is fueling gabapentin adoption. Enlarging online pharmacy networks and higher penetration of retail and hospital pharmacies also aid in quick market growth in the Asia Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Gabapentin Market Key Players

-

Pfizer Inc. (Neurontin, Gralise)

-

Amneal Pharmaceuticals, Inc. (Gabapentin Capsules, Gabapentin Tablets)

-

Teva Pharmaceuticals (Gabapentin Oral Solution, Gabapentin Capsules)

-

Aurobindo Pharma Limited (Gabapentin Tablets, Gabapentin Oral Solution)

-

Sun Pharmaceutical Industries Ltd. (Gabapentin Tablets, Gabapentin Extended-Release)

-

Mylan N.V. (now part of Viatris Inc.) (Gabapentin Capsules, Gabapentin Oral Suspension)

-

Dr. Reddy’s Laboratories Ltd. (Gabapentin Capsules, Gabapentin Tablets)

-

Hikma Pharmaceuticals (Gabapentin Oral Solution, Gabapentin Capsules)

-

Lupin Pharmaceuticals, Inc. (Gabapentin Tablets, Gabapentin Capsules)

-

Zydus Lifesciences Limited (Gabapentin Capsules, Gabapentin Oral Suspension)

-

Torrent Pharmaceuticals Ltd. (Gabapentin Tablets, Gabapentin Oral Solution)

-

Glenmark Pharmaceuticals Ltd. (Gabapentin Capsules, Gabapentin Extended-Release Tablets)

-

Apotex Inc. (Gabapentin Tablets, Gabapentin Oral Suspension)

-

Sandoz (a Novartis division) (Gabapentin Capsules, Gabapentin Oral Solution)

-

Alkem Laboratories Ltd. (Gabapentin Tablets, Gabapentin Capsules)

-

Endo International plc (Gabapentin Oral Solution, Gabapentin Tablets)

-

Eli Lilly and Company (Gabapentin Capsules, Gabapentin Oral Suspension)

-

Wockhardt Ltd. (Gabapentin Tablets, Gabapentin Oral Suspension)

-

Bausch Health Companies Inc. (Gabapentin Capsules, Gabapentin Extended-Release)

-

Cipla Limited (Gabapentin Tablets, Gabapentin Oral Suspension)

Suppliers (These suppliers provide key pharmaceutical ingredients, including active pharmaceutical ingredients (APIs), excipients, and intermediates essential for Gabapentin formulation. They also offer custom synthesis, contract manufacturing, and regulatory support services to ensure high-quality production and compliance with global standards.) in Gabapentin Market.

-

BASF SE

-

Lonza Group Ltd.

-

Thermo Fisher Scientific Inc.

-

WuXi AppTec

-

CordenPharma

-

Jubilant Pharmova Limited

-

Hovione

-

Dishman Carbogen Amcis Ltd.

-

Sigma-Aldrich (Merck KGaA)

-

Sai Life Sciences Ltd.

Recent Developments in the Gabapentin Market

-

December 2024, Pfizer has dramatically shortened drug development by utilizing sophisticated computing methods, such as Modeling and Simulation (M&S), which seamlessly combines data from lab research to clinical use. This method has been crucial in simplifying drug discovery processes, as evidenced by the successful development of Neurontin (gabapentin), shortening the time it takes to get new treatments to market.

-

October 2024, Amneal Pharmaceuticals, Inc. and Metsera, Inc. signed a strategic collaboration to speed development and large-scale global supply of future-generation weight loss medicines. This partnership blends Amneal's deep pharma experience with Metsera's cutting-edge obesity and metabolic disease treatment, increasing accessibility and efficiency in delivering new therapeutic products.

-

In November 2024, Aurobindo Pharma's American arm entered into a USD 25 million collaboration and licensing deal with a top multinational pharmaceutical player to support respiratory drug development. As per the deal, both parties will share the related development and commercialization expenses on an equal basis, expanding Aurobindo's foothold in the respiratory therapeutics segment while promoting innovation in treatment options.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.33 Billion |

| Market Size by 2032 | US$ 3.55 Billion |

| CAGR | CAGR of 4.75 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Dosage Form (Tablet, Capsule, Oral Solution) • By Type (Generic, Branded) • By Application (Epilepsy, Neuropathic Pain, Restless Legs Syndrome, Others) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Pfizer Inc., Amneal Pharmaceuticals, Inc., Teva Pharmaceuticals, Aurobindo Pharma Limited, Sun Pharmaceutical Industries Ltd., Mylan N.V. (now part of Viatris Inc.), Dr. Reddy’s Laboratories Ltd., Hikma Pharmaceuticals, Lupin Pharmaceuticals, Inc., Zydus Lifesciences Limited, Torrent Pharmaceuticals Ltd., Glenmark Pharmaceuticals Ltd., Apotex Inc., Sandoz (a Novartis division), Alkem Laboratories Ltd., Endo International plc, Eli Lilly and Company, Wockhardt Ltd., Bausch Health Companies Inc., Cipla Limited, and other players. |