Phenol Derivatives Market Report Scope & Overview:

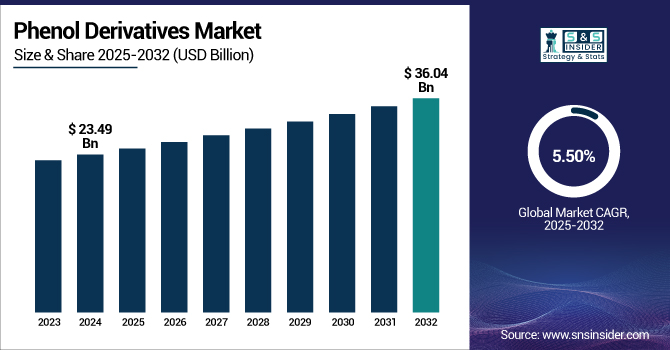

The Phenol Derivatives Market size was valued at USD 23.49 billion in 2024 and is expected to reach USD 36.04 billion by 2032, growing at a CAGR of 5.50% over the forecast period of 2025-2032.

To Get more information on Phenol Derivatives Market - Request Free Sample Report

The growing use in water treatment and industrial cleaning drives the market growth. This growth can be attributed to the increasing use of phenol derivatives in water purification and industrial cleansing applications, given the rising need for effective cleaning agents in industrial processes and environmental protection. Alkylphenols and nonylphenol ethoxylates are widely used as surfactants in cleaning formulations owing to their strong chemical properties that break down oils, grease, and other rough industrial phenol derivatives, clearing waste. These derivatives are crucial in disinfectants, biocides, and coagulants for providing clean water for consumption, used primarily in manufacturing plants, wastewater plants, and municipalities.

For instance, the U.S. Environmental Protection Agency (EPA) makes the methodologies for the analysis of phenols in environmental samples available, such as Method 604, methods for the determination of organic compounds in drinking water, phenol and certain substituted phenols in municipal and industrial wastewater. To make the point, the EPA is concerned with the monitoring of phenol compounds in the environment, which are a direct reflection of a compound manufacturing process used.

Phenol Derivatives Market Dynamics:

Drivers:

-

Rising Demand from the Construction and Automotive Industries Drive Market Growth

Increased consumption of phenol derivatives in the construction and automotive sectors is a major reason associated with the growth of the phenol derivatives market. Phenols, including bisphenol-A (BPA) and phenolic resins, are important precursor materials for high-performance polymers, such as epoxy resins and polycarbonates. Laminates, insulation foams, adhesives, and coatings that provide durability, chemical resistance, and structural strength are also widely used in construction from these materials. Phenol derivatives find critical application in the automotive sector, where they are used as building blocks to produce lightweight and impact-resistant automotive components, such as headlamp lenses and dashboards, under-the-hood parts, which help automobile manufacturers achieve aggressive fuel efficiency and emission targets by reducing vehicle weight.

For instance, in November 2023, INEOS Phenol acquired Mitsui Phenol Singapore for USD 330 million, marking its entry into the Asian market and expanding its global footprint in bisphenol A production.

Restraints:

-

Fluctuating aw material prices may hamper the market growth.

Phenol and its derivatives are mainly sourced from petrochemical feedstocks, like benzene, and the benzene market is very vulnerable to the price fluctuation of global crude oil. Crude oil prices are often affected by geopolitical developments, market speculation, and global supply-demand imbalance. When they increase or decrease, it influences the prices of crude palm oil and other materials, which are the raw materials in the production of phenol. Such volatility leads to unexpected production costs, which manufacturers either adjust their price strategy or have their profitability reduced due to a higher cost to procure.

Opportunities:

-

Increasing Investment in R&D Create Opportunities for Market Growth

Rising investments in research & development (R&D) are increasing the phenol derivatives market growth. It is due to the upgrading of these industries, the demand for various high-performance and cost-effective phenolic compounds environmental-friendly is increasing, and customers are looking for phenolic compounds for various applications, such as automotive, electronics, construction, water treatment, and others. Manufacturers invest in R&D to develop new, improved phenol and its derivatives with superior properties like stronger heat resistance, greater strength, and lower toxicity. This will help meet growing demand for sustainable and innovative offerings while ensuring companies proactively address regulatory demands and evolving market trends.

Moreover, the companies are focused on launching and investing in the phenol derivatives market. For instance, in November 2024, Haldia Petrochemicals signed a pact with Lummus Technology to increase the phenol production capacity. This expansion is to the tune of USD 59.15 million to strengthen domestic production capabilities and reduce import dependency while facilitating the growth of the Indian chemical industry.

Phenol Derivatives Market Segmentation Analysis:

By Derivatives

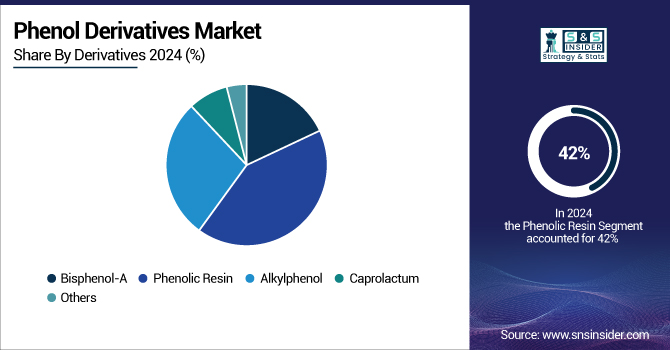

The phenolic resin segment held the largest market share, around 42% in 2023. Phenolic resin is famous for its extraordinary heat resistance, mechanical strength, and electrical insulating properties, and accounts for a variety of applications from automotive to construction and electrical, and industrial manufacturing. They are used in the automotive industry to manufacture friction materials, such as brake pads, owing to their excellent properties under extreme conditions. Furthermore, the high temperature and chemical stability of these materials are exploited for various applications that lend themselves to their use in coatings, adhesives, and laminates, with widespread use in building & construction and electronics.

Alkylphenol held a significant market share and was the fastest-growing segment during the forecast period. The segment’s expansion is driven by its widespread use in various industrial sectors, mainly as a feedstock for surfactants, antioxidants, and synthetic resins. Nonylphenol and octylphenol are among the most widely used industrial substances commonly employed in the production of detergents, emulsifiers, and other chemical intermediates. They are furthermore indispensable feedstocks for the commercial manufacturing of phenolic resins to be found in coatings, adhesives, and automotive parts.

Phenol Derivatives Market Regional Outlook:

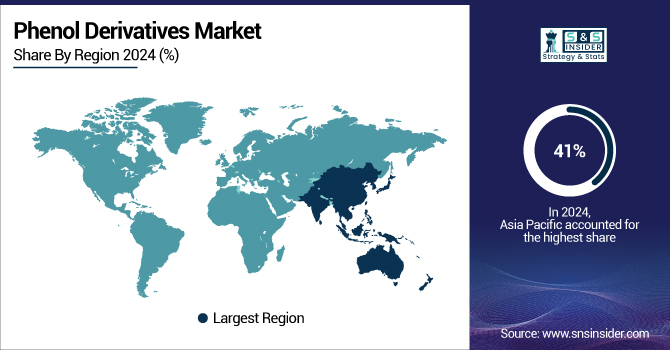

Asia Pacific held the largest market share, around 41%, in 2024. The demand for automotive components, coatings, adhesives, and packaging materials in the growing manufacturing sector, especially in emerging economies, such as China and India, is expected to drive the demand for phenolic products. In addition to this, the Asia Pacific region is also experiencing an increase in the use of sustainable and high-performance materials, which is expected to boost the demand for phenol derivatives.

Moreover, the region is also showing a high market share due to major investments in infrastructure development, especially in the automotive and construction industries, along with the rising adoption of newer technologies. Government initiatives promoting industrialization are also bolstering demand, such as China's "Made in China 2025" strategy and India's "Make in India" drive, which is further augmenting phenol derivatives demand. This large-scale industrial activity, rapid urbanization, and increasing consumer markets render Asia Pacific region the largest globally in terms of the phenol derivatives market.

For instance, according to UN COMTRADE, China exported USD 482 million of phenols in 2024, ranking it among the top global exporters of phenols.

North America held a significant market share and growing region in the forecast period. The advanced chemical manufacturing technologies, well-established R&D infrastructure, and stable regulatory environment in the region promote the adoption of high-performance derivatives.

The U.S. market size was valued at USD 4.23 billion in 2024 and is expected to reach USD 6.94 billion by 2032, growing at a CAGR of 6.40% in the forecast period 2025-2032.

In the U.S., there has been persistent consumption of phenol derivatives, including bisphenol-A (investment in polycarbonate plastics and epoxy resins) and phenolic resins (used in wood adhesives, laminates, and molded products). Additionally, increasing utilization in the electronics and electric vehicle industry is generating the need for phenolic high-performance materials.

Europe held a significant market share in 2024 The region’s growth is driven by the sound chemical manufacturing base, solid regulatory structure favoring high-quality and sustainable products, and sustained demand from the automotive, construction, and electronics industries. Major phenol processing plants and leading chemical manufacturers in the region, including Germany, France, and Belgium. Finally, the group also noted that Europe focuses more on environment-friendly and recyclable materials, which has increased the demand for derivatives, such as phenolic resins and bisphenol-A in various high-performance applications, including insulation, coatings, and plastics.

For instance, in December 2023, INEOS Phenol started operations in Marl, Germany, at the largest Cumene plant in Europe. Designed to deliver a 50% reduction in CO₂ emissions per tonne, the world-scale 750,000 kt/a plant reflects the company's commitment to environmentally sustainable practices.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The phenol derivatives companies include SABIC, Solvay, INEOS, LG Chem, Mitsui Chemicals, Honeywell International Inc., Kumho Petrochemical, PTT Global Chemical, Aditya Birla Chemicals, Formosa Chemicals & Fibre Corporation.

These key players help to understand the Phenol Derivatives market share, phenol derivatives market, analysis Phenol Derivatives Market Trends, and Phenol Derivatives industry trends.

Recent Developments:

-

In January 2025, Mitsui Chemicals launched a joint study to ensure a stable supply of phenol-related products, aiming to improve logistics efficiency and reduce GHG emissions.

-

In April 2024, SABIC Fujian Petrochemicals selected KBR's phenol technology for a new 250 KTA phenol plant in China. The project aims to enhance sustainability through reduced energy consumption.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 23.49 Billion |

| Market Size by 2032 | USD 36.04 Billion |

| CAGR | CAGR of 5.50% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Derivatives (Bisphenol-A, Phenolic Resin, Alkylphenol, Caprolactam, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | SABIC, Solvay, INEOS, LG Chem, Mitsui Chemicals, Honeywell International Inc., Kumho Petrochemical, PTT Global Chemical, Aditya Birla Chemicals, Formosa Chemicals & Fibre Corporation. |