Galacto-oligosaccharide (GOS) Market Report Scope & Overview:

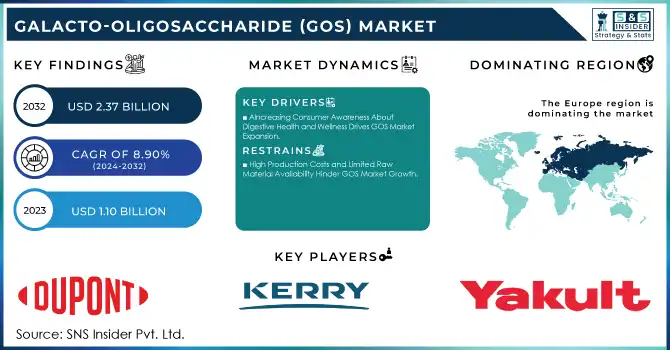

The Galacto-oligosaccharide (GOS) Market Size was valued at USD 1.10 Billion in 2023 and is expected to reach USD 2.37 Billion by 2032 and grow at a CAGR of 8.90% over the forecast period 2024-2032.

To get more information on Galacto-oligosaccharide (GOS) Market - Request Free Sample Report

The Galacto-oligosaccharide (GOS) Market has witnessed significant growth, driven primarily by the increasing demand for prebiotics in functional foods and dietary supplements. GOS, being a soluble fiber that promotes gut health, plays a pivotal role in enhancing the gut microbiota by stimulating beneficial bacteria. This has fueled its incorporation into various food and beverage products, particularly in the infant formula, dairy, and nutritional supplement sectors. The growing awareness of the link between gut health and overall well-being has spurred demand for prebiotic ingredients like GOS. Furthermore, the rising prevalence of digestive disorders and the expanding focus on immunity-boosting products have bolstered the market's growth. In the dairy sector, GOS is increasingly utilized in yogurt, milk, and other fermented products due to its ability to improve digestive health and provide functional benefits. As consumer preferences continue to shift towards healthier, plant-based, and functional foods, the demand for GOS has expanded across both developed and emerging markets.

Several recent developments in the sector highlight the dynamic nature of the market. For instance, advancements in the production technologies for GOS have led to more cost-effective manufacturing processes, allowing producers to meet the rising demand for these ingredients. Companies have been focusing on improving the yield and purity of GOS from lactose, making the process more efficient. The emergence of GOS-based innovations in the infant formula market is another notable development. These innovations have been designed to replicate the prebiotic content of breast milk, supporting the growing trend of functional infant nutrition. Additionally, the increased popularity of plant-based products has driven interest in plant-derived GOS, especially in the vegan and lactose-free food categories. Companies are also expanding their product portfolios to include GOS in various formats such as powder and liquid forms, offering flexibility in product development. For example, one notable advancement includes the introduction of GOS in functional beverages, where it is added to juices and smoothies for added digestive benefits. These developments reflect the evolving landscape of the GOS market, as producers strive to meet consumer demands for healthier, more sustainable, and scientifically backed products.

Market Dynamics:

Drivers:

-

Increasing Consumer Awareness About Digestive Health and Wellness Drives GOS Market Expansion

The growing awareness of digestive health and its direct connection to overall well-being has significantly fueled the demand for prebiotics like Galacto-oligosaccharides (GOS). As consumers become more informed about the benefits of maintaining a healthy gut microbiota, the demand for GOS as a dietary supplement has increased. GOS helps in improving gut health by fostering the growth of beneficial bacteria, such as bifidobacteria, and thus aids in digestion and immune function. This has led to its inclusion in various food and beverage products, including functional foods, dairy, and infant formulas. With rising concerns over gut disorders such as IBS (Irritable Bowel Syndrome) and bloating, consumers are more inclined to opt for products that contain GOS to support digestive wellness. Additionally, the increasing awareness around probiotics and prebiotics has supported GOS’s growth in the market. Consequently, the emphasis on maintaining good digestive health and the rising popularity of functional foods is expected to drive the expansion of the GOS market globally.

-

Rising Demand for Functional and Nutrient-Dense Foods Supports GOS Market Growth

-

Surge in Infant Formula Consumption Boosts the Demand for GOS in the Market

-

Expansion of Plant-Based and Lactose-Free Products Promotes GOS Adoption in Food Sector

-

Technological Advancements in GOS Production Process Drive Market Growth and Cost Reduction

Restraint:

-

High Production Costs and Limited Raw Material Availability Hinder GOS Market Growth

Opportunity:

-

Rising Demand for Functional Beverages Creates New Avenues for GOS Applications

-

Growing Focus on Sustainable and Plant-Based GOS Production Methods Enhances Market Potential

-

Increased Applications of GOS in Infant Nutrition and Personalized Diets to Accelerate Market Demand

The increasing demand for personalized nutrition, particularly in infant nutrition and functional diets, presents a lucrative opportunity for the Galacto-oligosaccharides (GOS) market. The growing adoption of infant formulas enriched with GOS, which mimics the prebiotic effects of breast milk, continues to be a key driver in the market. Additionally, personalized nutrition services, which offer tailored diets based on individual health needs, are gaining popularity. GOS’s ability to enhance gut health and support immune function makes it an attractive ingredient in such personalized nutrition plans. As demand for specialized nutrition continues to rise, GOS is expected to see increasing applications in both infant formulas and personalized dietary products, further expanding its market potential.

Key Consumer Trends in the Galacto-oligosaccharides (GOS) Market

|

Trend |

Description |

|

Increased Demand for Digestive Health |

Growing awareness about prebiotics drives consumers to seek GOS for gut health benefits. |

|

Preference for Clean-label Products |

Consumers opt for natural, minimally processed GOS-enriched products. |

|

Rising Popularity of Plant-based GOS |

Demand surges for non-dairy GOS options among vegan and lactose-intolerant consumers. |

|

Adoption of Functional Beverages |

GOS inclusion in fortified drinks appeals to health-conscious individuals. |

|

Infant Nutrition Awareness |

Parents increasingly prioritize GOS in infant formulas for digestive health benefits. |

The GOS market is shaped by heightened consumer awareness of digestive health benefits, driving demand for prebiotic-rich foods and beverages. A notable shift toward clean-label and plant-based products aligns with growing preferences for natural and vegan options. Functional beverages with added GOS are gaining traction among health-conscious consumers. Additionally, the infant nutrition segment witnesses robust growth as parents seek advanced formulas enriched with GOS to enhance gut health in children. These trends highlight the dynamic evolution of consumer expectations.

Segment Analysis

By Source

In 2023, the dairy-based segment dominated the Galacto-oligosaccharides (GOS) market with a market share of approximately 65%. This dominance can be attributed to the widespread utilization of GOS derived from lactose primarily sourced from dairy products. Dairy-based GOS is particularly valued for its prebiotic properties, making it a preferred choice in infant formulas, yogurts, and functional dairy products. For instance, major infant formula brands often incorporate dairy-derived GOS to mimic the natural oligosaccharides found in human breast milk, thus enhancing the nutritional profile of their products. This segment's growth is also supported by the increasing consumer preference for gut health and digestive wellness, particularly among parents seeking the best nutrition for their infants.

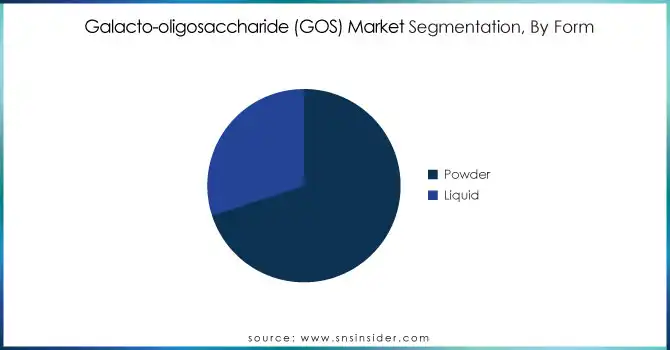

By Form

The powder segment dominated the Galacto-oligosaccharides (GOS) market in 2023, holding a market share of around 70%. This predominance can be attributed to the versatility and convenience offered by powdered GOS, which can easily be incorporated into a wide range of food and beverage products. Powdered GOS is commonly used in formulations for dietary supplements, infant formula, and functional foods, where precise dosing and formulation flexibility are critical. For example, manufacturers often prefer powdered GOS for its ease of blending with other ingredients and its extended shelf life. The powdered form also facilitates consumer usage in various applications, such as mixing into drinks or adding to recipes, further driving its market share.

By Application

In 2023, the infant formula segment dominated the Galacto-oligosaccharides (GOS) market, accounting for a market share of approximately 55%. This strong performance is primarily driven by the increasing demand for infant nutrition products that closely replicate the prebiotic benefits of breast milk. GOS is favored in infant formulas due to its ability to promote healthy gut flora and improve digestive health in infants. For instance, several leading brands of infant formula have incorporated GOS to enhance the product's nutritional value and support immune development. The rising trend of parents opting for advanced nutritional solutions for their infants has further propelled the growth of GOS in this application segment.

By End-User

The food industry segment dominated the Galacto-oligosaccharides (GOS) market in 2023, holding a market share of around 60%. This dominance is largely due to the increasing incorporation of GOS in functional foods, dairy products, and beverages aimed at health-conscious consumers. The food industry leverages GOS for its prebiotic benefits, enhancing the gut health profile of various food products, including yogurts, smoothies, and snack bars. For example, several functional food brands are incorporating GOS to boost the nutritional content of their offerings, catering to the rising consumer demand for health-oriented foods. Additionally, the versatility of GOS allows food manufacturers to create products that appeal to diverse dietary needs, further solidifying its position within the food industry.

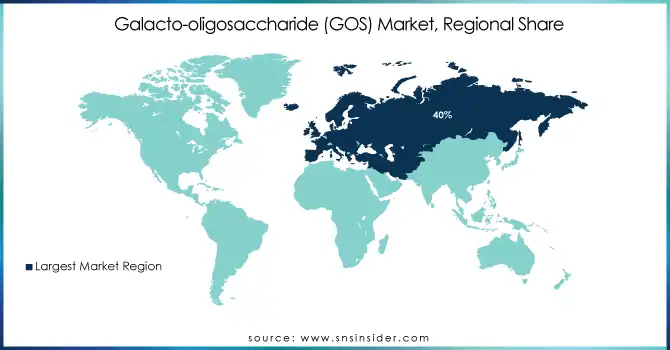

Regional Analysis

In 2023, Europe dominated the Galacto-oligosaccharides (GOS) market, holding a market share of approximately 40%. This leadership is driven by the region's strong emphasis on functional foods and dietary supplements, coupled with the rising health consciousness among consumers. Countries like Germany, France, and the Netherlands are key contributors to this dominance. For example, the Netherlands is home to Friesland Campina Ingredients, a major producer of GOS, which supplies global infant formula and functional food manufacturers. Germany and France have shown significant demand for GOS-enriched products due to the growing awareness of gut health and the prevalence of digestive disorders. Additionally, regulatory support for prebiotic ingredients in food products further bolsters the market in Europe. The region’s well-established dairy industry provides an abundant supply of lactose, a key raw material for GOS production, facilitating regional dominance. In Germany alone, the functional food market witnessed robust growth, with GOS playing a pivotal role in meeting consumer demand for health-enhancing products.

Moreover, the Asia-Pacific emerged as the fastest-growing region in the Galacto-oligosaccharides (GOS) market in 2023, with a CAGR of around 10%. The growth is fueled by the rising population, increasing disposable incomes, and growing awareness of health and wellness, particularly in countries such as China, India, and Japan. China, being a significant contributor, accounts for a substantial portion of the regional demand due to its expanding infant formula market, driven by a high birth rate and increasing adoption of premium nutrition products. According to market data, China's infant formula market alone grew by over 8% in recent years, with GOS being a critical ingredient in these products. Similarly, in Japan, GOS is widely used in dietary supplements and functional foods targeting an aging population that prioritizes digestive health. India also shows considerable growth potential, with an increasing focus on fortified foods and beverages. The region's rapid urbanization and evolving dietary habits are encouraging the incorporation of GOS in various food products, making Asia-Pacific a significant hotspot for market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Recent Developments

January 2024: FrieslandCampina Ingredients received approval in Thailand for 2’-fucosyllactose (2’-FL) use in infant formulas, becoming the first supplier of both HMOs and GOS in the country, expanding early-life nutrition innovation.

Key Players

-

Baolingbao Biology Co., Ltd. (GOS Powder, GOS Syrup)

-

DuPont (Danisco) (Danisco GOS, GOS 95)

-

FrieslandCampina Ingredients (Dairy GOS, Galacto-oligosaccharide Powder)

-

GTC Nutrition (GOS-90, GOS-70)

-

Ingredion Incorporated (Ingredion GOS, NutraFlora)

-

Kerry Group (Kerry GOS, GOS 2000)

-

NutriLeads B.V. (GOS 60, Prebiotic GOS)

-

Royal Cosun (GOS 80, GOS Syrup)

-

Shandong Yuwei Biotechnology Co., Ltd. (GOS Powder, Yuwei GOS)

-

Yakult Pharmaceutical Industry Co., Ltd. (Yakult GOS, GOS for Infant Formula)

-

Arla Foods Ingredients (Lactose-free GOS, Arla GOS)

-

Beijing Oriental Tongzhou Bio-tech Co., Ltd. (GOS 80, GOS 90)

-

BIOXIN Biotech Co., Ltd. (BioXIN GOS, GOS for Functional Foods)

-

Dongyuan Foods (GOS Liquid, GOS Syrup)

-

Fufeng Group (Fufeng GOS, GOS Powder)

-

Inner Mongolia Yili Industrial Group Co., Ltd. (Yili GOS, GOS Milk Powder)

-

Lactalis Ingredients (Lactalis GOS, GOS Prebiotic)

-

Sanlu Group (Sanlu GOS, Infant GOS Formula)

-

Tate & Lyle (Tate & Lyle GOS, GOS 1000)

-

The Ingredion Incorporated (Ingredion GOS, GOS 75)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.10 Billion |

| Market Size by 2032 | US$ 2.37 Billion |

| CAGR | CAGR of 8.90% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Dairy-based, Non-dairy-based) •By Form (Liquid, Powder) •By Application (Animal Feed, Infant Formula, Dietary Supplements, Functional Foods, Others) •By End-User (Healthcare, Food Industry, Animal Feed Industry) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | DuPont (Danisco), Ingredion Incorporated, FrieslandCampina Ingredients, Yakult Pharmaceutical Industry Co., Ltd., NutriLeads B.V., GTC Nutrition, Kerry Group, Royal Cosun, Baolingbao Biology Co., Ltd., Shandong Yuwei Biotechnology Co., Ltd. and other key players |

| Key Drivers | •Rising Demand for Functional and Nutrient-Dense Foods Supports GOS Market Growth •Surge in Infant Formula Consumption Boosts the Demand for GOS in the Market |

| RESTRAINTS | •High Production Costs and Limited Raw Material Availability Hinder GOS Market Growth |